Briefly: In our opinion, a speculative short position (full) in gold, silver and mining stocks is justified from the risk/reward point of view.

In our Friday’s alert we described in great detail our medium-term outlook and we thoroughly discussed when and at what prices we expect gold to bottom. The price levels, however, is only one of many things that one needs to look at in order to estimate whether the bottom is really in or not. In today’s alert, we’ll discuss these confirmations.

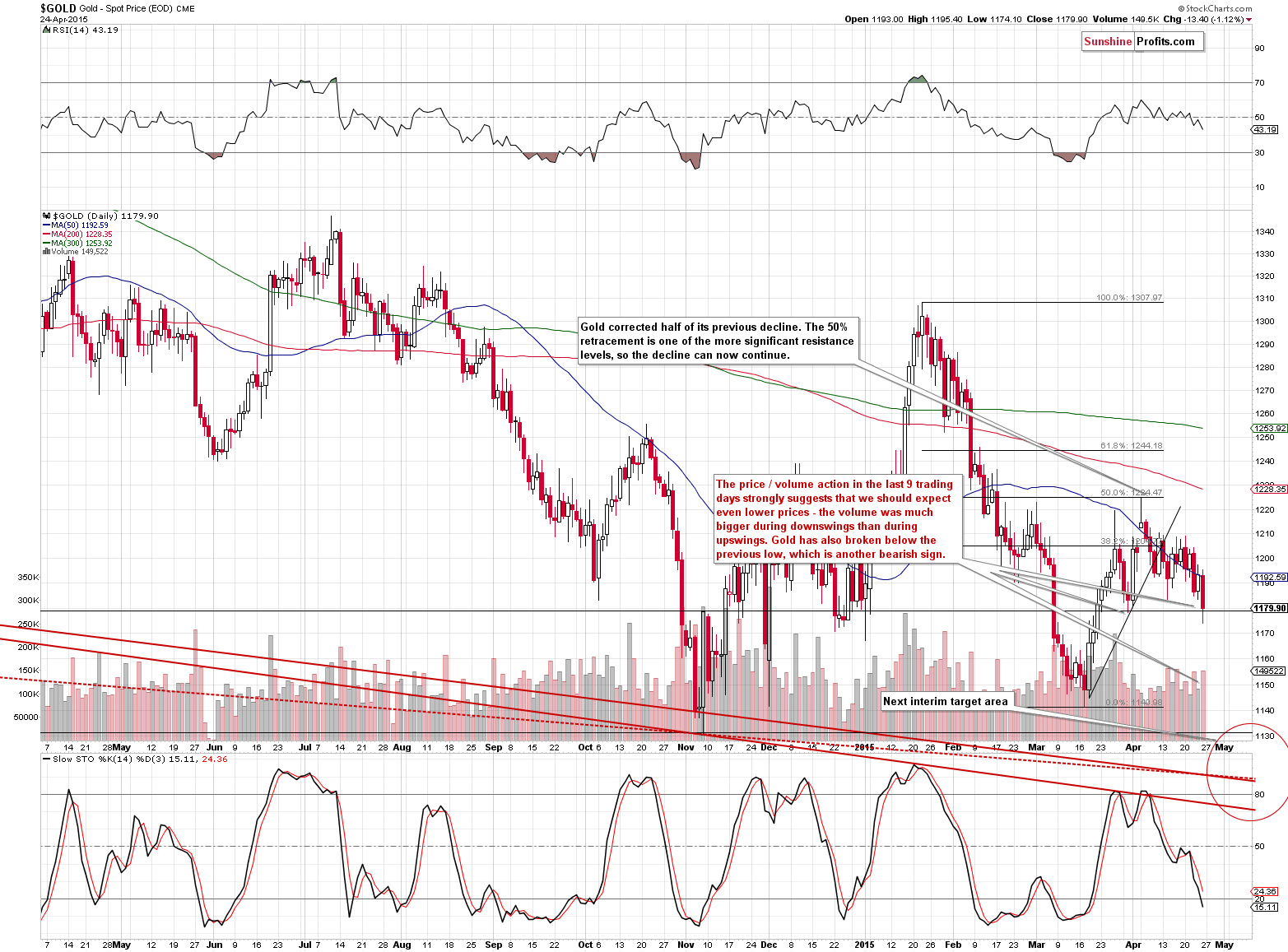

Before we do that, let’s take a look at what happened on Friday. In short, the profits on the short position have increased further. The decline was most visible in gold (charts courtesy of http://stockcharts.com).

Gold declined significantly and the move was accompanied by significant volume. Moreover, gold closed below the previous local low. These are both bearish signs, suggesting that the decline will continue. Let’s keep in mind that the current decline creates the right shoulder of the bearish head-and-shoulders formation, which will have even more bearish implications once it’s completed.

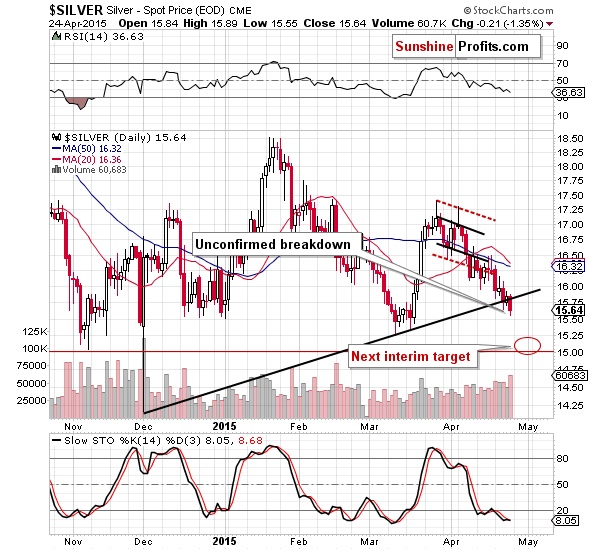

Meanwhile, silver broke below the rising medium-term support line and the move took place on relatively high volume. Still, the size of the move below the support line was relatively small, so we don’t think that the breakdown is confirmed at this time. The situation deteriorated, but not significantly – we could still see some sideways trading or a corrective upswing before silver plunges once again (we think it’s a good idea to wait out the possible correction because it’s not likely to be significant and the following decline could start very soon and in a very sudden way).

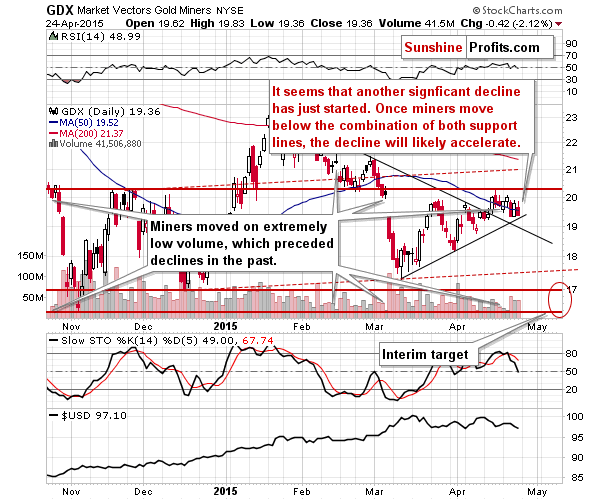

Just like silver, miners didn’t move much lower on Friday (the volume, was not low, though). The miners are likely to catch up with gold and silver, as it was often the case.

What’s the reason for miners’ strength? Perhaps it was the same thing that caused Friday’s decline in silver not to be bigger. If you’ve been with us for some time, you might have already guessed what that factor may be - the rising general stock market.

Silver moves with the S&P at times due to its multiple industrial uses and mining stocks often move in tune with other stocks simply because they are … well, stocks. The S&P 500 moved slightly above their recent highs an the breakout was not confirmed by the DJIA nor by other factors. In fact, the SPY ETF that tracks the S&P 500 moved higher on tiny volume, which (as you have just seen in case of the mining stocks) suggests a move lower. Additionally, Paul has also turned bearish last week. It seems that the trend in the general stock market might change quite soon and what caused miners to hold up relatively well, might now cause them to decline even faster than gold.

Overall, we saw bearish signs yesterday and we can summarize today’s outlook in the same way as we’ve summarized it in Friday’s alert:

Summing up, we think that gold will move much higher (in the following years), but only after it declines once again (in the following months). It seems that another bigger downswing has already started and that it will continue for a few tens of dollars for gold before we see any significant rebound. The price-volume analysis and other factors continue to favor the bearish outlook for the short and medium term.

Having said that, let’s move back to the topic of this alert – the confirmations that we would like to see before stating that the final bottom in gold is likely in or extremely close to being in. Before we begin, let’s discuss why we think that confirmations are meaningful or useful. In short, it’s about what they represent. The confirmations that we will list below are all ways in which we will aim to detect if the bearishness has already reached the extreme level. Markets move from being perceived extremely bullish (where we see tops because everyone is already in the market and expecting higher prices) and extremely bearish (where we see bottoms because of capitulation and everyone leaving the market).

The more significant trend that is being discussed, the more visible and useful the above-mentioned signals become. In case of very short-term trends that form during a single session, we will not see any change in the sentiment around us – we will not see people writing on various forums about gold’s huge potential or about it being a disaster – it’s too small a move to generate a visible response. However, at the 2011 top, everyone and their brother wanted to buy gold because of its extreme potential and bullish outlook. The link between the top and the overall sentiment was very strong.

In light of the previous paragraphs, it’s natural to expect that this bottom will be accompanied by all sorts of developments signaling extreme bearishness that can be used to detect it or confirm it.

Consequently, we’ll be looking for signals that indicate extreme bearishness:

- Silver declining extremely sharply – greatly underperforming gold (the last parts of a given move are quite often more volatile in case of silver than in case of gold; plus practically all major declines ended with silver’s sharp underperformance)

- Headlines in major financial portals like finance.yahoo.com about gold’s extremely bearish outlook

- Gold’s and silver’s medium-term decline is once again evident in terms of all major currencies

- Silver, HUI and XAU indices, HUI to gold ratio, XAU to gold ratio, HUI to S&P 500 ratio all (or almost all of them) move to a major support levels

- A lot of hate-mail in our e-mail inbox from readers that will be holding precious metals at that time (given that we are bearish at that time and it is known publicly)

- USD Index at a major resistance level

- We would like to see the gold stocks to gold ratio plunge (as mentioned in point 4) but we would like gold stocks to show strength after a while, thus refusing to follow gold’s declines

- Websites dedicated to gold freeze for a while when people are so interested in the volatile downswing and keep refreshing these websites for latest prices (did you know that something like that occurred in 2011 right before the final top?)

- We would like our non-investing friends to call us asking what’s going on with gold as they’ve heard that it has declined so badly.

Not all of the above points have to be seen for us to say that it’s very likely that we are at a bottom or that it’s at hand, but the more of these confirmations we get, the more likely will the key turnaround be.

We will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short (full position) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (!) target prices:

- Gold: initial target price: $1,115; stop-loss: $1,253, initial target price for the DGLD ETN: $87.00; stop loss for the DGLD ETN $63.78

- Silver: initial target price: $15.10; stop-loss: $17.63, initial target price for the DSLV ETN: $67.81; stop loss for DSLV ETN $44.97

- Mining stocks (price levels for the GDX ETN): initial target price: $16.63; stop-loss: $21.83, initial target price for the DUST ETN: $23.59; stop loss for the DUST ETN $12.23

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: initial target price: $21.17; stop-loss: $27.31

- JDST: initial target price: $14.35; stop-loss: $6.18

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Yesterday, we didn't see too much action in Bitcoin. Today, this also seems to be the case? Does this mean that Bitcoin has become boring lately? We don't think so, and we offer some hints as to what the current outlook might be.

Bitcoin Trading Alert: Bitcoin Provides Traders with Hints

=====

Hand-picked precious-metals-related links:

Venezuela carries out $1 bln gold swap with Citibank -media

Why Is JP Morgan Accumulating The Biggest Stockpile Of Physical Silver?

Randgold’s big Ivorian gold mine back on track

=====

In other news:

Greece’s Day of Reckoning Inches Closer as Payments Loom

The S&P 500 has a serious revenue problem

War Haunts Russia’s Southern Fringe, Threatening Pipelines

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts