Investors are still worried about the stock market. It’s quite understandable, given the recent correction, but it draws their attention away from the really important developments. Let’s analyze the hidden threats and consider how they could affect the gold prices.

It’s Bonds, Stupid!

Let’s establish one thing at the beginning. The bond market is more important than the stock market. First, it’s significantly bigger. The global bond market exceeds $100 trillion, while the global stock market is higher than $70 trillion. Point for bonds.

Second, the bond market is more diversified, or, less sensitive to sentiment – and more to fundamentals. The indicators of the bond market are not so famous as S&P 500 and Dow Jones, while fixed returns make bond returns more predictable.

Third, the bond market exerts stronger effects on the stock market than the other way around. When bond yields are high, there’s no reason to invest in equities. Why should you invest money in a risky project, when you can pick up nice profits in the less risky bond market? Please also note that the Fed injects new money into the bond market – to lower interest rates and put upward pressure on stock prices.

Unfortunately, despite its importance, the bond market doesn’t get enough attention. Until something bad happens, of course. Recently, everyone talks about Treasuries hitting 3 percent. What would it mean for the gold market?

Will 3% End the World?

Yields on the 10-year Treasuries are heading toward 3 percent. As one can see in the chart below, they touched 2.94 last week.

Chart 1: 10-Year Treasury Yields (in %) over the last twelve months.

What does it mean? Well, bond guru Bill Gross claims that the bear market in bonds has finally begun. Higher yields should make the stock market look less attractive. However, investors should remember that climbing Treasury yields imply lower bond prices. Hence, fund managers may shift their allocations toward foreign fixed income. Such changes should further weaken the U.S. dollar. Thus, gold may shine – even if Treasury yields are rising.

But it all boils down to the reason why yields are rising. Interest rates may be a leading indicator, which signals anticipated economic growth. In such an environment, stocks should continue to perform well. And gold bulls may leave empty-handed. Let’s examine the recent behavior of real interest rates.

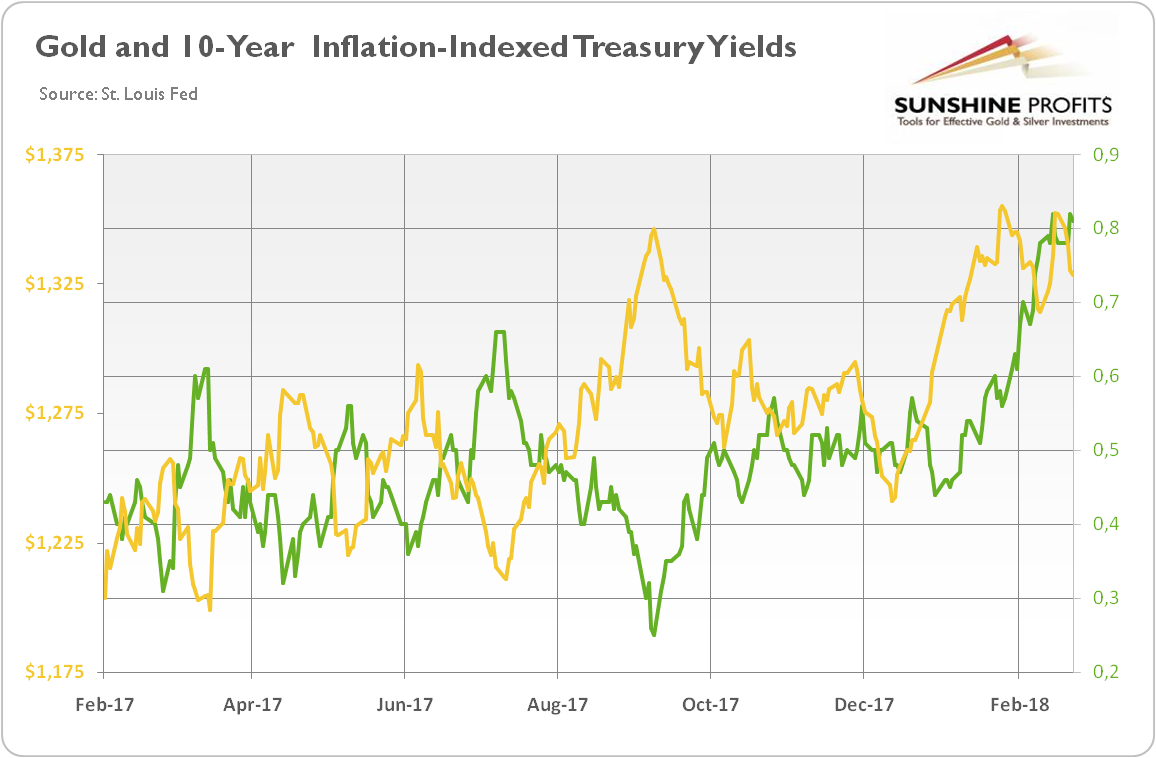

Chart 2: Gold prices (yellow line, left axis, London P.M. Fix, in $) and real interest rates (green line, right axis, 10-year inflation-indexed Treasuries, in %) over the last twelve months.

As the chart above shows, real interest rates have gone up as well. It means that inflation is not rising faster than yields – and investors expect a cyclical uptick in economic growth. Thus, although there might be turbulences on the way, the economic airplane shouldn’t crash into Treasury yields at 3 percent or above.

Implications for Gold

Look at the second chart once more. In 2018, the well-established negative correlation between gold prices and real interest rates collapsed. But will this last forever? We doubt. At some point, real interest rates high enough could halt the slump in the U.S. dollar – and the yellow metal will struggle.

But in the very short-term, all eyes are on Powell who will testify before Congress today. If traders don’t like his remarks, we will see more volatility in the financial markets. Gold, as a safe-haven asset, may benefit then. We bet that although Powell may change the rhetoric a bit, he is not likely to radically alter the Fed’s course. Will this come true? We will see, stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview