Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

“Look, gold went up today, let’s jump in!” “No…wait!” A few positives don’t reverse a trend or make a new one, and just because gold or anything else moved higher on one day, doesn’t mean the trend is now to the upside.

Gold moved higher quite sharply yesterday (Jan. 4), making words like “breakout”, “strength”, and “bull market” become popular and trendy among gold investors. But is it all really justified right now?

Figure 1 – COMEX Gold Futures

Breakout – that’s exactly what we saw. But it’s not a breakout that makes a situation in a given market particularly bullish – it’s a confirmed breakout that matters. So far, we saw just one daily close above gold’s declining resistance line.

We saw a similar rally in November 2020 – gold moved from about $1,900 to about $1,950, only to slide shortly thereafter. Right now, gold is not even at its November highs (it’s close to them though).

Strength – perhaps, but compared to what, actually?

Figure 2 – USD Index

Gold was strong relative to the USD Index for one day (yesterday), and one swallow doesn’t make a summer. Gold investors appear to have become excited too early – the USD Index did move below the previous 2020 lows, but it rallied back up before the end of the day.

If we consider the broader perspective, we see that the USD Index was just below its 2020 lows, while gold wasn’t even above its November highs, let alone the 2020 highs.

So, should we be talking about gold’s strength at this time? In my view, the jury is still out.

Bull market – this depends on what perspective one takes. Did gold rally in the short term? Yes. Did the short-term move change the medium-term downtrend? It’s too early to say so, especially given the triangle-vertex-based reversal which is due today.

What about silver and mining stocks?

Figure 3 – COMEX Silver Futures

Silver is slightly after its triangle-vertex-based reversal, but the one in gold might have simply been more important, and since the entire precious metals sector often moves together, silver might have simply delayed its own reversal.

The white metal is above its November high and even somewhat close to its 2020 high, which shows that it’s been outperforming gold.

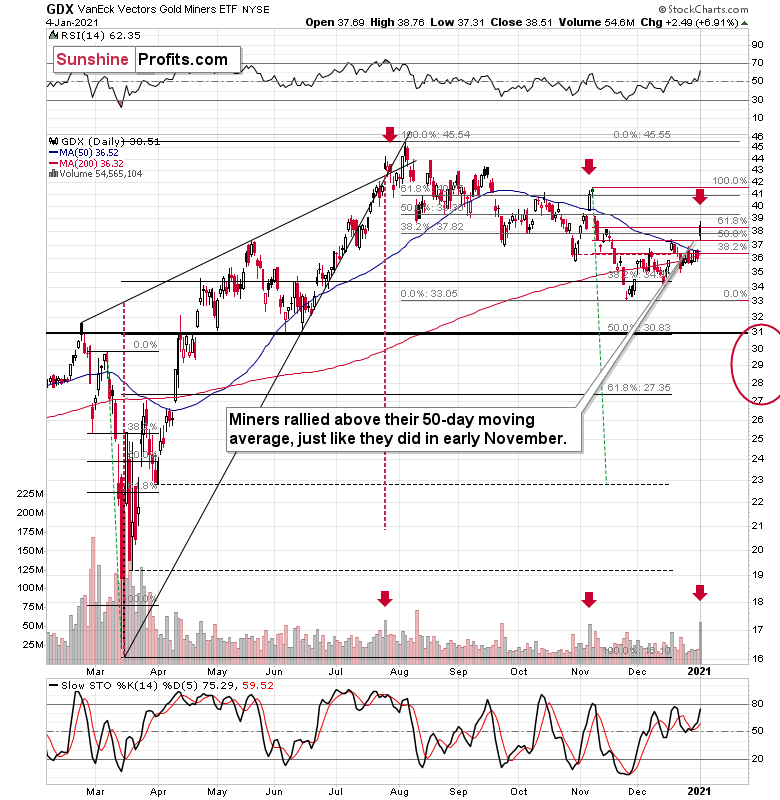

Figure 4 – VanEck Vectors Gold Miners ETF

Miners were underperforming gold for many days and weeks, and they showed strength yesterday. Just like in the case of gold – it was a one-day phenomenon, and one swallow doesn’t make a summer.

During the day, the GDX ETF managed to rally above its 50-day moving average – just as it did at its November top. Unlikely gold, miners are not very close to their November high. They corrected about 61.8% of the decline from this top. Moreover, please note that miners have corrected about 38.2% of the August – November decline. They haven’t even erased half of the decline that occurred in the previous months – so it’s definitely too early to say that miners started a new powerful rally here. Instead, we see that miners are making lower lows and lower highs.

Moreover, please take note of the spike in volume that we saw yesterday. There were very few cases when we saw something similar in the previous months, which was at the November high and at the July high, right before the final 2020 top. The implications are bearish.

Crude oil is behaving just like it did in early 2020 (which started its massive decline that took PMs much lower as well), while the USD Index and cryptocurrencies suggest that we’re seeing the repeat of early 2018, when the USD Index bottomed. Given the current correlations between PMs and the USD Index, the rally in the USDX is likely to have very bearish implications for the precious metals market.

The USD Index’s reversal yesterday suggests that PMs and miners are about to get a bearish push, and we might get exactly the same thing from the general stock market. And speaking of the general stock market… There’s something very interesting happening in it with regard to the options market.

Rampant Speculation

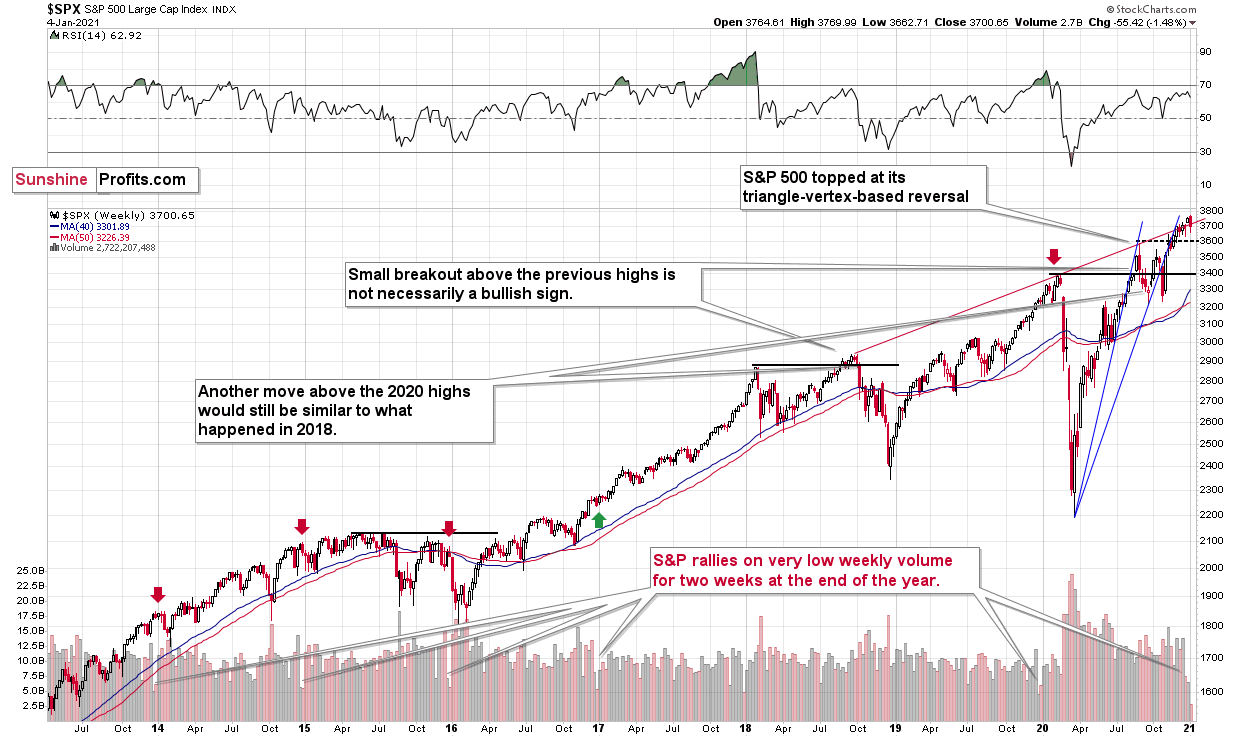

Yesterday, I warned that the S&P 500 (SPX) was nearing a critical inflection point (and so did Matthew Levy). With the Santa Clause rally underpinned by weak volume (as well as manic sentiment, overheating technicals, deteriorating fundamentals and extreme overconcentration), I predicted that a short-term pullback would likely ring in the New Year.

I wrote (Jan. 4):

If you analyze the chart below, weak end-of-year volume tends to precede short-term pullbacks. Over the last five years (when two-week volume plunged before the end of a year), the SPX topped soon after.

And when the house of cards comes crashing down, the unwinding of excessive leverage (which I’ve been highlighting for some time) means a significant drawdown is likely to occur.

Figure 5 – Figure X – S&P 500 Index

And with Monday’s bloodbath likely the straw that broke the camel’s back, the weakness is poised to persist.

Case in point?

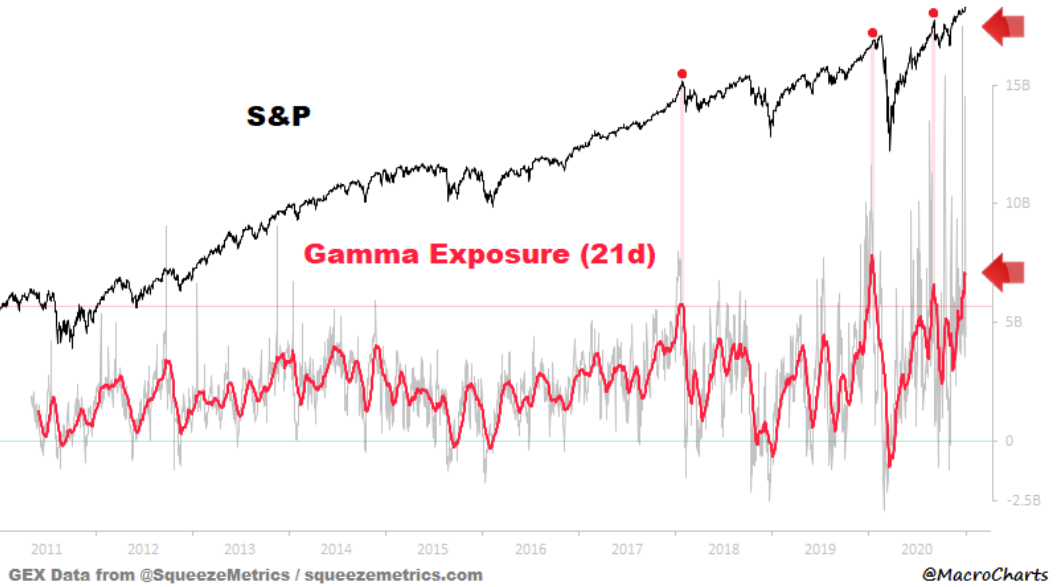

If it’s not bad enough that record margin debt (buying stocks with borrowed money) is leaving investors exposed to forced-selling, option gamma has exploded back to its August highs.

Please see the chart below:

Figure 6 – (Source: MacroCharts)

To explain, the gray bars represent investors’ current Gamma exposure, while the red line represents its 21-day moving average. Right now, the 21-day MA is in the top 0.37% of all-time readings, and only nine days in history have either equalled or exceeded the current value.

Remember, option values are determined by ‘The Greeks’ – Delta, Gamma, Theta, Vega and Rho. And while their mechanics are extremely complicated (and not necessary for this explanation) Delta and Gamma are important because they determine dealers’ (options sellers like investment banks, hedge funds and prop traders) hedging activity. And just as important, dealers’ hedging activity influences the option’s underlying asset (In this case, the SPX.)

In a nutshell, when investors buy call options, dealers hedge their exposure by purchasing the underlying asset (which causes the SPX to rise). As the dance continues, it manifests itself into a positive feedback loop where: speculators buy SPX call options … dealers hedge (by purchasing SPX ETF shares or using similar hedges) … the SPX rises … speculators buy more call options.

Rinse, repeat.

And while the merry-go-round can circle for some time, when the frenzy eventually reverses and dealers offload their hedges, a wave of selling hits the market.

For context, a similar event occurred in August and reached its climax from Sep.3 to Sep. 8. In just three trading days, the NASDAQ fell by 10%, the SPX fell by 7% and high-flyers like Tesla plunged by 26%.

So, with Gordon Gekko’s “Greed, for lack of a better word, is good” echoing across Wall Street again, another Minsky moment could be on the horizon.

The implications for the precious metals market – especially for silver and mining stocks – are bearish.

Overview of the Upcoming Decline

- As far as the current overview of the upcoming decline is concerned, I think it has already begun.

- During the final part of the slide (which could end within the next 1-10 weeks or so), I expect silver to decline more than miners. That would align with how the markets initially reacted to the COVID-19 threat.

- The impact of all the new rounds of money printing in the U.S. and Europe on the precious metals prices is incredibly positive in the long run, which does not make the short-term decline improbable. Markets can and will get ahead of themselves and decline afterward – sometimes very profoundly – before continuing with their upward climb.

- The plan is to exit the current short positions in miners after they decline far and fast, but at the same time, silver drops just “significantly” (we expect this to happen in 1 – 5 weeks ). In other words, the decline in silver should be severe, but the decline in the miners should look “ridiculous”. That’s what we did in March when we bought practically right at the bottom . It is a soft, but simultaneously broad instruction, so additional confirmations are necessary.

- I expect this confirmation to come from gold, reaching about $1,700 - $1,750 . If – at the same time – gold moves to about $1,700 - $1,750 and miners are already after a ridiculously big drop (say, to $31 - $32 in the GDX ETF – or lower), we will probably exit the short positions in the miners and at the same time enter short positions in silver. However, it could also be the case that we’ll wait for a rebound before re-entering short position in silver – it’s too early to say at this time. It’s also possible that we’ll enter very quick long positions between those short positions.

- The precious metals market's final bottom is likely to take shape when gold shows significant strength relative to the USD Index . It could take the form of a gold’s rally or a bullish reversal, despite the ongoing USD Index rally.

Summary

Summing up, the situation on the precious metals market is not as bullish as it might appear based on yesterday’s session alone. The triangle-vertex-based reversals in gold and silver along with huge volume spike in the GDX ETF and other technical signs, point to a looming decline in the prices of precious metals and mining stocks.

Crude oil is behaving just like it did in early 2020 (which started its massive decline that took PMs much lower as well), while the USD Index and cryptocurrencies suggest that we’re seeing the repeat of early 2018, when the USD Index bottomed. Given the current correlations between PMs and the USD Index, the rally in the USDX is likely to have very bearish implications for the precious metals market.

The USD Index’s reversal yesterday suggests that PMs and miners are about to get a bearish push, and we might get exactly the same thing from the general stock market.

Despite a recent decline, it seems that the USD Index is going to move higher in the following months and weeks, in turn causing gold to decline. At some point gold is likely to stop responding to dollar’s bearish indications, and based on the above analysis, it seems that this is already taking place.

Naturally, everyone's trading is their responsibility. But in our opinion, if there ever was a time to either enter a short position in the miners or increase its size if it was not already sizable, it's now. We made money on the March decline, and on the March rebound, with another massive slide already underway.

After the sell-off (that takes gold to about $1,700 or lower), we expect the precious metals to rally significantly. The final decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely earn much more in the following weeks and months), but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $32.02; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $28.73; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $42.72; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $21.22; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,703.

Gold futures downside profit-take exit price: $1,703

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief