The US presidential elections are quickly approaching. So, what do they have in store for the price of gold?

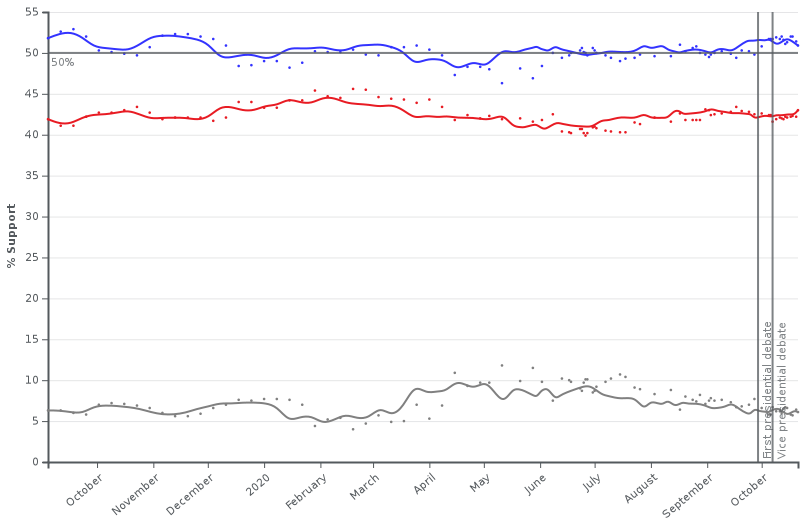

There are less than two weeks until the US presidential elections. Who will become the next POTUS? Biden or Trump? Well, according to the polls, the Democratic candidate will definitely move into the White House. As the chart below shows, Biden has an average polling lead of 7.9 percentage points over Trump.

Recently, Biden’s advantage has been slightly decreased, but despite that, the man is still in a huge lead. The problem is that it doesn’t matter. Back in 2016, Hillary Clinton was also in a continuous lead according to polls, but she ultimately lost the race. Of course, Biden’s lead appears much higher, but still, the polls cannot be trusted, especially nationwide ones. The recent state-by-state polling date, as well as the predicting markets, also forecast Biden’s victory. But, everything can happen, and Trump can remain in the White House.

What will happen if that’s the case then? Well, Trump’s triumph in 2016 sent gold prices lower – As the chart below shows, they declined from about $1,300 to almost $1,100 in December.

However, the possibility of a 2016 rerun is not very likely now. And why is that? The first reason is that Trump’s victory was a surprise, making markets more cautious not to discount any particular outcome. Second, investors hoped that Trump, as a pro-business-oriented person, would cut red tape and taxes (what he actually did), accelerating economic growth as a result. However, he also began trade wars, put pressure on the Fed, and added uncertainty into the markets with his erratic behavior. His fiscal policy was entirely frivolous as well, resulting in a substantial budget deficits expansion, even before the pandemic occurred. Third, the macroeconomic and epidemiological situation was much different. We are currently in the second wave of coronavirus infections, which makes the economic recovery really fragile. The real interest rates are negative, while both the Fed’s balance sheet and the public debt have ballooned in response to the economic crisis.

In such a macroeconomic environment, gold shouldn’t plunge after Trump’s victory. After all, if he wins, we could expect the current situation to continue (however, given Trump’s unpredictable behavior, I wouldn’t be surprised to see changes during his second presidency). The administration’s coping with the epidemic will remain unsatisfactory, while the public debt will stay on an upwardly-steep trajectory.

Therefore, Biden’s triumph could bring more volatility into the marketplace. The consensus is that Biden will expand government spending even more than Trump did, triggering higher inflation as a result. If Democrats also take over the Senate, tax hikes are highly likely, but not immediate. For all of these reasons, Biden, as the next POTUS, is considered very positive for gold.

But still, precious metals investors should remain cautious. Market narratives can change quickly. Before the 2016 presidential elections, analysts believed that Trump would be negative for the stock market, but it turned out that Wall Street quickly started to like Donald. Thus, Mr. Market could also decide that Biden could be a nice change after all, ending trade wars, etc.

Another reason why we don’t have to see a replay of 2016 is the likelihood that the 2020 election results would be contested due to the massive use of absentee voting amid the coronavirus epidemic. Many times, Trump expressed his skepticism about mail-in ballots and refused to promise in advance that he will accept the results and hand over the power in a peaceful manner.

Ergo, a remarkably close and contested result would cause a legal battle that leaves the outcome uncertain until January, when the new Congress certifies the election results. In other words, a contested election could throw the country into chaos, which should support the gold prices in the short-term.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.