Briefly: In our opinion, full (200% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

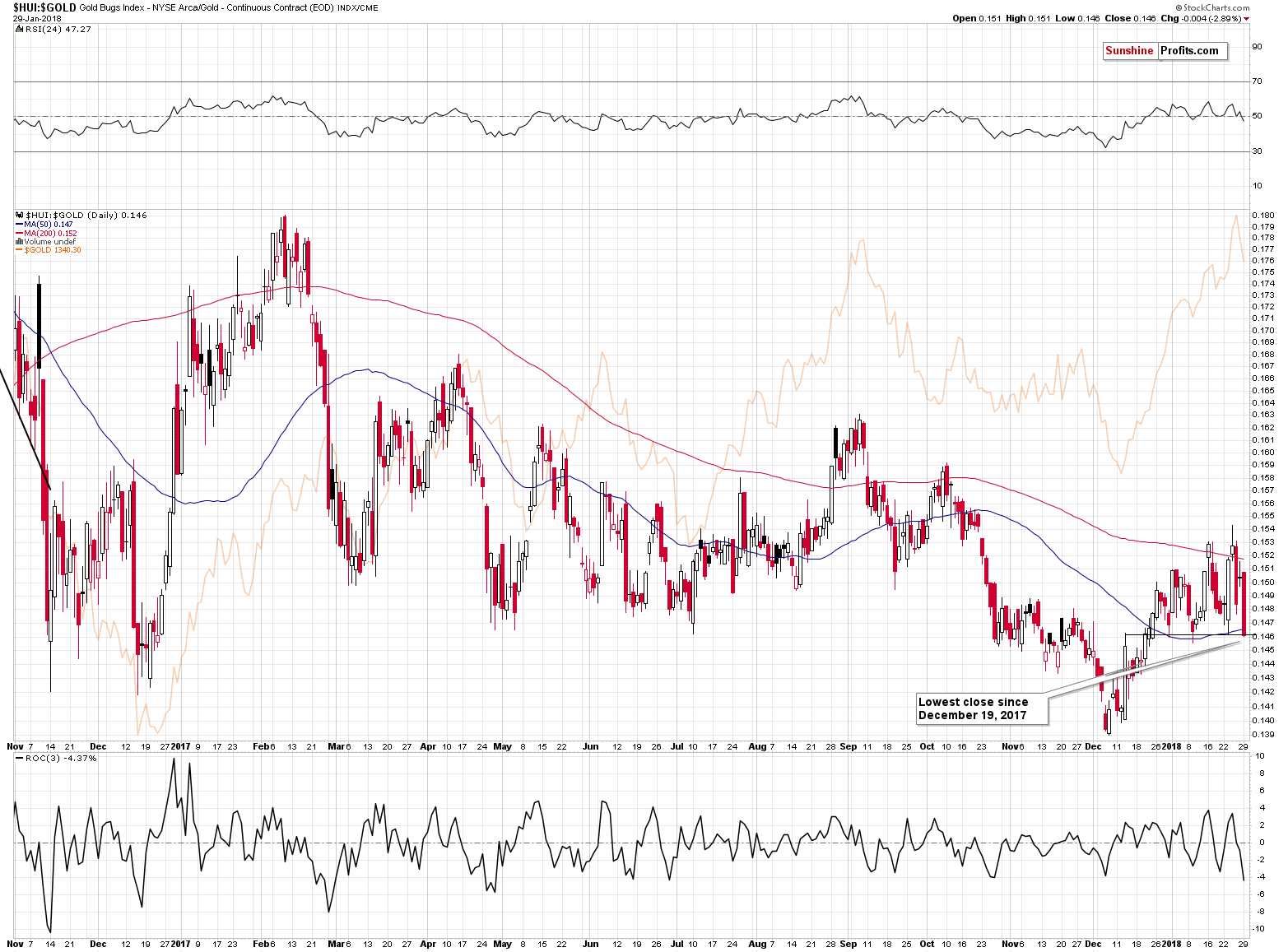

If there’s one word that can summarize yesterday’s gold stock performance, it’s “disappointment”. The HUI Index declined by almost as many index points as an ounce of gold declined in dollars. The Index broke below the mid-January high, the early-January high, the declining support/resistance line (thus invalidating the breakout), the rising support lines and it closed the session at levels not seen since January 11th. The HUI to gold ratio broke below the previous 2018 low and closed at levels not seen since December 19, 2017. All in one day. What does this shocking underperformance tell us?

