The Consumer Price Index increased 0.1 percent last month. What does it imply for the gold market?

CPI Remains Soft

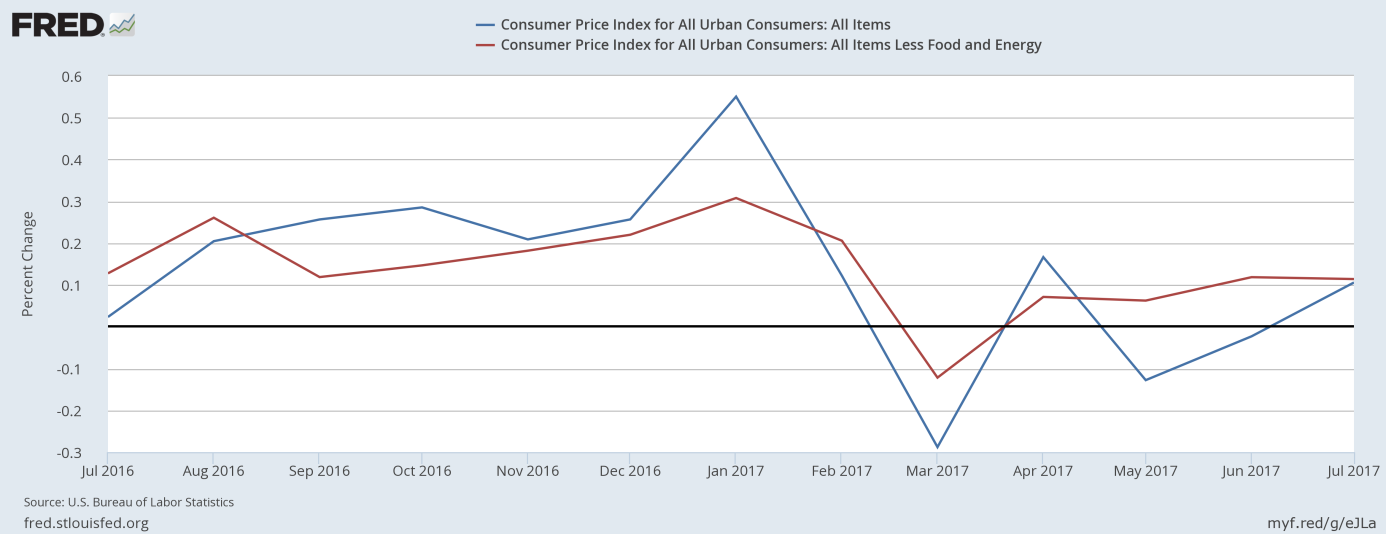

U.S. consumer prices rose 0.1 percent in July, following a flat reading in June. It means a slight rebound, but the actual number was below expectations. In short, inflation remains very soft, as one can see in the chart below. The core CPI Index, which excludes food and energy, rose 0.1 percent, the fourth month in a row it increased by that amount.

Chart 1: CPI (blue line) and core CPI (red line) on a monthly basis over the last year.

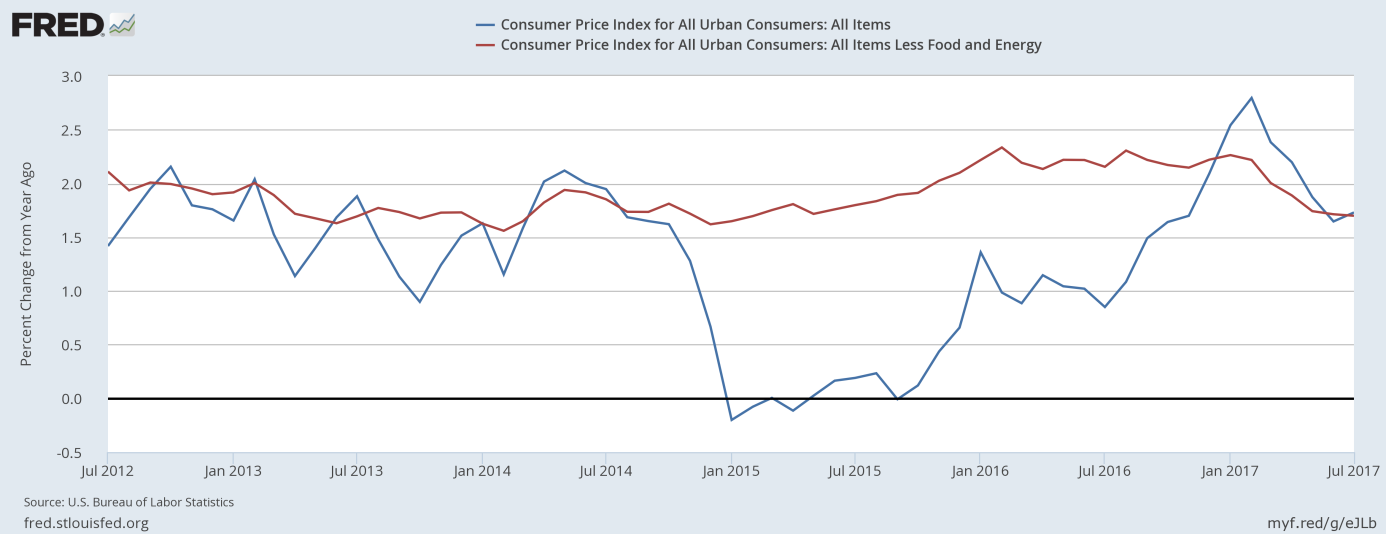

On an annual basis, both the overall index and its core version increased 1.7 percent. The chart below shows that although the overall index accelerated slightly from a 1.6 percent jump in June, the core CPI – which is watched more closely by the Fed – remained at a 1.7 percent annual rate, the same rate as in May and June. The weak inflation was mainly caused by moderation in housing costs, a decline in new vehicle prices, which dropped 0.5 percent, the biggest decrease for eight years, and a 4.2 percent plunge in the index for lodging away from home, the biggest slide since the series began in December 1997.

Chart 2: CPI (blue line) and core CPI (red line) year-over-year over the last five years.

PPI Declines

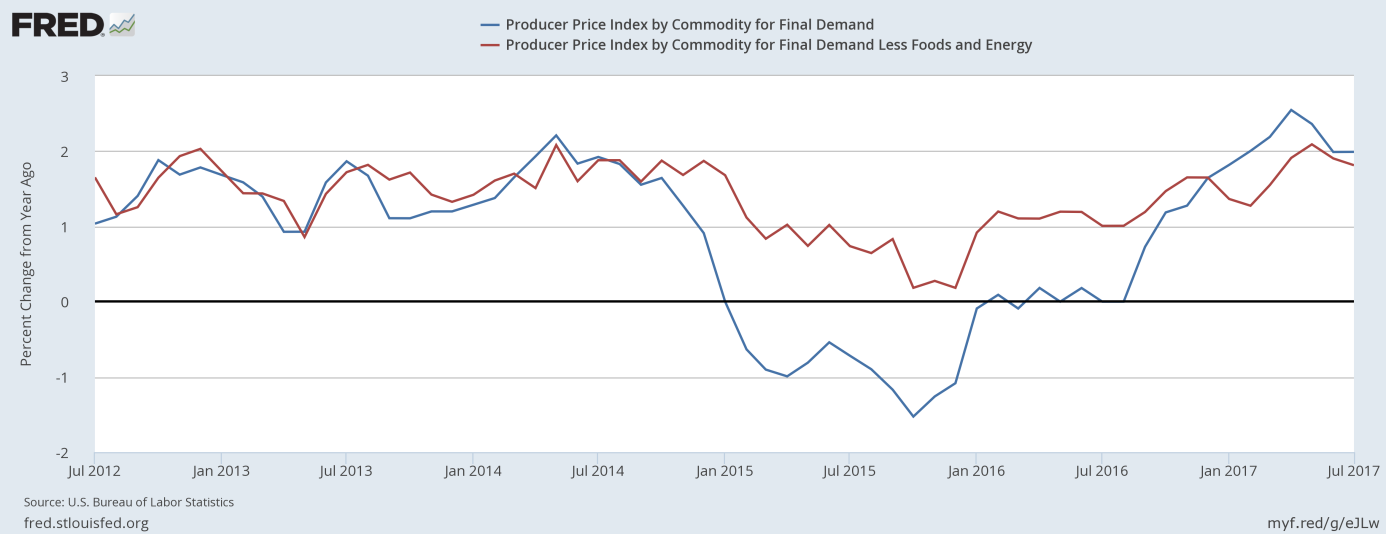

The CPI data followed the report on the U.S. producer prices. As we reported on Friday, the Producer Price Index declined 0.1 percent in July, the first drop in almost a year. The core version of the index, which excludes volatile categories of food, energy and trade, was unchanged. Moreover, on an annual basis, the PPI remained flat at 2 percent when compared to June, but it means a slowdown from 2.5 percent in April, as can see in the chart below.

Chart 3: The PPI for final demand (blue line) and the PPI for final demand less energy and food (red line) as a percent change from year ago over the last five years.

Weak Inflation, Fed and Gold

Both the recent readings on the PPI and CPI show that inflationary pressure remains muted. As lack of inflation is the major trouble for the Fed, the newest data will not make the U.S. central bankers happy. Indeed, after the report Neel Kashkari, Minneapolis Fed President, said that the Fed had a luxury of waiting to see more signs of inflationary pressure. Robert Kaplan, Dallas Fed President, agreed with Kashkari saying that he was “willing to be patient”. Thus, the soft inflation and the central bankers’ comments will not improve expectation for the next interest rate hike – actually, the market odds for the Fed hawkish move in December sharply declined from 43.7 percent to 35.9 percent. Now, traders even believe that there is a slight chance (2.6 percent) of an interest rate cut at the end of year. And they expect the next interest rate hike not earlier than in June 2018, a radical, dovish shift.

What does it mean for the gold market? Well, weak inflation translates into dovish expectations of the Fed’s actions, which should be bullish for gold. Indeed, gold prices climbed to two-month highs on Friday supported by tensions about North Korea and the soft CPI report, as the next chart shows.

Chart 4: Gold prices from August 9 to August 11, 2017.

Surely, weak inflation may be detrimental for the yellow metal as an inflation hedge, however investors should remember that inflation affects gold also through effect on the real interest rates and the Fed’s policy. In the current macroeconomic environment, weaker inflation implies more dovish Fed and lower real interest rates, which are positive factors for the gold market. Thus, unless it turns out that the dip in inflation is the result of one-time effects that will soon pass (which we cannot exclude), fundamental factors seem to be friendly for the shiny metal. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview