Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

In today’s analysis, we have quite an interesting thing to cover on gold’s technical chart, but let’s start with the fundamental overview as it provides great context for the recent technical moves.

Old Habits Die Hard

With more geopolitical-related re-positioning stealing the spotlight on Mar. 1, Brent and WTI surged, and the PMs spiked higher as well. However, while the short-term implications haven’t been beneficial, the recent rallies may be nearing their end.

For example, when crises erupt, investors follow a familiar playbook. With another re-enactment on full display, the unwinding of these positions will likely have a drastic impact over the medium term.

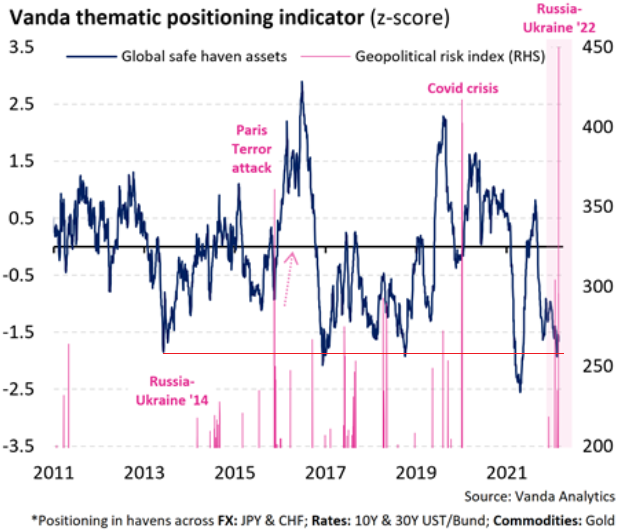

Please see below:

To explain, the blue line above tracks investors’ positioning in global safe-haven assets. For context, the basket includes risk-off currencies, bonds, and, of course, gold. However, if you analyze the right side of the chart, you can see that the dark blue line is roughly two standard deviations from its average. As a result, the implied probability of further bullish positioning is roughly 2.5%. Quite a huge contrast from the “100% certainty” that gold soars during wartime that we see in some internet forums, isn’t it?

Furthermore, if you focus your attention on the low points witnessed over the last ~10 years, investors’ current positioning in safe-haven assets has surpassed the peak that materialized during the Russia-Ukraine conflict in 2014 (follow the horizontal red line above).

On top of that, if you analyze the pink vertical bar on the right side of the chart, you can see that Vanda Research’s geopolitical risk index has hit a roughly 10-year high. As a result, fear is abundant, and investors use safe havens as a short-term hiding spot. However, over-positioning in safe-haven assets nearly always leads to sharp reversions once sentiment shifts. Thus, if history is any indication, we may have already seen peak fear, and a re-allocation away from these assets will likely sink the PMs.

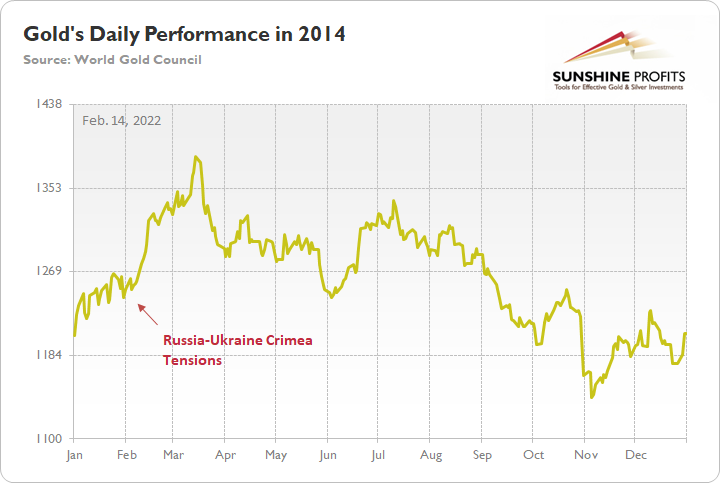

For context, I’ve presented the chart below on numerous occasions. However, if you compare investors’ positioning in global safe-haven assets in 2014 to where we are today (again, follow the horizontal red line above), you can see that the current reading has surpassed the peak from when Russia annexed Crimea in 2014.

Furthermore, if you compare the data with the chart below, you can see that peak safe-haven flows in 2014 coincided with peak gold. As investors’ positioning in global safe-haven assets reverted toward neutral from 2014 to 2015, the yellow metal sank like a stone.

As such, considering that the z-score implies a ~2.5% probability of further bullish positioning ahead, it means that there is a ~97.5% chance that safe-haven bets decelerate from here. With gold suffering mightily during the 2014 unwind, is this time really different?

If that wasn't enough, the Fed's next monetary policy meeting is on Mar. 15/16. While investors remain distracted by the Russia-Ukraine conflict, officials aren't backing off their hawkish rhetoric.

For example, Fed Governor Christopher Waller said on Feb. 24 that "it is possible that the state of the world will be different in the wake of the Ukraine attack, and that may mean that a more modest tightening is appropriate."

However, with Russia accounting for less than 2% of global GDP and the U.S. only levered to Russian oil, Waller said: "I believe appropriate interest rate policy brings the target range up to 1% to 1.25% early in the summer," and that selling assets on the Fed's balance sheet should occur "no later than" the July meeting.

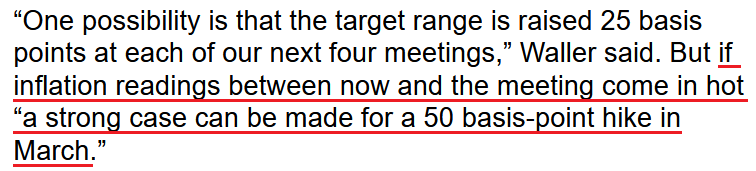

Furthermore, if inflation outperforms when the data is released on Mar. 10, Waller said that a 50 basis point rate hike could be appropriate.

Please see below:

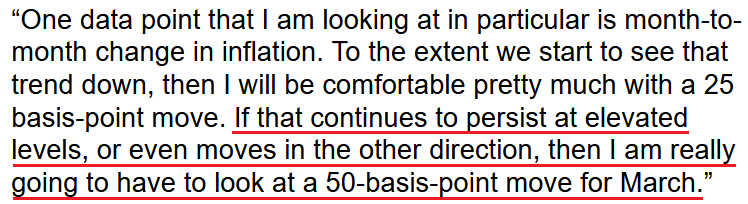

Echoing that sentiment, Atlanta Fed President Raphael Bostic said on Feb. 28: “I am still in favor of a 25 basis-point move at the March meeting.”

However, he added: “every meeting is live for us. As data comes in, we will have to make judgments about what happens at every stage of the way.”

“Historically, over the last 10 years or so our moves have been in 25 basis point increments,” he said. “I was hearing and getting a sense that many expected that was the only type of move we could do. I actually think that is wrong. We need to make sure people have different levels of move in mind, and awareness of those are possibilities.”

As a result, if inflation remains elevated, Bostic also said that a 50 basis point rate hike in March is a possibility:

To that point, if the Fed wants inflation, it doesn’t have to look very far. For example, the S&P Goldman Sachs Commodity Index (S&P GSCI) has rallied by nearly 27% year-to-date (YTD). For context, the S&P GSCI contains 24 commodities from all sectors: six energy products, five industrial metals, eight agricultural products, three livestock products and two precious metals. However, energy accounts for roughly 54% of the index’s movement.

Moreover, with the Russia-Ukraine conflict intensifying the supply shortages, the inflationary impact is material.

Please see below:

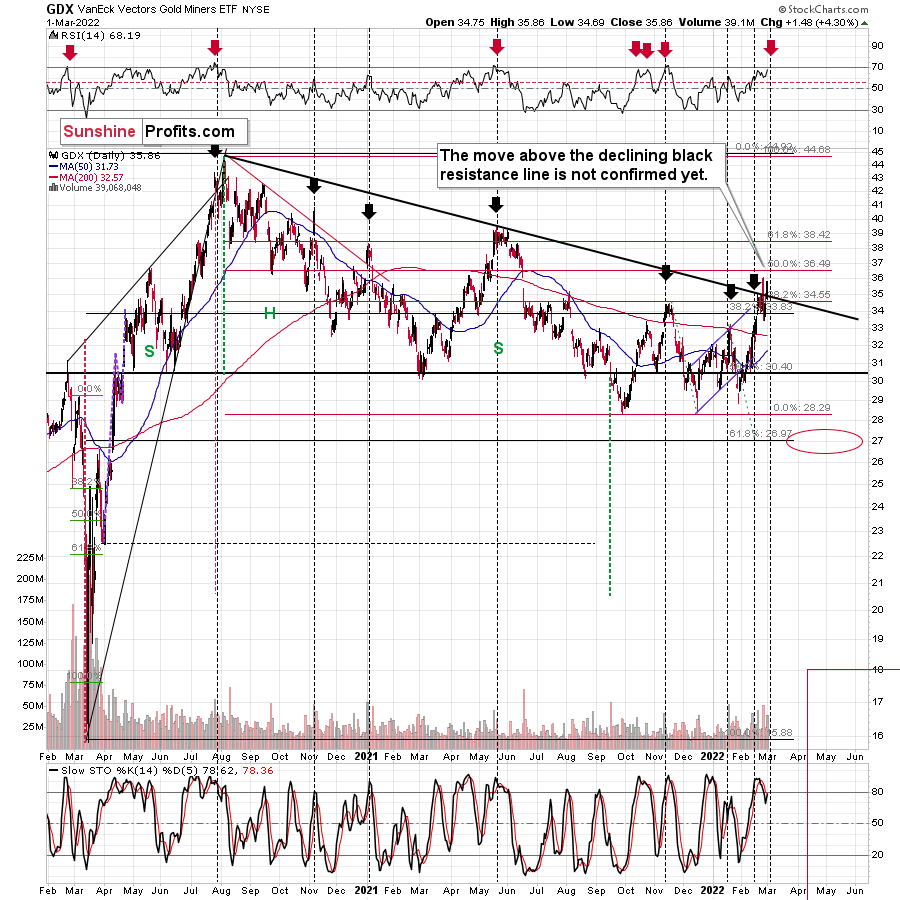

Second, IHS Markit released its U.S. manufacturing PMI on Mar. 1. While the headline index increased from 55.5 in January to 57.3 in February, and “less severe supply disruption was reflected in a slower increase in input prices,” the data was compiled before Russia invaded Ukraine. As a result, with the S&P GSCI going vertical in recent days, input prices will likely accelerate next month.

Furthermore, the short-term slowdown in input prices didn’t stop businesses from raising their output prices.

Please see below:

To that point, Chris Williamson, Chief Business Economist at IHS Markit, said:

“Demand is clearly continuing to run well ahead of supply, meaning it is a sellers’ market for a wide variety of goods. Although the survey’s price gauges covering companies’ costs and selling prices are off the peaks seen last year, they remain very high by historical standards and point to persistent elevated inflation in coming months. With rising oil prices adding further to soaring costs, and the Ukraine crisis likely to add to global supply disruptions, the inflation outlook is an increasing concern.”

Speaking of demand, the report revealed:

“Increased new order inflows spurred greater optimism among manufacturing firms in February. Output expectations for the coming year were the strongest since November 2020, as firms were buoyed by hopes of a reduction in supply-chain disruption and a greater ability to retain employees.”

Finally, the Institute for Supply Management (ISM) also released its Manufacturing PMI on Mar. 1. Showcasing similar strength, the headline index increased from 57.6 in January to 58.6 in February. Moreover, while pricing pressures calmed somewhat from last month, Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee, said:

"The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment. The COVID-19 omicron variant remained an impact in February; however, there were signs of relief, with recovery expected in March. A higher-than-normal quits rate and early retirements continued. Panel sentiment remained strongly optimistic, with 12 positive growth comments for every cautious comment, up from January's ratio of 7-to-1.”

As a result, U.S. economic growth remains resilient, and all of the metrics tracked by the ISM are pointing in positive directions.

Why is this so important?

Well, because it keeps the pressure on the Fed. With growth and inflation outperforming their pre-COVID trends, the Fed has little reason to perform a dovish 180. Moreover, with the Russia-Ukraine conflict only exacerbating the pricing pressures, the Fed is running out of time to act. In addition, it was only four months ago that the idea of a rate hike in March was ridiculous. Now, some Fed officials are debating whether 25 or 50 basis points are appropriate.

Thus, while the PMs remain distracted from the more important fundamental development, the situation is unfolding exactly like in 2014. As a result, while it’s unclear when sentiment will shift, history implies that when it does, safe-haven positioning and the fundamental backdrop should be extremely unkind to the PMs.

In conclusion, the PMs rallied on Mar. 1, as investors remain sensitive to every Russia-Ukraine headline. However, with one-sided safe-haven bets surpassing the splurge from 2014, the medium-term unwind will likely culminate with crashing precious metals prices. As a result, while the short-term environment remains challenging, sentiment should look a lot different in the coming months.

Having said that, let’s take a look at what happened on the charts and how much of a game-changer happened.

All eyes on gold.

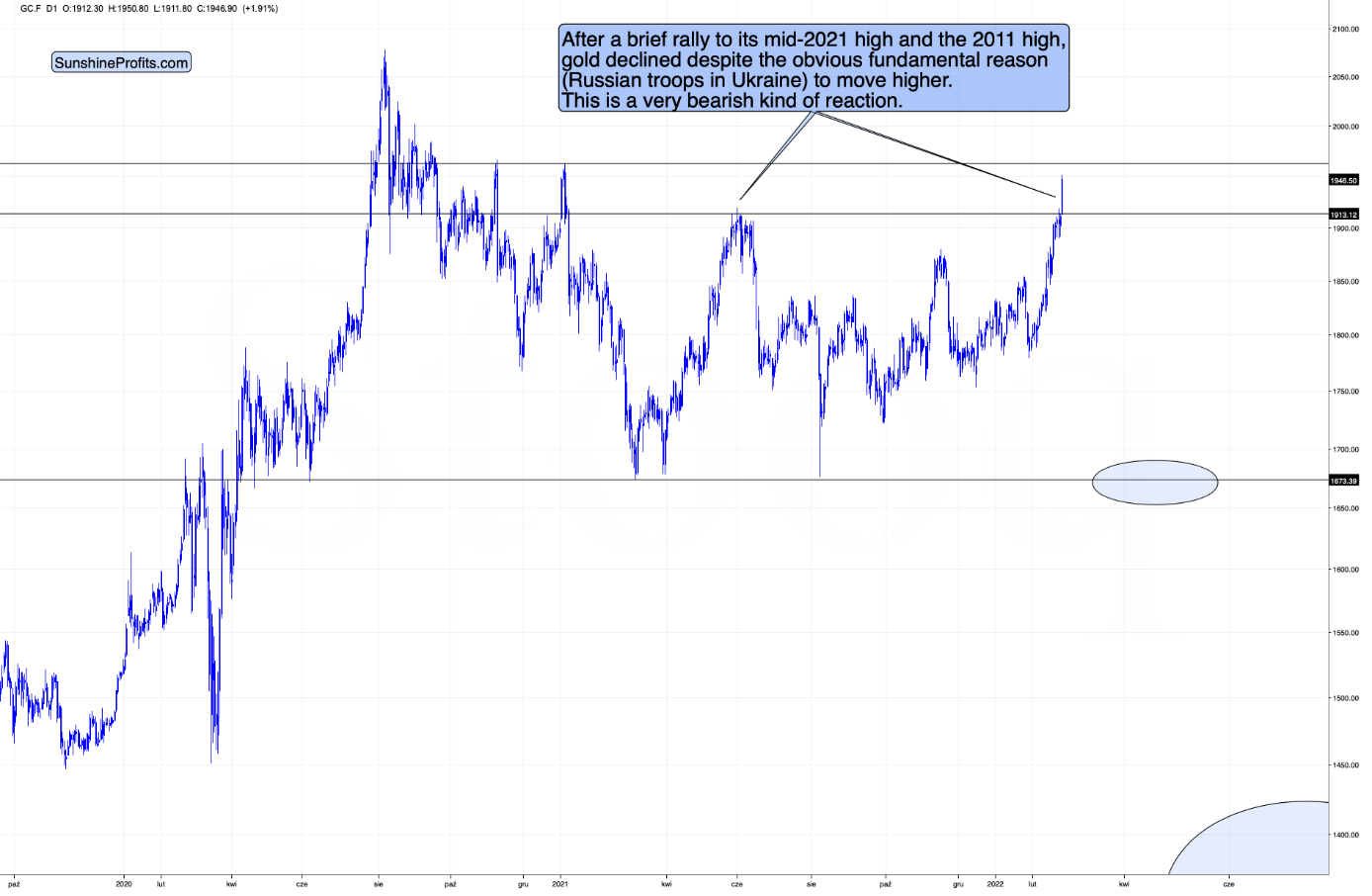

We saw a daily rally yesterday. A quite visible one on an intraday basis, but gold didn’t move above its previous intraday (actually, overnight) high of about $1,976.50. So, gold corrected.

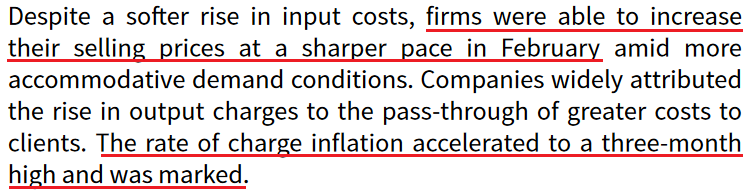

Let’s see if these kinds of corrections are common after major tops, or not. I marked the key previous tops with orange rectangles, and I also marked the corresponding movement in the RSI indicator. Here’s what we can infer from those similar cases:

a rebound after the very initial part of the decline is normal. In fact, in ALL recent cases, gold corrected at least 38.2% of the initial decline before sliding in a meaningful manner. In 3 out of 4, gold corrected more than half of the previous decline, and in 2 out of 4 cases (the most recent ones), gold corrected more than 61.8% of the decline. What happened in early March is in tune with the above BEARISH pattern.

The above is confirmed by volume, as it was not as big during yesterday’s upswing as it was when the top was formed.

It’s confirmed by the action in the RSI indicator as well. After topping above 70, it’s common for the indicator to pause or correct before truly declining to new lows (at least below 50). We haven’t seen a move in the RSI below 50 recently, and right now we are seeing a regular post-top correction.

Now, what might be concerning is the fact that mining stocks moved to new yearly highs yesterday, even though gold didn’t. However, that’s not a fair comparison, because gold’s recent high was formed during overnight trading, and thus miners were not able to react to gold’s gains at that time.

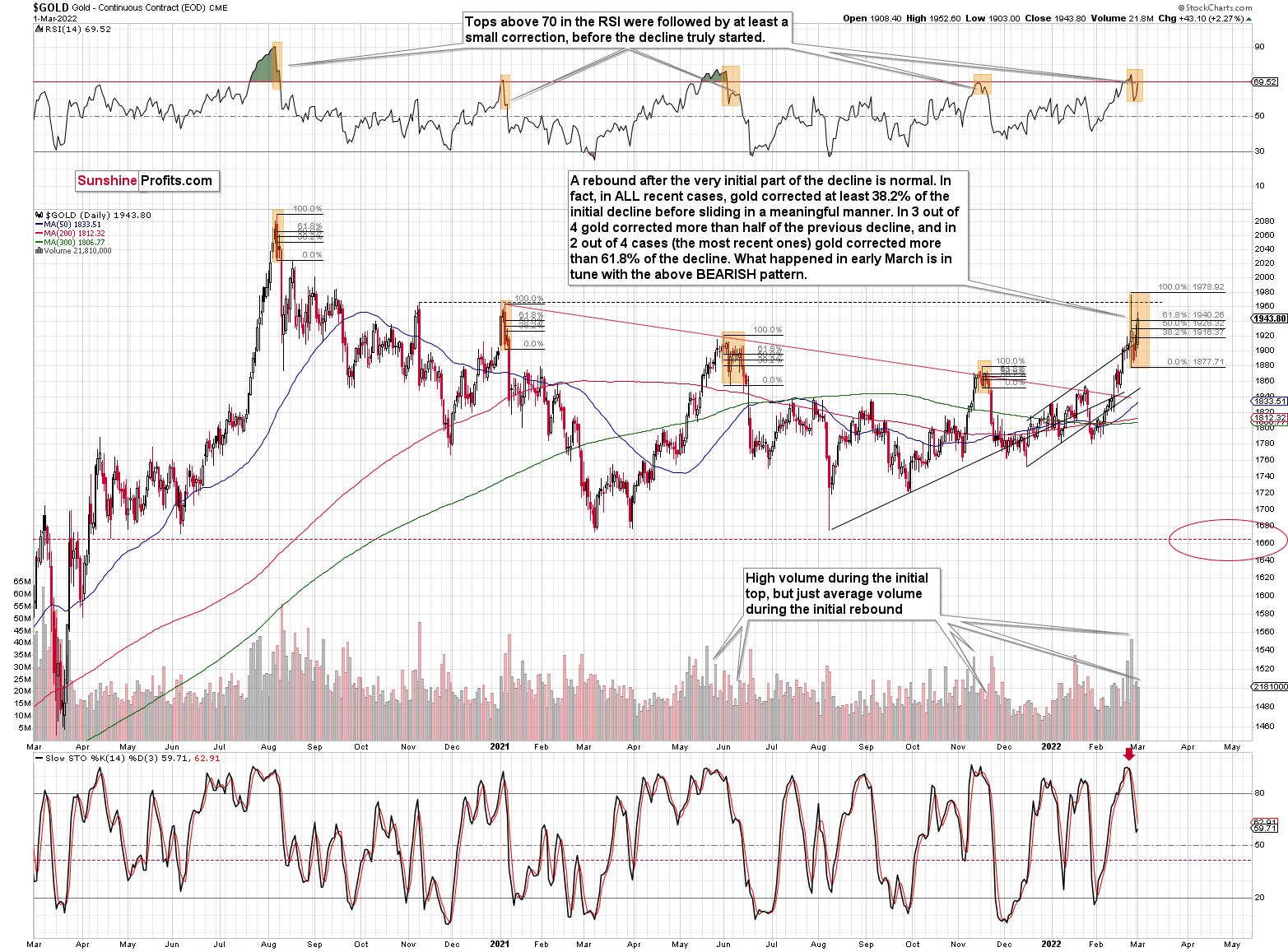

A comparison between miners and the GLD ETF would be fairer, as they both trade during the same hours.

Indeed, in terms of closing prices, we only see the rally now. However, does it invalidate the analogy to the previous tops? No, it actually confirms it in case of the mid-2021 top. The path that gold took to both tops was characterized by two high-volume sessions – one when RSI was almost at 70, and the second when it was a bit above it. The final top formed when RSI was even higher, and when GLD was higher too. That’s what we saw yesterday – GLD’s price was higher than it was during its previous huge-volume session while RSI was above 70.

The above might seem confusing when described, but if you look at the above chart and focus on the orange rectangles and the dashed blue lines, you’ll see just how similar the situations are.

Interestingly, there was a small deviation in the analogy in the form of big volume yesterday. However, high-volume sessions in the GLD while the RSI based on it was above 70 marked the tops many times before, too. So, the implications are bearish, anyway.

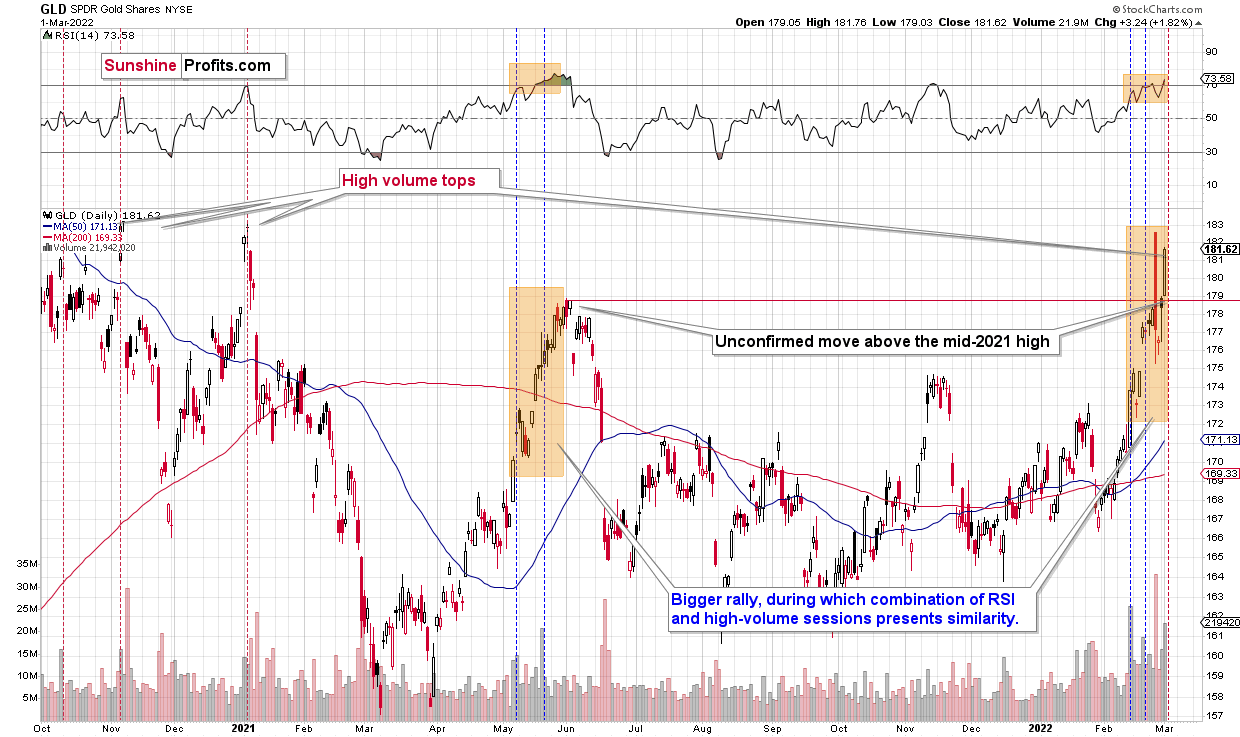

Gold mining stocks moved higher yesterday, and they even moved above the declining black resistance line. The previous intraday attempt to move above it was quickly invalidated. This time, gold miners were able to close above it. Will this breakout be successful? That remains to be seen, but it seems rather unlikely.

Please note that the RSI moved almost to 70 – something that very often marked the final moments of a given rally. I marked those cases with red arrows on the above chart.

Moreover, volume was significant, and as you can see on the above chart, huge-volume rallies in GDX are usually a sign of a rally being over or very close to being over. I marked those cases with vertical, dashed lines.

Moving back to the RSI, close to 70 situations: in practically all those cases, the prevailing “feeling” was that gold mining stocks would continue to rally indefinitely (or near-indefinitely – at least it “felt” like the end of the rally was not in sight). We know this because we monitor what kinds of messages people post on various forums, and we read the messages that hit our support mailbox. We see something similar now. There’s one common thing in those situations – it’s very common that gold, silver, and mining stocks do the opposite of what is supposed to be the “100% guaranteed” move.

If it seems like “gold is to go up during wartime and it’s 100% inevitable,” please re-read my comments and examine the charts featuring situations when troops of one country entered another country. That’s exactly what happened. Gold didn’t have to go up, and it wasn’t 100% inevitable. In fact, there were only short-term rallies, and then declines thereafter as the concern and fear waned.

What I wrote about those analogies previously (Feb. 24) remains up-to-date. Please note that I wrote the above when gold was after a huge overnight rally; at that time, it was still before the reversal; the quote below is exactly what I wrote on Feb. 24, so if you’ve read that analysis, feel free to skip the part in italics.

Third, mining stocks, especially junior mining stocks, don’t have to react just as gold does. In fact, they are not likely to, based on the analogy to what happened when Russia took over Crimea in 2014. I already wrote about that previously, and it’s worth quoting it once again:

What would happen then is that PMs would be likely to rally until the conflict actually starts, then a bit more, and then they would likely continue their medium-term decline. It already happened in 2014, when Russia took over Crimea. Interestingly, it was more or less at the same time of year. By mid-Feb, the majority of the rally was over. The entire rally in gold was about $200, and the part that continued after mid-Feb. was about $50.

Thus, considering December 2021 as the starting point of this rally, gold is up by about $150 now – so the history rhymes here.

Consequently, IF (and that’s a big if) the tensions escalate and Russia takes over a part of Ukraine once again, we might be looking at “only” an extra $50 rally in gold or so and a top in mid-March – and then the medium-term slide would be likely to continue.

When I wrote the above, gold was trading at about $1,900. It’s trading just below $1,950 at the moment of writing these words, so we now have a to-the-letter analogy to 2014. And in this analogy, the “peak concern” and “peak gold” have likely already materialized.

Oh, and by the way, GDXJ actually topped in mid-Feb 2014, and then it just moved back and forth until gold topped in mid-March 2014. OK, to be precise, the GDXJ’s intraday high in March was about 3% above its mid-Feb high, and it was then followed by an immediate decline.

It seems like the worst time to be exiting short positions in junior mining stocks. Instead, it might be a perfect time to be entering or adding to them (if one doesn’t have the desired exposure yet).

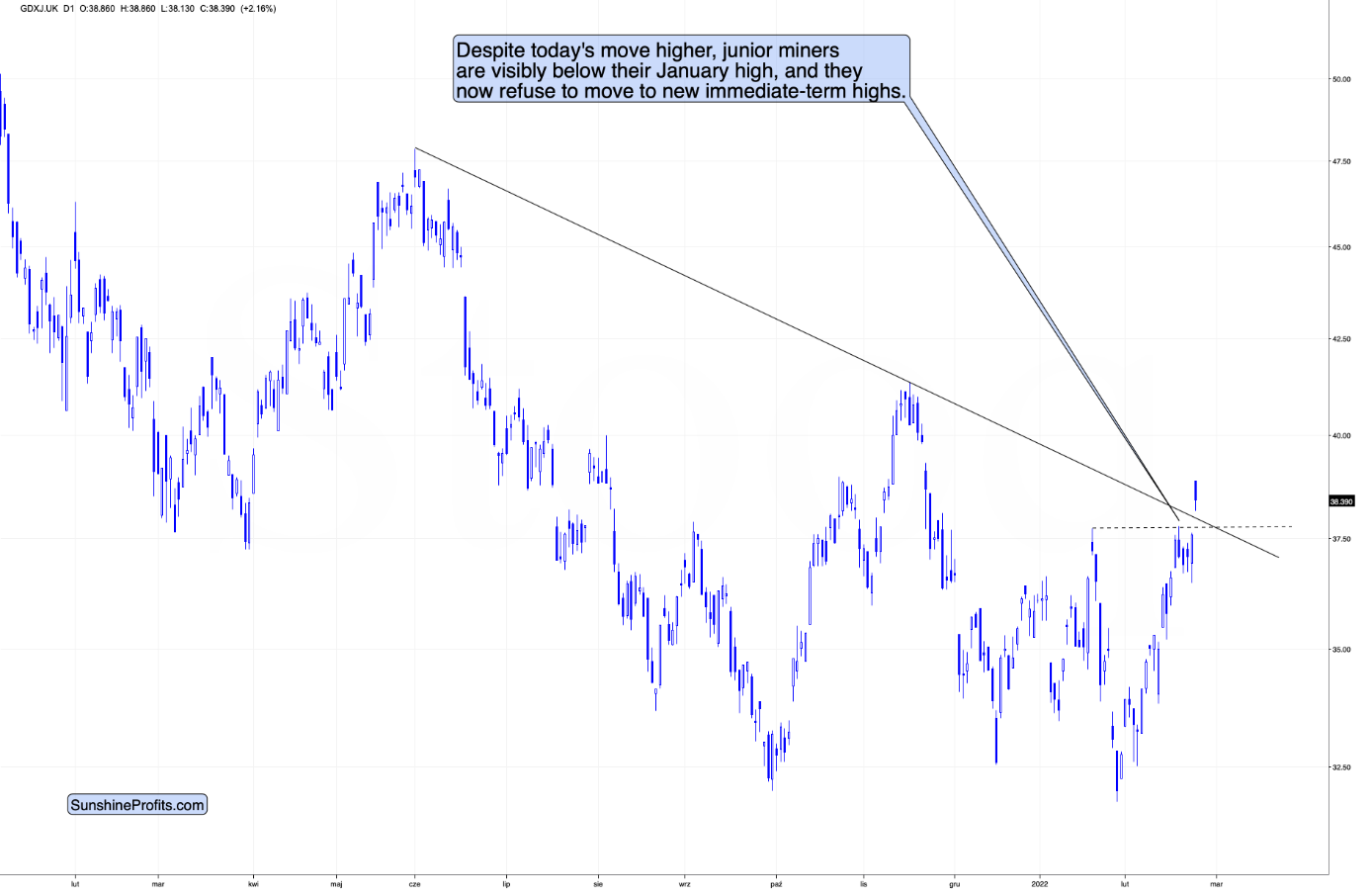

Well, since gold is about $200 above its late-2021 low, thus completing the analogy to 2014, let’s check if junior miners are also behaving similarly.

In today’s London trading, the GDXJ is up, but not very significantly so. Today’s intraday high (so far) is 38.86. The recent intraday high was 37.79. This means that today’s intraday high is 2.83% higher, which is in perfect tune with what happened in 2014.

Please note that we already saw an intraday decline, despite the higher open, which is also what accompanied the early-2014 top in the GDXJ. Of course, the session is far from being over, so this could change. It’s a weak (but present) indication, while the near-3% size of the rally above the previous highs is a strong indication that the situation is similar to what we saw in 2014. And this has bearish implications for the following weeks in case of the junior mining stocks.

And speaking of analogies to the past, let’s check what gold did when troops crossed borders in case of other relatively recent wars.

The arrow on the above chart shows what happened on the day when the U.S. – Iraq war started.

There was an intraday rally, but ultimately the start of the war itself was not a bullish factor for gold.

The above chart features the same thing with regard to the U.S. – Afghanistan war. Gold moved higher in the immediate aftermath, but then declined profoundly, as the tensions subsided.

You already saw the analogy to the invasion on Crimea in 2014, so you saw that there was only a short-term rally after the military action took place (in 2014, it took the following form: On 27 February, masked Russian troops without insignia took over the Supreme Council (parliament) of Crimea and captured strategic sites across Crimea.

So, while it might be contrary to one’s intuition about such events, based on the most recent historical analogies, it seems that the Ukraine-war-based rally in the precious metals sector is either over or very close to being over.

And this is even more likely to be the case with junior mining stocks. In case of the latter, it seems that we are witnessing a top in the making at this very moment.

It might be hard to view the above statement as justified in light of the huge rally in gold that we just saw, but the facts and analogies are in place nonetheless.

Technically, gold just encountered very strong resistance provided by its 2021 and late-2020 highs, and the breakout above the mid-2021 highs is not confirmed.

Let’s keep in mind that for gold to decline, the war doesn’t have to end, it doesn’t have to be won by either side. The only thing that matters with regard to it, is how big the uncertainty and concern is. And the peak uncertainty/concern might be today, as everything is new, and the situation is dramatically changing the geopolitical environment in Europe.

For comparison, remember Covid-19 cases, deaths in early 2020? That was just a tiny fraction of what we saw later. However, it was new and unknown. People were particularly scared then, and the markets moved particularly significantly then – not based on additional millions of cases and thousands of deaths next year.

Investing and trading are difficult. If it was easy, most people would be making money – and they’re not. Right now, it’s most difficult to ignore the urge to “run for cover” if you physically don’t have to. The markets move on rumor and sell the fact. This repeats over and over again in many (all?) markets, and we have direct analogies to similar situations in gold itself. And junior miners are likely to decline the most, also based on the massive declines that are likely to take place (in fact, it already started) in the stock markets.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is now over or very close to being over , and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

- It seems that the first (bigger) stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

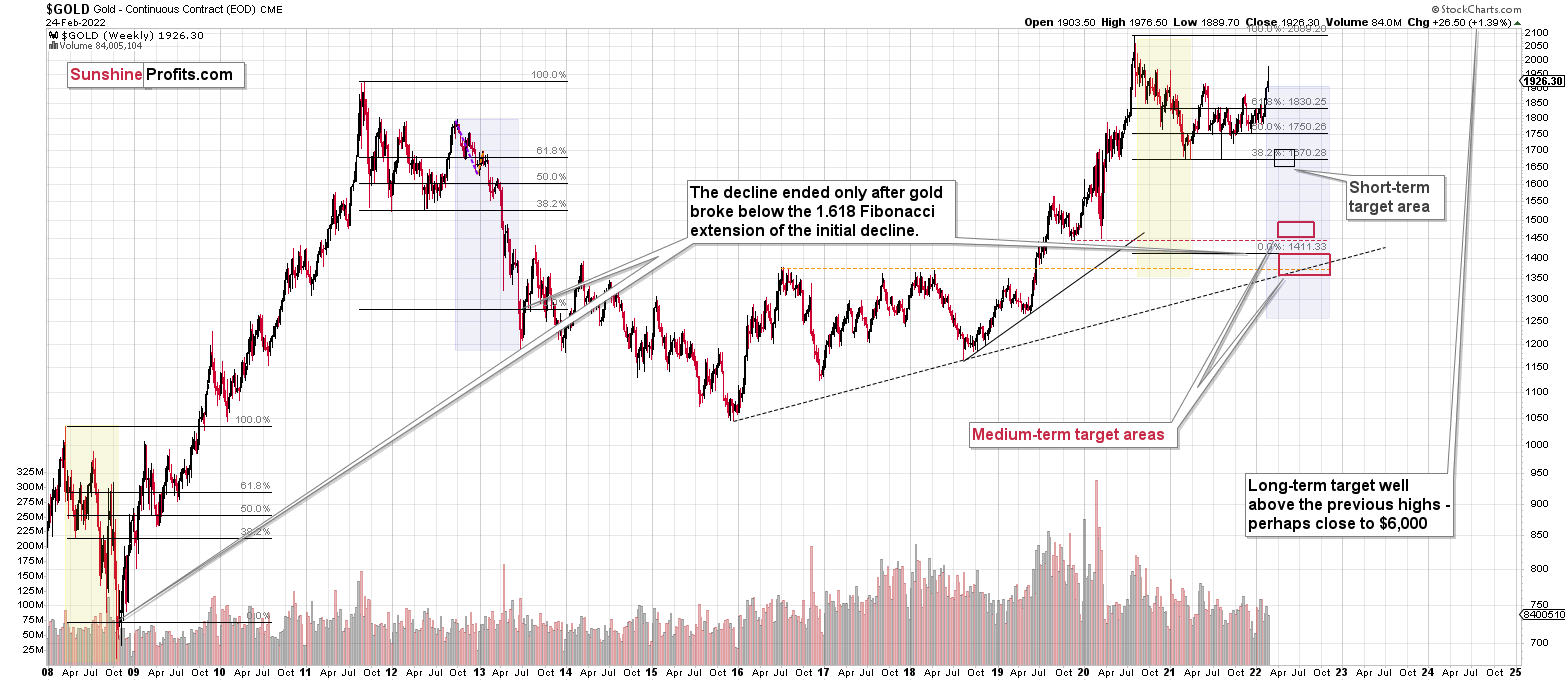

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, despite last week’s rally in gold, the outlook for junior mining stocks remains exactly as I described previously.

Gold was up about $200 from its late-2021 low, just like how much it rallied in 2014 when Russia took over Crimea. When that happened, junior miners moved about 3% above their previous highs (this remains true also in light of the March 1 rally), and we saw something very similar in last week’s GDXJ trading. Both gold and junior miners declined then, despite the obvious fundamental reasons for their rally.

It looks like “peak uncertainty” and “peak gold” are already here or very, very close. It’s even more likely that the top in junior mining stocks is in.

Investing and trading are difficult. If it was easy, most people would be making money – and they’re not. Right now, it’s most difficult to ignore the urge to “run for cover” if you physically don’t have to. The markets move on “buy the rumor and sell the fact”. This repeats over and over again in many (all?) markets, and we have direct analogies to similar situations in gold itself. Junior miners are likely to decline the most, also based on the massive declines that are likely to take place (in fact, they have already started) in the stock markets.

From the medium-term point of view, the two key long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the coming months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $34.63; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $14.98; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $25.48; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $38.28

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $11.79

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $29.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief