Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective. This position was originally featured on Jan. 12, 2017 at 3:49PM. Today, we are adjusting the stop-loss levels for gold and silver.

The likely direct reason behind today’s overnight spike in the price of gold is a cruise missile strike at a Syrian airbase, most likely the one from which a deadly chemical weapons attack had been launched earlier this week. However, it's not likely that 59 Tomahawk missiles was enough to ignite a rally alone. The strike had damaged ties between Washington and Moscow, as Russian spokesman Dmitry Peskov described the U.S. action as "aggression against a sovereign nation" on a "made-up pretext". Was the move just a temporary blip on the radar screen or is it enough to trigger a more sustained rally?

Let’s begin today’s discussion with some background information. If you haven’t done so already, we encourage you to read our detailed take on geopolitical risk and gold (which you’ll find in our Dictionary section – following the above link will take you right to it), but if you’re short on time, here are the key parts regarding today’s price spike:

However, gold does not always gain due to geopolitical crises. The best example may be the terrorist attacks in Paris in November 2015 and in Brussels in March 2016. Their impact on gold prices was only temporary and quickly vanished. There are three main reasons why geopolitical concerns do not affect gold as strongly as it is commonly believed, and why the relationship between geopolitics and gold is not as simple as it seems to be.

(...)

Second, gold is mainly a bet against the U.S. economy. This is why terrorist attacks (or other geopolitical events) which occur overseas and not in America often do not have any durable effects on the gold market

(...)

Although gold serves as a safe haven, the importance of the geopolitical concerns for the gold market is often overstated (thus, we do not advise automatically buying gold because of the rise of geopolitical risks).

(...)

Therefore, long-term investors should not make a decision based only on geopolitical events, which often strengthen gold only in the short-term, but always look at the fundamentals. Traders should also compare the weight of what happened and what reaction it caused with the technical factors that were (and likely still are) present on the market. In many cases, it could turn out that the post-news spike is actually a shorting opportunity instead of a buying signal. Unfortunately, there is no general rule whether this would be the case or not and each case needs to be analyzed separately.

Has anything changed on U.S. soil? Has anything really changed regarding the current way the world works? No – the attacks and the resulting action were tragic, but they haven’t changed as much as it may appear at the first sight. Remember when Russia took control over Crimea? The event itself was much bigger than the attack that we discussed above and it had lasting implications (Russia controls Crimea up to this day) and what happened with gold? Shortly after the annexation gold started to decline and didn’t end its slide until almost 2 years later. In fact, gold is visibly lower even today. So, is an attack in Syria and comments from a Russian spokesman enough to trigger lasting changes on the gold market? That seems rather unlikely.

Still, gold and silver moved quite close to our stop-loss levels for the current trade so let’s take this opportunity to discuss them. First of all, let’s define what a stop-loss level is and how it can be used. Quoting our FAQ section:

A stop-loss is the price level that would close the position by itself (!), regardless of the size of the volume, corresponding action in other related markets, ratios etc. (…) In other words, a stop-loss level is a reply to the question “how far should the price move for us to change our mind on a given trade without considering anything else. (…) Please note that a $20 rally in gold on low volume after major bullish news is a bearish phenomenon, while a $15 rally on strong volume without bullish news is a very bullish phenomenon - the price action alone is not everything.

In other words, a stop-loss is not a price target and it’s not something that is likely to be reached. It is something that helps in executing a trading strategy.

Now, a good follow-up question would be: "Why would one want to close a position at a certain level?" The only reason to adjust the position is a change in the risk-to-reward situation, which is partially based on the outlook (and partially on the individual investors' circumstances). Assuming that nothing changed regarding investor’s preferences, risk tolerance etc., we could simplify the above by saying that a change in a position would be based on a change in the outlook. So, a stop-loss is a price level, after (b)reaching which the outlook changes and so does the position – simple as that and as confusing as that. Confusing, because in reality there are multiple outlooks – there’s the short-term outlook, intra-day outlook, long-term outlook and so on. So, the question is what outlook would (b)reaching a stop-loss level change. The reply to this question determines what triggering a stop-loss really means.

A change in the long-term outlook would likely imply a change in the long-term investment capital, whereas a change in the very-short-term outlook would not likely have implications for even a medium- or short-term trade.

Moving from the general discussion to the current situation and the stop-loss level – if the stop less level is breached, it would not invalidate any points that we made earlier this week (even the ones regarding the 50-week moving averages – unless gold moves far above it, which is a different matter) and therefore it would not make the bigger picture bullish. So, why a move above the stop-loss level would close the position automatically?

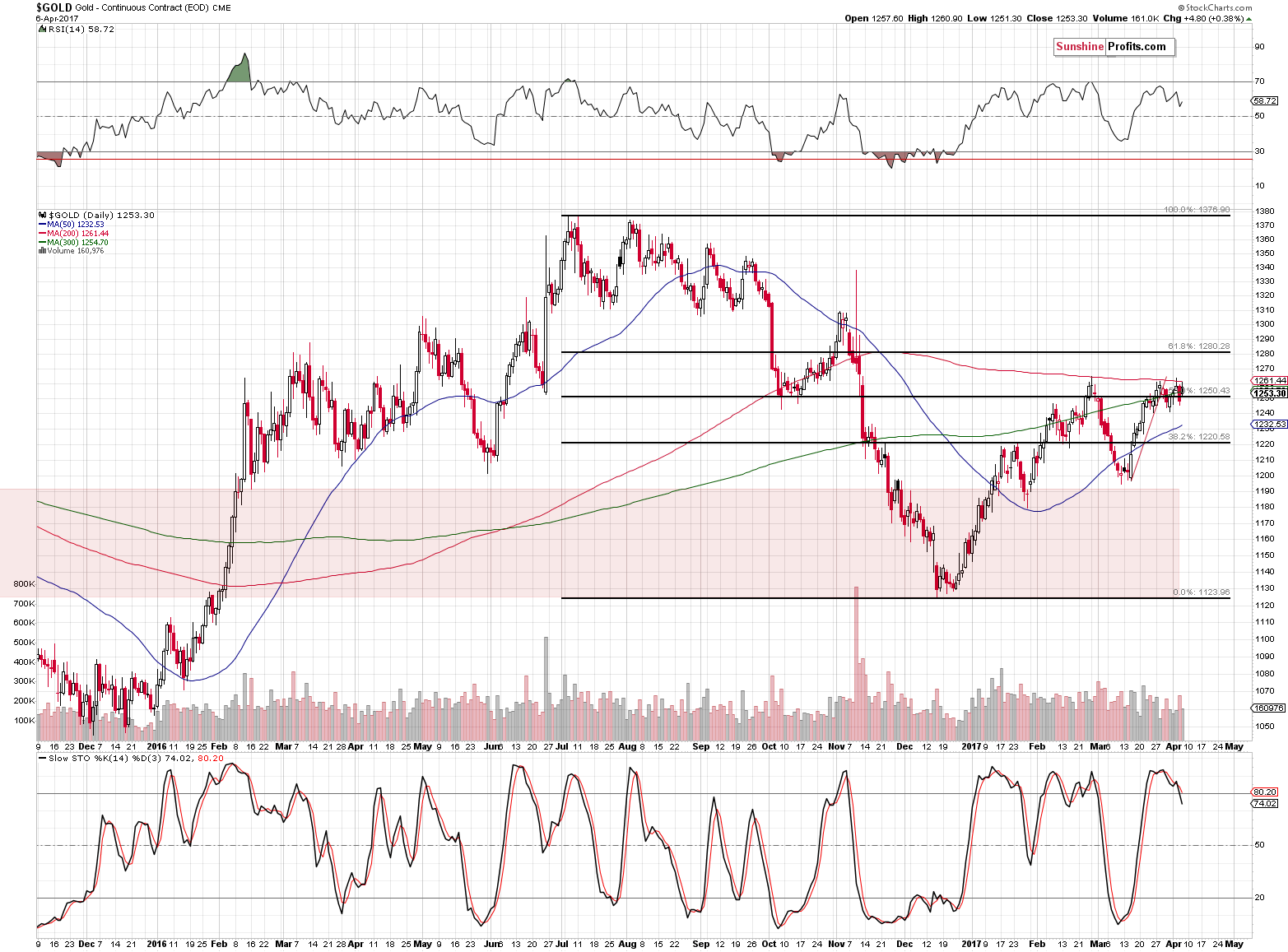

Even without a change in the bigger trend, a move above the stop-loss level would make it likely that the precious metals sector would move even higher temporarily before turning south again. What would such a level be in the case of gold (charts courtesy of http://stockcharts.com)?

The 61.8% Fibonacci retracement based on the 2016 decline – at about $1,280 would be the target for the rally, which is just around the corner. Now, if it wasn’t for the much improved situation in the USD Index (compared with what we had several weeks / months ago) and other signals with bearish implications for the precious metals market, gold could rally even higher based on the move above the $1,273 level, however, as of today, it seems doubtful.

Neither the events in Syria, nor the weak employment numbers that were reported today negate the major signals that are currently in play. Consequently, we are moving the stop-loss levels higher, so that they reflect it. We are moving the stop-loss level in gold above the 61.8% Fibonacci retracement as a big move above it could trigger an even bigger rally (perhaps to the intra-day U.S.-elections high). Again, we don’t view this as likely, but the stop-loss levels exist to have more control over the unlikely and moving them higher seems to be justified at this time. The same goes for silver.

Summing up, today’s pre-market upswing in the precious metals sector appears to be a temporary news-based move that is most likely not going to be sustained. There are multiple signs pointing to much lower precious metals prices that remain in place and it doesn’t seem that any of them changed based on today’s price swings. We are moving the stop-loss levels based on the mentioned news-based rally and the sell signals that remain up-to-date.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: exit-profit-take level: $1,063; stop-loss: $1,294; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $45.87

- Silver: initial target price: $13.12; stop-loss: $19.22; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JDST ETF: initial target price: $104.26; stop-loss: $10.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

At the end of March, Thomson Reuters GFMS released its Gold Survey 2017, looking at the developments in the global gold market and the future of gold prices. What are the main conclusions of the report?

Although gold performed really well in the first quarter of 2017, it seems to remain at the crossroads. On the one hand, uncertainty about Trump’s actions and the outcome of European elections, as well as the Fed’s being less hawkish than expected, support gold prices. On the other hand, the macroeconomic outlook remains unpleasant for precious metals, as the U.S. dollar is likely to continue its upward trend, given the widening divergence in monetary policies conducted by major central banks. We invite you to read our today’s article about the gold market in the first quarter of 2017 and find out which way gold is likely to go.

Gold Market in Q1 and the Outlook for 2017

=====

Hand-picked precious-metals-related links:

Gold Rallies on Haven Demand as U.S. Missiles Hit Syrian Targets

=====

In other news:

Stocks spooked, safe assets jump after U.S. missile strike on Syria

U.S. weekly jobless claims post largest drop in almost two years

U.S. job creation misses forecasts in March, unemployment rate drops

ECB's Praet says it's too early to start discussing a reduction of bond buying

The buying power of the U.S. dollar over the last century

Fed's Kashkari: Dimon got it wrong, 'too big to fail is alive and well'

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts