Briefly: In our opinion, full (200% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

Silver was just breaking to new highs, gold stocks (HUI) were above the 205 level and gold was at levels not seen since August 2016. Gold and silver bulls were cheering. They are not cheering anymore. Even though the above was the case just several days ago, it was all invalidated, just like we expected it to be. Based on what happened on Friday, silver and mining stocks are at their new 2018 lows and their entire 2018 performance is a one huge bearish reversal. Where do precious metals go from here?

Lower. Likely much lower.

Why? Let’s see, starting with the short-term charts (chart courtesy of http://stockcharts.com).

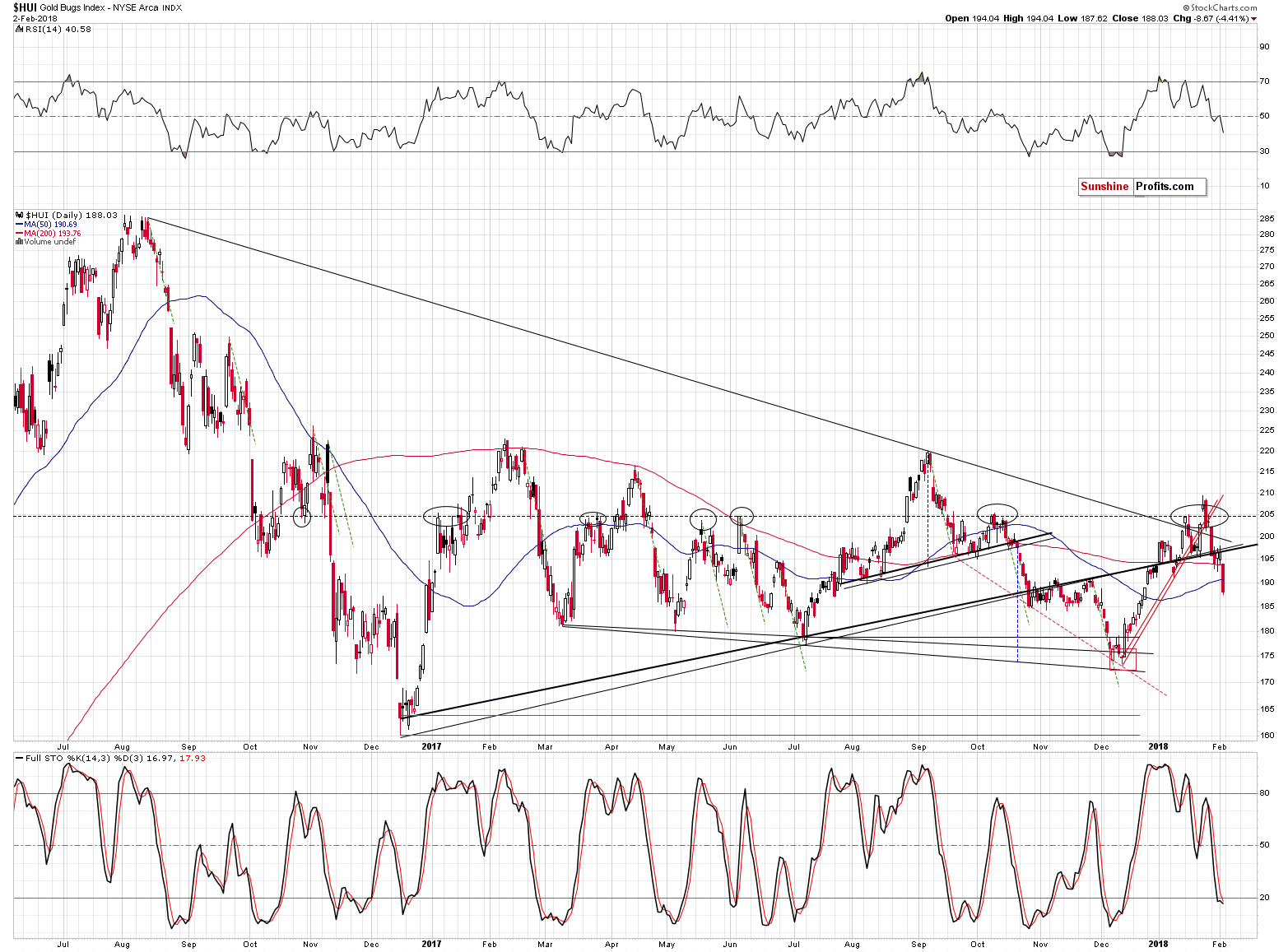

In our previous analyses we emphasized that the small 2-day consolidation didn’t change anything because gold miners have recently broken below all important nearby support levels that could be broken and none of these breakdowns was invalidated:

- The mid-January high.

- The early January high.

- The late January low.

- The 205 level (invalidating the breakout).

- The declining, medium-term resistance line (invalidating the breakout).

- The rising, medium-term resistance / support line.

- The rising short-term (red) resistance / support line.

Consequently, the bearish implications remained in place and during Friday’s session, we saw their result. Gold stocks took a dive and closed at levels not seen since December 22, 2017. The HUI Index also close below the 50-day and 200-day moving averages. Both MAs served as important support and resistance lines (especially the latter), so this move is significant.

The very high reading of volume during the decline seems to confirm that this is really the direction in which the market wants to go.

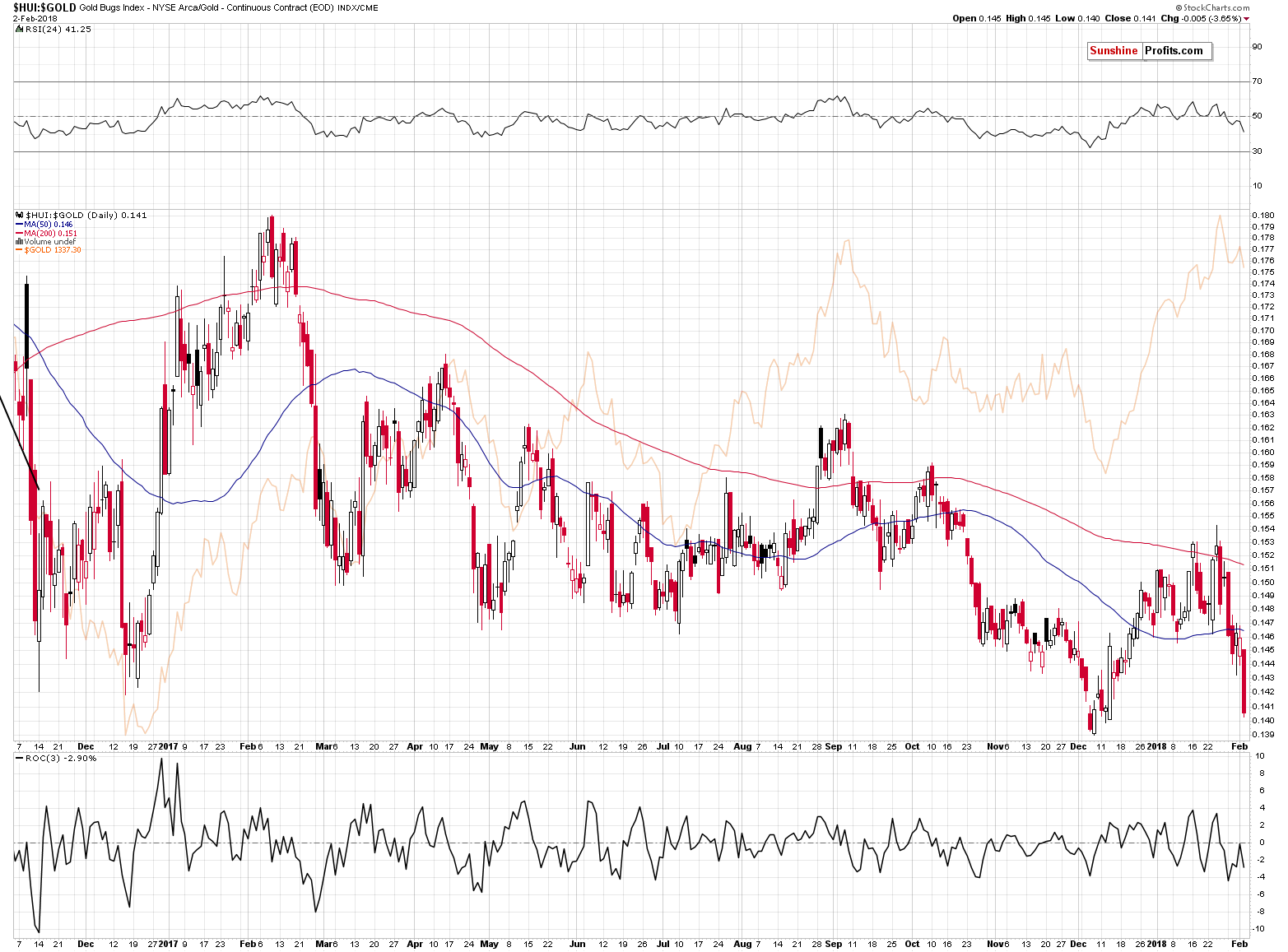

The gold stocks to gold ratio is indicating the same thing. The miners underperformed gold to a great extent and are on the verge of breaking below the 2017 lows. They are already below the 2016 lows at this moment, which is yet another bearish sign.

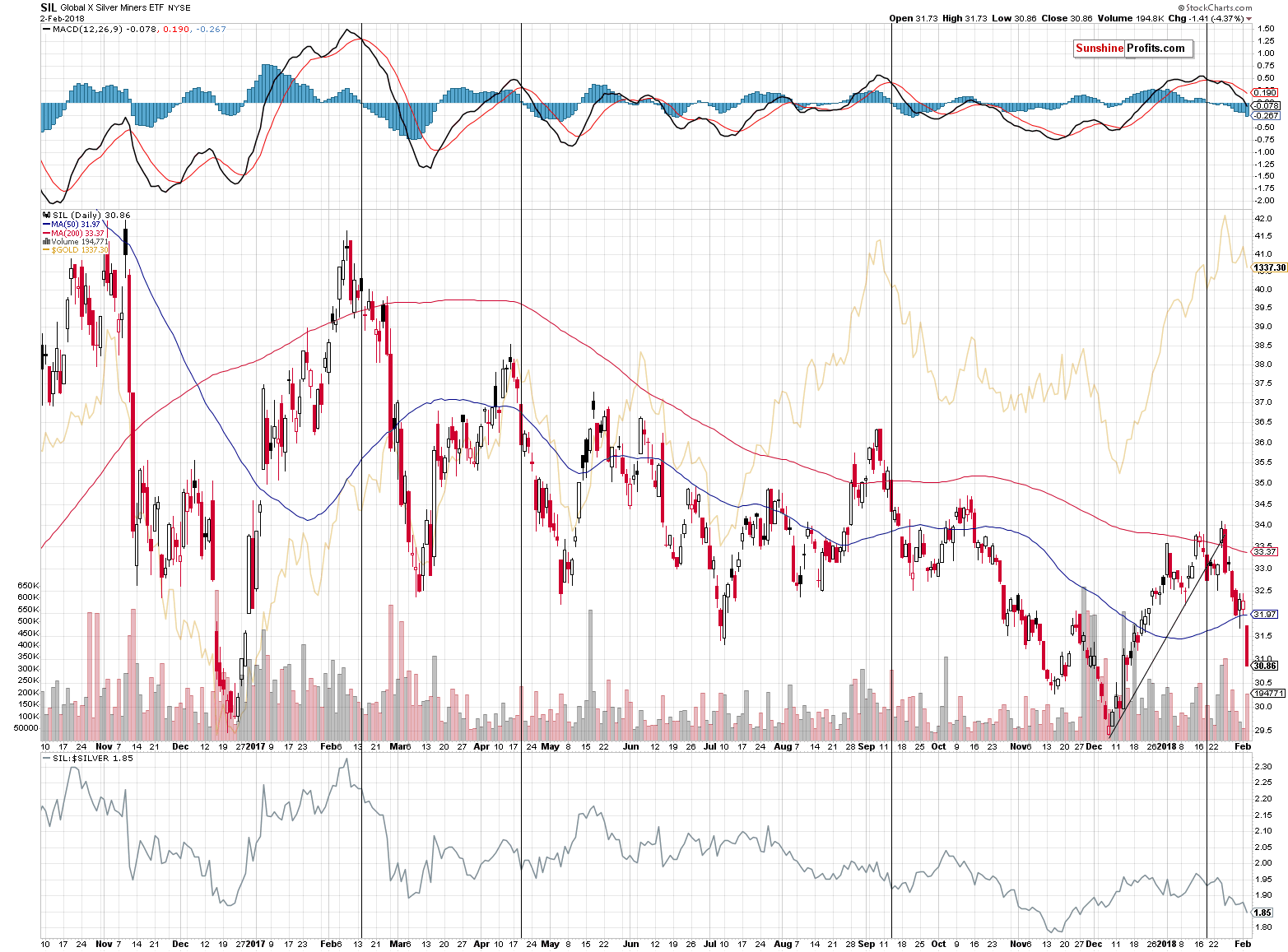

Meanwhile, silver stocks declined sharply and moved quite close to the late 2016 and 2017 lows. If this momentum continues for a few more days, we’ll see another major breakdown that will open the door to even bigger – and more volatile – declines.

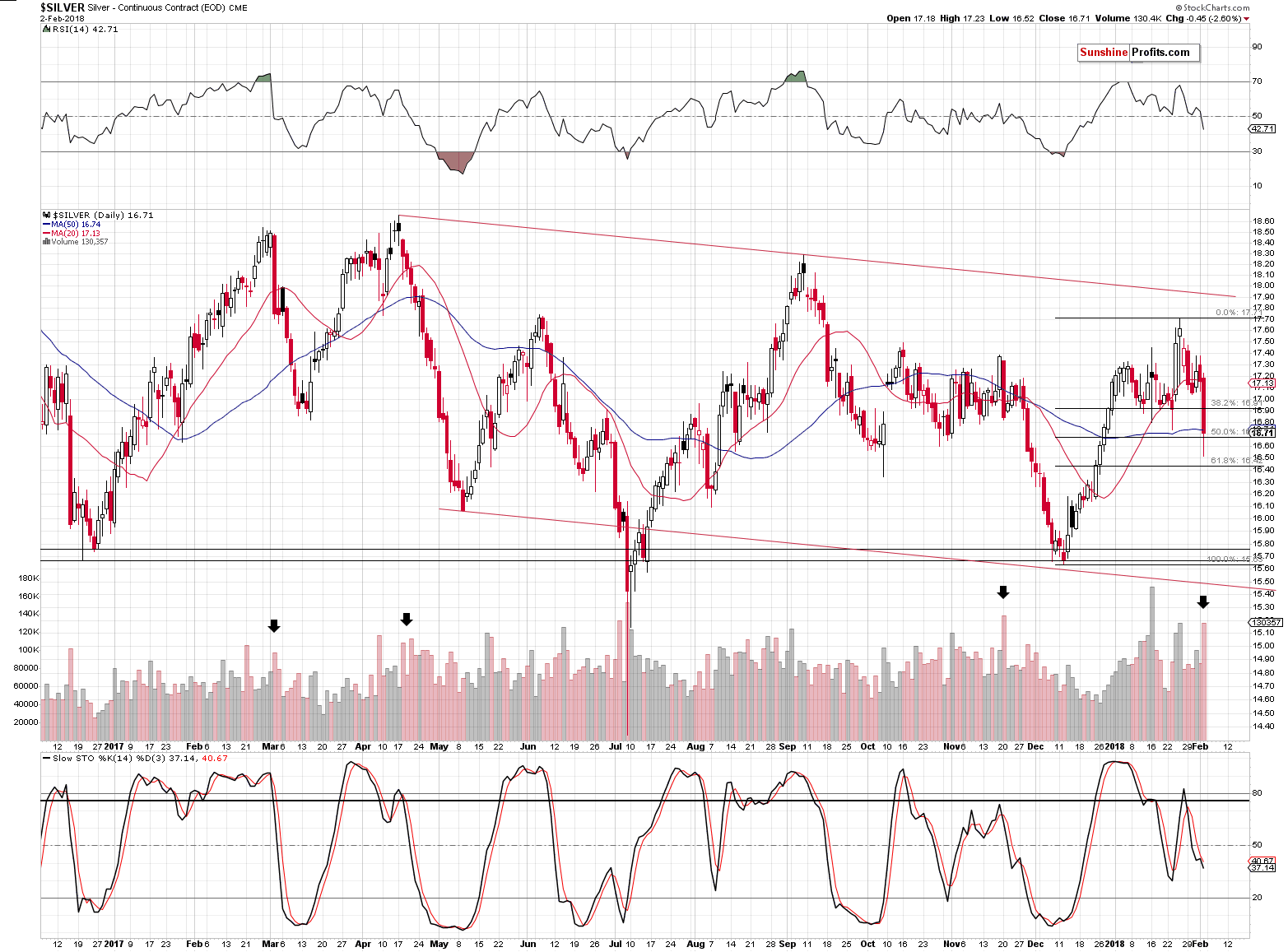

The white metal declined profoundly during Friday’s trading on huge volume. This serves as a good indication that the main part of the decline is beginning. We marked similar situations (with regard to volume) with black arrows. The previous cases were followed by additional $1-$2 declines, so the analogy to them is definitely bearish.

To be clear, we don’t think that silver is going to decline by only $1-$2, but by much more, but a decline of this magnitude will be a good start.

In fact, we expect silver to move lower very substantially before bottoming. The white metal’s decline should scare precious metals investors away from the market and the investors’ sentiment should be extremely unfavorable before the huge bull market in silver can resume. That’s the factor that was missing in late 2015 – people were not scared or very bearish – as they should have been at a key bottom. Consequently, it doesn’t seem that late 2015 was indeed the final bottom and our last week comments on the above chart remain up-to-date:

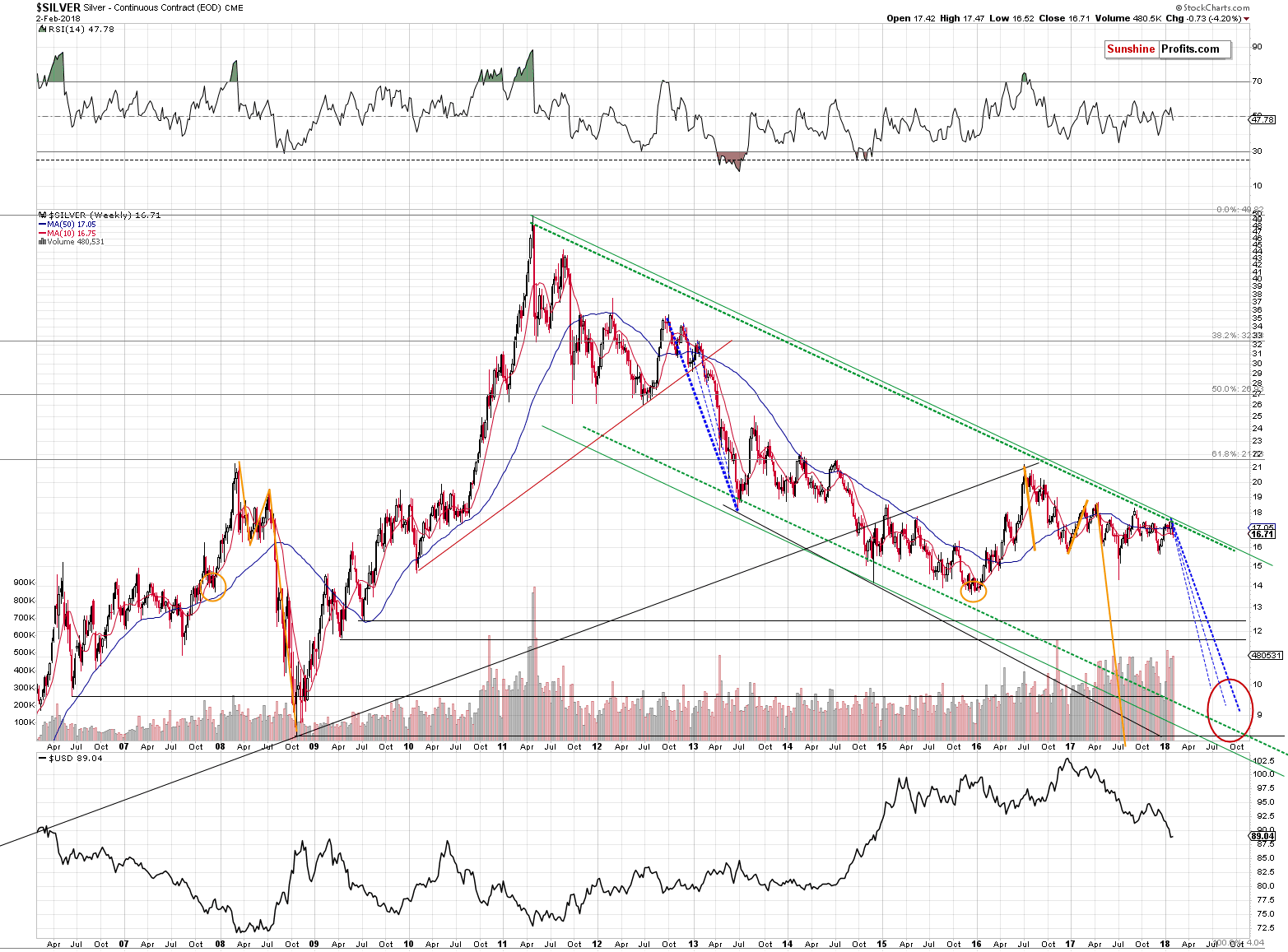

There is a very good chance that this top is the final one, so let’s check what this implies.

In order to do this, we’ll apply 2 techniques that we’re using in the case of other charts and we’ll remind you about something that we discovered a long time ago, but that remains to be very up-to-date also today. We get the feeling that you are most interested in the latter, so let’s start with it.

Please note the orange ellipses and lines on the above chart. You can see them in late 2007, in 2008 and 2015, 2016 and 2017. You see, starting from the bottoms marked with orange ellipses, the price moves that are marked with lines are practically identical – at least so far. The price moves are not identical only in the case of their range. The starting and ending points are extremely similar as well.

In both cases, silver bottomed a bit below $14 and quickly soared above $21. Then it declined to about $16 (in both cases). Then it rallied to about $19 (again, in both cases). Then it moved lower once again and declined very far dramatically before moving above the previous highs. Back in 2008, the decline was seen quickly. In this case, silver is taking its time. Does this invalidate the analogy or does it make it any less valid?

No. Back in 2008 silver’s decline got help from a strong rally in the USD and in this case, silver gets a boost from a huge decline in the USD. A decline that seems to be ending, but let’s stay with silver for a while. The important observation is that silver should have rallied given the decline in the USD from about 100 to below 90 over the last year. It didn’t. It’s actually even lower than it was during the 2017 top.

The analogy to 2008 wasn’t invalidated – it was just significantly delayed. When the circumstances are analogous, and the USD starts a rally, the silver market is likely to perform just as it did in 2008 or at least similarly. This means that we can expect silver to move to $10 or perhaps even temporarily below it before the final bottom is reached.

As we wrote above, that’s only one technique that points to these levels. The other two ones are the analogy to the 2013 decline and the lower border of the declining trend channel.

We marked the former with the declining dashed lines. The boldest of them marks the most likely analogy – if the top that we are – most likely – currently seeing is indeed the start of the final decline, then it is precisely this analogy that we should be focusing on.

The lower border of the trend channel is parallel to the line based on the key tops of the 2011 – today decline. That’s a classic way to create a support line, so it doesn’t seem to require a lot of commentary. Trend channels work in most markets and silver is one of them, so adding this kind of support is useful.

What does it all leave us with? Silver is likely to slide much lower before the decline is completely over. In fact, it could go to level that appear shocking or unbelievable at this time. Before dismissing the above, please note that a move from the current levels to single-digit prices already took place less than ten years ago. Why wouldn’t it be possible for history to repeat itself? After all, that’s the thing that it tends to do.

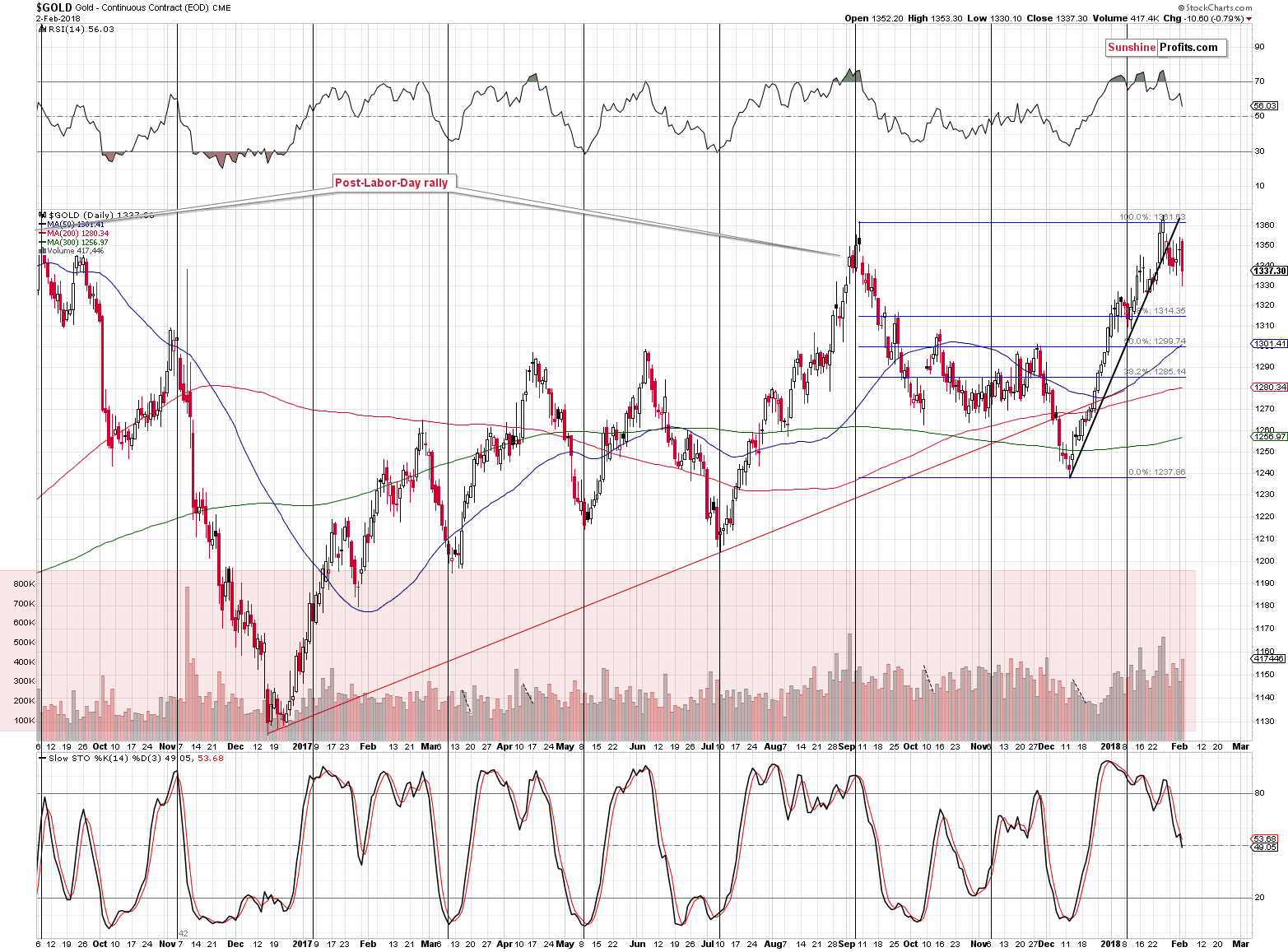

Gold’s decline is not as big or sizable as what we see on the silver chart or the ones featuring mining stocks, but the price-volume link is definitely bearish. Gold’s recent declines took place on volume that was visibly bigger than what we had seen during daily price increases.

According to kitco.com’s closing price, gold ended the week at $1,332, so the last session shouldn’t be viewed as a reversal, which it may resemble on the above chart.

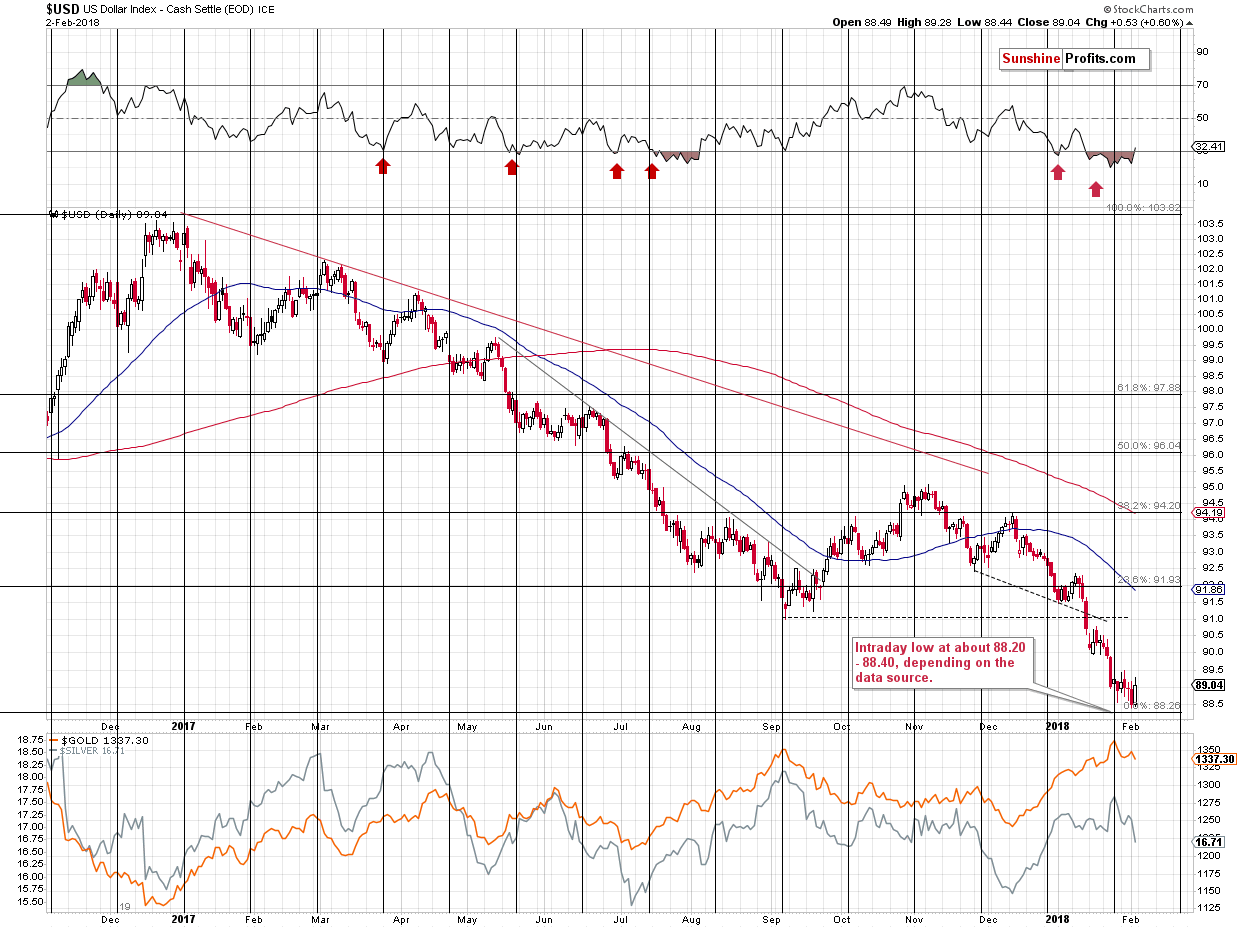

Finally, let’s take a look at what happened in the USD Index.

The interesting thing about gold’s, silver’s and mining stocks’ decline is the context. The USD Index moved higher, but the move was not that spectacular. To be clear – a 0.5 increase in the value of the Index is significant, but compared to what the USD Index did previously is nothing to call home about. The USD has been trading back and forth around the 89 level and Friday’s session was a continuation of this pattern.

If the USD action is not that important, then what is? The precious metals sector’s reaction to this rather normal course of action. Metals and miners continued to mostly ignore the USD’s declines and to amplify the reaction to the USD’s rallies. That’s one of the most bearish factors that are current in play for the precious metals market – if not the key one in case of the short term.

Let’s stay in the currency realm for a while zooming out a bit.

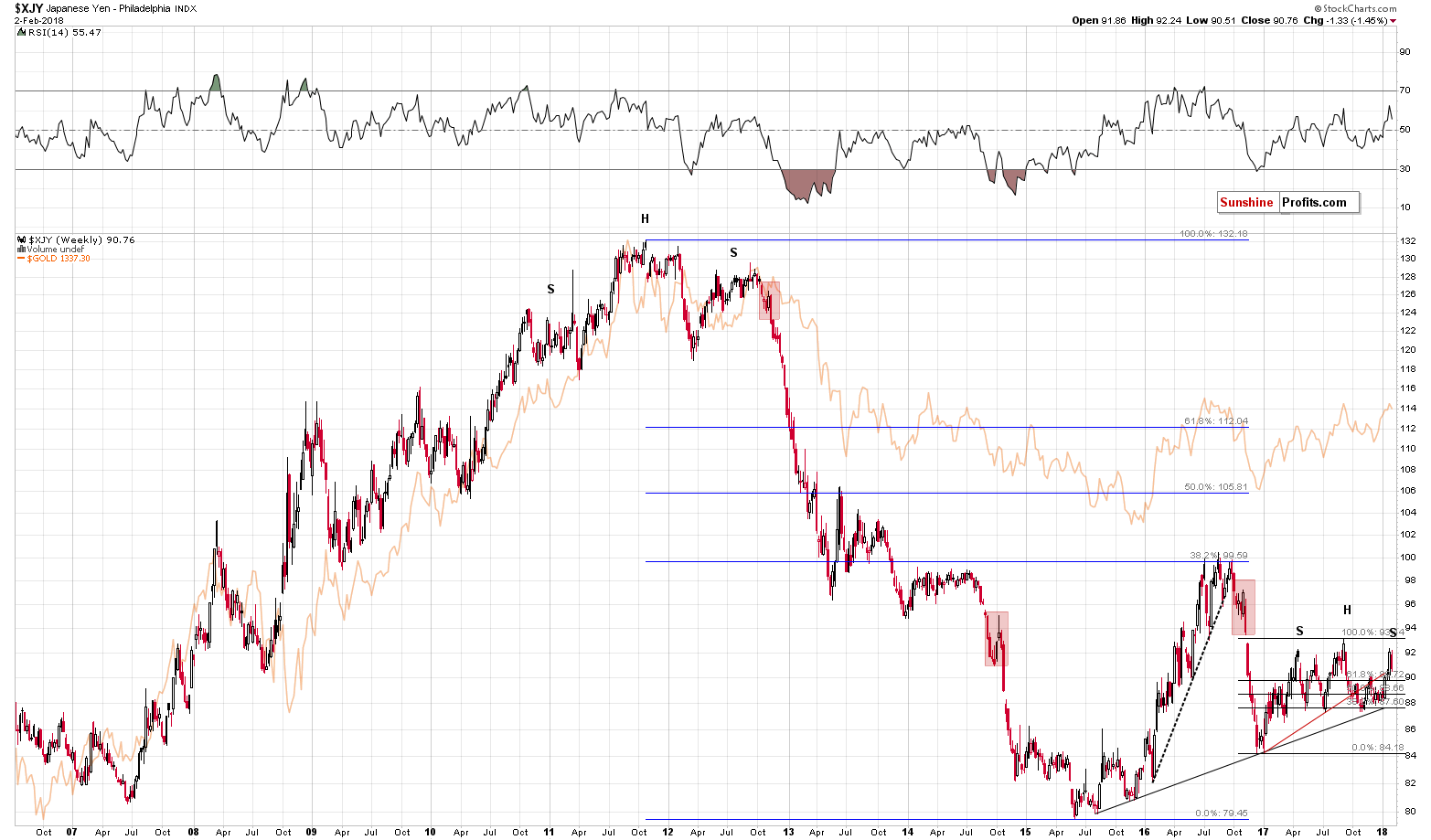

Several days ago, we discussed a possibility regarding the Japanese yen that could have profound bearish implications not only for the currency, but also for the gold market. We wrote the following:

The Japanese yen moved above the rising red support / resistance line. This move could still be invalidated, but it’s not that clear anymore – the yen is too much above the line for the reversal to be imminent.

So, while the short-term situation for the yen is unclear based on the long-term picture (you’ll find more short-term details in our Forex Trading Alerts), there is a – potentially – interesting development that we would like to mention. The formation is far from being complete, but it’s possible that a decline from here would result in a quite clear head-and-shoulders pattern.

What’s so interesting about it? The 2011 tops in the yen and gold as well as the 2016 tops in yen and gold all took shape of this pattern. Again, that’s just a possibility at this time, but something that’s worth keeping in mind.

(…) in the case of the mentioned tops, the shoulders of the formations – tops – were formed at very similar price levels. The early 2011 top and the late 2012 top formed at very similar prices and we can say the same thing about the shoulder tops from late 2016.

Why is this significant?

Because yesterday’s intraday top was very close to the early 2017 tops – the first shoulder of the possible head-and-shoulders formation. This observation makes it more likely that the final top for the yen is already in or about to be in. This, in turn, makes the same more likely for the precious metals market.

The Japanese yen declined substantially in the final part of the previous week and it seems quite likely that the top is indeed in. As discussed above, the implications are bearish for both the yen and the precious metals market. Naturally, they will be much more significant once the head-and-shoulders formation is completed. Still, the fact the formation seems to be underway (the shape is near-perfect) already sheds some bearish light.

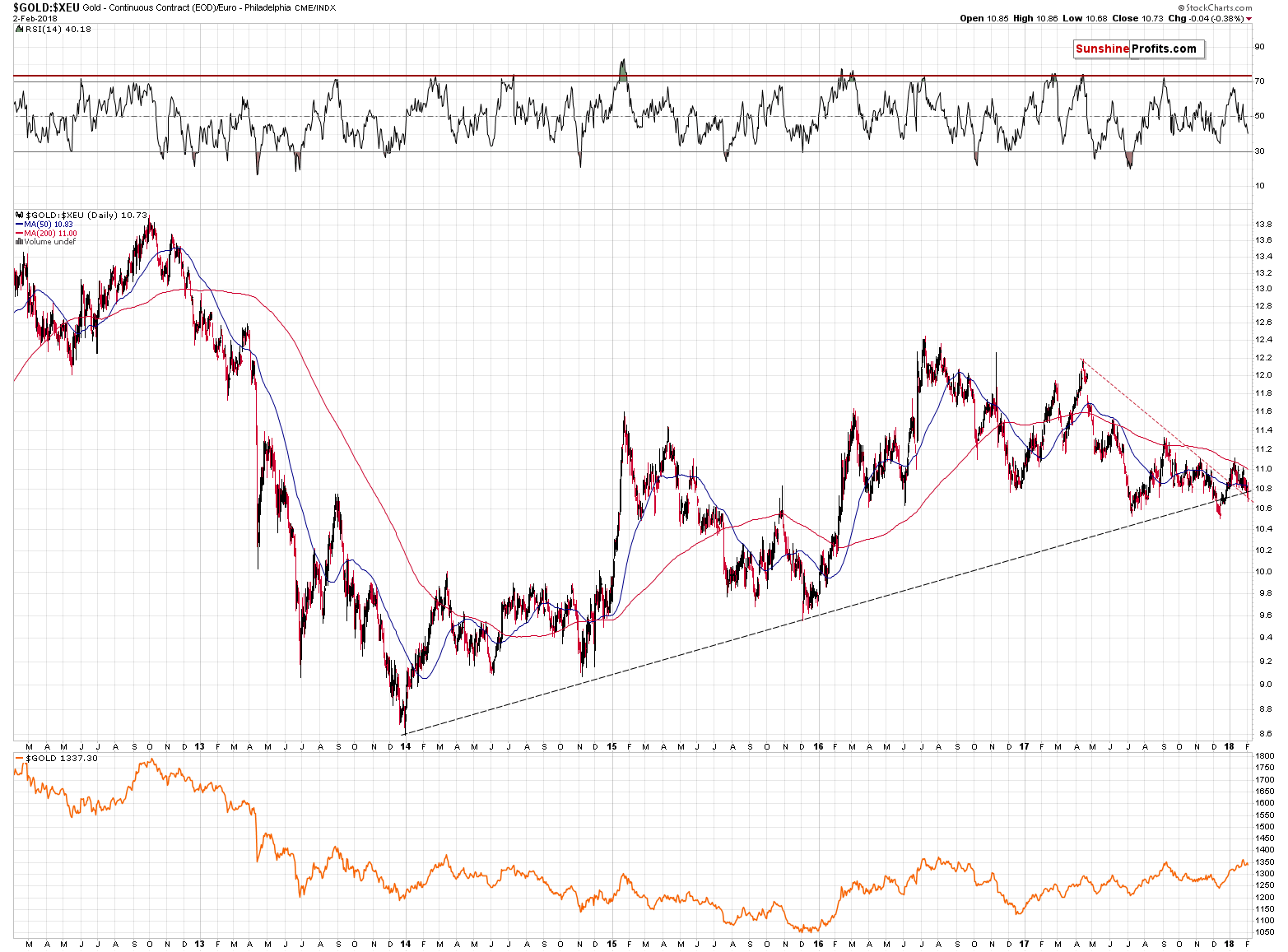

Let’s move away from the currency market, but not entirely. The next chart that we prepared for you is the one featuring the price of gold, but in terms of the euro.

The most important thing that we can see on the above chart is the breakdown below the rising black support line. The breakdown is not confirmed and since the previous attempt was invalidated, we shouldn’t trust it to the full extent just yet. Still, the outlook is more bearish even after an unconfirmed breakdown than before it, so we can say that the outlook deteriorated.

The second thing that we would like to emphasize here is that the apex triangle reversal technique seems to have worked once again. Gold in terms of the euro topped very close to the apex of the triangle created by both lines visible on the above chart (rising black one and declining red one). This serves as a confirmation of this techniques’ usefulness for the precious metals investors.

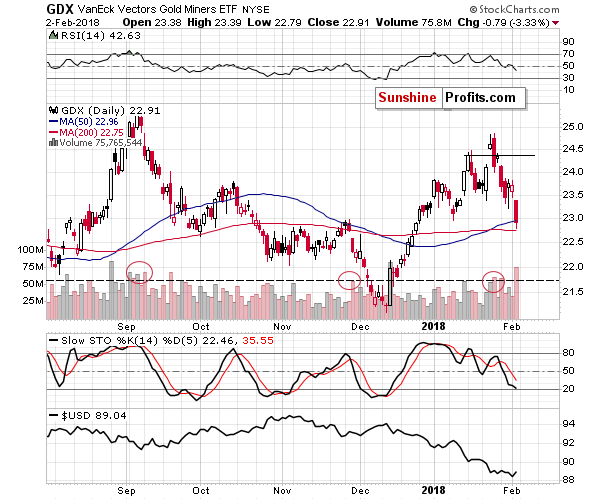

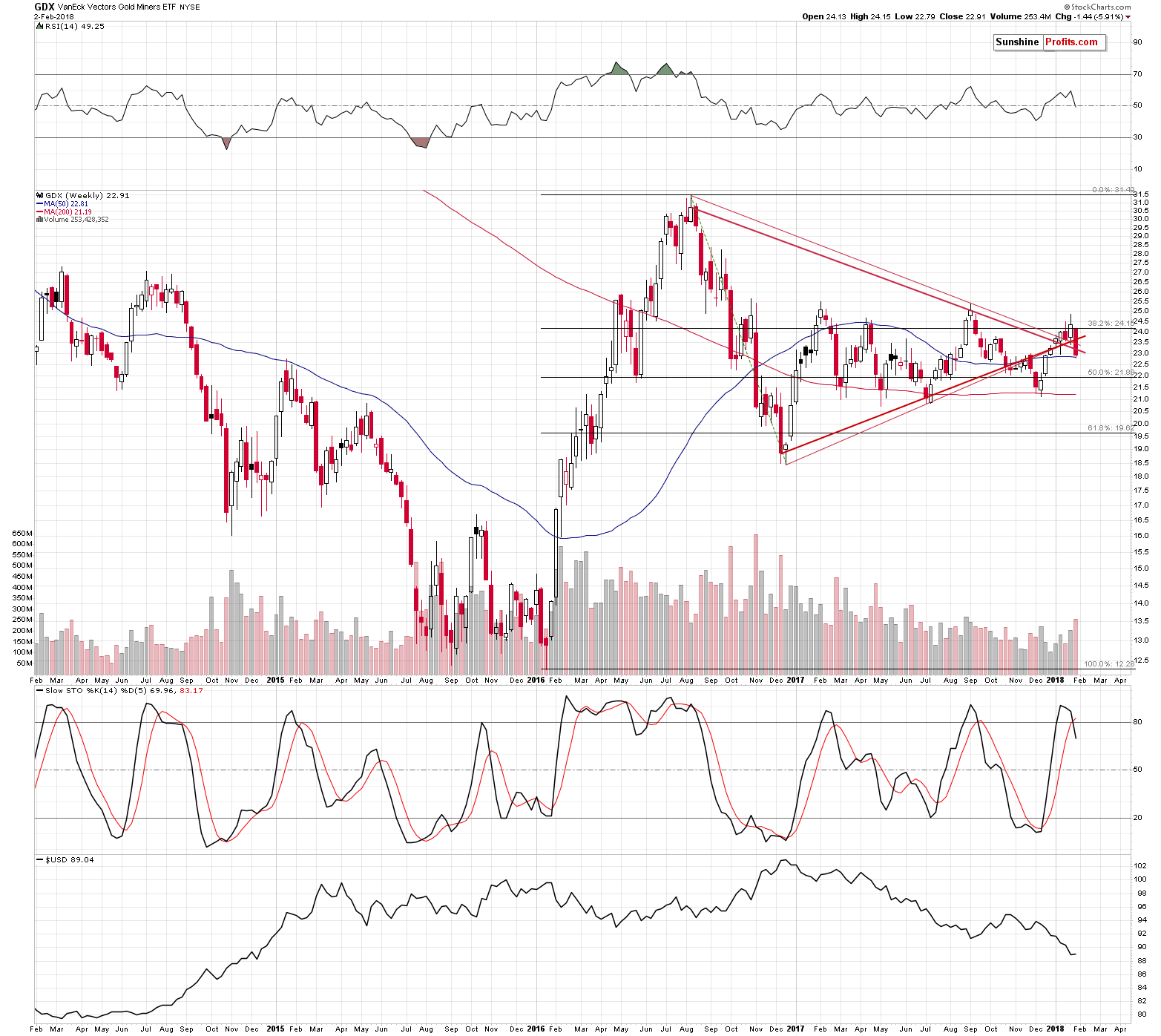

Yet another validation thereof can be seen on the long-term GDX ETF chart below.

Mining stocks topped and reversed during the week that had been indicated by the apex based on the intraday support and resistance lines (thin red lines). This, plus the fact that GDX invalidated the breakout above all the red support lines that you can see on the above chart makes the situation very bearish for the following weeks.

The increase in the weekly volume level during the decline (volume not seen since late August 2017) and the clear sell signal from the Stochastic indicator confirm the above and add to the overall bearishness.

Summing up, the USD’s recent epic turnaround along with gold’s extraordinary weakness relative to the USD’s movement along with multiple bearish confirmations paint a very bearish picture for the precious metals market for the following weeks. The situation was very bearish for PMs based on the above, but the record-breaking weekly and monthly volume levels in gold took the bearishness to a new – even more extreme – level.

Friday’s huge slide in the precious metals sector and the mining stocks’ underperformance suggest that the big decline is already underway.

On a side note, please note that our bearish comments on the precious metals sector doesn’t make us an enemy of gold and silver investors – it makes us a true (!) friend. If you ask your friends how you look before going to an important meeting, everyone will tell you that you look great regardless of the truth as they will prefer not to be the ones that ruin your mood by saying something unpleasant. But a true friend will tell you how things really are, so that you can fix something before your leave. This may be unpleasant, but ultimately, it’s the second approach that benefits you. Most gold promoters will want you to think that gold is going to go higher no matter what happens and all you should do is buy, buy, buy. And then buy some more. They don’t want to risk upsetting you. But not us. We’re that true friend that tells you what they think and why, regardless of the possibility of being unpleasant – so that you can benefit more. In this case, if we’re correct about the bearish outlook for the precious metals, it will be much more profitable to be buying at lower prices than at the current ones.

So, in our view, the outlook for the precious metals market is friendly bearish. The precious metals market is likely to move much higher in the coming years, but if we’re correct about the medium-term decline first, then the best buying opportunity is still ahead of us.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (200% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,218; stop-loss: $1,382; initial target price for the DGLD ETN: $53.98; stop-loss for the DGLD ETN $37.68

- Silver: initial target price: $14.63; stop-loss: $17.82; initial target price for the DSLV ETN: $33.88; stop-loss for the DSLV ETN $20.88

- Mining stocks (price levels for the GDX ETF): initial target price: $19.22; stop-loss: $26.14; initial target price for the DUST ETF: $39.88; stop-loss for the DUST ETF $15.78

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $27.82; stop-loss: $38.22

- JDST ETF: initial target price: $94.88 stop-loss: $37.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

S&P 500 index lost 2.1% on Friday, following breakout below the short-term support level of 2,800. Investors reacted negatively to quarterly earnings, economic data releases. The broad stock market retraced more than 50% of its almost month-long January rally. Is this a new bear market? Certainly it is a relatively deep downward correction. The index is close to the important 61.8% retracement of the rally at 2,749.73. This may hold it for a while, as investors hunt for price bargains.

Friday's Sell-Off Sets The Tone For Weeks To Come

In the last couple of days we have seen strong depreciation, particularly today. This might be a very important indication for the next move. Read the alert for more details.

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold claws back lost ground after Friday's slide

India Jan gold imports plunge to 17-month low on subdued demand -GFMS

China tops gold consumption table for fifth consecutive year

BIS gold derivatives fall in December but remain hefty

=====

In other news:

Stocks Extend Selloff as Dollar Drops; Gold Rises: Markets Wrap

Global stocks routed, yields rise as U.S. inflation threat spooks markets

Outgoing Fed Chair Janet Yellen Says Prices High for U.S. Stocks and Real Estate

China's currency is still nowhere near overtaking the dollar for global payments

German parties make final push for coalition deal

Carillion’s fall will bring down more construction firms, say accountants

India plans to regulate cryptocurrency exchanges: finance minister official

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts