Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Welcome to this week's flagship Gold & Silver Trading Alert. Predicated on last week’s price moves, our most recently featured medium-term outlook remains the same as the price moves align with our expectations (or at least are not really against them). On that account, there are parts of the previous analysis that didn’t change at all in the earlier days and are written in italics.

Today’s flagship analysis comes early, as the long Thanksgiving weekend is about to start. There will be no U.S. trading tomorrow, and the trading on Friday is likely to be limited too, so we will post the next regular analysis on Monday (Nov. 28). If anything major happens and the outlook changes (and it impacts my opinion on the current investment or trading positions), I’ll send you a quick follow-up.

Monday will also be the day when we’re going to upgrade the way in which we’re providing our services to you. This will be a HUGE upgrade, not just a minor tweak. I don’t want to tell you much more over here, as that’s the place for the current market analysis (to which I will move in just a moment), but one of the big improvements will be the possibility to ask questions and enter discussions right below each analysis. So far, it’s been functioning as “Letters to the Editor,” but in the very near future, you will be able to discuss what piqued your interest with other subscribers/readers in real time. And I will be participating in those conversations as well.

How about a premium live webinar? That’s also going to happen very, very soon.

I’ll get back to you with the above in the following days, probably in video format (and I’ll likely mention the market situation in those messages/videos as well, so while there will be no more “regular” analyses this week, you’ll be kept up-to-date).

Having said that, let’s move on to the market analysis.

The key thing that has happened so far this week is that gold declined, just as it was likely to, but miners moved higher, just like stocks did.

Why did this happen, and what does it imply for the following weeks? I’ll elaborate at the beginning of the technical part of today’s analysis, and in meantime, let’s take a look at…

The Weekly Fundamental Roundup

With investors going all in on a Santa Clause rally, risk assets rallied on Nov. 22; and with the GDXJ ETF participating in the festivities, seasonality has investors buying hope and selling reality. Moreover, while this week has culminated with Fed officials amplifying their hawkish rhetoric, the crowd doesn’t realize their misguided optimism only strengthens inflation.

Please see below:

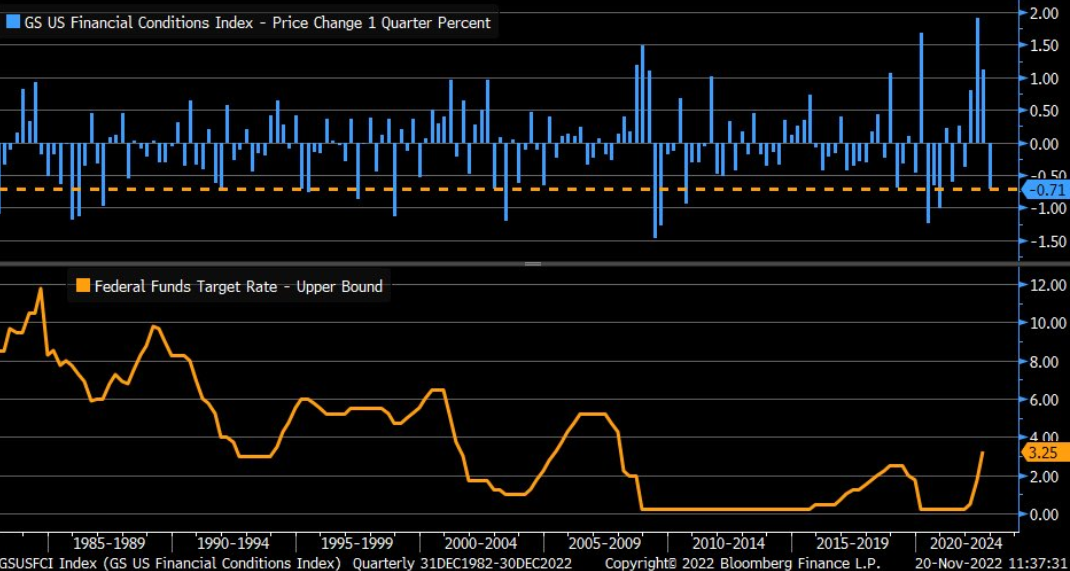

To explain, the orange line above tracks the U.S. federal funds rate (FFR), while the blue bars above track the quarterly percentage change in the Goldman Sachs U.S. Financial Conditions Index (FCI).

If you analyze the right side of the chart, you can see that the FCI has declined by 0.71% this quarter (as of Nov. 20), and similar drawdowns occurred when the Fed was cutting the FFR or when it was already low.

However, with looser financial conditions enhancing inflation, higher stock prices, lower credit spreads, a weaker U.S. dollar, and lower interest rates are the opposite of what the Fed needs right now. As a result, investors’ pivot optimism materially reduces the chance of one occurring.

For example, Cleveland Fed President Loretta Mester said on Nov. 22:

“Given the high level of inflation, restoring price stability remains the number one focus of the FOMC. We’re committed to using our tools to put inflation on a sustainable downward trajectory to 2%.”

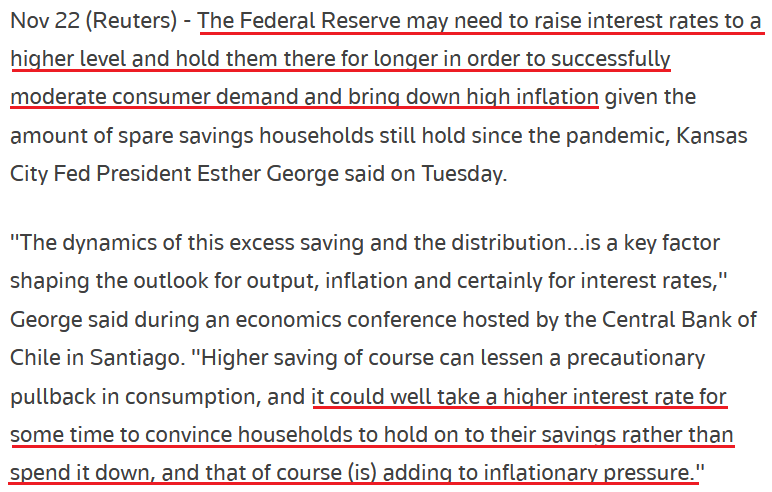

Likewise, Kansas City Fed President Esther George said on Nov. 22:

“While high savings is likely to provide momentum to consumption and require higher interest rates, it’s certainly positive that we see that these households are wealthier, less financially constrained and better insured. But that said, reduced inflation will mean we have to incent saving over consumption.”

As such, while I warned repeatedly that unprecedented household checkable deposits and wage inflation have Americans flush with cash, George acknowledged that consumers’ ability and willingness to spend may necessitate a higher FFR to curb inflation.

Please see below:

Therefore, while the recent price action across the financial markets implies that inflation is old news and the Fed is about to turn dovish, investor sentiment couldn’t be further from the fundamental reality.

Remember, 10+ Fed officials have warned about the challenges that lie ahead, and the crowd either assumes they are bluffing or they’re uninformed about the difficulty of normalizing unanchored inflation. Either way, a substantial reality check should materialize over the medium term.

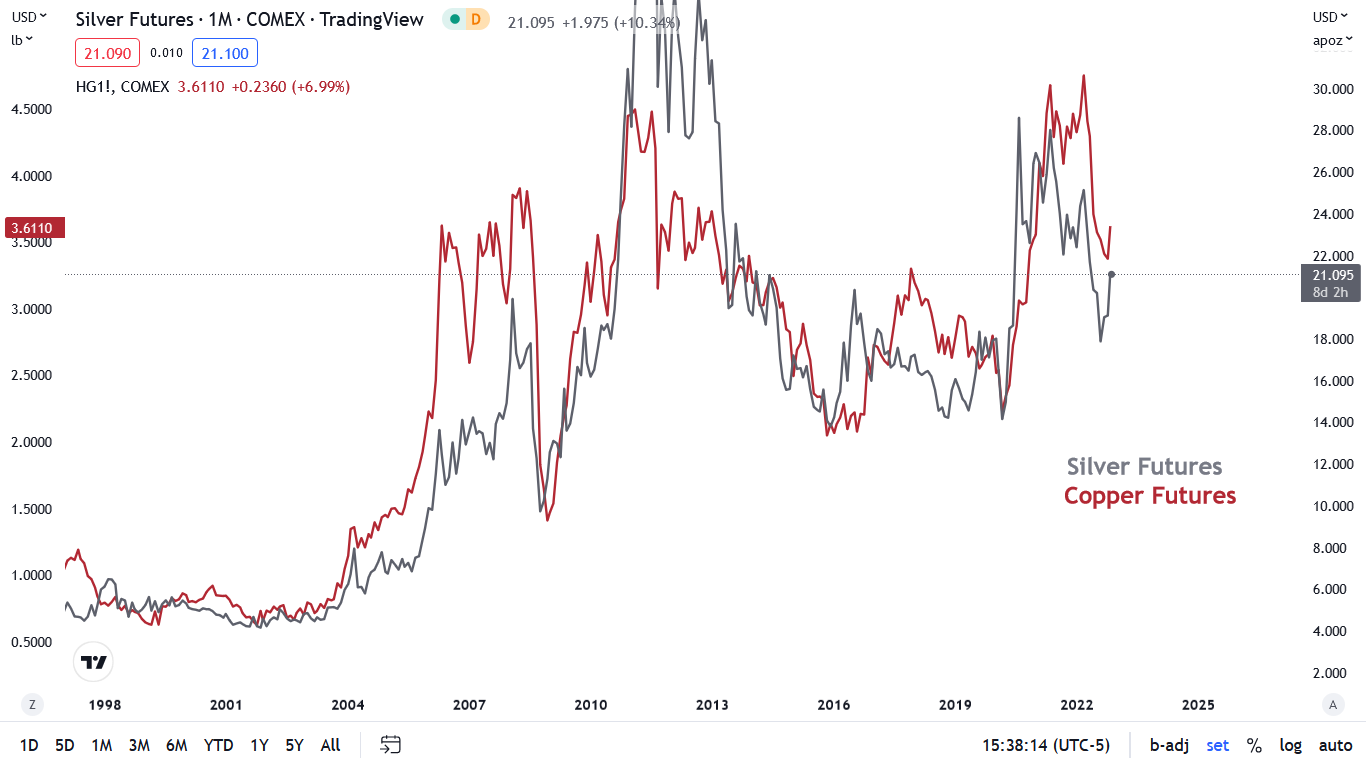

To that point, when the same misguided inflation and pivot optimism percolated in the summer, I noted the contrast between hedge fund manager Bill Ackman and David Rosenberg. I wrote on Jul. 27:

The final destination of the U.S. federal funds rate will be the most important medium-term fundamental development.

On one side of the coin:

On the other:

Thus, while the chorus grows louder and believes the Fed is approaching the end of its rate hike cycle (futures market expects 3%), hedge fund manager Bill Ackman has it right: “the more the market believes that the Fed will immediately reverse course, the less effective raising rates will be in moderating inflation, and the more the Fed will have to raise rates.”

As such, while I continue to warn that investors materially underestimate the ferocity of inflation, the counterintuitive nature of Ackman’s comment is spot on: the more the financial markets perceive Powell as dovish, the more hawkish he will have to be in the end.

So, after the U.S. 10-Year Treasury yield rose from 2.80% to north of 4% and market-implied FFR expectations rose from 3% to more than 5%, the bond bulls and pivot predictors are deep in the red.

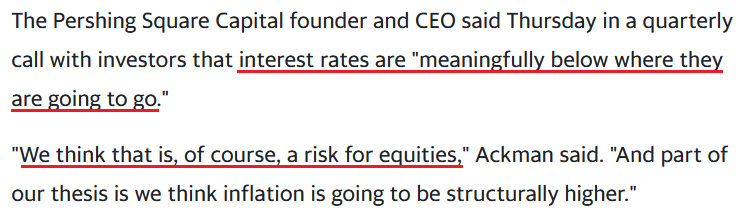

Yet, we find ourselves in the same situation again; and with Ackman still seeing things from our perspective, he told his investors during a conference call on Nov. 17:

“We're no longer going to have the same sort of [low interest rate] subsidy going forward (…). We think inflation is going to be structurally higher going forward than it has been historically. We do not believe that it's likely the Federal Reserve is going to be able to get inflation back to a kind of consistent 2% level.”

As a result, while inflation misperceptions helped push the S&P 500 to new lows twice in 2022 following bear market rallies, the crowd must think the third time’s a charm.

Please see below:

Overall, investors continue to assume that inflation will decline linearly and do so with little economic pain. But the optimism contrasts with history, and the reality is that the Fed has achieved very little in its fight against inflation, despite the shift in sentiment.

Please note that the Atlanta Fed’s Sticky Consumer Price Indexes (CPI) did not decline in October and remained at ~40-year highs. Consequently, the bulls should regret their overenthusiasm in the months ahead.

How Could a Recession Affect the Silver Price?

With silver outperforming gold in recent months, the iShares Silver Trust (SLV) ETF/ SPDR Gold Shares Trust (GLD) ETF ratio has rallied off its September lows. However, I’ve warned on numerous occasions that silver’s outperformance is bearish and often an ominous sign for the precious metals market.

Please see below:

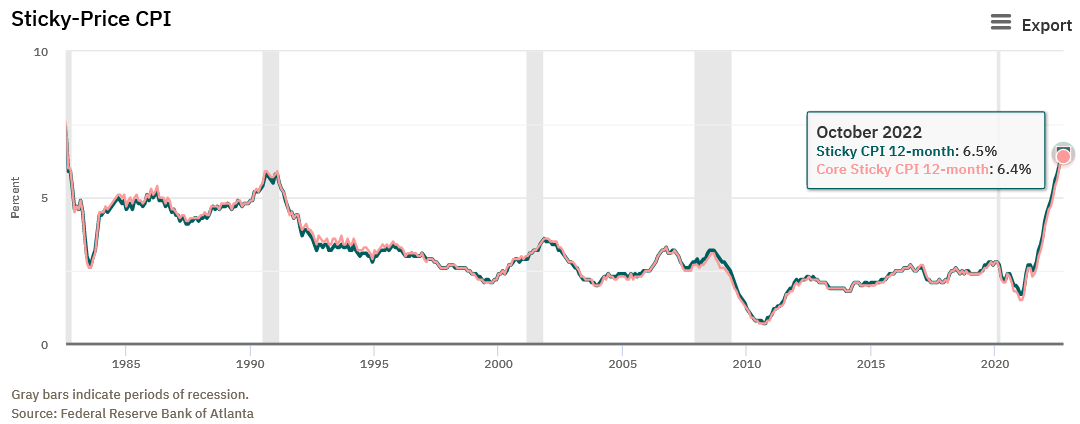

Yet, because silver is more cyclical than gold, the white metal often outpaces the yellow metal during periods of economic optimism. Therefore, with recession fears dissipating as growth stabilized, the latest real GDP growth estimate from the Atlanta Fed has the silver permabulls brimming with confidence. For example, the report stated on Nov. 17:

“The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.2 percent on November 17, down from 4.4 percent on November 16. After this morning’s housing starts report from the US Census Bureau, the nowcast of fourth-quarter real residential investment growth decreased from -7.6 percent to -11.7 percent.”

Please see below:

To explain, the green line above tracks the Atlanta Fed’s Q4 real GDP growth estimate, while the blue line above tracks the Blue Chip consensus estimate (investment banks). If you analyze the right side of the chart, you can see that the green line remains highly elevated and signals resilient growth ahead.

However, every U.S. inflation fight since 1954 has ended with a recession; and while I’ve been bullish on the U.S. economy for some time, the actions required to normalize inflation should result in substantial economic weakness over the next 12 months, and economically-sensitive metals, like silver, should suffer more than gold when the tide turns.

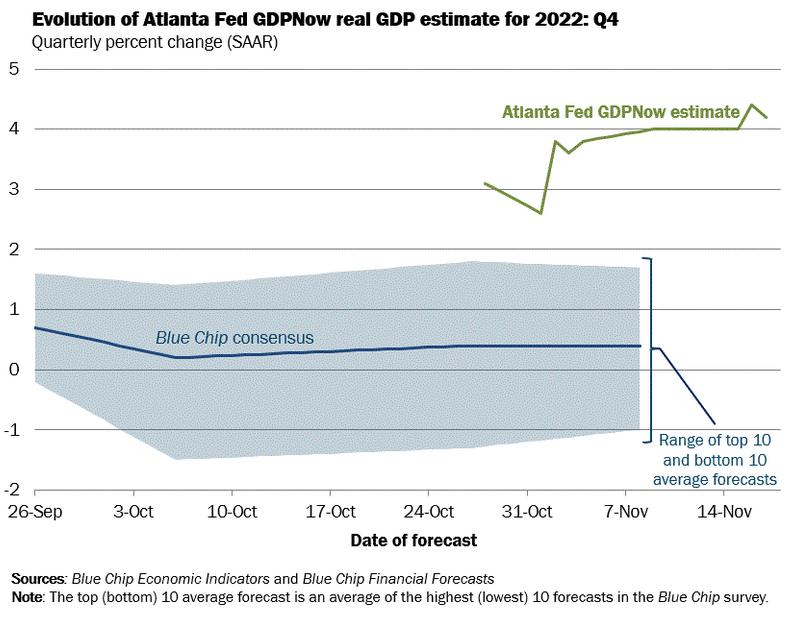

Please see below:

To explain, the gray line above tracks the monthly movement of the silver futures price, while the red line above tracks the monthly movement of the copper futures price. If you analyze the relationship, you can see that they often follow in each other’s footsteps over the long term.

Furthermore, when the recession hit in 2001, it culminated with a ~20% decline in the silver futures price, while the 2007-2009 recession resulted in a ~46% drop, and the 2020 recession resulted in a ~23% drop. Consequently, while silver may seem like a solid momentum play when prices rise, the reversal can be just as violent on the downside.

Overall, with investors aiming to engineer a Santa Clause rally, their appetite for the worst-performing assets has increased. However, with history showing that silver often races ahead of gold before the bottom falls out, the medium-term outlook is much less bullish than it seems.

The Bottom Line

While the crowd chases risk assets to make up for their poor 2022 performance, please remember that FOMO has nothing to do with fundamentals. Moreover, with 10+ Fed officials repeating the same message, investors’ disobedience mirrors their actions during the summertime bear market rally. Yet, with that upswing reversing sharply when reality returned, this time should be no different.

In conclusion, the PMs rallied on Nov. 22, as the USD Index and the U.S. 10-Year real yield declined; and although risk appetite remains elevated due to bullish seasonality, the deteriorating fundamentals should result in substantial re-pricings when sentiment shifts. As a result, we expect gold, silver, mining stocks, and the S&P 500 to hit new lows before this bear market ends.

What to Watch for Next Week

With more U.S. economic data releases next week, the most important are as follows:

- Nov. 28: Dallas Fed manufacturing index

The Dallas Fed will provide insight into the growth, inflation and employment outlooks in Texas.

- Nov. 29: Dallas Fed services index

Like the manufacturing index, the Dallas Fed’s survey of service providers will provide more context about the economic outlook in Texas.

- Nov. 30: JOLTS job openings, Fed Beige Book

The JOLTS report uses governmental data to assess the health of the U.S. labor market, while the Fed’s Beige Book consolidates all of the findings from the regional Fed banks. As such, it’s akin to a nationwide survey, and the results are material.

- Dec. 1: Challenger job cuts, S&P Global and ISM manufacturing PMIs

With labor demand outpacing supply, the fundamental backdrop is highly inflationary. So, monitoring layoffs is critical to determining when the imbalance shifts. In addition, S&P Global and the ISM conduct nationwide surveys, and the results often lead future government data.

- Dec. 2: U.S. nonfarm payrolls, unemployment rate, labor force participation rate, average hourly earnings

The four data points are essential because they paint a portrait of the U.S. labor market and wage inflation. Thus, they significantly impact the future direction of the FFR.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

Technically Speaking

As I promised earlier, I’ll now elaborate on why I think mining stocks, and in particular junior mining stocks, performed so well this week while gold declined.

In fact, since it’s been just a few days since I posted my previous flagship analysis, and practically everything from it except for the junior’s oddly strong performance (which I will explain in the following paragraphs) remains up-to-date, I will focus on a link that I haven’t discussed previously instead of re-posting the practically unchanged analysis. If you haven’t had the chance to read Friday’s big analysis, or you need extra context, I encourage you to read it today.

Those of you who have been following my analyses for a while may be expecting me to write that it is based on the stock market's rally and thus only temporary, as miners will follow gold sooner rather than later. That’s their ultimate source of revenue (current or expected). While that’s true, right now there is another huge factor that’s likely contributing to the situation.

It's most likely the unfolding crypto-drama.

Remember when I previously commented on the link between juniors and cryptocurrencies? What I wrote back then was particularly important with regard to the less known (obscure?) ones with a shady background. In fact, some even call them “shitcoins.”

I wrote that for many individual investors, cryptocurrencies became the “new precious metals market.”

Alternative payment system? Just like gold, right?

There’s a flagship asset (gold, Bitcoin).

There’s a less expensive but obviously more useful asset (silver, Ethereum).

There are a number of little-known assets that are risky but have the potential to provide massive returns (high-quality mining stocks, low-quality mining stocks, especially low-quality junior mining stocks, altcoins, "shitcoins").While gold was not doing much, the wild rallies in cryptos got much more attention. That was finally exciting!

So, individual investors flocked from the precious metals market to cryptos. Not all investors, of course, but many.

While cryptos were on the rise and the overall sentiment was positive, investors dropped their PM holdings to buy cryptos as they forecasted that the latter would continue to rally “to the moon.” And while it didn’t matter that much for gold, as the yellow metal has powerful buyers and sellers that are not interested in cryptos, it mattered a lot to the junior mining stock sector as the buying power waned.

Fast-forward to the current situation, every other day we hear or read about yet another crypto scandal, while prices of cryptocurrencies are declining sharply.

This means that the above-mentioned effect could have been reversed. The investors who moved out of the junior mining stock sector in order to get into cryptos (in particular altcoins) could now be aiming to get out of that market (people tend to sell on declines, in fact, that’s why declines happen in the first place) and get back to what they “had liked” before – junior miners.

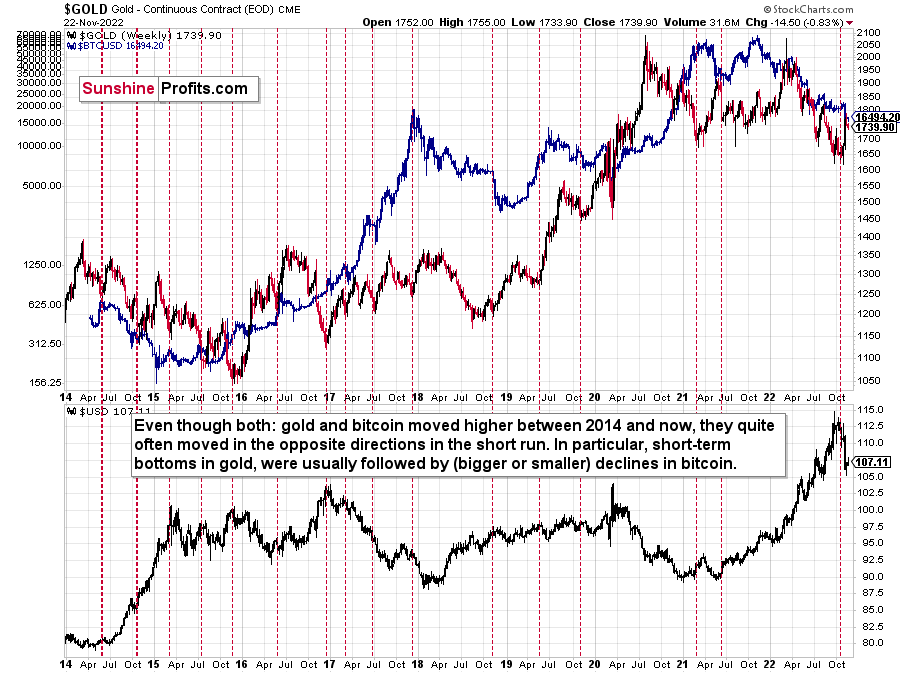

This specific phenomenon can be seen from a broader point of view when one compares the prices of gold and bitcoin.

As I wrote, the link is likely stronger in the case of altcoins and juniors, but gold and bitcoin have price data that’s more comparable, so that’s what I’m going to analyze.

Even though both gold and bitcoin moved higher between 2014 and now, they quite often moved in opposite directions in the short run. Short-term bottoms in gold, in particular, were usually followed by (larger or smaller) declines in bitcoin.

Interestingly, I originally featured the above chart many months ago, and please note that this tendency worked like a charm recently.

Gold formed a short-term bottom, rallied, and now Bitcoin slides. Why? Probably because people were fed up with Bitcoin’s inability to hold its ground, while gold soared. So they flocked to gold, silver, and - probably most intensely so - to junior mining stocks.

All right, so does this mean that as Bitcoin slides into the abyss, junior miners are now going to soar?

No.

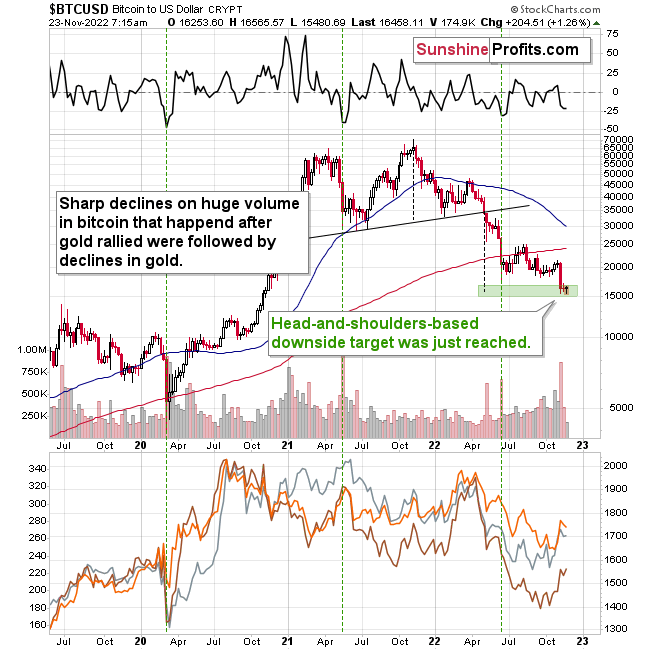

No market moves up or down in a straight line, right? Well, neither does Bitcoin. How low is too low, then? That’s where technicals come in.

Remember when I wrote that Bitcoin was topping at about $50,000? Well, it did move a bit above that, but it didn’t trade there for long.

The flagship crypto fell like a stone in water, and it did so in tune with the technical principles. Bitcoin formed a bearish head and shoulders top pattern, and after breaking below the neck level earlier this year, it then corrected a bit, and then it plunged below $20,000.

All this is a textbook-example of how a head and shoulders pattern should work.

Now, the size of the decline based on this pattern is likely to be equal to the size of its head. I marked that with dashed lines.

Guess what – Bitcoin just moved to this target level (marked with green) recently. That is a strong indication that the bottom has been reached.The second indication comes from the huge volume that just accompanied the decline and the fact that the decline was quite sharp. The ROC (rate of change) indicator at the top of the above chart is close to -25 and when this happened and bitcoin was after a huge-volume decline, it then rallied.

What is even more interesting is that those were also the times when gold declined.

The sentiment itself is the final indicator that a short-term (!) bottom for bitcoin is in or near. Just go to any news website and look at what is being written about Bitcoin – it’s all scary and bearish. Or at least the majority of news/articles. That's what happens when prices fall to their lowest point. Remember what was written on those same pages when bitcoin was trading above $50,000? It was all sunshine and rainbows. All this time, I warned about the incoming slide. Very few listened then, just as very few want to hear about the upcoming slide in junior mining stocks.

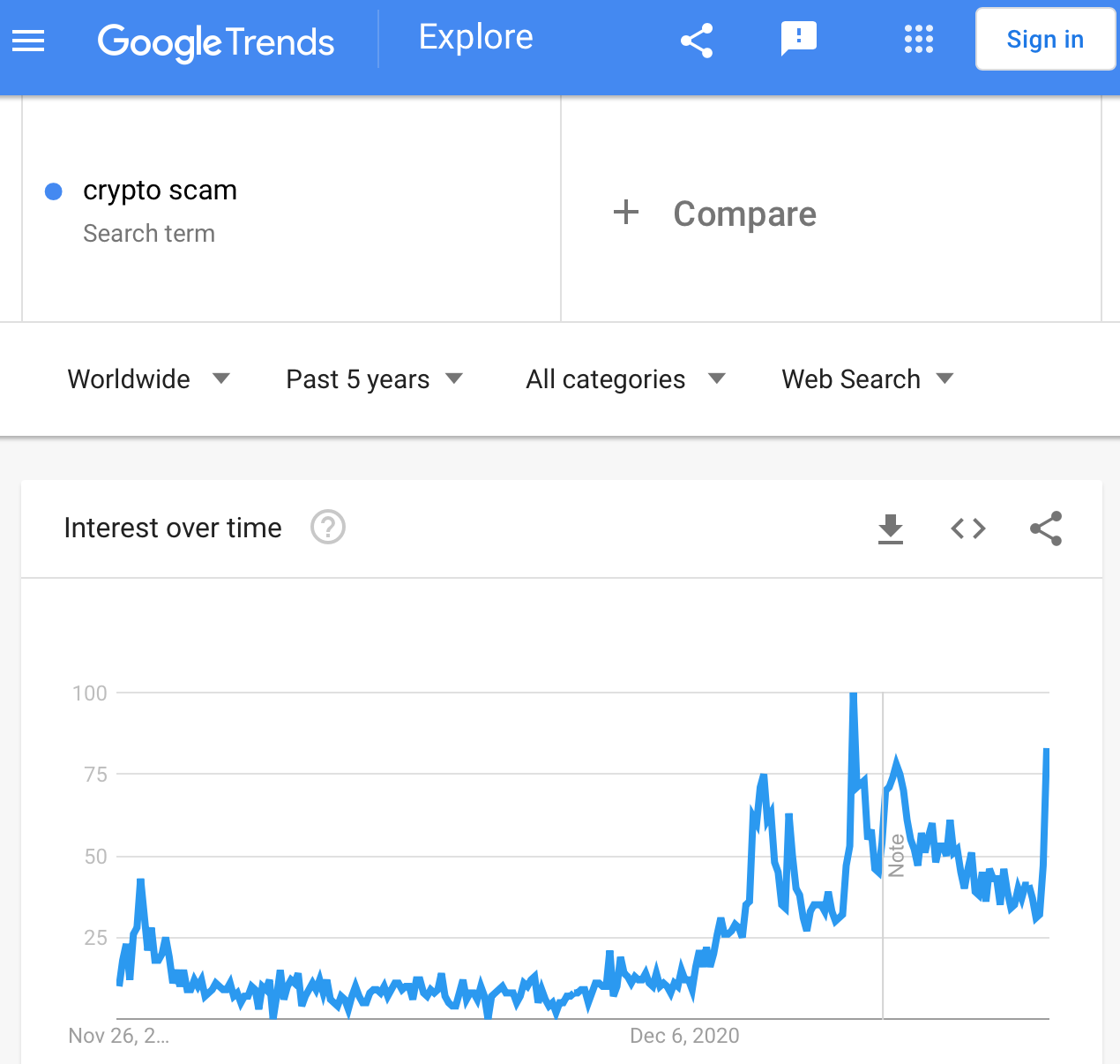

Anyway, here’s how frequently people search for “crypto scam” on Google (chart courtesy of Google Trends).

The other distinctive peaks in those searches were in May 2021 (a major top and major decline in Bitcoin), early November 2021 (a major top in Bitcoin), and the end of January 2022 (a major bottom in Bitcoin).

The interest was this high only when there were major turnarounds in Bitcoin. And since it’s crystal clear that the previous move in Bitcoin was to the downside, it can’t be a top. Therefore, it’s likely that there’s a major bottom in Bitcoin.

Not necessarily the final one, but a major one for some time. A bottom that’s big enough to trigger a sizable rally in Bitcoin… And a sizable decline in the precious metals sector!

It’s easy to follow the herd. “Miners good, Bitcoin bad” is the current word out there. It’s also easy to repeat this mantra. But what’s easy and what’s profitable are rarely the same thing, which is why many tend to lose money over time. I’m not saying that each and every price move can be predicted – it can’t. However, as time goes on, following logical analysis and paying attention not to follow the herd often pays huge dividends.

My responsibility is to keep you up to date on my market views, which I strive base on logical analyses free of bias. Whether it’s possible for a human to achieve this kind of objectivity is another question, but, as much as I can, I aim to deliver analysis that’s as objective as possible. Right now, the way I see it, Bitcoin appears to have formed a short-term bottom, and mining stocks have either formed a short-term top or are about to do so soon.

Of course, I can’t make any guarantees, but in my view, the next move lower in the precious metals sector – especially in the junior mining stocks – is likely to be something epic.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is over (or about to be over) and that the next big move lower is already underway (or that it’s about to start).

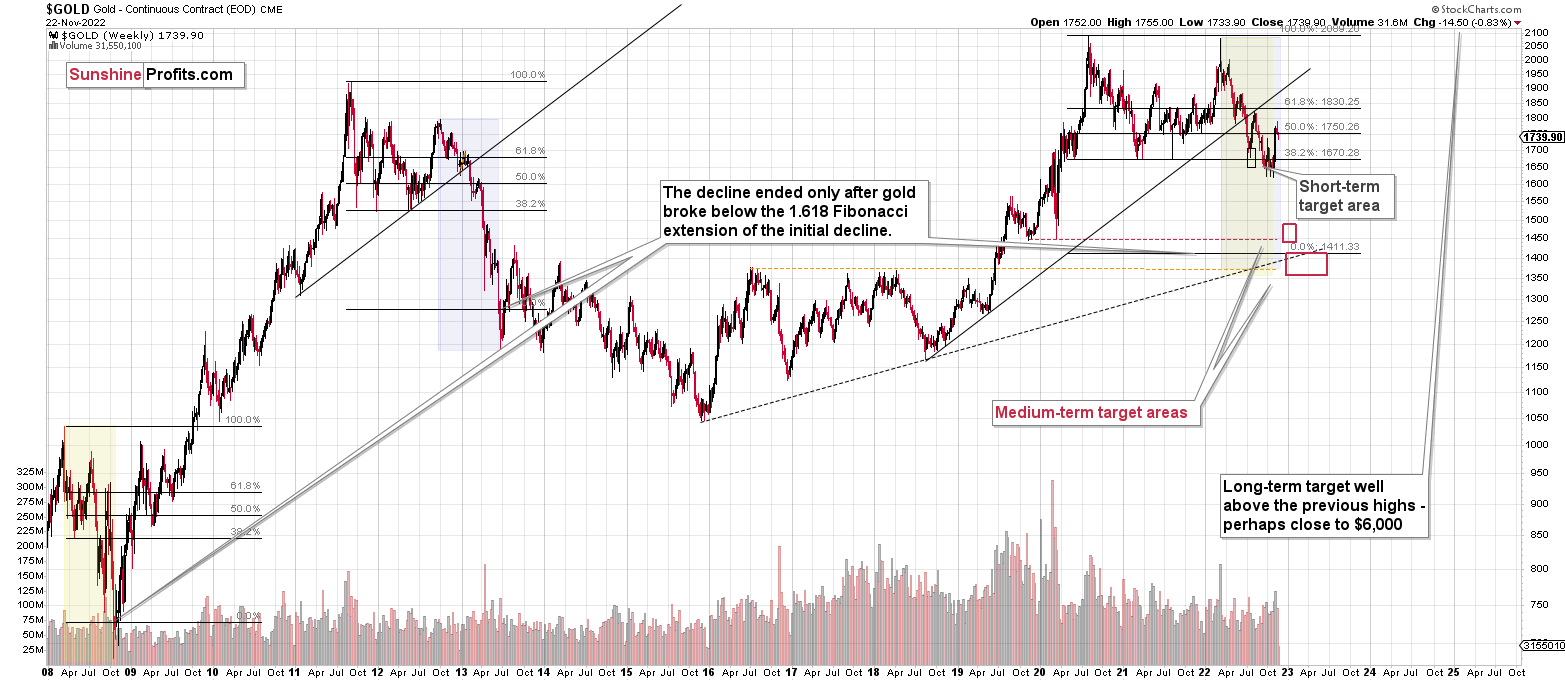

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Summary

Summing up, last week’s shooting star reversal candlestick in gold already resulted in lower gold prices, and as Bitcoin forms its short-term bottom, the big decline in the precious metals sector (especially in junior mining stocks) is likely to resume.

I would like to take this opportunity to congratulate you on your patience with this trade (and I’m grateful for your understanding that not every corrective upswing can be “caught” in trading terms). Many investors and traders panic and get out of the market exactly at the wrong time, but your patience and self-discipline mean that you’re poised to make the most of what the market brings us this and next year.

Moving back to the market, it appears to be yet another time when the markets are incorrectly expecting the Fed to make a dovish U-turn, and based on this, the part of the 2008 decline where we saw the biggest corrective upswing materialized.

In my opinion, the current trading position is going to become profitable in the following weeks, and quite possibly in the following days. And while I can’t promise any kind of performance, I fully expect it to become very profitable before it’s over and to prolong our 2022 winning streak.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

On an administrative note, there will be no regular analyses posted tomorrow and on Friday as the long Thanksgiving weekend is about to start. There will be no U.S. trading tomorrow, and the trading on Friday is likely to be limited too, so we will post the next regular analysis on Monday (Nov. 28). If anything major happens and the outlook changes (and it impacts my opinion on the current investment or trading positions), I’ll send you a quick follow-up.

Monday will also be the day when we’re going to upgrade the way in which we’re providing our services to you. This will be a HUGE upgrade, not just a minor tweak. I don’t want to tell you much more over here, as that’s the place for the current market analysis (to which I will move in just a moment), but one of the big improvements will be the possibility to ask questions and enter discussions right below each analysis. So far, it’s been functioning as “Letters to the Editor,” but in the very near future, you will be able to discuss what piqued your interest with other subscribers/readers in real time. And I will be participating in those conversations as well.

How about a premium live webinar? That’s also going to happen very, very soon.

I’ll get back to you with the above in the following days, probably in video format (and I’ll likely mention the market situation in those messages/videos as well, so while there will be no more “regular” analyses this week, you’ll be kept up-to-date,).

Finally, due to the above (and due to the fact that we haven’t done so in a long time, and those things need refreshing simply due to small changes in the laws and regulations), we are updating our Terms of Use and Privacy Policy. To make a long story short, if you’d like to keep receiving information from us, no action is necessary on your part. The pricing stays the same as well.

You will find the links to the updated documents below:

https://www.sunshineprofits.com/info/terms-use/

https://www.sunshineprofits.com/info/privacy-policy/

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $20.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $27.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $12.32

SLV profit-take exit price: $11.32

ZSL profit-take exit price: $74.87

Gold futures downside profit-take exit price: $1,504

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $18.47

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $46.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief