The political turmoil in Washington triggered by Comey’s firing continues. What does it mean for the gold market?

Some analysts argue that the recent White House’s problems may be a game-changer for the yellow metal. First, it may be a nail in the Trump’s rally coffin. The reason is simple: the political damage could make the new administration unable to enact its pro-business legislation in the near future. Second, uncertainty abounds. It’s a funny twist, since it was the initial thesis about Trump’s impact on the gold market. Gold was supposed to shine due to the uncertainty about Trump’s politics. However, the hopes of pro-growth reforms sent gold prices south in November 2016. Now, it may be the case that the uncertainty and unpredictability associated with Trump has just reared its ugly head.

Well, we cannot preclude this scenario. However, it may be too early to trump the end of Trump. The reason is that investors often overestimate the importance of politics. You see, the economy goes on, in spite of of political quarrels. Let’s assume that Trump will be impeached, although there is a long way to doing it. Then Vice President Mike Pence would replace the POTUS. Will the economic agenda radically change? We do not believe so, since Republicans – no matter who lives in the White House – are going to introduce some tax reforms.

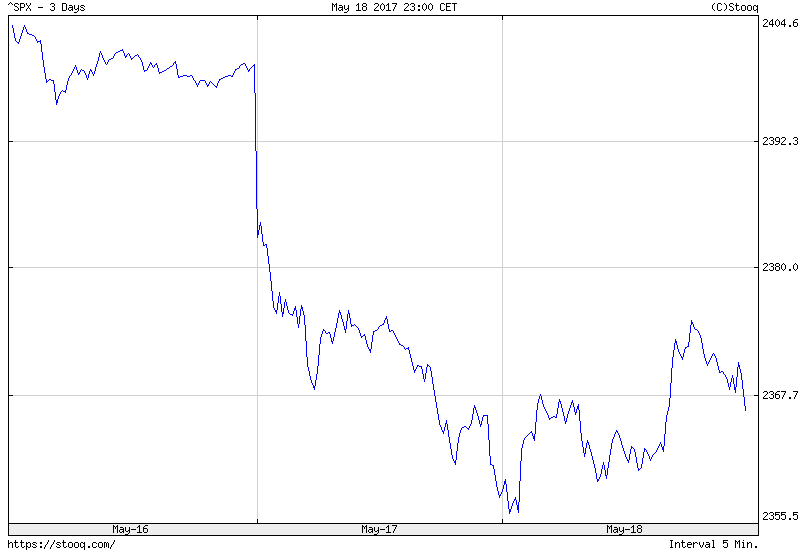

Hence, the recent turmoil may be only temporary. Indeed, the stock market rebounded yesterday a bit, as one can see in the chart below.

Chart 1: S&P 500 index over the last three days.

And the price of gold dropped on Thursday, as the chart below shows.

Chart 2: Price of gold over the last three days.

However, today gold prices have been rising during Asian trading hours. Given that the EUR/USD exchange rate has risen today, we may see further appreciation in the gold market in the short-run.

Summing up, chaos in Washington continues. Based on that, some precious metals analysts call a bull market in gold. We agree that the yellow metal may rally further in the short run, but we are skeptical about its long-term potential. It may be the case that when the current political turmoil calms down (importantly, the market odds of a Fed hike in June jumped again above 70 percent), the price of gold will drop. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview