The U.S. economy added 156,000 jobs in December. What does it mean for the gold market?

Job Gains Soft

Total nonfarm payroll employment rose by just 156,000, according to the U.S. Bureau of Labor Statistics. Analysts expected 175,000 jobs created. Thus, the actual number was below expectations. However, employment gains in October and November combined were 19,000 higher than previously reported. It implies that job gains in the last three months have averaged 165,000. Job gains were concentrated in education and health services (+70,000), leisure and hospitality (+24,000) and… manufacturing (+17,000). Mining and construction reduced jobs.

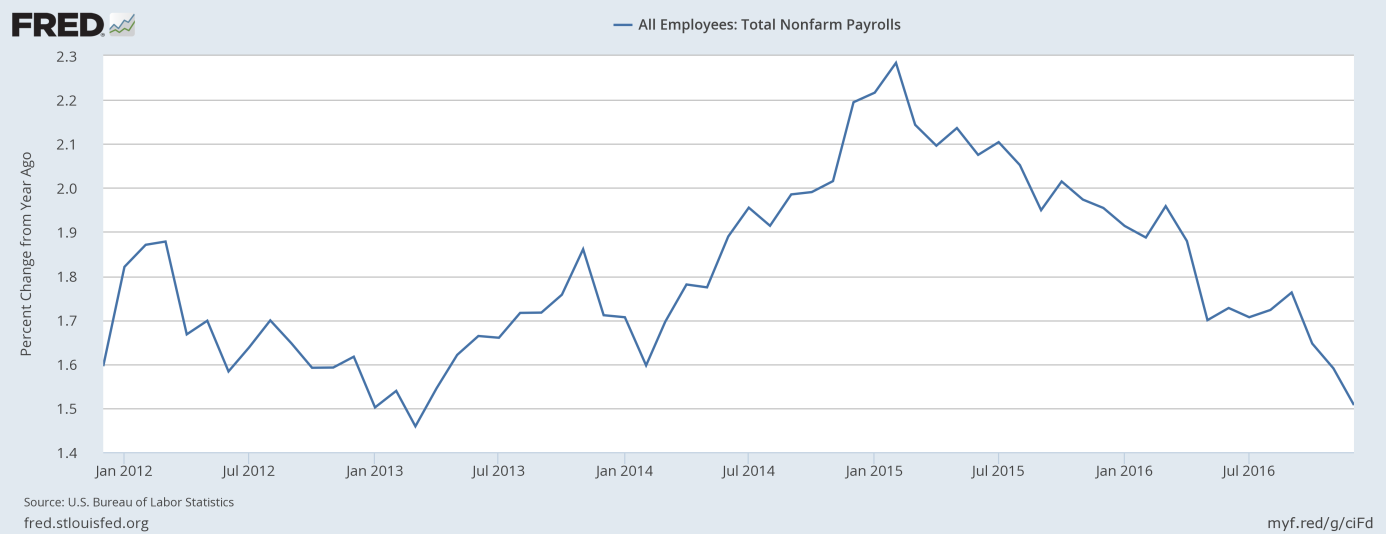

The job gains were soft in December, proving that the pace of hiring in the U.S. slowed down in the fourth quarter of 2016 after a good third quarter. Actually, the chart below shows that the last report is a continuation of a downward trend in job gains which started in February 2015.

Chart 1: Total nonfarm payrolls (percent change from year ago) over the last five years.

The annual pace of job gains declined to 1.51 percent in December from 1.59 percent last month and 2.28 percent at the peak. Thus, job growth has averaged 165,000 per month over the past three months and 180,000 per month in 2016, compared with an average of 229,000 per month in 2015. The trend is rather ugly and falsifies the current stories about boosted growth. The number alone would be positive for the gold market, however, other labor market indicators outweighed the softness in job creation.

Other Labor Market Indicators

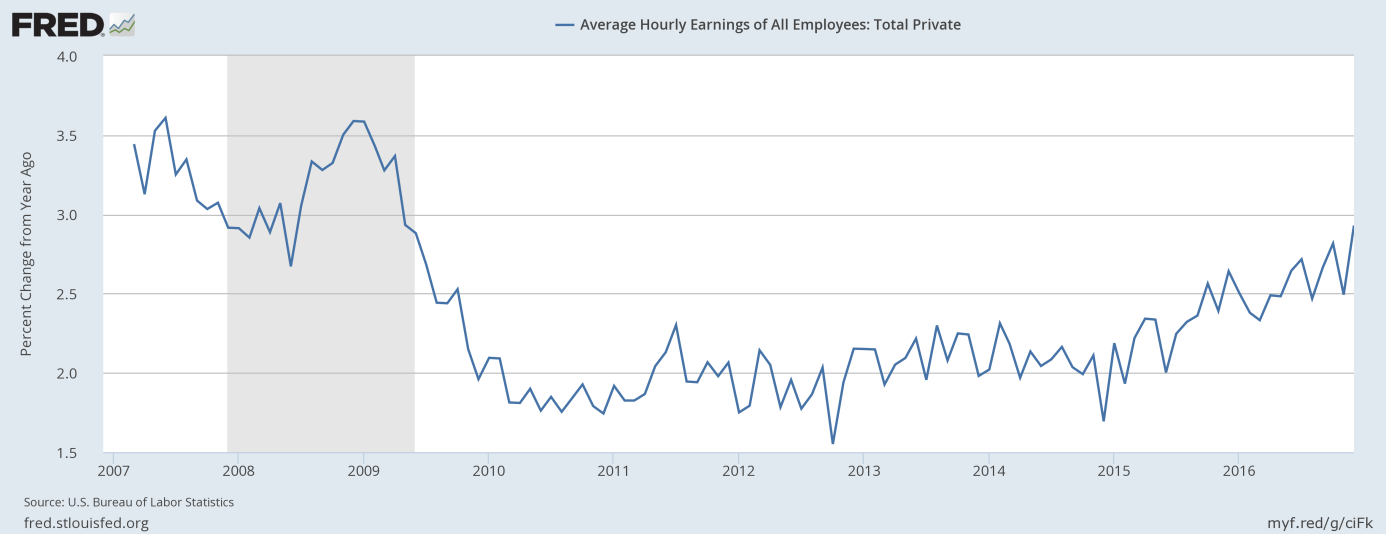

Other labor market indicators were rather positive. The unemployment rate edged up from 4.6 percent to 4.7 percent. The labor force participation rate and the employment-population rate remained essentially unchanged, at 62.7 and 59.7 percent, respectively. However, the average wage in the private sector increased 10 cents to $26.00, after edging down 2 cents in November. It means that the hourly pay jumped 2.9 percent over the year, the fastest pace since May 2009, as one can see in the chart below. Hence, the Fed hawks should enjoy the report.

Chart 2: Average hourly earnings of all employees in the private sector (as percent change from year ago) from 2006 to 2016.

Payrolls, Fed and Gold

The rise in hourly earnings reflects the upward wage pressure, which should be welcomed by the Fed, keeping it on a gradual rate hiking path. This is negative development for the yellow metal. As a reminder, in the recent FOMC minutes, the U.S. central bankers stated that if the labor market continues to tighten and inflation accelerates, there may be a faster pace of tightening. Bloomberg points out that the wage inflation above 3 percent is widely seen as feeding overall inflation. Interestingly, after the report was published, Charles Evans, the Chicago Fed President, said that three hikes were not implausible in 2017, if data were a bit stronger. Similarly, Jeffrey Lacker, the Richmond Fed President, stated that the Fed may increase interest rates quicker that markets currently expect, if there were greater fiscal stimulus. Robert Kaplan, the Dallas Fed President, backed gradual rate increases and the removal of accommodation in 2017. In consequence, the market odds of the Fed hikes in 2017 rose slightly after the employment report and the Fed officials’ speeches, and the U.S. dollar appreciated, which is bad news for gold. The price of the shiny metal fell yesterday.

The take-home message is that December employment gains were slightly disappointing and signaled a further slowdown in job creation. However, the wage pressure strengthens the case for faster tightening of monetary policy, which is fundamentally negative for the yellow metal.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview