In short, I’m taking profits from the short position in the FCX (I mean, I’ll wait until this notification is properly distributed). And those of you that chose to follow this extra trade might want to do the same (just my opinion, not individual investment advice) – congratulations on the profits from this trade!

I’m keeping the short position in junior mining stocks intact. In fact, since I gained quite a lot on the FCX trade (as you might have), I’m adding to the short position in the junior mining stocks, because my portfolio is now bigger. (Note: this is based just on the above-mentioned increase in the size of the portfolio – if you are happy with the size of your current position, I’m not saying that you should adjust it.)

As a reminder, we haven’t been holding any positions in gold – targets level for it are provided just as a courtesy to those that insist on trading this market instead of juniors.

===

Gold just soared to new 2023 highs! Sounds bullish, right? At least that’s what most market participants think. They view past events (the rally has already happened) as something that indicates more rallies in the future – which is simply not true. How would tops form in this case? They have to be preceded by a rally, and – by definition – they are followed by a decline. So, something’s not right here… Right?

There are many trying moments on any market, and practically on each day investors and traders can choose, whether they want to follow the herd and do what others are doing based on their natural instincts OR one can choose to analyze the situation as objectively as possible, compare it to previous similar periods, apply tools that have been working over and over again for a given market and so on.

The first approach tends to result in “unsatisfactory” results in the long run, even though it feels “right” in the “emotional heat” when markets are volatile.

The second approach tends to result in portfolio growth in the long run, even though it is difficult at times – especially in volatile times.

Well, as you have noticed, we are in those volatile times right now.

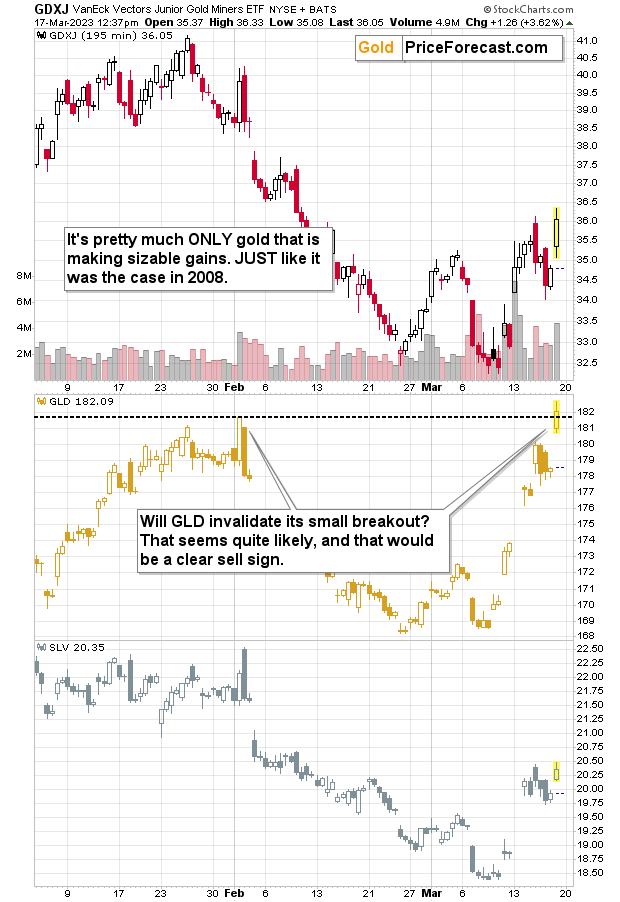

Today’s huge analysis shows just how similar the current situation is to what we saw in 2008. And as more banks fail or “need assistance”, the more concerned people get. However, it’s not the end of the world, and there might be quite many liquidity problems of various institutions related to this crisis. Investors might need to liquidate their positions and so on – just like it was the case in 2008. This caused gold, silver, and miners to decline profoundly back then, and it’s likely to cause them to fall substantially also this time.

And you know what is the key aspect of the 2008 rally – the final one before the slide? It’s sharpness. In reality, the rally took only several days. Then there was some back-and-forth movement in gold, while miners already declined.

Well, gold has been moving higher for several days, so the “time aspect” also points to the rally being over or almost over. Huge volume is another confirmation, but I already wrote about it in today’s big, flagship analysis.

Huge volume after relatively calm periods (volume-wise) shows panic buying – which tends to happen at the tops. Well, looking at the charts that I featured earlier today shows exactly what I meant.

On an intraday basis, we see the following:

GLD moved slightly above its previous 2023 high and is now moving back down. SLV tested its March high and so did the GDXJ.

So, it’s pretty much only gold that is soaring today. Juniors were just below our entry point for the short position, which proves just how weak juniors really are. This is a major SELL signal, not a buy one.

I know it’s difficult right now, but we’ve seen this kind of relative indications many, many times – that’s what indicates great shorting opportunities, not buying ones.

That’s why I’m keeping the short positions in junior mining stocks fully intact.

Now, moving to the FCX, I’m taking profits because I see some bullishness in the relative strength of the FCX vs. the general stock market.

It might or might not mean much, but FCX was just too close to our downside target and the risk to reward is currently too unclear to continue to justify holding a short position in it. In other words, it’s not that I’m bullish on FCX in the short term. No. But I’m not bearish enough to keep an open position at this time. I will probably re-enter this short position in the following days or weeks.

This has been the sixth profitable trading position in a row. Congratulations once again!

Thank you.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief