U.S. consumer spending rose 0.4 percent in June. What does it mean for the gold market?

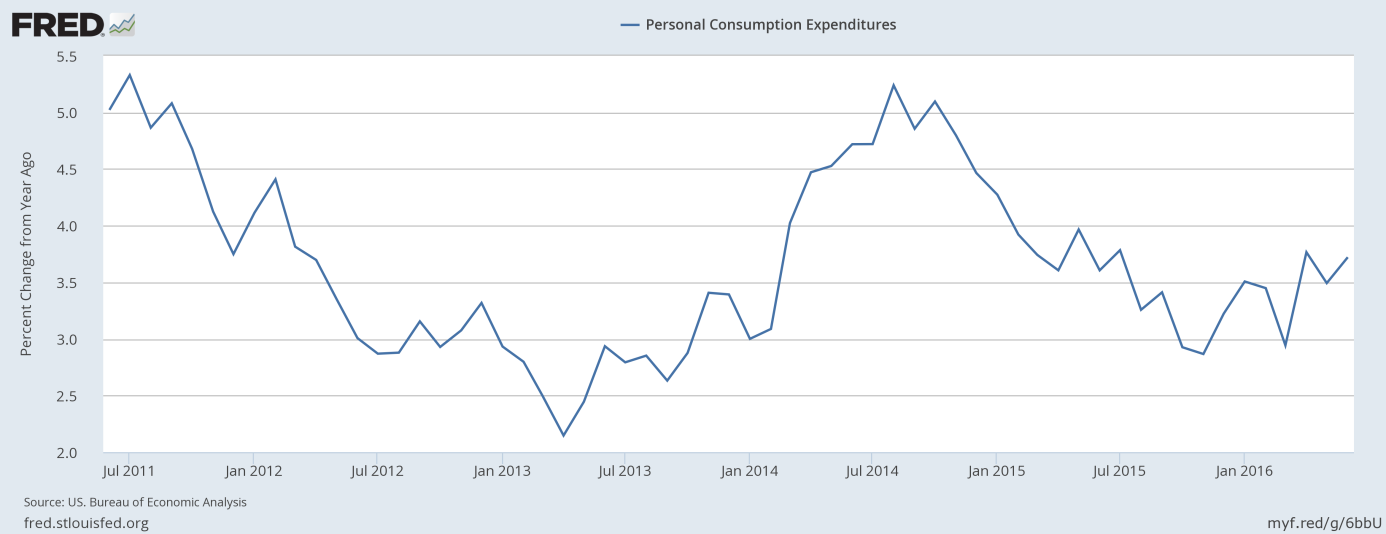

Personal consumption expenditures increased 0.4 percent two months ago after an identical rise in May. The jump was slightly above the expected 0.3 percent. It was the third straight increase, which shows that consumers continued to spend. On an annual basis, consumer spending rose 3.72 percent and remained relatively strong, as one can see in the chart below.

Chart 1: Personal consumption expenditures from 2011 to 2016 (as percent change from year ago).

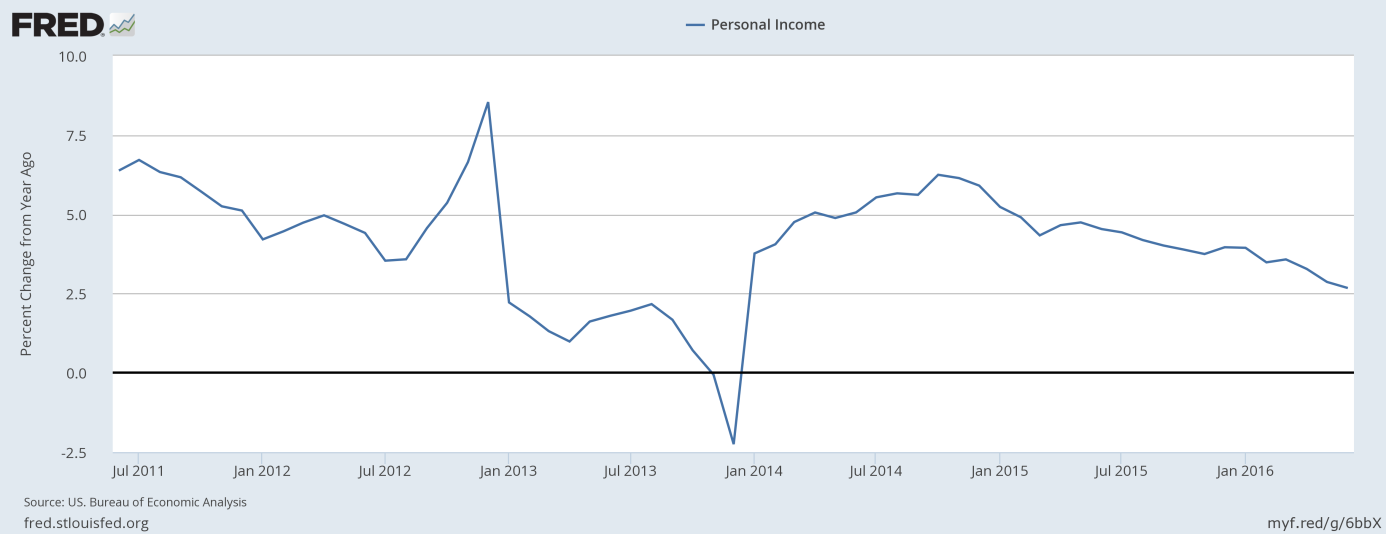

The strong consumer spending should not support the gold market. However, the impact of the report would be limited, as markets have already priced in strong consumer spending in the second quarter of 2016 after the Q2 GDP report. Investors also have to remember that U.S. economic growth could not rely only on personal consumption expenditures, especially when we take into account the recent softness in motor vehicle sales and sluggish income growth. Indeed, personal income did not keep up with spending, increasing only 0.2 percent. It goes without saying that spending will not strengthen further if income does not pick up. On an annual basis, the pace of growth of personal income has been in the downward trend since October 2014, as one can see in the chart below.

Chart 2: Personal income over the last 5 years (as percent change from year ago).

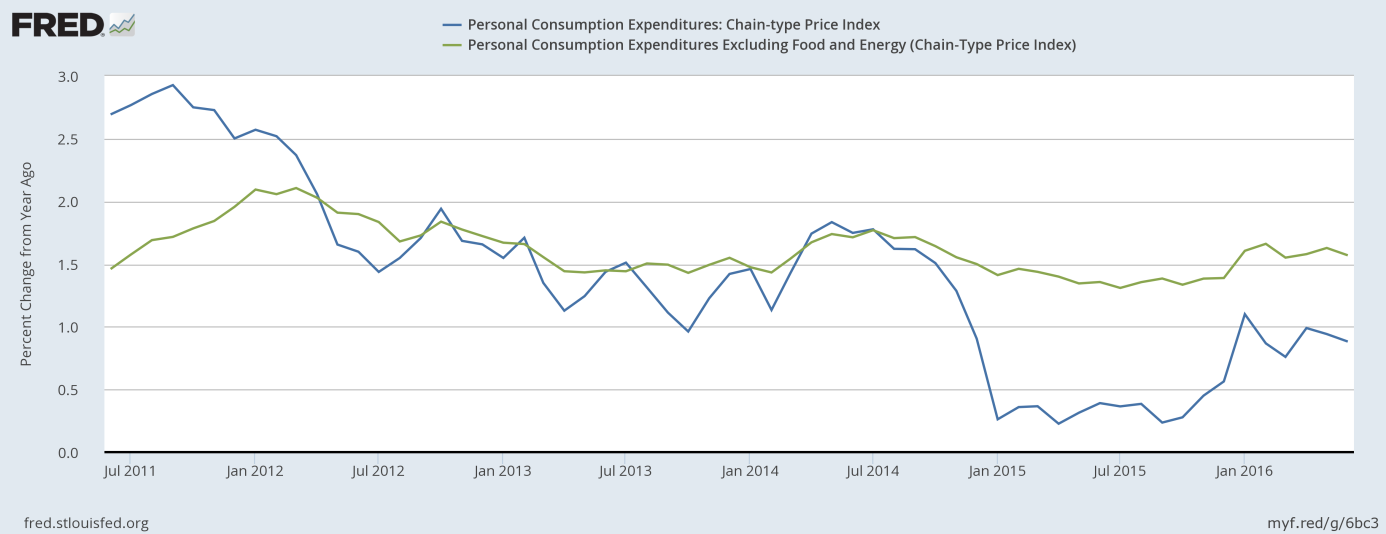

Inflation data also does not impress. The PCE price index and its core version, which excludes food and energy, increased only 0.1 percent in June, following a 0.2 percent rise in May. On an annual basis there was no improvement, as the PCE price index jumped 0.9 percent, while the core PCE price index rose 1.6 percent, a pace unchanged from the previous month. It means that there are still no signs of widespread price pressures in the U.S. economy, as one can see in the chart below. The stubbornly low rate of inflation will give the doves among the FOMC members another excuse to not raise interest any time soon, which is good news for the gold market.

Chart 3: PCE Price Index (blue line) and Core PCE Price Index (green line) as percent change from year ago, from 2011 to 2016.

Summing up, the June Personal Income and Outlays report was moderate. Consumer spending was strong, but incomes did not keep up with expenditures, while inflationary pressures remained absent. The data may thus reassure investors that the Fed will not hike interest rates in the near future, which should be positive for the price of gold. Indeed, gold prices increased yesterday, but the rise may be attributed to the recent weakness in the U.S. dollar and a waning risk appetite.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview