Central banks remain powerful creatures. Will gold escape from their grip?

Bank of Japan

It’s a hot period in central banking. On Tuesday, the Bank of Japan kept its monetary policy on hold. Kuroda tried to convince the markets that the BoJ won’t follow the Fed towards an exit from easy monetary policy soon. “We haven’t reached the stage of thinking about how to handle an exit [from monetary easing]”, he said. The BoJ Governor also insisted that the bank is fully committed to easy monetary policy and is not about to scale back its stimulus.

However, the Japanese economy enjoys strong economic momentum. It has recorded seven consecutive quarters of positive growth, with the average annual rate reaching 1.9 percent. And with the unemployment rate at 2.7 percent, the country is now at full employment. What is only missing is inflation. But Kuroda stated in Davos that the inflation is now close to the BoJ’s target. He said:

There are some indications that wages are actually rising and some prices have started to rise (…) There are many factors that made the 2 percent target difficult and time-consuming but we are finally close.

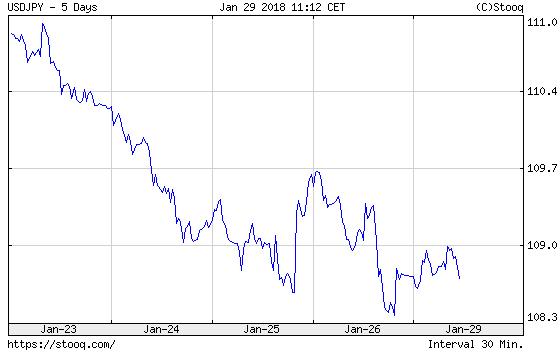

As a consequence, investors remained optimistic about monetary policy normalization in Japan in the future. As one can in the chart below, the Japanese yen strengthened the greenback. It was music to gold’s ears.

Chart 1: USD/JPY exchange rate over the last five days.

ECB

On Thursday, the ECB released its most recent monetary policy statement, while Draghi answered questions at the press conference. The ECB also kept its monetary policy unchanged. However, in his introductory statement, Draghi was quite optimistic about inflation.

The strong cyclical momentum, the ongoing reduction of economic slack and increasing capacity utilisation strengthen further our confidence that inflation will converge towards our inflation aim of below, but close to, 2%.

These remarks were welcomed by euro bulls. The euro hit $1.25, a level not seen since 2015. The common currency increased despite Draghi’s efforts to pause its rally. He said:

At the same time, domestic price pressures remain muted overall and have yet to show convincing signs of a sustained upward trend. Against this background, the recent volatility in the exchange rate represents a source of uncertainty which requires monitoring with regard to its possible implications for the medium-term outlook for price stability.

Moreover, the President of the ECB signaled no interest rate hikes this year. “Based on data, on today's data and today's projection, I think I see very few chances at all that interest rates could be raised this year”, he stated.

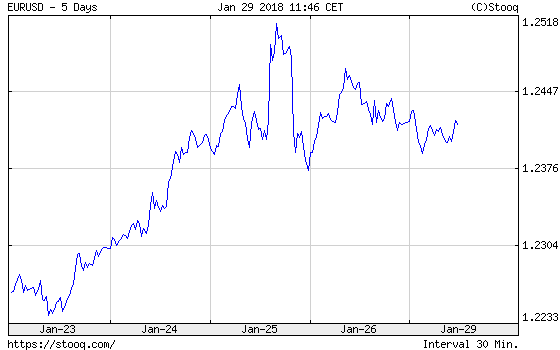

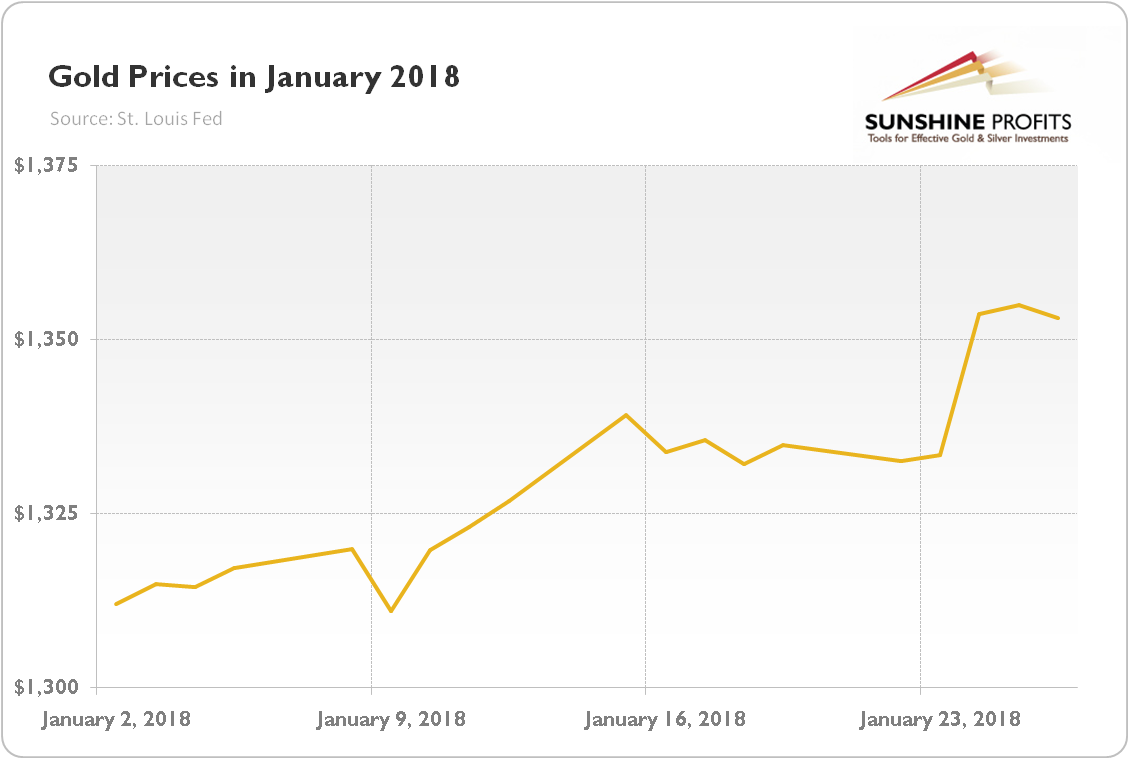

These comments made the euro give up its gains, as the chart below shows. Nevertheless, the euro came out victorious last week. The same applies, of course, to gold (see the chart 3), which also doesn’t like the U.S. dollar.

Chart 2: EUR/USD exchange rate over the last five days.

Chart 3: Gold prices over the last year.

Fed

This week, the Fed holds its first meeting in 2018, the last meeting with Janet Yellen as the Fed’s Chair. As there is no press conference scheduled after the upcoming meeting, the Committee will likely keep its monetary policy unchanged. However, as the composition of voters in the FOMC will change, the U.S. central bank may send some hawkish signals. Gold bears may take advantage of it. Be prepared, the March hike is coming.

Conclusions

After Mnuchin’s words that “a weaker dollar is good”, the greenback registered a steep slide. The latest comments from the BoJ and the ECB didn’t help the U.S. dollar. Kuroda believes that inflation in Japan is close to target, while Draghi’s tone on the exchange rate was rather moderate. Some traders were afraid that the ECB would try to halt the euro’s rally in a more decisive way. It didn’t.

What does it mean? It should be now clear that the ECB is comfortable with a strengthening euro – it implies that the euro has more room to appreciate against the U.S. dollar. It’s bullish for gold.

However, the Fed has its own meeting this week. We could see a hawkish strike, especially that it will be the last Yellen’s meeting and she has nothing to lose. The changing composition of the policy committee could also point to a more aggressive pace of rate hikes in 2018. If that happens, the U.S. dollar may catch its breath, which would exert downward pressure on gold prices. Anyway, gold will remain in the orbit of central banks’ influence. For good or bad. Stay tuned.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview