Please log in to read the entire text.

If you don’t have a login yet, please select your access package.

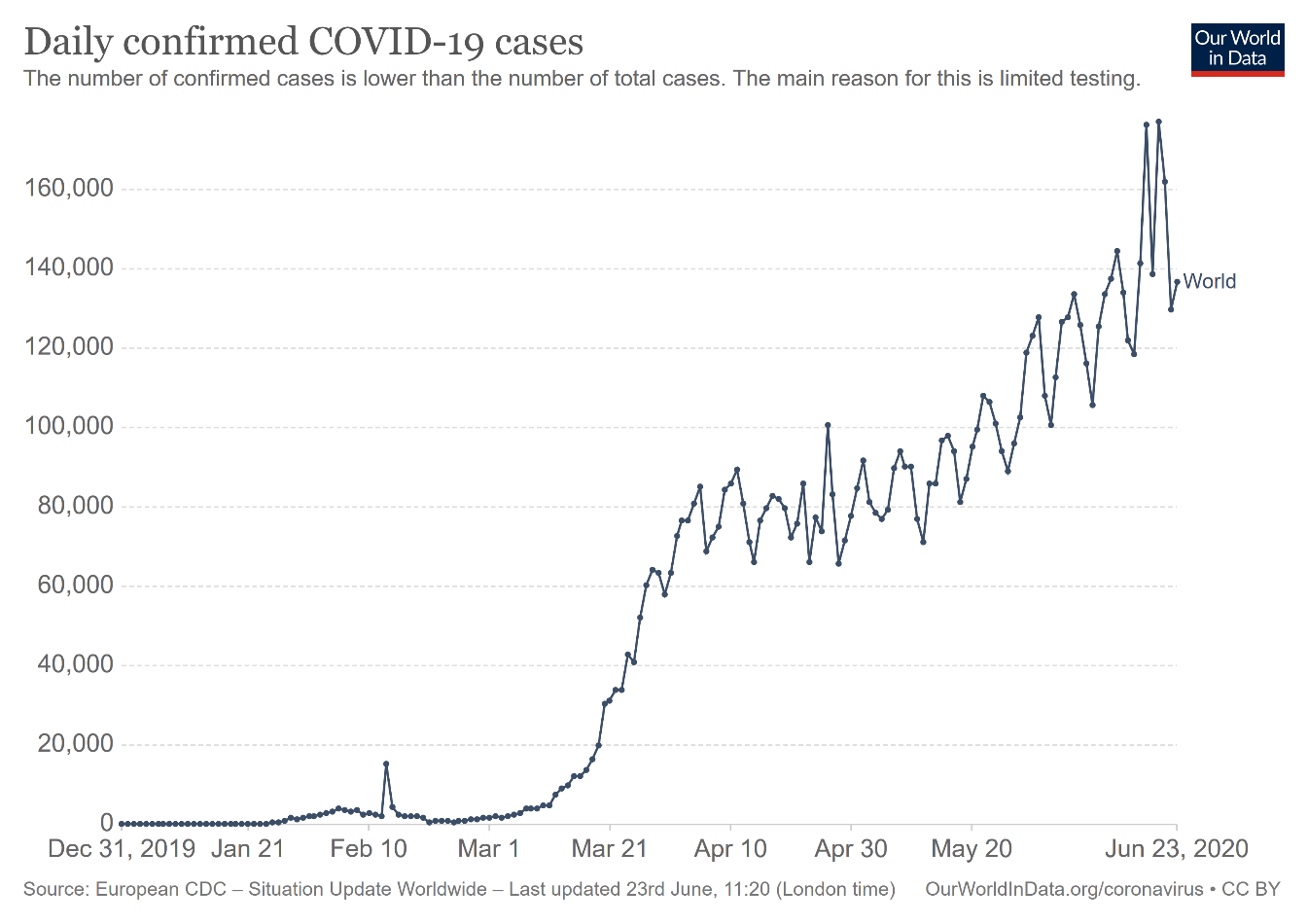

Sometimes when we observe people on the streets, when we see crowded restaurants and pubs, it seems like the pandemic has ended. But is the global epidemic really over? Not at all. Please look at the chart below. As one can see, the daily number of confirmed cases of COVID-19 in the world is still in an upward trend.

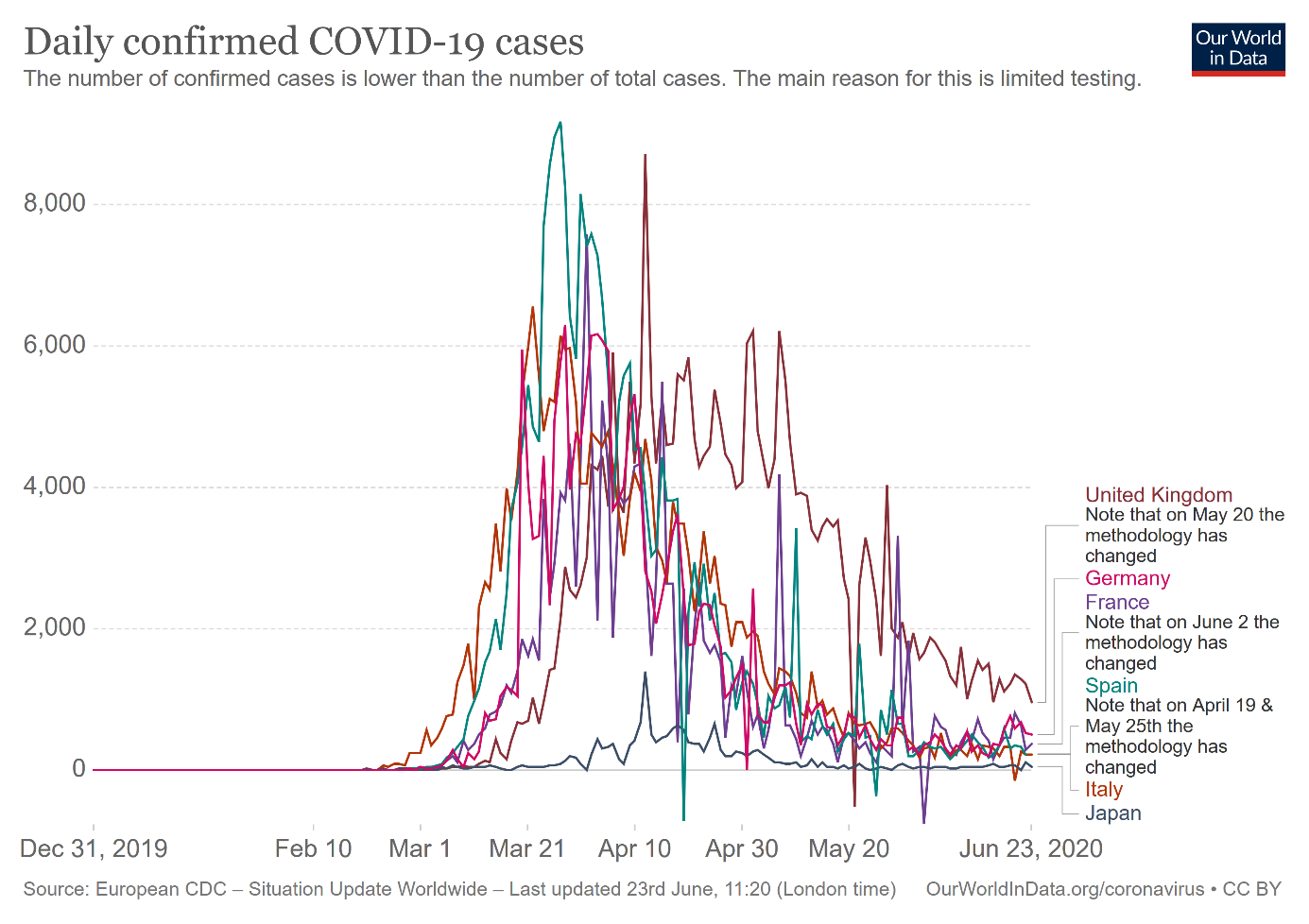

However, in the developed countries the number of daily new cases has declined and stabilized at very low levels, as one can see in the chart below. So, although the pandemic is not over, it has been contained in the West. And remember that global capital markets focus on developments in major economies and financial centers, which are precisely rich countries.

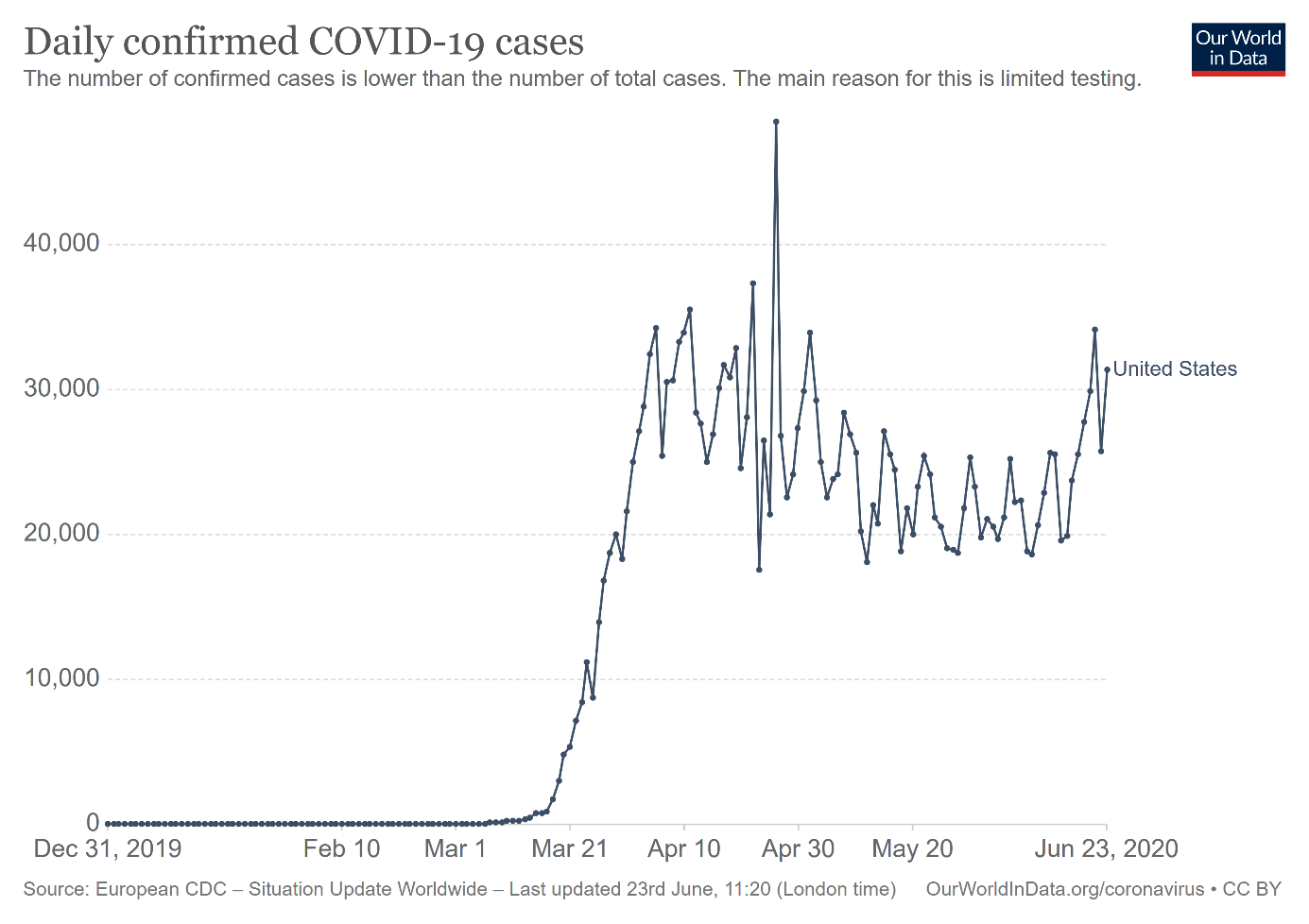

The only possible exception is the U.S., where the number of new cases has also peaked, but it stabilized at not so low level, as the chart below shows. Actually, the number of new cases is at level from the turn of March and April - and it has been even rising recently.

However, people's reaction is different. So, although the pandemic is not over, the fear is over. At the beginning of the epidemic, people panicked (rightly or not), but after two months in quarantine, they got used to the new epidemiological situation. After all, the virus has not mutated (so far), the healthcare systems have not collapsed (luckily and partially thanks to the adopted containment measures), the mortality rates have not surged, and the world has not ended. People quickly adapted to new circumstances and they learnt how to live with the coronavirus threat.

This is very important as markets are driven not by facts and the number of daily new cases of Covid-19, but by people's emotions and reactions to these facts and to the epidemiological threat. And now it seems that many people stopped to fret about the coronavirus.

Rightly or not. We mean here that there are some important arguments for not worrying and be optimistic about the epidemic. The worst is probably behind us and we are now better prepared to handle the pandemic (the shortages of equipment have been remedied). Moreover, in June, the scientists at Oxford University in the United Kingdom reported that the dexamethasone could be the first drug able to save the lives of Covid-19 patients (however, the study results were presented only in press release without any scientific paper).

On the other hand, the threat of the resurgence of the coronavirus is real. Many American states noted a record number of new cases (or new hospitalizations) of coronavirus in June, and Florida could be the next epicenter of the pandemic.

Meanwhile, on the other side of the Pacific, China faces the new coronavirus outbreak in Beijing. In consequence, several communities in the Chinese capital are back on lockdown. The surge in new cases in Beijing, and in other Asian cities (like Tokyo) or American states, is a clear warning to the U.S. and other Western countries: the second wave is possible.

This is, of course, positive for the gold market, as the risk of resurgence of the coronavirus and the reintroduction of the economic lockdowns supports the safe-haven demand for gold and its prices. However, investors should remember that the number of new cases within the second waves are so far limited. The autumn wave could be worse, but the situation is not out of control yet (and wearing masks can help reduce the size of a possible second wave of infection). And the key issue is that even the second wave will not trigger rally in the gold market, unless it spurs fear in the marketplace and it diminishes confidence in the US economy.

So far, the market is not worried about a large outbreak in the fall. It seems that investors believe that there will by the fall enough testing, contact tracing, drugs and R&D on vaccines. And that we will not shut down economies as deeply as we did in spring, if there is the second major outbreak in fall. This time the market might be right - however, at the beginning of the year, Mr. Market was clearly too optimistic, so correction in the risky asset markets is possible at some point this year.

Luckily, the bullish perspective for gold does not depend solely on the second wave. After all, the price of gold has not collapsed amid the optimism about the end of epidemic and economic revival. The key is what the Fed has recently said: it would take nearly two years to fully recover from the coronavirus recession. The subdued economic growth, the dovish U.S. central bank and ultra low real interest rates should support the gold prices (unless they surge suddenly).

Thank you for reading today's free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the June Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.