The U.S. economy cut 33,000 jobs in September. What does it mean for the gold market?

Hurricanes Take Jobs Away

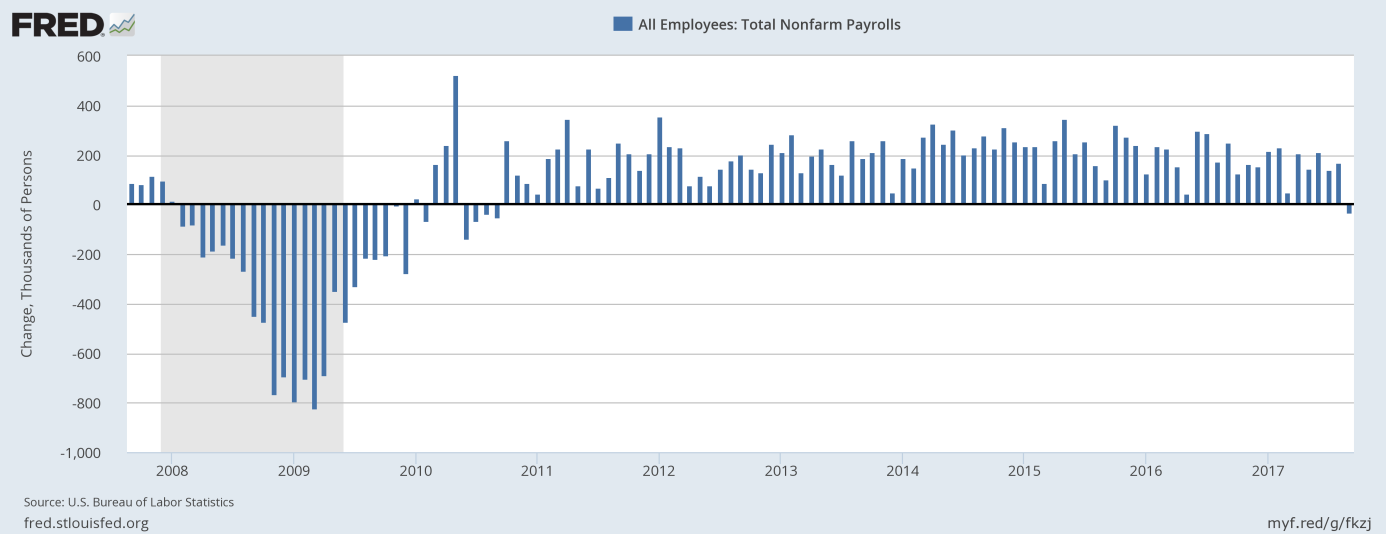

Total nonfarm payroll employment decreased 33,000 in September. Yep, you heard well. The U.S. economy lost jobs for the first time in seven years, as one can see in the chart below.

Chart 1: Total nonfarm payrolls (change, thousands of persons) over the last ten years.

The decline followed an increase of 169,000 in August (after an upward revision), according to the U.S. Bureau of Labor Statistics. Analysts had expected 100,000 jobs to be created. Thus, the actual number significantly disappointed expectations. Moreover, employment gains in July and August combined were 38,000 lower than previously reported. It means that job gains in the last three months have averaged 91,000.

However, the decline in September was due to workplace disruptions caused by hurricanes Harvey and Irma. The Department of Labor did not quantify their effects, but stated that its analysis “suggests that the net effect of these hurricanes was to reduce the estimate of total nonfarm payroll employment for September.” In particular, a sharp employment decline in food services and drinking places likely reflected the impact of Irma and Harvey. Indeed, leisure and hospitality cut 111,000 jobs, while education and health services (+27,000) and transportation and warehousing (+21,800) created jobs.

Hence, September payrolls were a disaster. Nevertheless, the drop should be temporary and will likely reverse in the coming months. The U.S. labor market remains relatively strong. Even with the recent drop, the economy has been adding 148,000 jobs on average per month over the last 12 months.

Other Labor Market Indicators

Other labor market indicators were positive. The labor force participation rate increased from 62.9 to 63.1 percent, while the employment-population rate rose from 60.1 to 60.4 percent. Meanwhile, the unemployment rate fell to 4.2 percent from 4.4 percent, a multi-year low, as the chart below shows. The drop in the unemployment rate confirms the view that the U.S. labor market remains tight.

Chart 2: Unemployment rate over the last 10 years.

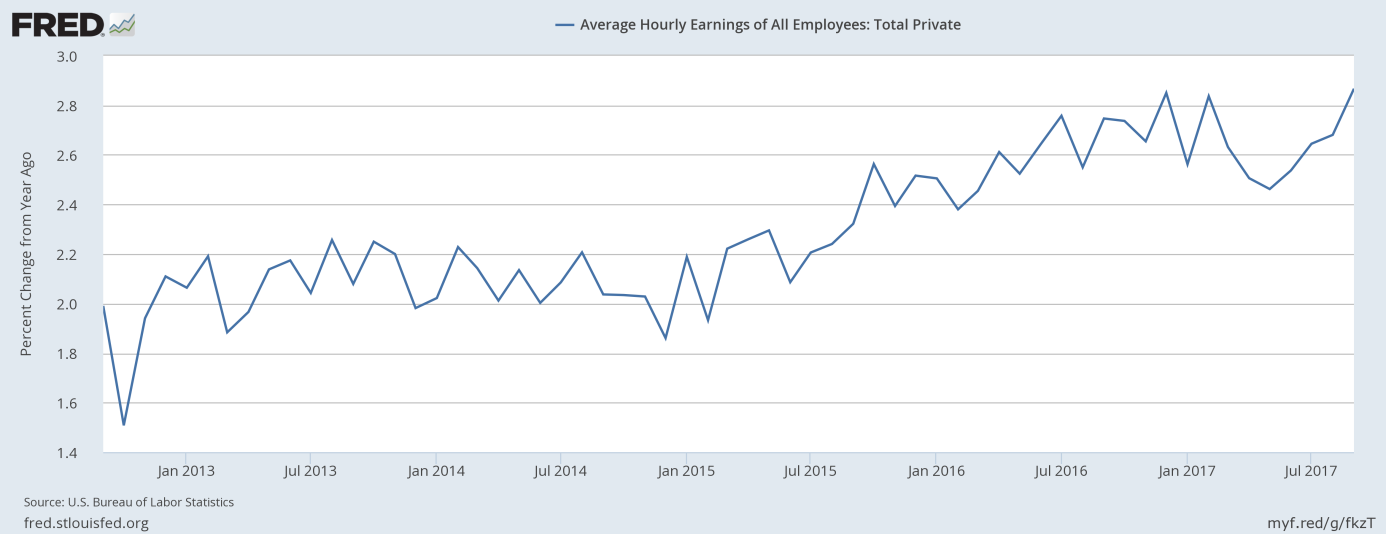

Moreover, the average hourly earnings for all employees on private nonfarm payrolls rose by 12 cents to $26.55. It means that the hourly pay jumped 2.9 percent over the year, an important acceleration from August, as one can see in the chart below. However, the uptick in wages may also be temporary, as it resulted from the absence of low-paid employees in food services and drinking places on the payroll.

Chart 3: Average hourly earnings of private employees (percent change from year ago) over the last 5 years.

Payrolls, Fed and Gold

The U.S. economy reduced jobs in September. It was a negative surprise for the markets. The U.S. dollar declined, while gold prices soared. As one can see in the chart below, the price of gold jumped from about $1,260 to about $1,275.

Chart 4: Gold prices from October 4 to October 6.

However, gold prices initially declined after the publication of the report. They went up only after a Russian report that North Korea is preparing to test a long-range missile that could reach the west coast of the U.S.

Therefore, investors should not expect that disappointing job numbers will boost gold prices. The reason is that the decline in jobs will be only temporary, as it was caused by hurricanes Harvey and Irma. Thus, employment will rebound in the next months. This is exactly what happened after Katrina. And the unemployment rate declined further, which indicates that the labor market remains in the relatively good shape. Long-term gold investors should not be guided by one-offs. The Fed will probably ignore the report and stay on track to raise interest rates in December. Indeed, on Friday, New York Fed President William Dudley said: “even though inflation is currently somewhat below our longer-run objective, I judge that it is still appropriate to continue to remove monetary policy accommodation gradually.” Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview