On Friday, the preliminary GDP report for the second quarter of 2016 was released. What does it mean for the gold market?

Big Miss on Q2 GDP

According to the BEA’s advance estimate, the real gross domestic product increased at an annual rate of 1.2 percent in the second quarter of 2016. The reported growth was significantly below the expected 2.6 percent. The disappointing headline buried hope for an economic rebound after a weak first quarter and sent gold prices up. The price of gold increased from less than $1,335 ahead of the release to about $1350 at the end of Friday’s trading in New York.

U.S. Economic Growth Slows

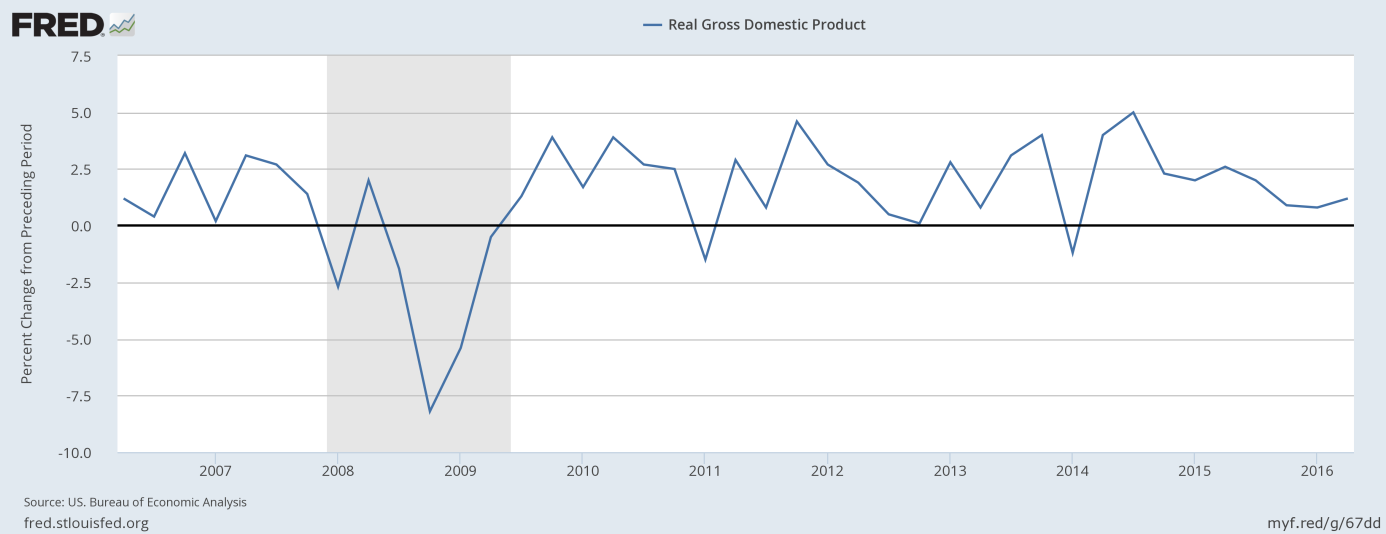

The weak growth in the second quarter of 2016 came after a downwardly revised 0.8 percent (from 1.1 percent) pace in the first quarter. Moreover, the GDP growth estimate for the fourth quarter of 2015 was cut from 1.4 to 0.9 percent. It means that the U.S. economy departed from its assumed 2-percent growth trend. Indeed, as one can see in the chart below, American economic growth remained tepid, despite the small increase in the pace of growth in the second quarter. The harsh reality is that the U.S. economy developed at pace of just around 1 percent in the three last quarters, which clearly signals a loss of momentum.

Chart 1: Real GDP growth from 2006 to 2016.

Inventories Are Drag on Growth

The increase in real GDP reflected mainly acceleration in personal consumption expenditures, which rose 4.2 percent, a jump from 1.6 percent previously. The biggest drag on growth was a decline in inventories which subtracted 1.16 percentage points from growth. It was the fifth successive decline. Some analysts argue that the inventory drawdown may provide a boost to output in the coming quarters as there could be a re-building of inventories, but we remain skeptical as the decline was the largest in over two years. It suggests that the inventory correction cycle is not over.

Weak Business Investment

There were also declines in other categories of investments. Residential constructions decreased 6.1 percent, while non-residential fell 2.2 percent. Importantly, business spending on equipment contracted for a third consecutive quarter, the longest stretch since the 2007-2009 recession. The decline happened due to low oil prices, and uncertainty over global demand and the U.S. presidential elections. Total private domestic investment plunged 9.7 percent. The dynamics of business spending is not encouraging as it may translate into slower hiring. How much longer will consumers carry the U.S. economy? The truth is that business spending is crucial for sustainable economic growth.

Conclusion

Real GDP growth in the second quarter of 2016 increased to 1.2 from 0.8 percent in the first quarter. However, the rise was half the expected pace and it signaled a loss of momentum. Although consumer spending was strong, business investment is very worrisome. The report is positive for the gold market, as it should undermine the sentiment and lower expectations of Fed interest rate hikes in the near future. Indeed, the market odds of a September move decreased from 18 to 12 percent. Surely, the U.S. central bank is focused on inflation and the labor market (investors should remember that there are two key employment and inflation reports before the next FOMC meeting in mid-September) rather than past GDP growth rates and wild swings in inventory, however, the doves may cite the weak headline numbers from the GDP report as a reason to continue the Fed’s cautious ‘wait and see’ stance. Such a scenario should be supportive for the gold prices. Moreover, the GDP report may strengthen Trump’s narrative that the U.S. economy is growing too slowly, which may increase his odds in the race for the White House and also support the price of gold.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview