Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

Yesterday’s price action in the precious metals sector was far from spectacular, but there is something about the lack of action in gold that is particularly interesting and that serves as a subtle clue as to what’s likely to happen next. It’s Friday the 13th once again today – will gold bulls or bears have bad luck in the near and more distant future?

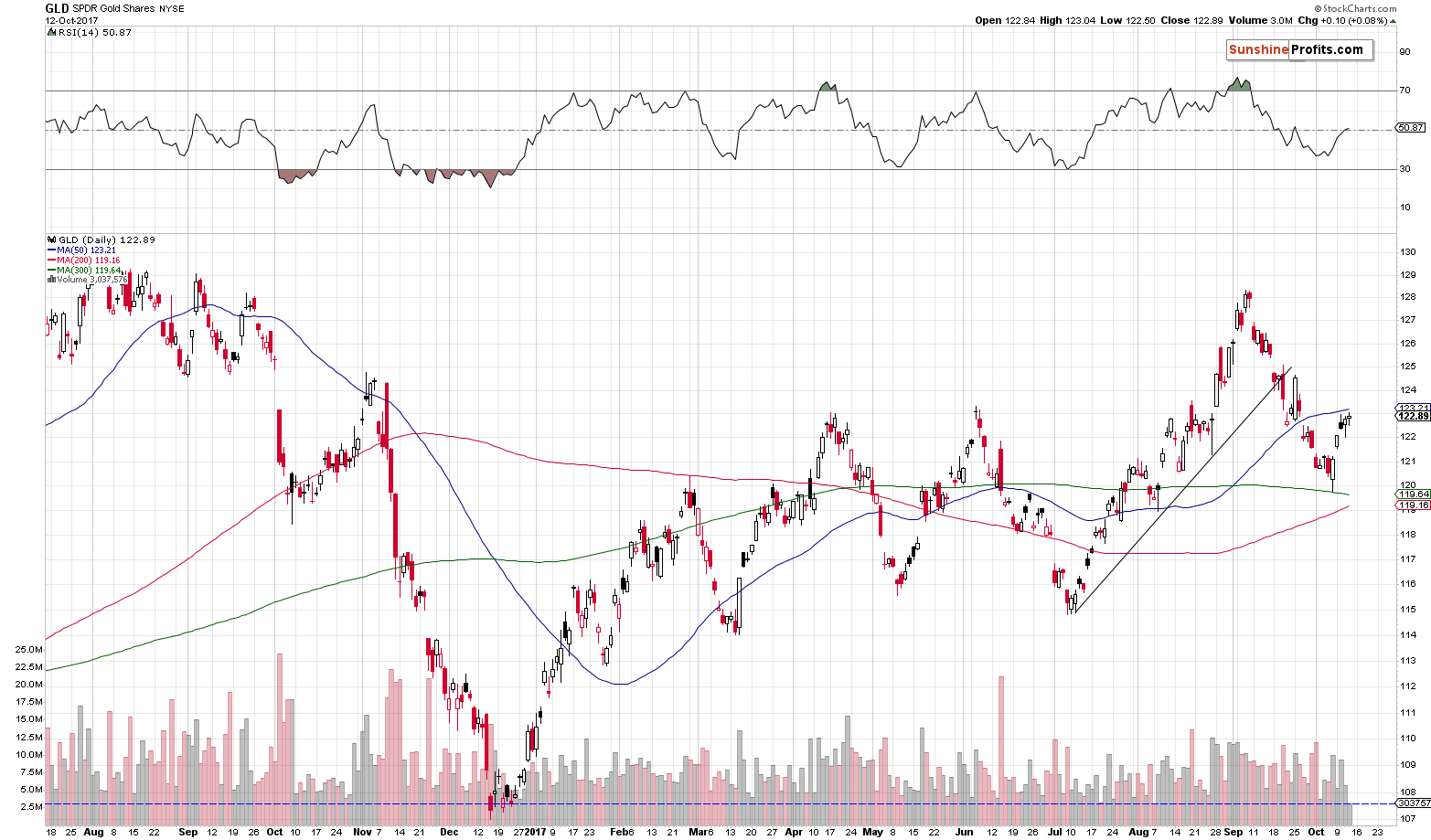

Yesterday’s extremely low volume in the GLD ETF seems to suggest that a black cat just crossed gold’s path.

Let’s take a look at the details (chart courtesy of http://stockcharts.com).

Yesterday’s volume reading in the GLD ETF is the lowest that we’ve seen in more than 12 months. This by itself does not tell us much yet, but compared with the previous action in volume (it declined with the exception of the Monday session) and the previous action in price (steadily higher prices with a declining pace of growth) it’s very informative.

The above is practically a textbook example of the divergence in volume and a sign that the buying power is drying up. This is a perfect confirmation of what we have already seen in the mining stocks (underperformance) and in silver (outperformance).

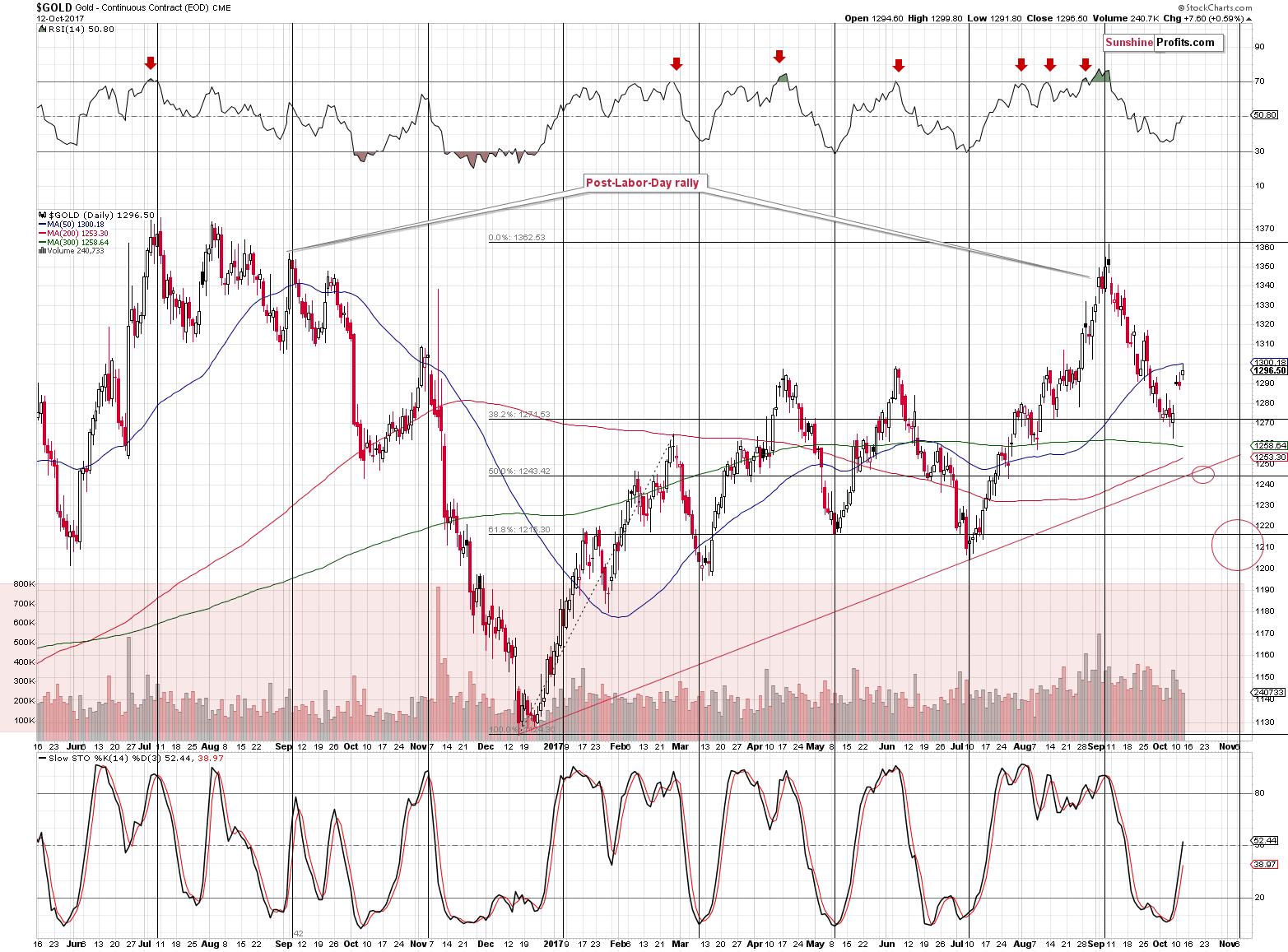

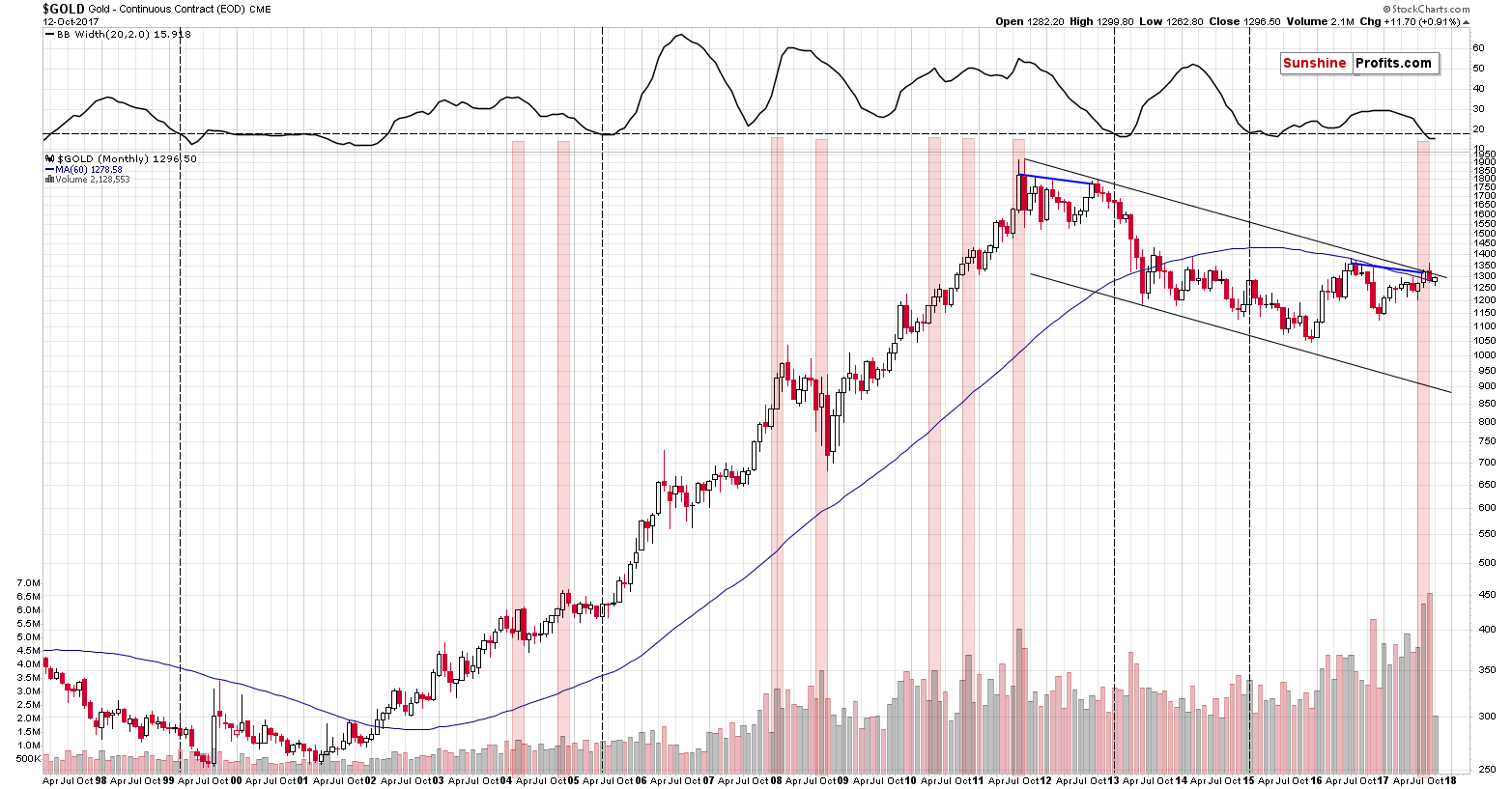

In the case of gold, we see – just like it’s the case with GLD – that the price moved to its 50-day moving average, the previous highs and then bounced back. This is a good reason for the rally to be already over, even though from the very long-term point of view, the rally still has about $9 more to rally.

As a reminder, that’s where we have the long-term declining resistance line.

