Retail sales came in really strong in May, which could strengthen risk appetite, but the dovish Fed should support gold.

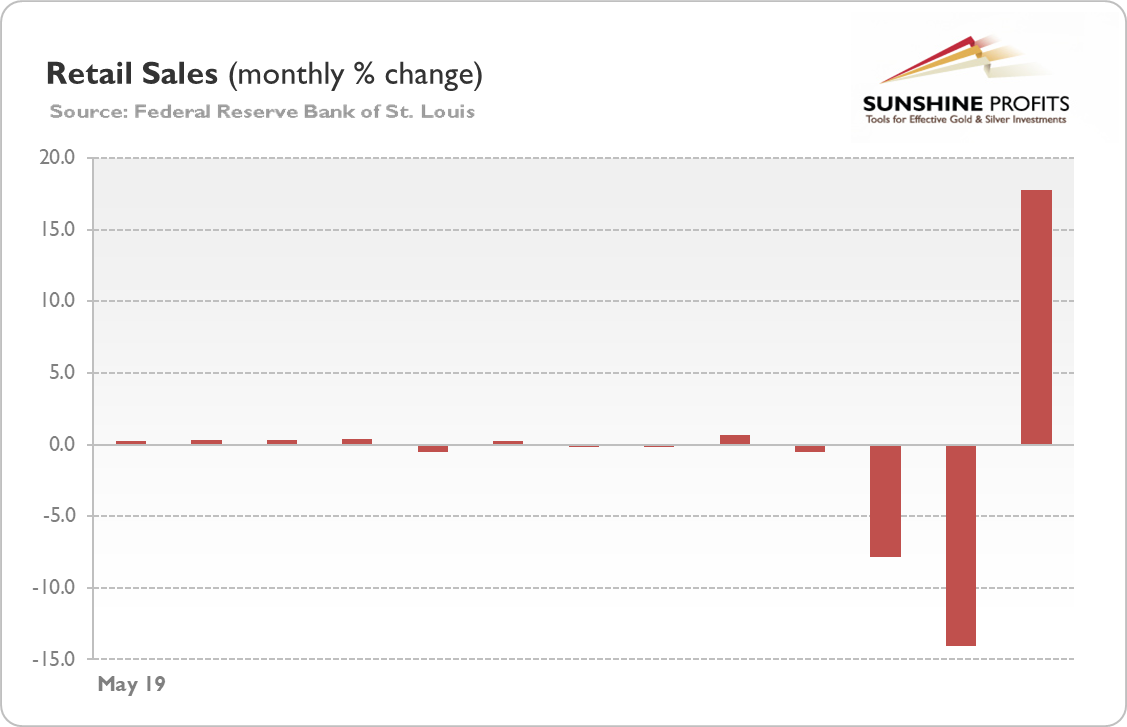

As the chart below shows, retail sales surged 17.7 percent in May, as the U.S. economy started to reopen. The number was a record high and above expectations, triggering optimism in the marketplace.

However, the sales were still 6 percent lower than a year ago, which means that the coronavirus crisis has not ended yet. But such reports may, nevertheless, increase the risk appetite among investors at the expense gold and other safe havens.

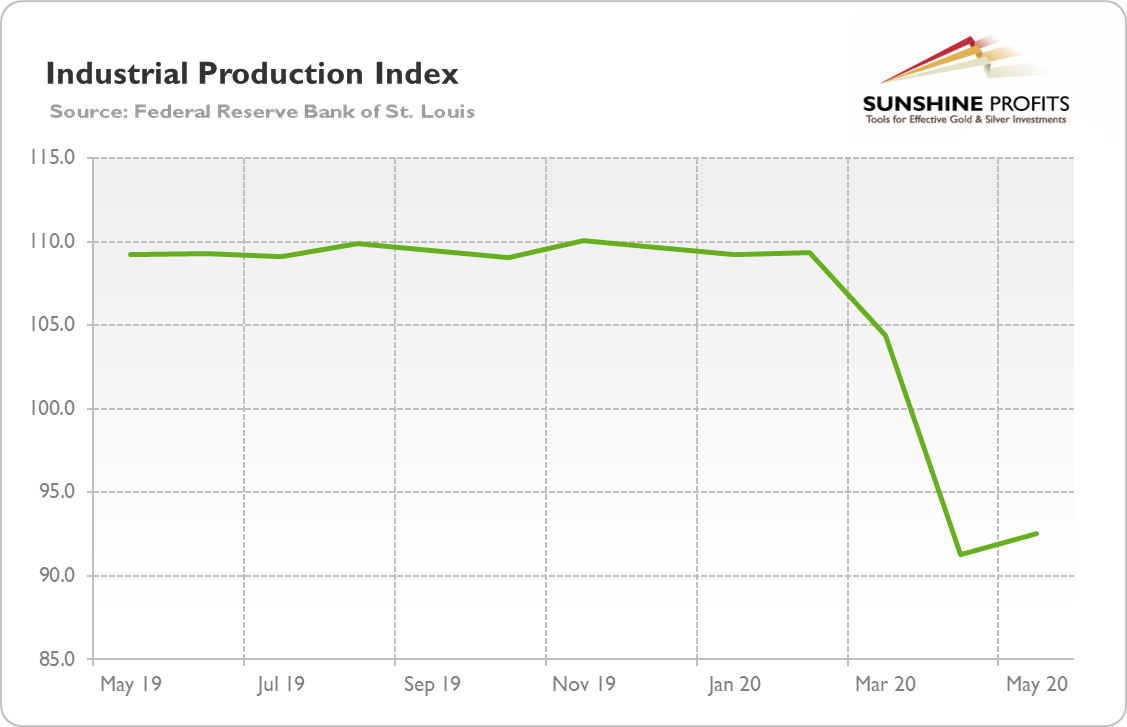

Another sign that the US economy began to revive in May, was the increase in industrial production by 1.4 percent, as many factories resumed operations. However, the number came below expectations, and the industrial production was still 15.4 percent below its pre-pandemic level, as one can see in the chart below.

Powell's Testimony and Gold

On Tuesday, Powell testified before the Senate Banking Committee. His prepared testimony was not much different than from his earlier remarks during the press conference after the June FOMC meeting. Powell reiterated his cautious view about the economic outlook and that he does not expect a V-shaped recovery:

the levels of output and employment remain far below their pre-pandemic levels, and significant uncertainty remains about the timing and strength of the recovery. Much of that economic uncertainty comes from uncertainty about the path of the disease and the effects of measures to contain it. Until the public is confident that the disease is contained, a full recovery is unlikely. Moreover, the longer the downturn lasts, the greater the potential for longer-term damage from permanent job loss and business closures.

Therefore, according to Powell, investors should not overreact to surprisingly good economic data such as the May nonfarm payrolls or retail sales report. He said that the economy would go through three stages: economic shutdown, the bounce-back as people return to work and the economy "well short" of the pre-pandemic level in February. In other words, we are at the beginning of rebound, and many economic reports may be very positive, but it should not be actually surprising as they are coming off extremely low levels. What is crucial here is how will the economy evolve later.

The new thing Powell said was admission that the latest Fed's dot plot does not factor in a potential second wave of coronavirus infections later this year, which is rather concerning. When asked by Senator Krysten Sinema whether "Does this projection assume a potential second wave of coronavirus and the accompanying economic impacts?", Powell replied:

I would think the answer to your question, though, largely will be that ... my colleagues will not principally have assumed that there will be a substantial second wave.

It means that the potential resurgence of coronavirus in the second half of the year would alter the Fed's stance into being even more dovish, which could be positive for gold prices.

Implications for Gold

What does it all mean for the gold market? In his testimony, Powell reemphasized that the Fed will be very accommodative for a long period of time, with potentially being even more dovish if the second wave of infections occur. The U.S. central bank is not concerned about inflation, but about lack of growth and unemployment rate. Although the upcoming economic data could be very positive due to the very low base, investors should not overreact and remember that there is still long way to recovery.

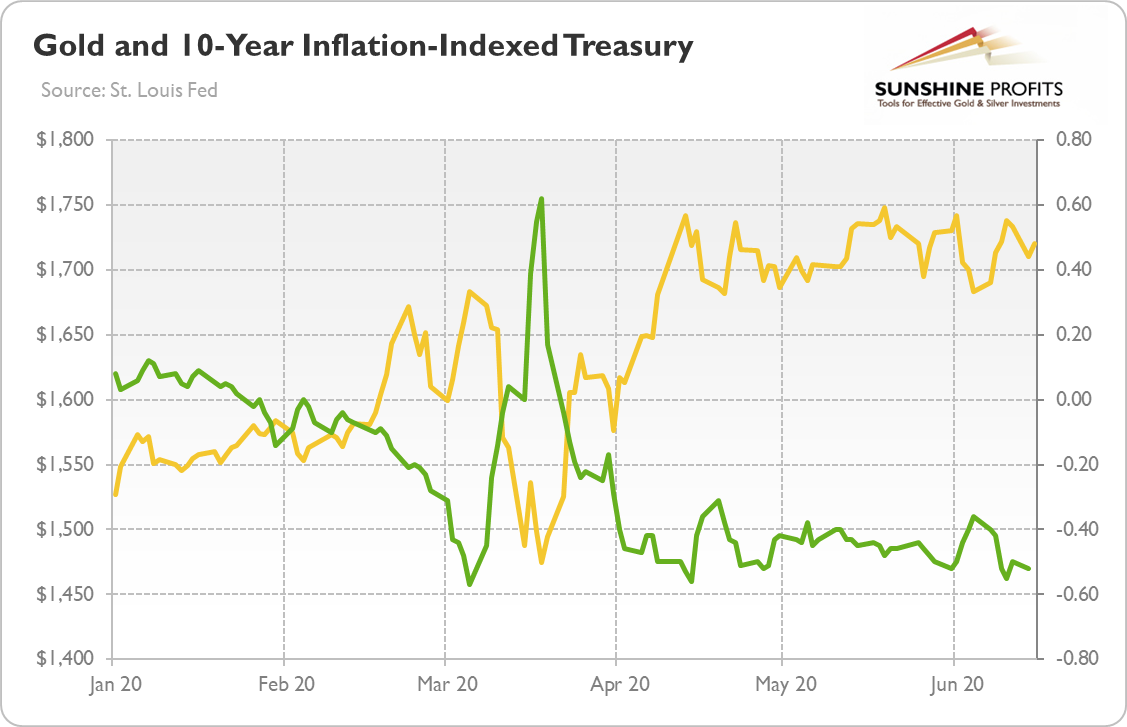

This is, however, what they should do. But they don't. The market is ignoring the bad news and focusing on the positives. After all, things turned out to be not so apocalyptic as the initial March assessment suggested. Moreover, the interest rates and bond yields are ultra low, while the Fed stands ready to intervene, which increases market confidence. The optimism among investors is a bad things for gold prices, but negative real interest rates and very accommodative central bank should support the yellow metal, as the chart below shows.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.