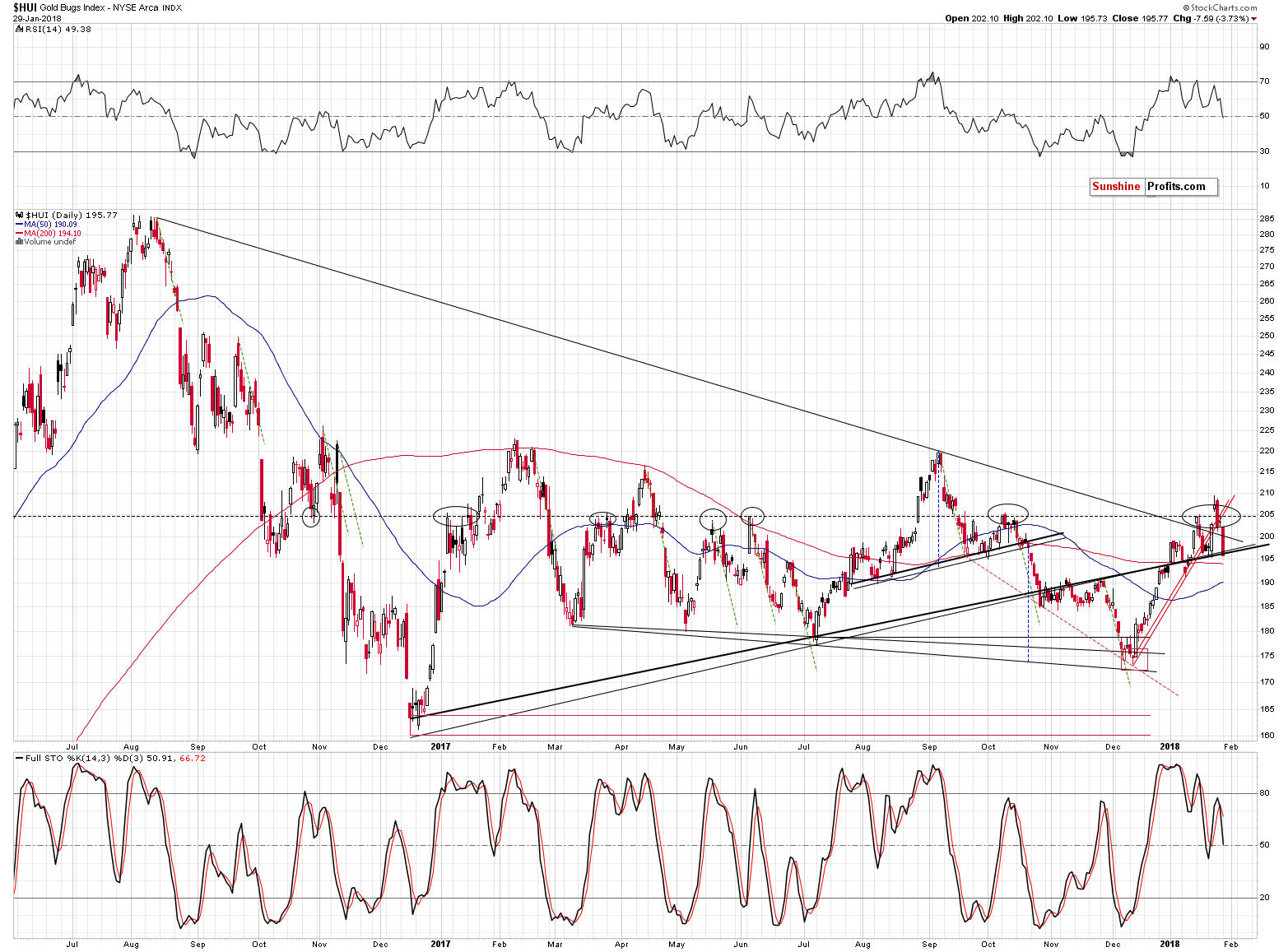

Let’s jump right into the HUI Index chart (chart courtesy of http://stockcharts.com).

Gold miners broke below almost all important nearby levels that could be broken. The level that was not clearly broken is the rising, medium-term support/resistance line based on the December 2016 an July 2017 lows. It was broken by just a little, so it’s not fully bearish, but practically everything else about the above chart is, so the implications are still very bearish.

However, it is not the decline in gold stocks by itself that’s so bearish. It’s its relationship with gold.

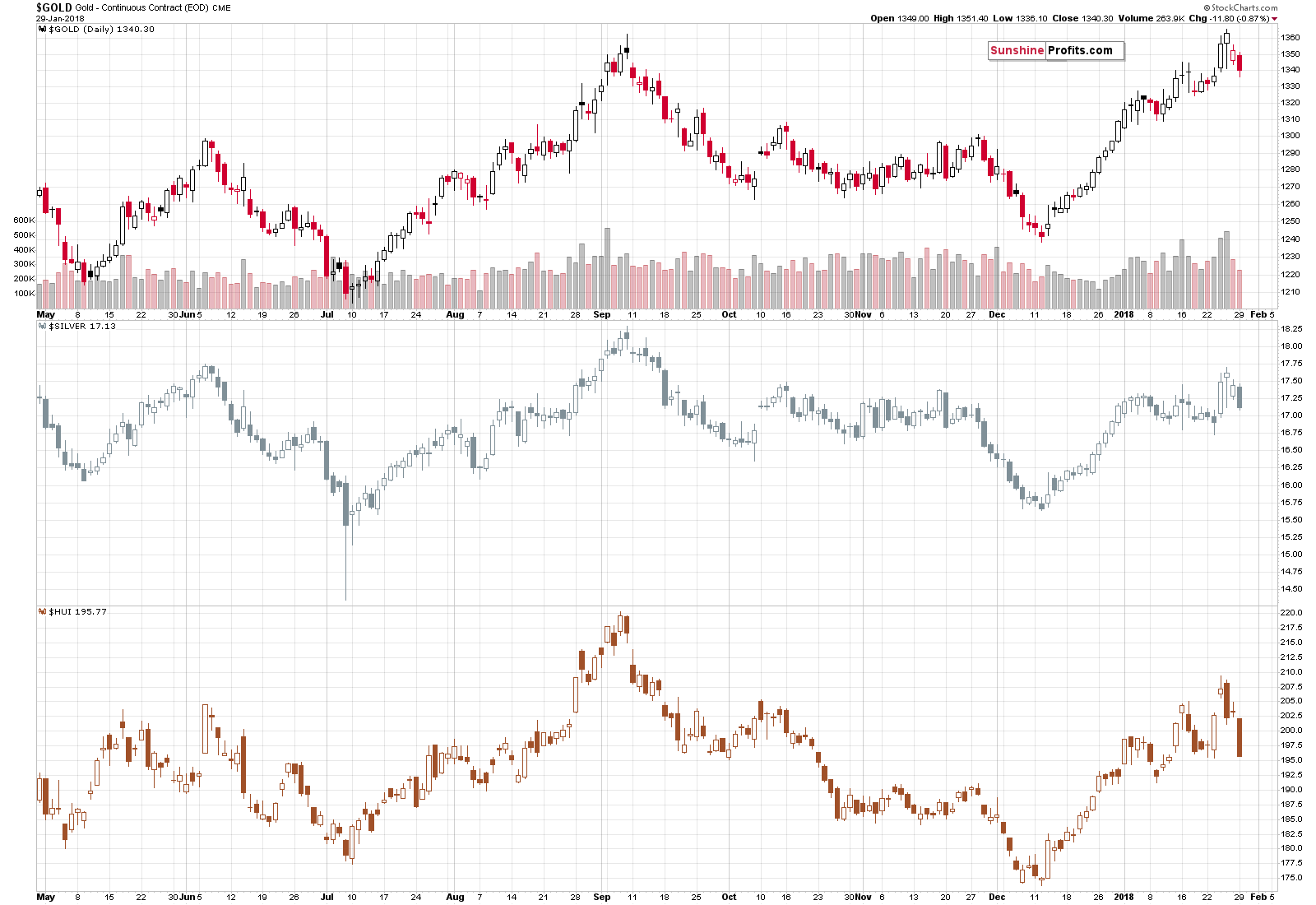

The above chart provides a very clear comparison. Gold is at its mid-January highs while gold stocks are already below the mid-January lows. Let’s put this underperformance in historical context.

The last time when we saw a lower HUI to gold ratio was on December 19, 2017 – over a month ago. This means that 2018 is already a down year for the ratio and this is a huge warning sign for everyone who expected (or still expect) gold to soar in 2018. To be clear – it very well may soar, but that’s unlikely before THE bottom.

Do you know what’s even more bearish than implications from gold stocks?

Implications from silver stocks.

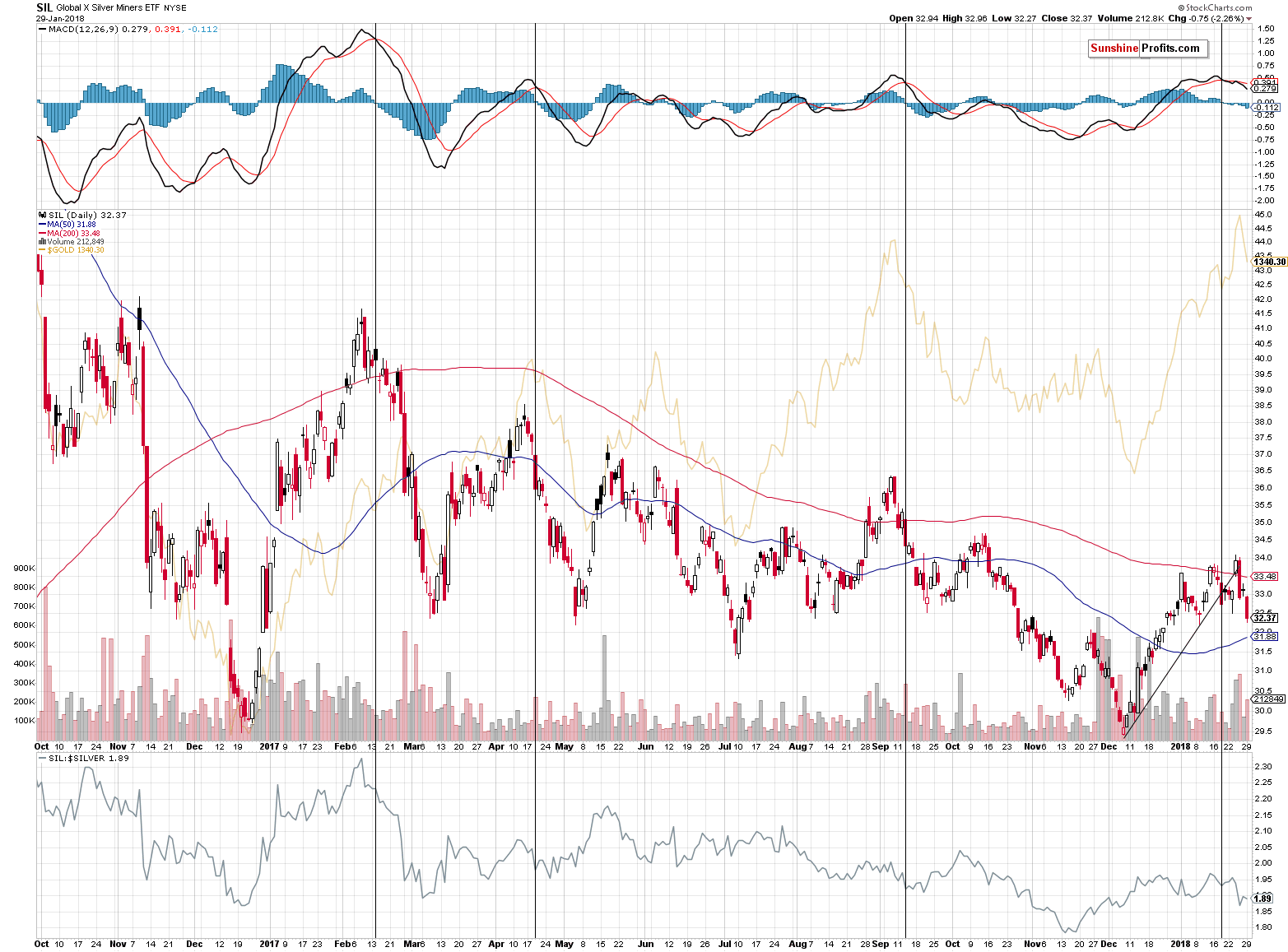

We previously commented on their performance on January 24. Back then, we wrote the following:

Interestingly, silver stocks were barely higher yesterday and they remain visibly below their rising resistance line. The breakdown below it was confirmed and its implications are bearish.

Moreover, we recently saw a sell signal from the MACD indicator, while both silver stocks and the indicator were after a visible rally. That’s something that took place only 3 times in the past 15 months. In each previous case, it was seen close to the top.

Precisely, in all 3 cases it was after the top in silver miners, and in 2 out of 3 cases it also confirmed that the top was already in in the case of gold. The remaining case took place in February 2017, when the signal was seen about 2 weeks before gold’s top.

While the above is not a precise sell signal for the very short term, it does indicate that the next big move is about to start relatively soon. It might already be underway in the case of silver stocks.

Since we wrote the above, there was one additional attempt of silver miners to break above the rising resistance line. It was invalidated on the very next day, confirming the bearish picture.

Silver mining companies started the week by closing below the previous 2018 low. The 2018 is now a down year for the silver miners and their entire 2018 performance is a one big reversal. This is a very bearish sign for the following weeks – not only for silver stocks, but for the rest of the precious metals market as well.

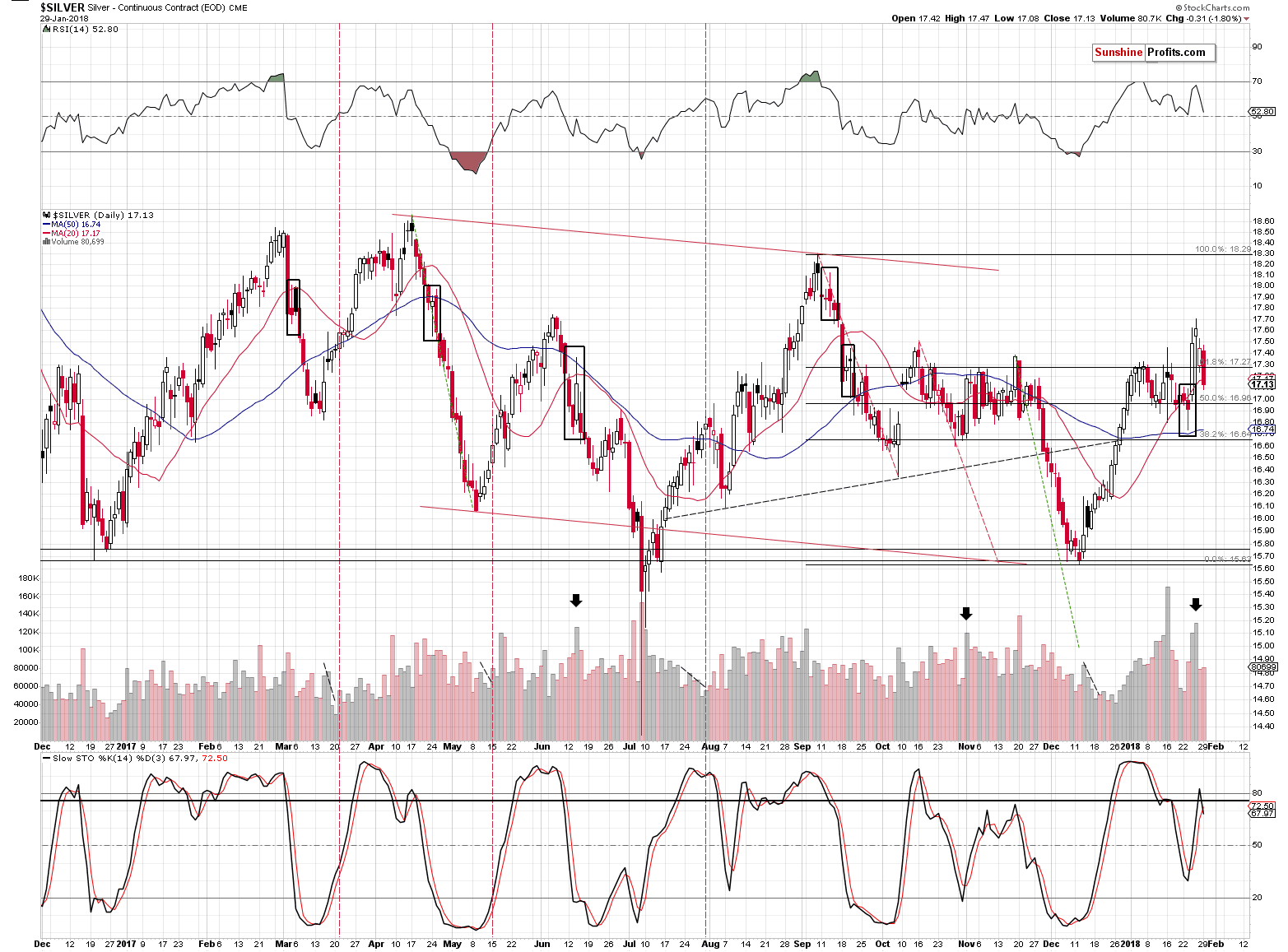

Having discussed silver stocks, let’s move to the underlying metal – silver.

In the recent past we wrote about 2 specific signals related to the very high volume levels. Both of them had bearish implications and it seems that we are beginning to see the results of these signals.

The Stochastic indicator just flashed a small sell signal, suggesting that that this is indeed just the beginning.

By the way, if you’ve been wondering what we based our stop-loss for silver on – it was the possibility of silver repeating the April 2017 topping pattern. Back then the breakout was small and it didn’t change the overall outlook. Moreover, it’s important to be aware that silver tends to “fake out” instead of breaking out quite often. It seems that silver has indeed repeated the “fakeout top” scenario. Naturally, the implications are bearish.

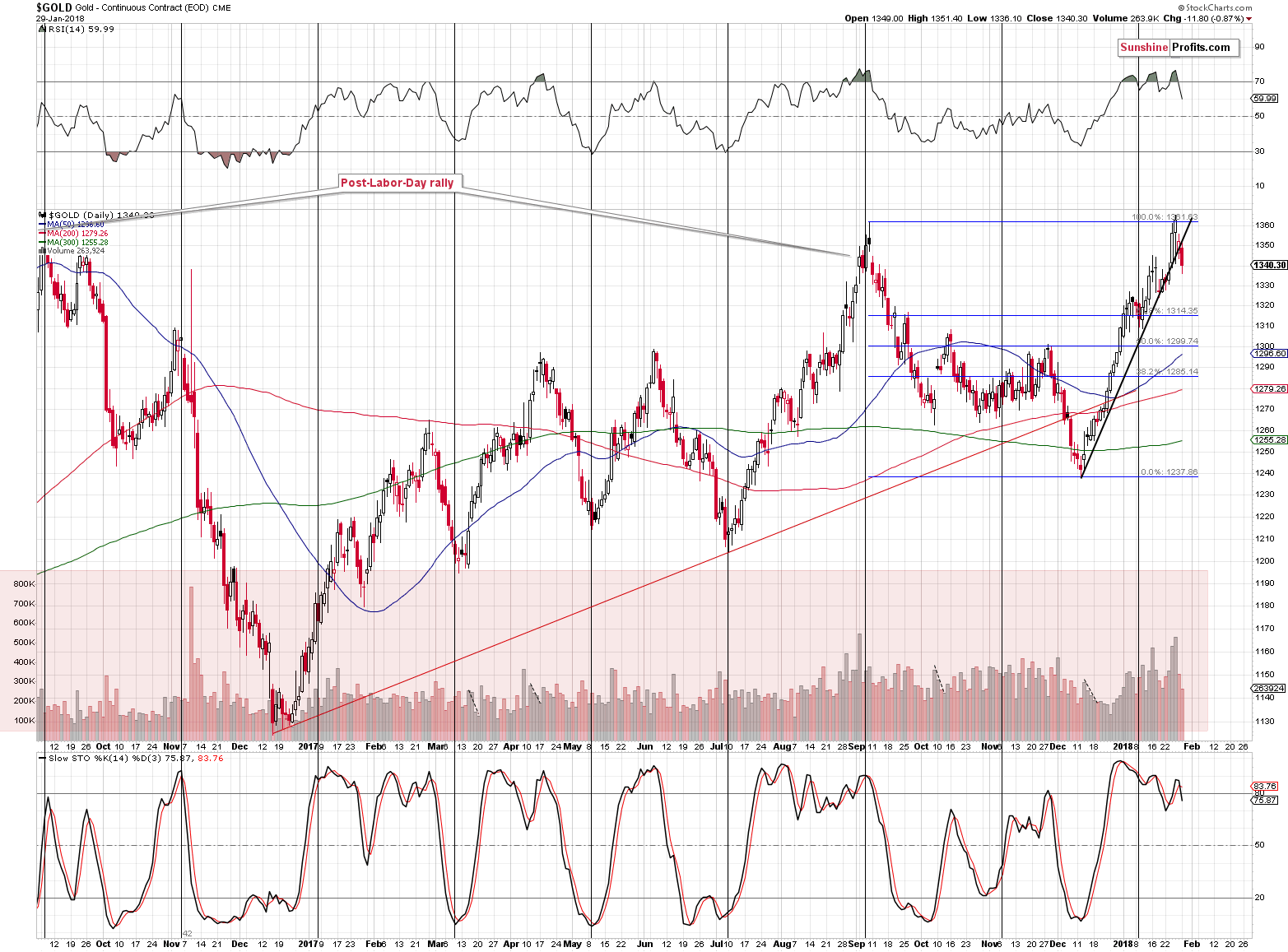

Is gold’s short-term picture just as bearish?

What Would Plato Say about the Gold Chart?

The most important developments are seen on the long-term chart and we discussed them yesterday, but as far as the above chart is concerned… It’s flashing warning signs that are likely not visible for those who are new to this market.

We saw a breakdown below the rising support line, which doesn’t seem significant at first sight as it was not accompanied by huge volume. In this case, what seems to be the case, actually isn’t. The early parts of gold’s declines were very often accompanied by low volume readings, so the fact that we are seeing relatively low volume right now doesn’t invalidate anything. Conversely, it’s quite normal.

We saw sell signals from the RSI an Stochastic indicators, but the latter is just tiny and thus it appears to be of little significance. And it’s true. However, it doesn’t change the extremely bearish outlook for the gold market. The outlook is based on many things that go beyond the simple short-term gold chart. If you consider the multitude of other factors, the above weak signal from the Stochastic indicator can easily be viewed as a confirmation – something additional to the analytical core.

On a side note, if one doesn’t know about the context, one might put a lot weight on the signals that are not that important and overanalyze them. It’s just like with Plato’s cave allegory (by the way, have you ever seen Plato’s cave allegory turned into a comic?) – people, who just start to analyze the gold market focus on just one thing – gold itself, not being aware of all the important dynamics in its surroundings. But you know all this and you are well prepared to take advantage of the opportunity that the precious metals market provides.

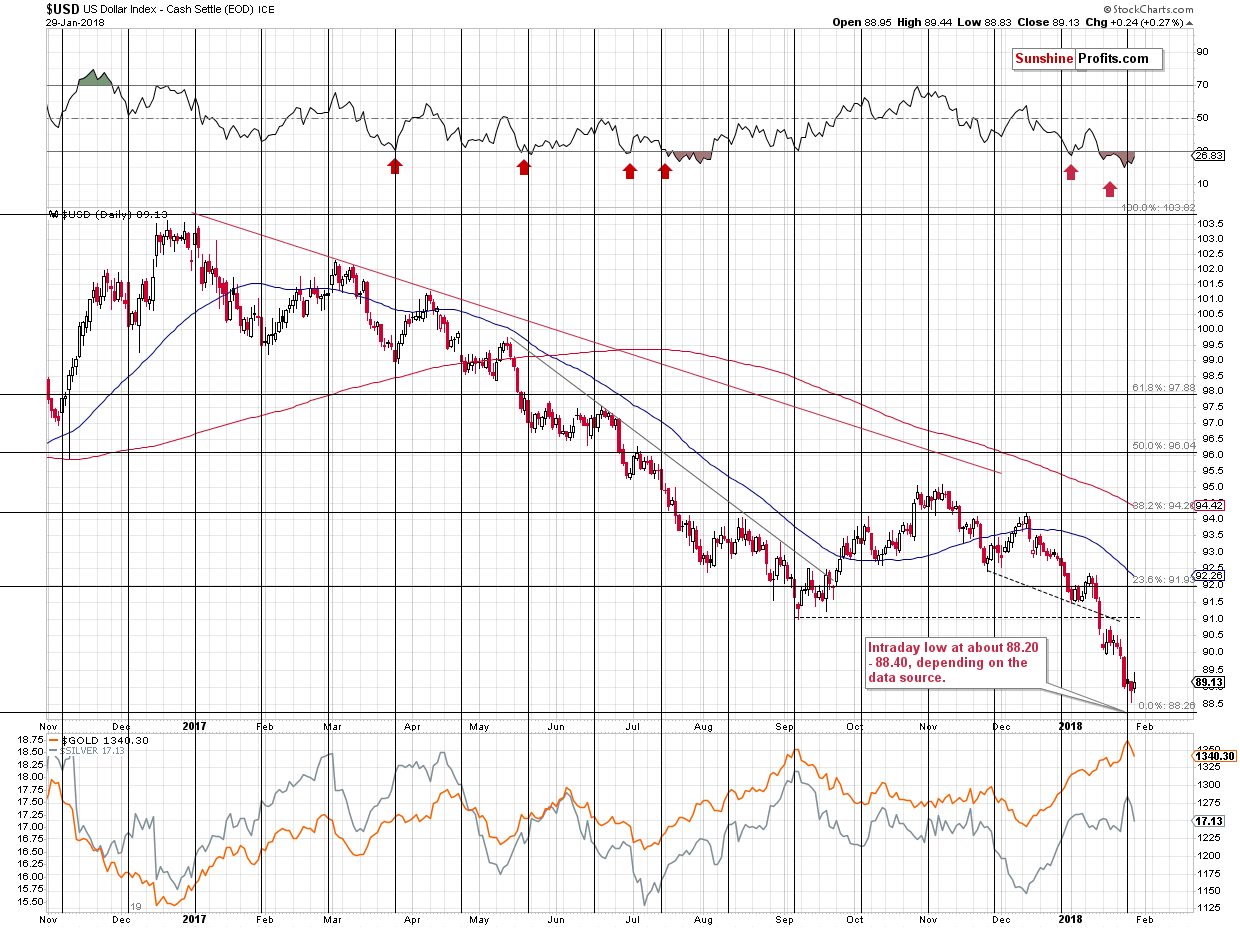

To be even more prepared, let’s take a look at the USD Index and check the PMs’ strength to the movement in the former.

The USD Index moved just a little higher yesterday. This may seem insignificant, until one considers where the USD Index was before the start of this week. In yesterday’s alert, we wrote the following:

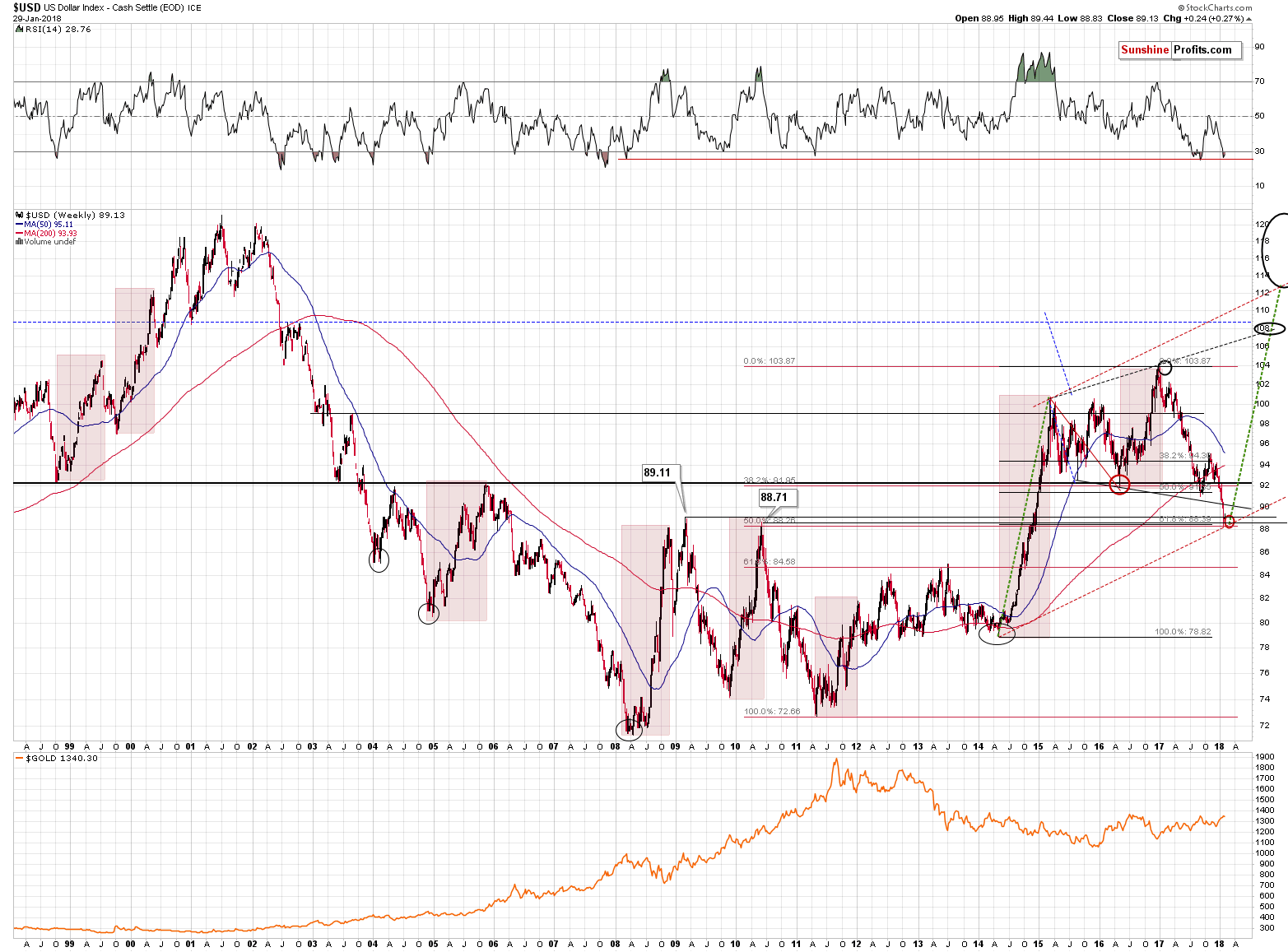

The USD Index closed [the week] slightly below the highest of the key support lines (2009 high of 89.11) and above 3 remaining support levels (the 2010 high of 88.71, 50% Fibonacci retracement based on the 2011 – 2017 rally and the 61.8% Fibonacci retracement based on the 2014 – 2017 rally).

The additional detail here is that in today’s pre-market trading, the USD Index has already moved to 89.27, which is more above the 2009 high than Friday’s close was below it. In other words, the tiny breakdown was already invalidated.

What does this tell us? It tells us that the USD Index is highly likely right after a critical bottom. Even if it was just one of the very important levels that would be reached, the situation would already be bullish in light of the very oversold situation in the RSI indicator. But it’s not just one extreme support that was reached, but 4 of them.

The fact that the USD Index closed above 89.11 has critical meaning – it adds credibility to the invalidation of the breakout as it was seen also in terms of daily closing prices. The invalidation is now a fact and the implications are very bullish for the USD and bearish for the precious metals market.

At the moment of writing these words, the USD Index is at about 89.06 – a bit below the highest of previous long-term highs. However, in light of yesterday’s closing price, it’s not really bearish. At least not at this price level.

It’s very interesting that the small price increase in the USD was all it took for the precious metals sector to decline so visibly. In particular, the mining stocks’ reaction was quite extreme. The metals-USD link is clearly in favor of lower precious metals prices in the coming weeks.

Summing up, the USD’s epic turnaround along with gold’s extraordinary weakness relative to the USD’s intraday decline along with multiple bearish confirmations paint a very bearish picture for the precious metals market for the following weeks. The situation was very bearish for PMs based on the above, but the record-breaking weekly volume in gold took the bearishness to a new – even more extreme – level. Yesterday’s very significant underperformance in gold stocks serves as a perfect bearish confirmation.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (200% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,218; stop-loss: $1,382; initial target price for the DGLD ETN: $53.98; stop-loss for the DGLD ETN $37.68

- Silver: initial target price: $14.63; stop-loss: $17.82; initial target price for the DSLV ETN: $33.88; stop-loss for the DSLV ETN $20.88

- Mining stocks (price levels for the GDX ETF): initial target price: $19.22; stop-loss: $26.14; initial target price for the DUST ETF: $39.88; stop-loss for the DUST ETF $15.78

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $27.82; stop-loss: $38.22

- JDST ETF: initial target price: $94.88 stop-loss: $37.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Central banks remain powerful creatures. Will gold escape from their grip?

Gold Sits in the Central Banks’ Claws

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold drops on firmer dollar, higher bond yields

Whistleblower suing Ernst & Young over gold dealings with Dubai firm

Africa's newest gold miner starts output and sees potential IPO

These Are The 6 Traders Who Were Just Arrested For Manipulating The Gold Market

=====

In other news:

Stocks Drop as Treasuries Edge Higher; Gold Rises: Markets Wrap

World stocks sucked under by bond market breakout

Euro-Area Economy Posts Strong 2017 Finish Buoyed by ECB

Market Euphoria May Turn to Despair If 10-Year Yield Jumps to 3%

An Open Letter to Jerome Powell

Brussels prepared for trade war with US if it restricts EU imports

Record Crypto Heist Raises the Appeal of a New Type of Exchange

CHART: Hedge funds have never been this bullish about oil

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts