Gains are in the forecast for all the precious metals this year, and silver is believed to be the star of the show.

The London Bullion Market Association (LBMA) has just published its annual precious metals forecast survey. In general, the report is bullish, as the analysts expect significant gains in all the precious metals against 2020 average prices. However, the experts see only modest increases from mid-January levels.

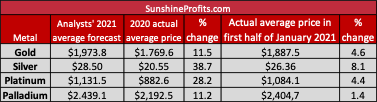

In particular, the analysts’ 2021 average forecast for the price of gold is $1,973.8. It implies a 11.5-percent jump relative to the 2020 average (broadly in line with last year), but just a 4.6-percent increase compared to the price in the first half of January 2021.

Silver is expected to be the best performing precious metal this year. Its average price is expected to be $28.5 in 2021, or 38.7 percent higher than last year, and 8.1 percent up from the mid-January. The forecast for all metals is presented in the table below.

Among the important drivers of the performance of the precious metals prices this year are geopolitical factors, the impact of the COVID-19 pandemic, and the pace of economic recovery. However, in line with my own understanding of the gold market, the top three drivers for the gold price pointed out by the analysts are more related to the macroeconomic factors: negative or falling interest rates, a weaker U.S. dollar, and U.S. fiscal and monetary policies.

Of course, the above numbers are the averages of more than 30 forecasts from different analysts. The most bearish expert sees the average price of gold as low as $1.650, while the most bullish participant at $2,300. Also interesting is the wide high/low range of $1,192 ($2.680 as the highest high and $1,488 as the lowest low) compared to $780 last year. So, it could shape itself to be a volatile year!

Given my fundamental outlook, I include myself in the camp of cautious bulls. Why cautious? Well, the current bearish/sideways trend is disturbing – especially when compared to Bitcoin – and there are important downside risks. In particular, with the ongoing economic recovery, the risk appetite could strengthen, and the real interest rates could increase, given their already ultra-low levels. The bond yields could rise especially if investors start to expect the Fed’s tapering of quantitative easing. So, we could indeed see heightened volatility and I wouldn’t be surprised if the gains in 2021 turn out to be smaller than last year.

However, there are also significant bullish arguments that investors shouldn’t neglect. As William Adams points out in the LBMA survey, “There are numerous factors supporting the view that we have entered another commodity super-cycle and, if that is the case, gold is likely to run higher too”. Furthermore, and what I have emphasized for a long time, in the aftermath of this recession, the central banks and governments pumped liquidity “not just into the financial markets but at the household/retail level too, which might be more likely to be inflationary”. Indeed, this time not only the monetary base has increased, but the broad money supply too.

In addition, the public debt has increased massively and it’s going to balloon even further this year. Thus, investors may get worried about the high indebtedness and the increased likelihood of the debt crisis and buy more gold as a safe haven. Given the lavish fiscal policy, the Fed will remain very dovish, while the real interest rates will stay well in the negative territory, supporting gold prices. Indeed, the yields on almost 30 percent of the world’s investment-grade debt are now below zero, which should strengthen gold’s appeal as a portfolio diversifier. Actually, if inflation expectations pick up (partially due to rising oil prices), the real yields could decline again, supporting gold prices.

Implications for Gold

What does the LBMA annual forecast survey predict for the yellow metal? The report is bullish, as participants expect double-digit price gains this year compared to 2020. However, they see only modest increases from the first half of January 2021. They also provide many reasonable arguments why gold could have trouble duplicating the bullish performance of the last year (especially if higher inflation doesn’t materialize), which is actually in line with my own cautious view. Hence, I agree with Ross Norman, the winner of LBMA’s 2020 Precious Metals Forecast Survey, who says that “we expect gold to perform well in 2021, although at a slightly more subdued rate compared to 2020”.

Interestingly, while most analysts are cautiously optimistic about gold, they are much more upbeat on silver, believing that it will outperform the yellow metal in 2021. Although it seems that the short squeeze in the silver market attempted by Reddit investors has failed, there is no doubt that the poor man’s gold started 2021 better than the yellow metal. Will this trend continue? Only time will tell!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.