Please log in to read the entire text.

If you don’t have a login yet, please select your access package.

While inflation continues to wreak havoc, gold is reluctant to respond. Will it finally change and the price of the yellow metal rise?

The Fourth Horseman of the Apocalypse

The end is nigh! There should be no doubt about it now, as more horsemen of the Apocalypse are coming (see the painting below). The first was Pestilence. Two years ago, the COVID-19 pandemic plunged the world into a Great Lockdown and the deepest recession since the Great Depression. At the end of February 2022, the Russian troops brought War and Death to the Ukraine. Also, say hello to Famine, another horseman. To be clear, I don’t mean ‘hunger’ in the United States or other developed countries (although people in besieged Mariupol are running out of drinking water and food), but rather dearth and dearness. In other words: inflation.

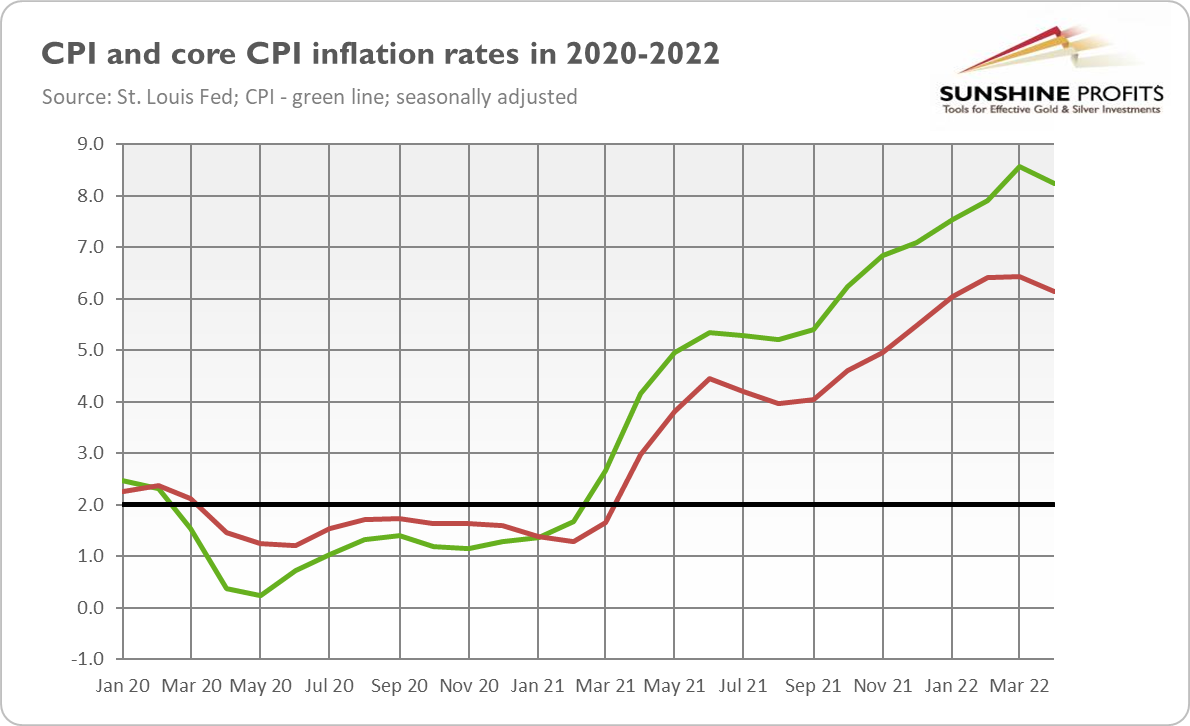

It doesn’t look very optimistic, indeed. As you can see in the chart below, the annual CPI rate has accelerated from 0.2% in May 2020 to over 8.0% in March and April 2022. Importantly, the core CPI, which excludes food and energy prices, has also surged recently, rallying from 1.25% two years ago to above 6.0% now.

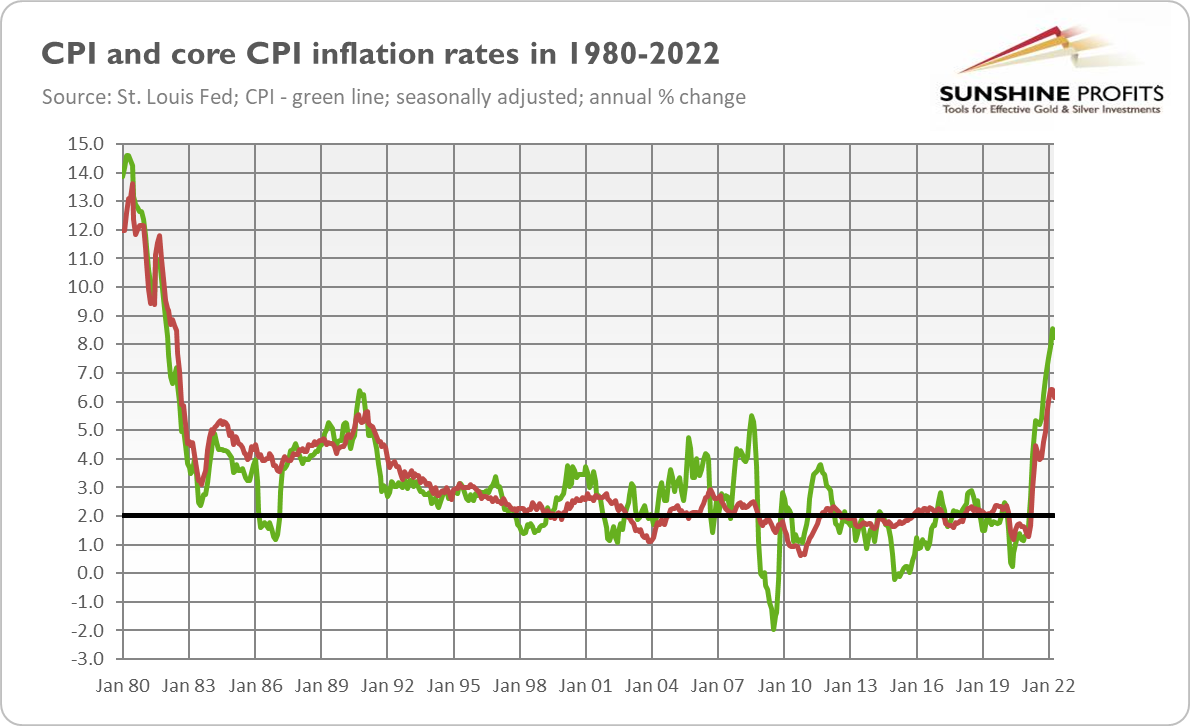

That’s a really high increase in the cost of living that hit society, especially the poor. There are already reports that people are skipping meals or taking desperate measures to save on heating costs (e.g., they are making fires in houses or, in the UK, pensioners are riding buses to keep warm and save on heating). As the chart below shows, March’s reading was the largest since December 1981 for the overall CPI and since August 1982 for the core CPI, as the chart below shows. And inflation rates were already retreating then, while today they are still on a rise.. Inflation rates were already retreating then, while today they are still on the rise.

Are they? Well, inflation numbers in April came in slightly lower than in March, so it’s possible that inflation has already peaked. However, the rate was still higher than the consensus estimate of 8.1%, and it may be just a temporary pullback, similar to the one we saw in the summer of 2021. Inflation was less red-hot because gasoline prices declined 6.1% in April, but they spiked again in May (see the chart below), which will contribute to the upcoming inflationary reading.

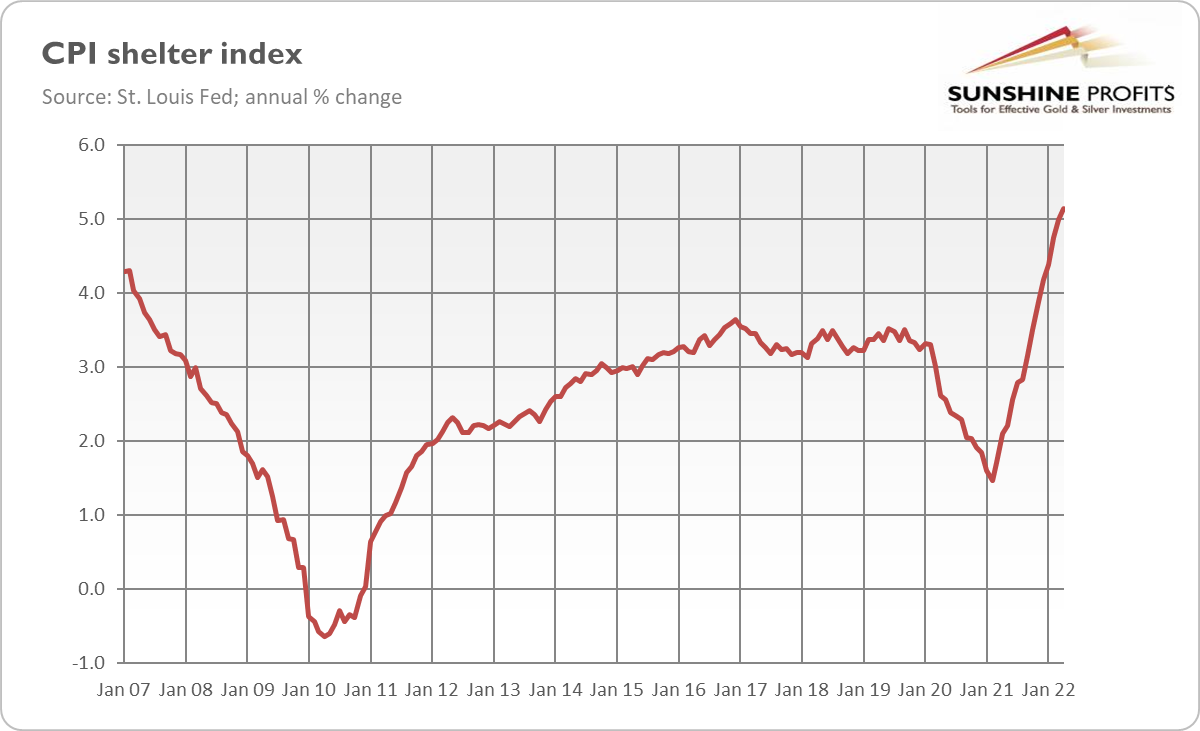

Moreover, as the chart below shows, the shelter index, which is the largest component of the CPI, has been constantly rising (as well as the producer price index), so there is an ongoing upward pressure on prices. Additionally, widespread lockdowns and an economic slowdown in China would hit the global supply chains again, strengthening the inflationary forces. Last but not least, the private savings boosted by the pandemic are still elevated, so consumers have resources they can tap. Hence, high inflation is likely to stay with us for some time.

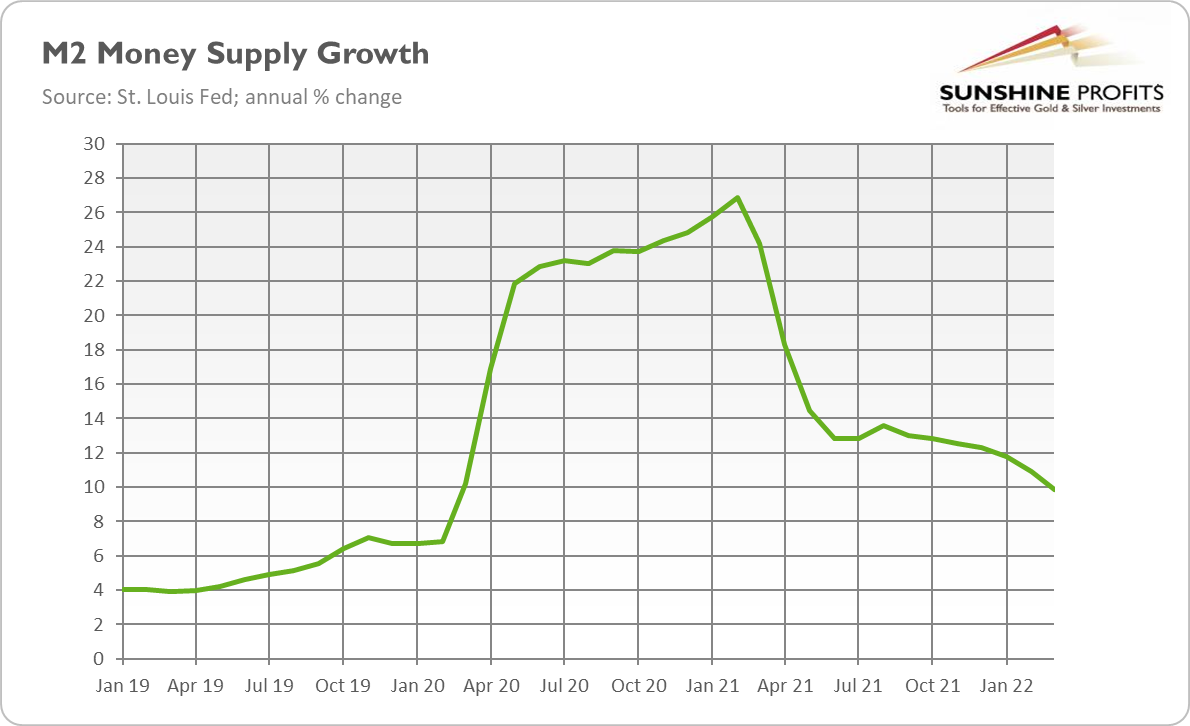

For how long? This is a great question that everyone is asking right now. On the one hand, the pace of growth in the money supply has recently slowed down, as the chart below shows, which gives us some hope for normalization in inflation in the future.

On the other hand, the pace still hasn’t returned to the pre-pandemic levels, so inflation won’t simply disappear. What’s more, there is still a huge overhang in the monetary ‘bathtub’ waiting to come out through the pipeline as inflation. You see, the broad money supply increased by about $6.4 trillion between February 2020 and March 2022, while the real GDP rose by just $2.5 trillion. In other words, the money supply surged far more that what could be absorbed by economic growth, and the rest of the newly created money must be accumulated by higher prices (and increased demand for money, but let’s not complicate things here). Hence, the decline in the inflation rate in April shouldn’t be viewed as the beginning of disinflation. Elevated inflation is likely to remain with us this year, and possibly also in 2023.

Good News for Gold?

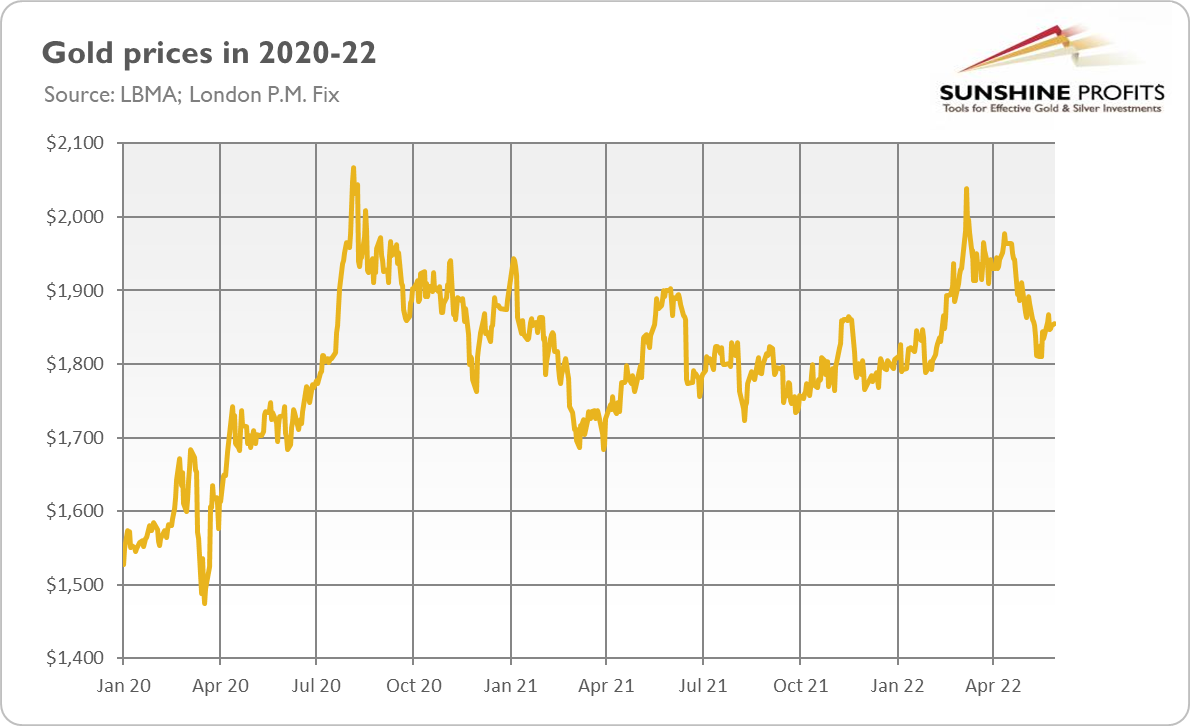

What does it imply for the gold market? Theoretically, it should be great news, as gold usually shines during periods of high and accelerating inflation. However, “usually” does not mean “always”. As we all know, gold has failed to rise in tandem with the current inflation so far and has been unable to break free from the $2,000 level. As the chart below shows, the yellow metal has remained in a downward trend since March 2022, if not August 2020.

One of the reasons for gold’s disappointing behavior is that rising inflation was accompanied by expectations of higher interest rates. Given the already hawkish stance of the Fed, prolonged inflation could only increase the Fed’s tightening cycle even more.. This is why the real interest rates have surged recently despite rising inflation, which is clearly not good news for the yellow metal.

The only hope for gold is that either inflation or the US central bank’s response to it will eventually trigger a recession. Well, it will occur one day, but not yet – with all that money still in the bathtub and generating overflow in the form of price inflation, the economy still seems overheated. This is probably another reason why gold didn’t rally like it did in the 1970s. To be clear, the economic outlook has darkened recently and the risk of stagflation has increased. However, the end is not nigh – unless it is…

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the June Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.