2020 is dead! Long live 2021! The new year should be positive for gold, but to a lesser extent than the previous year.

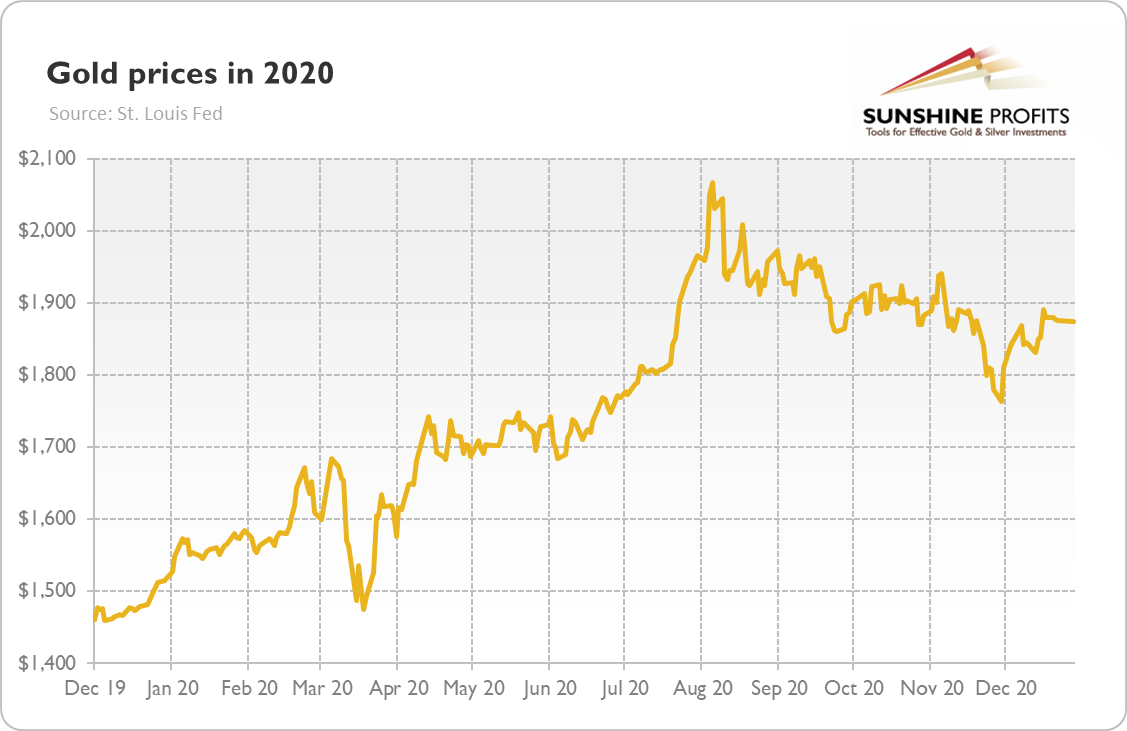

Finally, 2020 has drawn to a close! It was a strange year all right, bringing with it disaster for many people all over the world, so it’s a good thing that it’s passing. Few will miss 2020... but gold bulls should count themselves among this small group of people. After all, as the chart below shows, the yellow metal jumped from $1,515 to $1,874, gaining more than $350, or almost 24 percent!

Gold prices have been rising since May 2019, amid the Fed’s interest rate cuts. The pandemic was the catalyst for the rally in 2020, and increased the safe-haven demand for the yellow metal. The epidemic in the U.S. also triggered an expansion in monetary policy easing that led to abundant liquidity and negative real interest rates, which pushed the gold prices higher. Last but not least, the loose fiscal policy expanded the fiscal deficits, which ballooned the public debt and increased fears about the debt crisis and inflation. So, gold shined in 2020, although the aggressive March asset selloff and shift into cash plunged the gold prices for a while.

Implications for Gold in 2021

We know what happened in 2020, but the key question is what will 2021 bring for the gold market? Given that the price of gold peaked in August and has been unable to return above $1,900, there are justified worries that the best of times are already behind the yellow metal. However, others claim that we are just witnessing an interlude within gold’s bull market? Who is right?

Well, both sides are right. How is that possible? In my view, 2021 should be positive for the yellow metal, but to a lesser extent than the previous year. This claim is based on a careful comparative analysis. Long story short, 2021 should be economically better compared to 2020 (unless we see a solvency crisis). Armed with vaccines, we will eventually win the battle with the coronavirus and the era of economic lockdowns will end.

In consequence, although the monetary policy will remain accommodative, room for further easing is limited. Actually, there is a downward risk for gold that the interest rates will normalize somewhat during the economic recovery in 2021. The same applies to fiscal policy: although it will stay loose, the ratio of public debt to GDP should stabilize, especially if Republicans maintain control over the Senate and will block the most extravagant Democrats’ spending proposals. In other words, the economic normalization and strengthened risk appetite could create downward pressure on the yellow metal.

However, there are also some upward risks for gold in 2021. One tailwind is a weakening of the U.S. dollar amid a zero interest rate policy, large fiscal deficits, and capital outflows into foreign markets. Another positive macroeconomic trend for gold is reflation, i.e., the possibility that inflation will increase next year due to the disruptions in the global supply chains, a surge in the money supply, and economic recovery with the realization of pent-up demand.

Hence, the greenback’s depreciation and the continuation of easy monetary and fiscal policies should support the price of the yellow metal. History also shows that gold shines during the early phase of economic recovery, so gold bulls don’t have to be worried that the effects of the pandemic are over. At least not immediately, as January is historically positive for gold prices. And inflation may increase finally, creating downward pressure on the real interest rates, although there might be a significant lag between the surge in the broad money supply and increase in the consumer price index.

However, with the federal funds rate already at zero and no indications that the Fed wants negative interest rates, investors could start anticipating higher interest rates later in 2021, which should prove negative for the price of gold.

If you are interested in a more detailed outlook for gold in 2021, I will provide a thorough analysis in the upcoming January edition of the Gold Market Overview. Here’s a toast to gold in 2021!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.