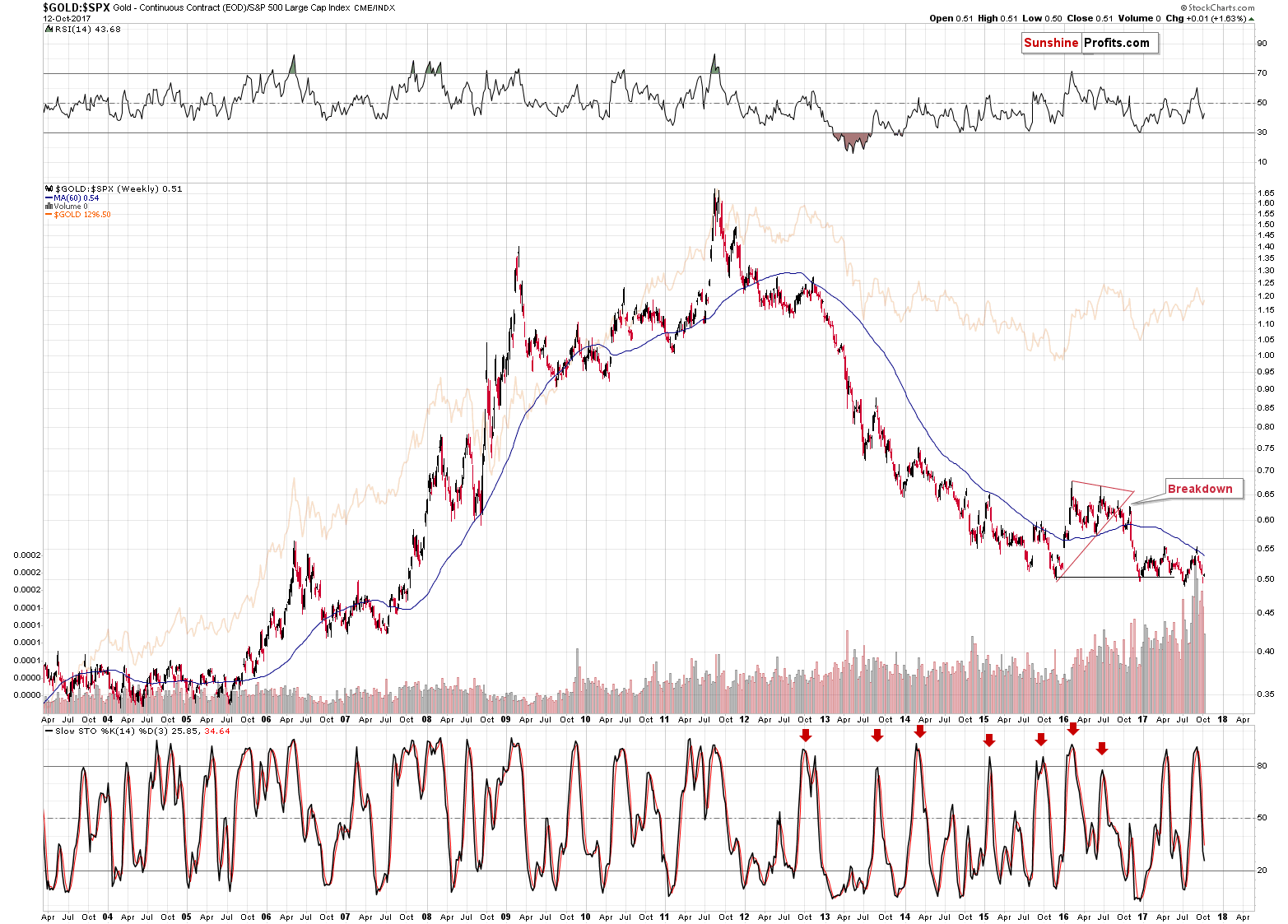

Anyway, it seems that the decline is just around the corner or its already underway. This has important implications for the gold to S&P ratio, which is likely to have a very strong impact on gold.

The ratio is currently at a very important support level – one that kept the declines in check for almost two years. Will it break below this support this time even though all previous attempts were invalidated?

At this time gold seems to be after a short-term rally, not a short-term decline, so it is prepared to decline relatively far. It’s likely to have strong support from the rallying USD Index, which seems to be completing its final correction. There are several short-term signs pointing to lower prices in the near term.

Consequently, it seems that the ratio could finally be ready to take a dive and break below the multi-year support level. Since the ratio moves in tune with gold (local tops and bottoms are aligned and the long-term trends are also alike), a major breakdown in the ratio is likely to result in much lower gold prices as well.

What about silver and mining stocks?

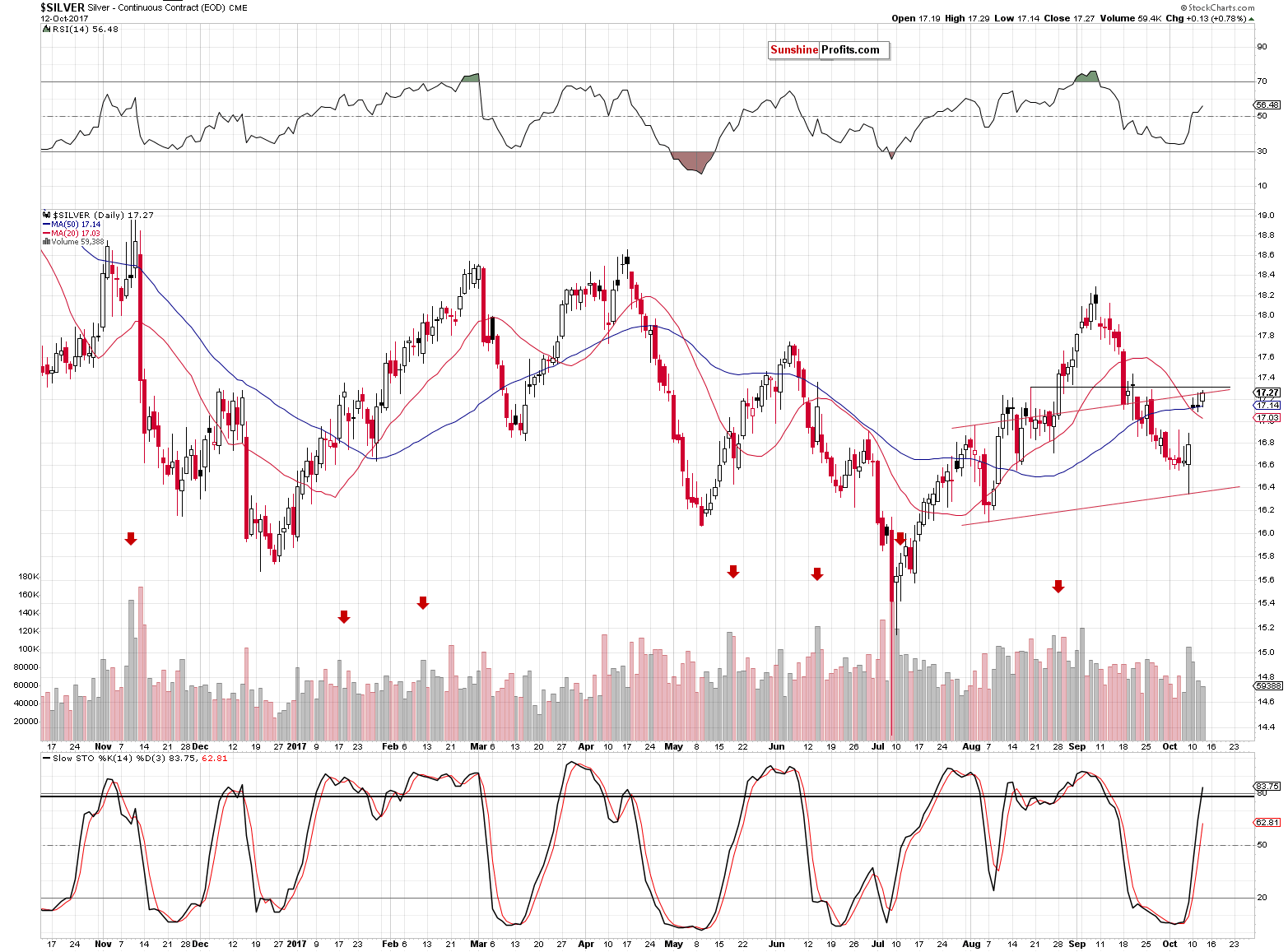

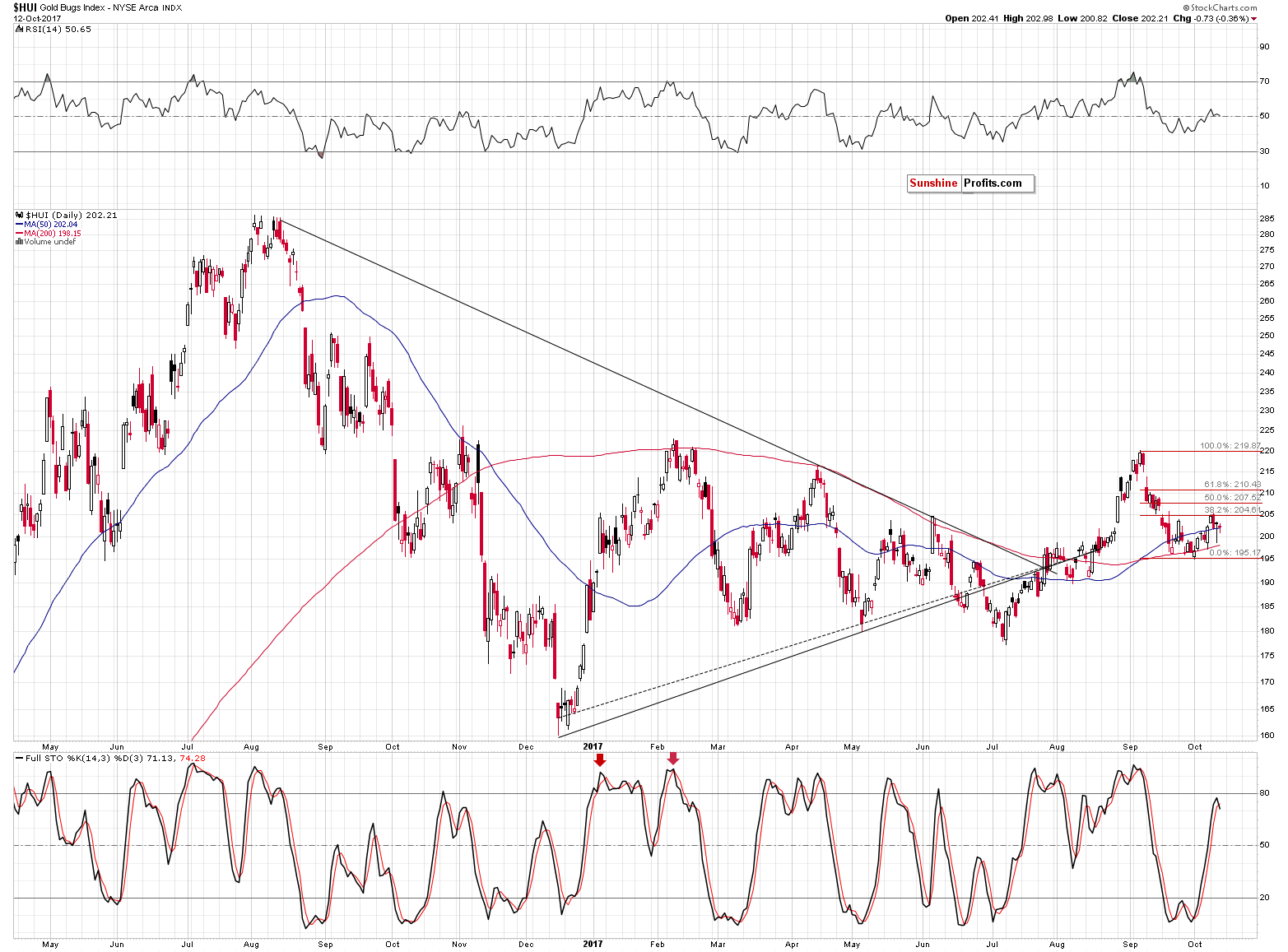

They both continue to perform in tune with our expectations, further confirming the bearish outlook. Silver moved right to its target area and mining stocks continued to underperform.

The new development in the case of the HUI Index is the sell signal from the daily Stochastic indicator. In short, it means that the bearish picture became a bit more bearish.

Summing up, gold, silver and mining stocks all seem to be very close to their upside targets for this short-term corrective upswing. Mining stocks have already declined after reaching our target price, while gold and silver area close enough for the top to be already in, but at the same time they still have some very limited room to rally. Silver outperformed while miners declined, which is a classic bearish confirmation. Consequently, it seems that the rally will be over sooner rather than later. Those who engaged in day-trading and aimed to profit on the short-term upswing in the precious metals sector may want to close their long positions at this time or prepare to do so shortly and switch to short ones.

The outlook for the precious metals sector for the following months remains bearish and – as we discussed yesterday – the analogy between the two most recent series of interest rate hikes confirms it.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: initial target price level: $1,063; stop-loss: $1,366; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $38.74

- Silver: initial target price: $13.12; stop-loss: $19.22; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JDST ETF: initial target price: $417.04; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The Blockchain technology enables tokenization of gold. What does it mean for the precious metals market?

The importance of the renminbi in the world is rising. But what is the relationship between the Chinese currency and gold? We invite you to read our today’s article about the link between the yuan and the yellow metal and find out what is the correlation between these two assets.

Earlier today EUR/USD and GBP/USD extended gains and reached their important resistance areas. Will currency bears use them to push the exchange rates lower?

Is It Right Time for Reversals in EUR/USD and GBP/USD?

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold set for first weekly gain in five weeks, U.S. data due

'Not Bullish' on Gold Price Says RBC Capital Markets

Barrick Gold sees drop in production as Tanzanian troubles drag

Where Gold Trade Goes If London Loses Its Grip

=====

In other news:

ECB to Consider Cutting QE Purchases in Half Next Year

Trump Expected to Disavow Iran Nuclear Deal, Not Abandon It

Global Demand for Bitcoin Shifts Wildly in Response to Regulation

Allies press Catalan leader to declare full independence, ignore Madrid deadlines

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts