There is no doubt that GDP is the godfather of all economic indicators. However, it does not say too much about the labor market – this role was quickly filled by the Employment Situation Report. It moves the markets if the results surprise investors. E.g. the surprisingly positive October issue beat expectations significantly. Consequently, the odds for rate hike in December increased, and the greenback appreciated, while gold declined.

In some respects the Employment Situation Report is even more important than GDP. Firstly, GDP is a lagging indicator as mentioned above, while some components of the Labor Report are coincident or leading indicators. The second reason is that the situation in the labor market concerns the Federal Reserve directly (the statutory objectives of the Fed’s monetary policy are: maximum employment, stable prices, and moderate long-term interest rates). The economic growth is relevant only indirectly, as it affects the labor market and the inflation rate.

The report consists of few sub-indicators: the unemployment rate, the nonfarm payroll employment, the average workweek and the average hourly earnings. The unemployment rate is a closely watched metric since the Fed is obliged to support full employment. However, the report is considered a lagging indicator – people tend to be out of work after problems in the economy have already occurred. Usually, entrepreneurs prefer to reduce working hours first rather than the number of employees. This is why the average weekly hours for the manufacturing sector are a leading indicator. Another is average hourly earnings which signal the inflationary pressure (higher wages and employers costs should result sooner or later in higher consumer prices). If gold serves as an inflation hedge (which is actually not always the case), then it should be positively correlated with the average hourly earnings. However, inflationary pressure may raise the odds for a Fed hike, which would be negative for the gold market.

The last component – perhaps the most important one – is the nonfarm payroll. Indeed, it is the benchmark statistic used to determine the condition of the labor market. Since it is considered as a coincident indicator (it shows the current state of economic activity), the National Bureau of Economic Research analyzes it (as one of the key statistics) to determine whether the economy is expanding or contracting. The nonfarm payroll is also closely watched by the Fed, as it shows whether and how quick the economy is growing (central bankers believe that fast rates of job gains may lead to an increase in inflation).

What is the relationship between the labor market and the price of gold? Let’s analyze the chart below to figure it out.

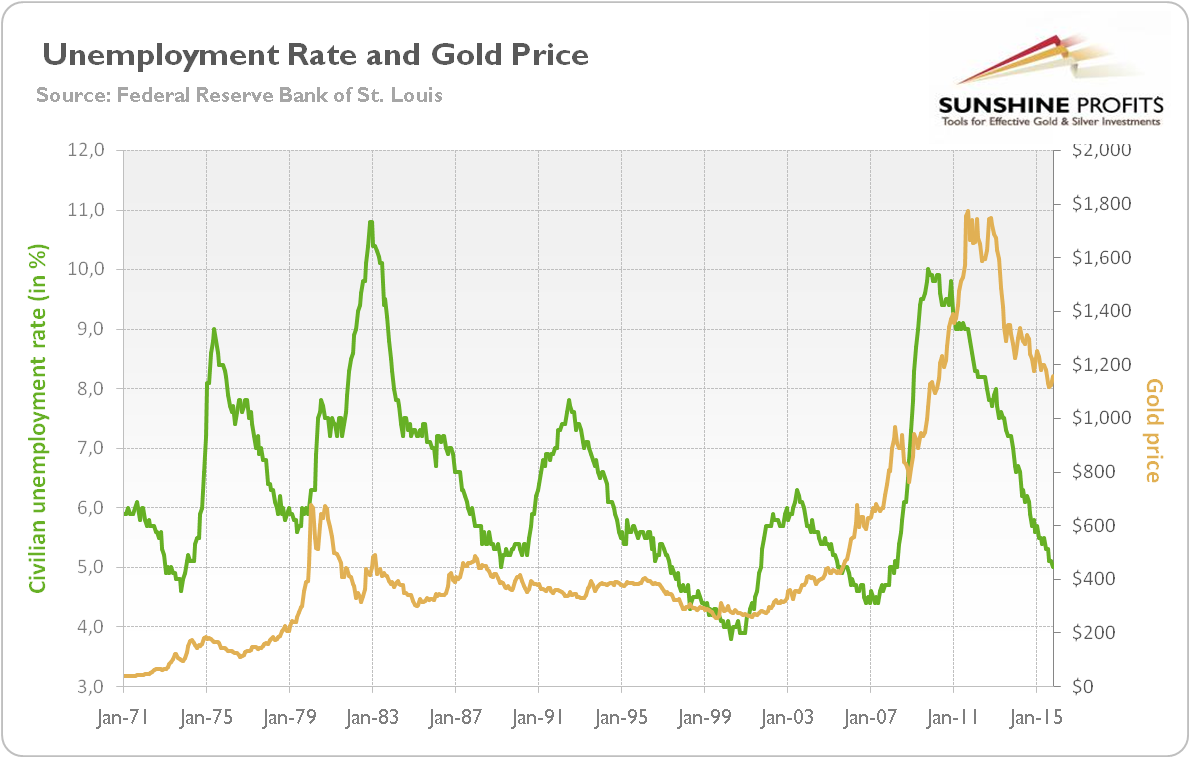

Chart 1: Civilian unemployment rate (green line, left scale, in %) and the price of gold (yellow line, right scale, London P.M. fixing) from 1971 to 2015

As you can see, there is no strict correlation between unemployment rate and the price of gold, even though both variables moved in tandem for a long time. In the 1970s and 2000s, the unemployment rate and price of gold were in an upside trend, while in the 1980s, 1990s and 2010s they were in a downside trend. This trend should not surprise us, since the price of gold reflects the confidence in the U.S. economy, and no economy can be healthy without a strong labor market. Let’s now move to the relationship between the nonfarm payroll and the shiny metal.

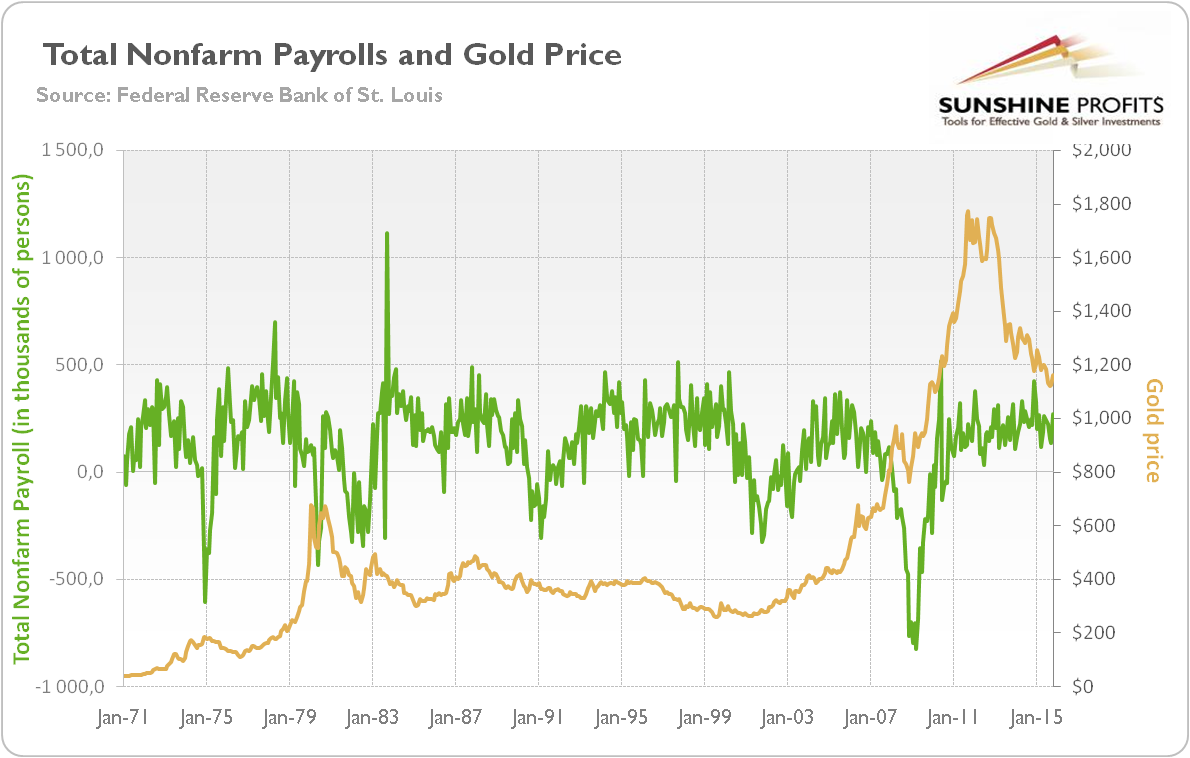

Chart 2: Total nonfarm payroll (green line, left scale, monthly change in thousands of persons) and the price of gold (yellow line, right scale, London P.M. fixing) from 1971 to 2015

Again, there is no clear long-term relationship between the gold price and job gains. However, Roachi and Rossi in their IMF Working Paper show that employment statistics (if they surprise investors) move the price of gold in the short-term. Usually, good news for the U.S. labor market is positive for the greenback and negative for the shiny metal. The price of gold tends to fall on the day when the Nonfarm Payroll Report comes out. It shows a headline figure that is stronger than expected and vice versa. Importantly, how investors react to the surprises depends on the report’s implications for the short-term interest rates (three-month Treasury interest rates are highly sensitive to payroll employment surprises). It was clearly seen this year, when practically every release of the jobs report was taken as crucial for the Fed to decide whether the economy is ready for an interest rate hike. And gold is mostly purchased when people worry about the condition of the U.S. economy. Therefore, strong jobs reports confirm that the U.S. economy is in a good shape and may withstand the interest rate hike. This is why the price of gold declined after the October nonfarm payroll report.

Summing up, there is no clear long-term link between labor market indicators and the price of gold. However, gold investors may take advantage of the short-term trading opportunities related to releases of the Employment Situation Report. In theory, the strong job gains may raise fear of inflation (negative for the greenback, positive for gold) or signal a tightening of credit markets (positive for the U.S. dollar, negative for the shiny metal). In the current reality the second channel dominates.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the price of gold, we invite you to read the December Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview