‘Trump rally’ faded away, while the odds of his impeachment rose. What does it imply for the gold market?

Inflationary Expectations Normalized

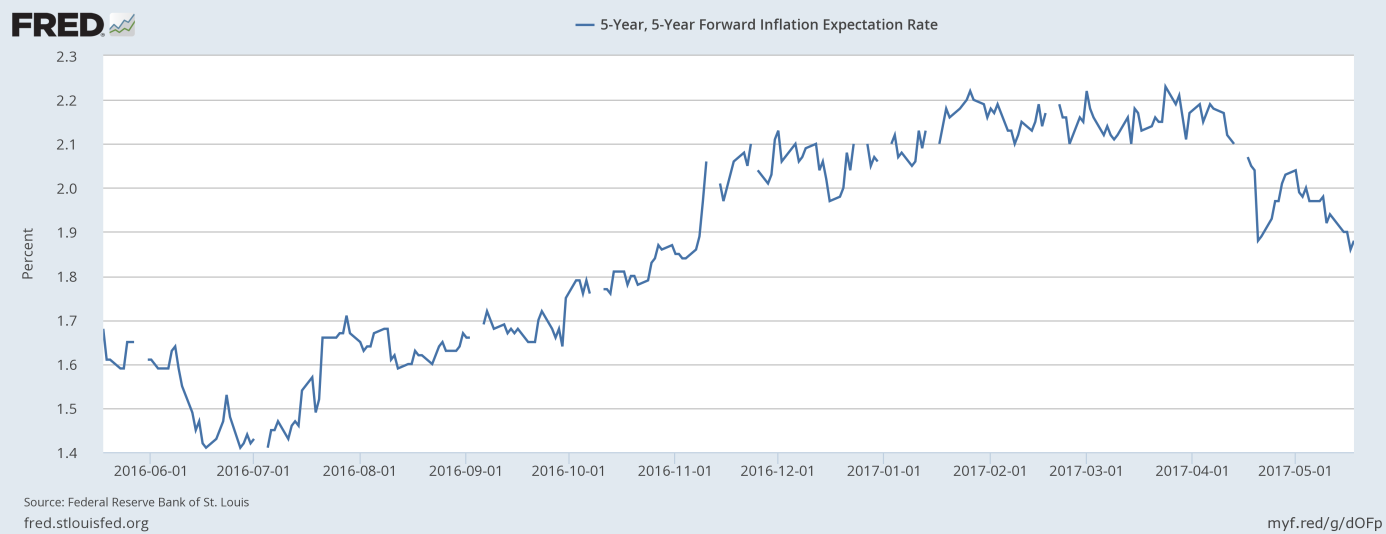

The so-called Trump rally is practically gone. The S&P 500 remains above the level seen before the presidential election, but post-election policy expectations have mostly unwound and almost every Trump trade has been faded by the market. Let’s look at the chart below, which shows that inflationary expectations have returned recently to the pre-election level.

Chart 1: Forward inflation expectations derived from 5-year and 10-year Treasuries over the last year.

Markets expect now that the inflation rate will stay below 1.9 percent over the five-year period that begins five years from today. It implies that investors abandoned the idea that Trump will boost inflation by his fiscal stimulus. Lower inflationary expectations are bad for the gold market, as the yellow metal is perceived by some investors as a hedge against inflation. Moreover, weakened expectations of inflation could translate in higher real interest rates which are detrimental to gold prices.

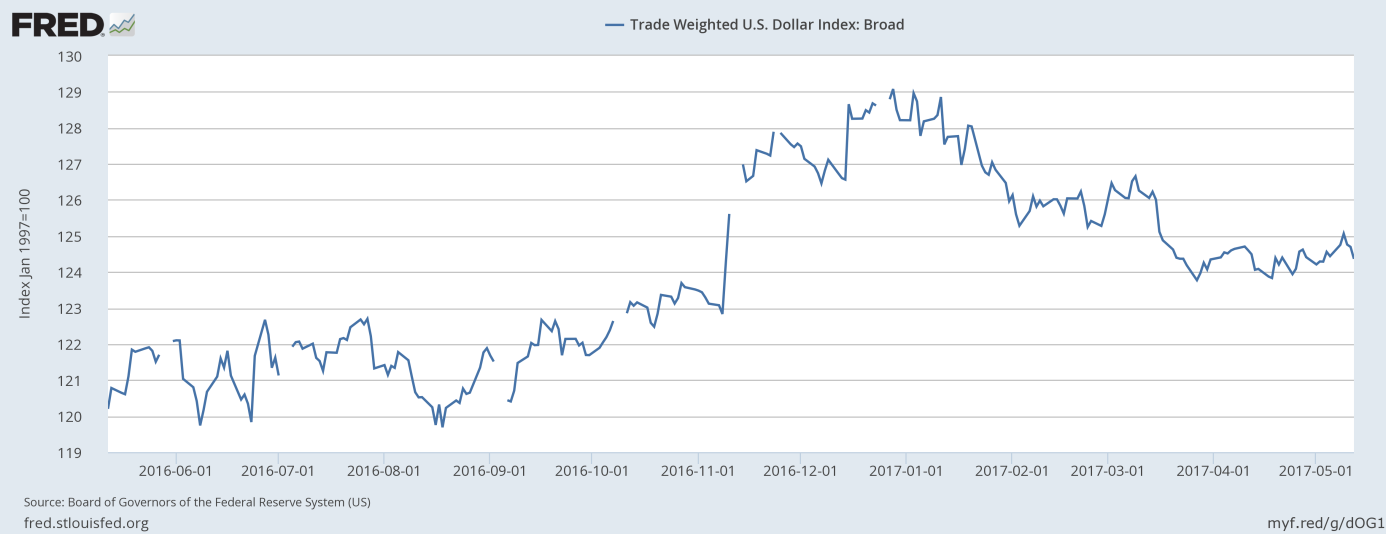

Dollar Erases Gains

Let’s take a look at another chart showing the Broad Trade Weighted U.S. Dollar Index. As one can see, the greenback has given up all its gains since the presidential election in November. The U.S. dollar was clearly hit by the uncertainty about Trump’s ability to deliver his legislative agenda amid political turmoil.

Chart 2: Broad Trade Weighted U.S. Dollar Index over the last year.

The greenback has weakened especially against the euro, as the chart below shows. The EUR/USD exchange rate has jumped above 1.1160, its highest since October before the U.S. presidential election. However, the euro gains come also due to improved economic and political data for the Eurozone. Nevertheless, the weakness in the greenback is positive for the price of gold, which is negatively correlated to the dollar’s strength.

Chart 3: EUR/USD exchange rate over the last year.

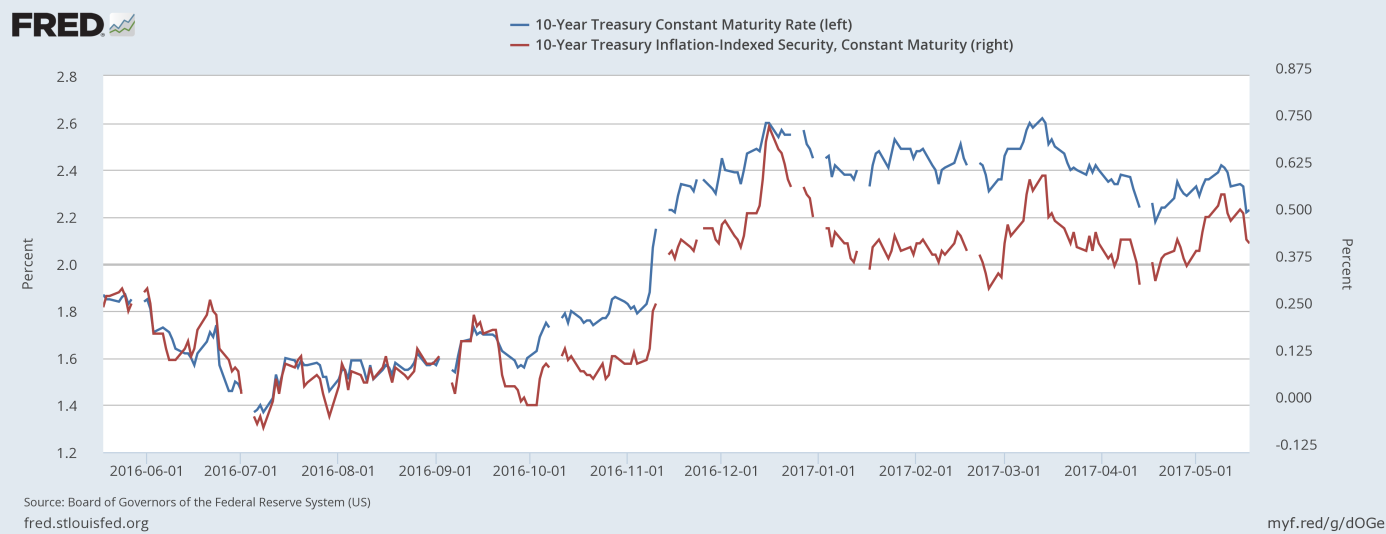

Yields Still Higher, but Could Fall

As one can see in the chart below, Treasury yields remain higher than in November. It shows that growth expectations have not faded away as strongly as inflationary expectations.

Chart 4: Nominal (blue line, left axis) and real interest rates (red line, right axis) over the last year.

However, the yields have dropped recently amid political turmoil triggered by Comey’s firing. And there is potential for further declines, as the ex-FBI chief will testify next week in an open hearing of the Senate intelligence committee. If new allegations or hard evidence come to light, the realization of Trump’s economic agenda may be put under question. Disappointed growth expectations with lower real interest rates and safe-haven bids will support gold prices.

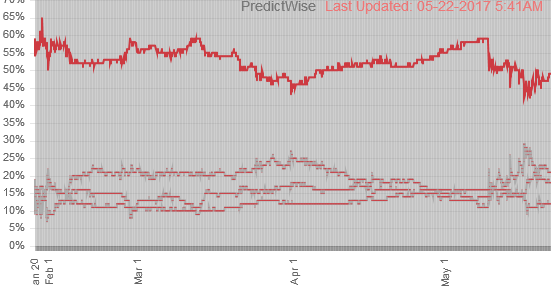

Impeachment Odds Rise

Last but not least, the odds of Trump staying in office for his full first term have declined recently. As one can see in the chart below, the probability of Trump ending his term as President of the USA in 2020 or later has dropped from 59 percent to 49 percent over the last two weeks, according to PredictWise.

Chart 5: Probability of Trump ending his term as President of the USA in 2020 or later.

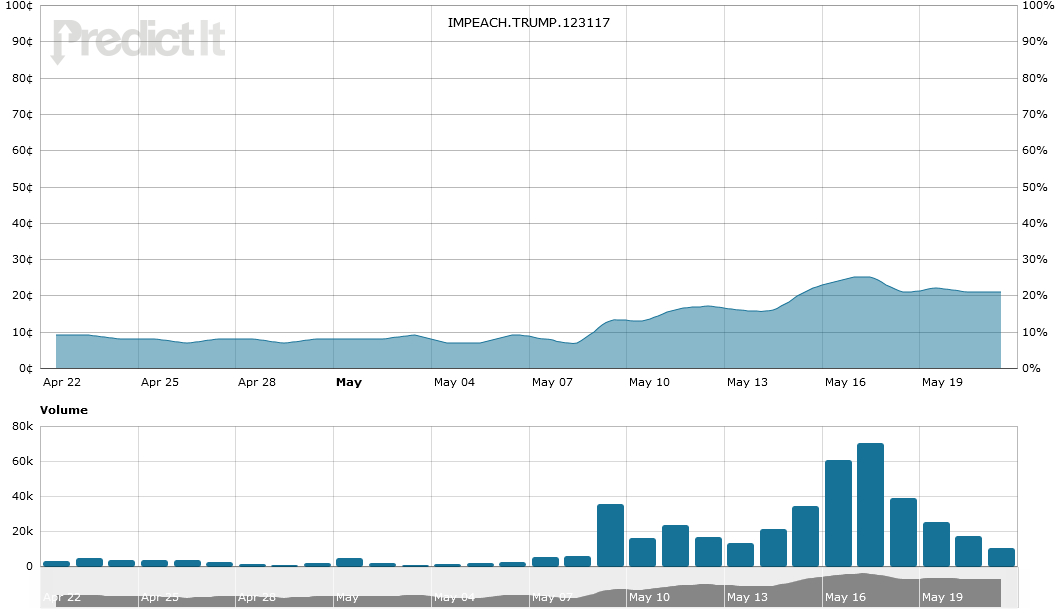

This is due to the rising odds of Trump’s impeachment. According to Predictit, there is a 21-percent chance of such a scenario, a rise from 7 percent two weeks ago. Hence, we have seen a clear uptick in bets that Trump will not serve his full four-year term.

Chart 6: Market odds of Trump’s impeachment over the last month.

Surely, as we pointed out on Friday, there is a long way to impeachment, and when the current political turmoil calms down, the price of gold could drop. However, the ongoing political worries are likely to keep downward pressure on the U.S. dollar and provide support for gold prices for a while. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview