Last week, the reports on U.S. consumer inflation and retail sales were released. What do they imply for the gold market?

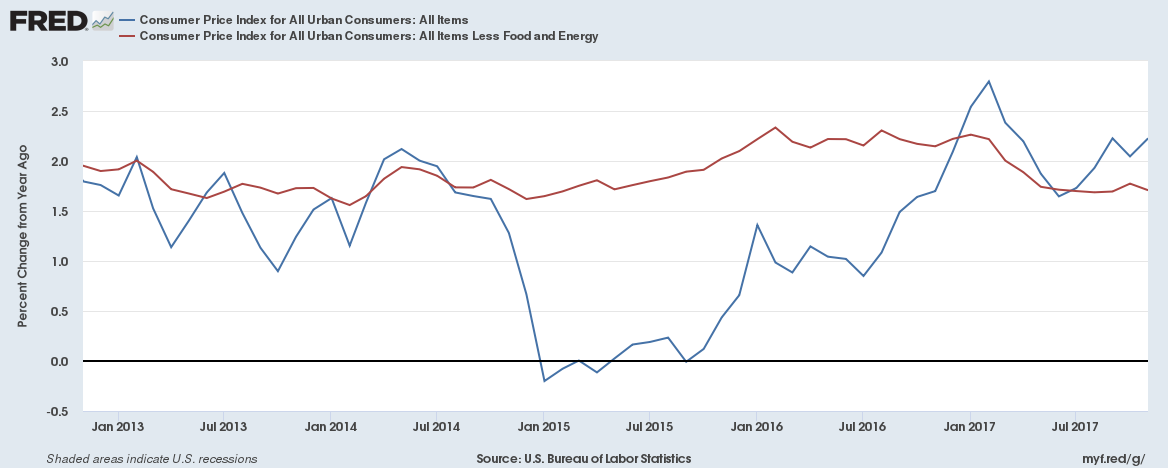

Consumer prices jumped 0.4 percent in November, following a 0.1 percent rise in October. However, the move was driven mainly by higher costs of gasoline and fuel oil. The energy index increased 3.9 percent last month. Hence, the core CPI, which excludes food and energy, increased merely 0.1 percent. On an annual basis, the core CPI was 1.7 percent, which means a drop from 1.8 percent in October. The overall index soared 2.2 percent, rising from 2.0 percent in October and exceeding the Fed’s target again. Therefore, there was a slight shift up in the overall index, but a minimal slowdown in core inflation, as one can see in the chart below.

Chart 1: CPI (blue line) and core CPI (red line) year-over-year from November 2012 to November 2017.

What does it mean for the Fed’s policy and the gold market? Well, inflation continues to rise slowly, very slowly. It is bad news for the gold market. Higher inflation could spur stronger demand for gold as an inflation hedge and would translate into even lower real interest rates. And the subdued inflation justifies the continuation of the gradual tightening of monetary policy.

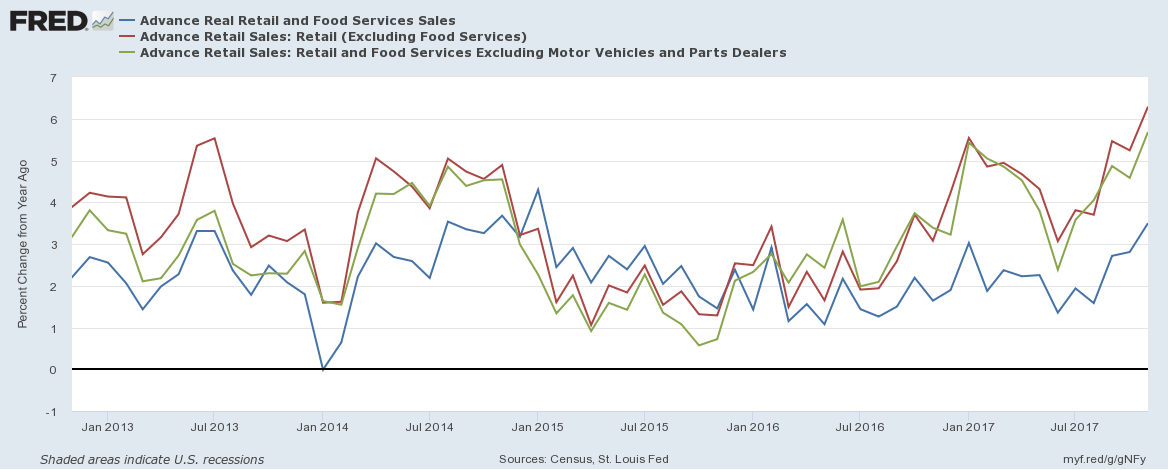

U.S. retail sales jumped 0.8 percent in November following a 0.5 percent rise in October (after an upward revision from 0.2 percent). The number was strong and significantly above expectations. Importantly, the overall index soared even despite a 0.2 percent decline in auto sales. When we exclude vehicles, retail sales rose 1 percent in November due to the unusual strength in e-commerce. And the annual growth also accelerated, as one can see in the chart below.

Chart 2: Real retail sales and food services sales (blue line), retail sales excluding food services (red line), and retail sales and food services sales excluding motor vehicles and parts dealers (green line) year-over-year from November 2012 to November 2017.

The report was strong as Black Friday and Cyber Monday generated extra demand. But it signals that the U.S. economy remains in good shape – the solid retail sales in November will add to the estimate of GDP growth in the last quarter of 2017. Indeed, the forecast of the Atlanta Fed of fourth-quarter real GDP growth increased from 2.9 percent to 3.2 percent after the release of the reports on the CPI and retail sales. It is bad news for the gold market.

Summing up, retail sales surged in November. Consumer prices also noted a nice increase, but the core index remained subdued. Hence, the macroeconomic environment – i.e., solid economic growth with low inflation – looks unpleasant for gold. However, weak inflation translates into dovish expectations of the pace of the Fed tightening, which, in turn, translated into a weak greenback. As the yellow metal is negatively correlated with the U.S. dollar, the lack of inflationary pressure is not necessarily negative for the gold market. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview