Briefly: Outlook for the precious metals market remains bearish for the following few weeks, and bullish for the following months and years.

Welcome to this week's Gold Investment Update.

The outlook that we featured last week didn't change based on last week's price moves as prices generally moved in tune with our expectations. Consequently, there are parts of the previous analysis that didn't change in the previous days - we will put them in italics.

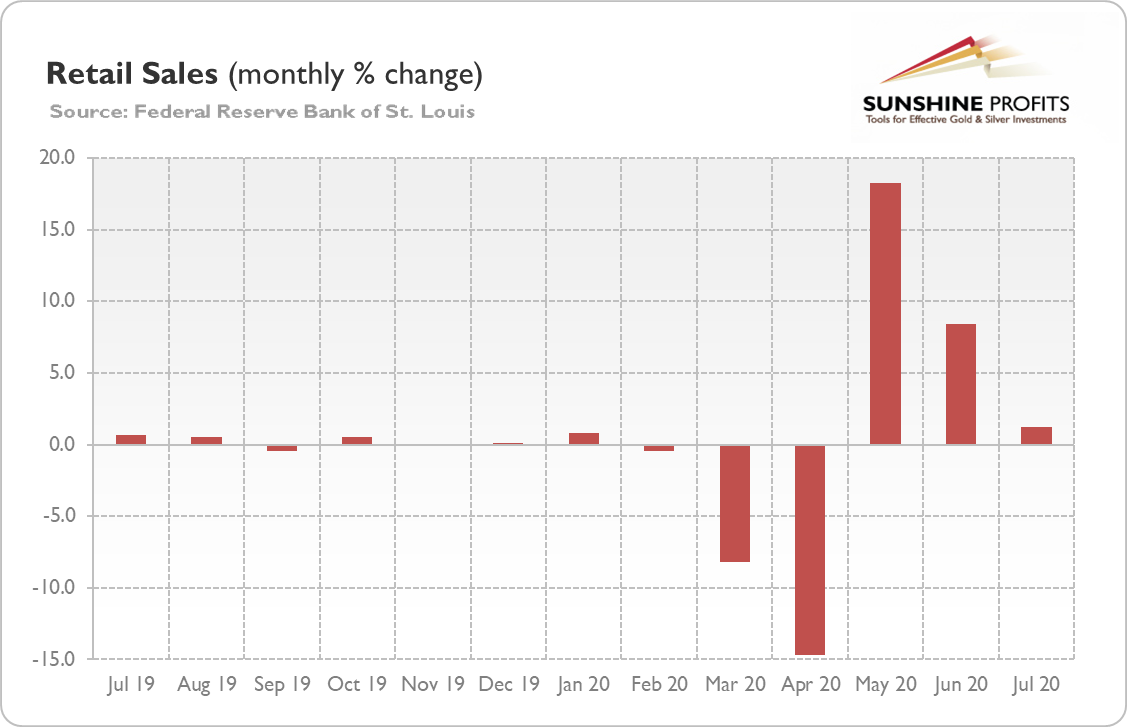

Before discussing the technical picture, we'd like to write a few words on the recent fundamental news. The most recent news was that the retail sales increased 1.2 percent in July, so that's what we'll focus on.

The growth was worse than expected, which hit the U.S. stock market. As the chart below shows, the number was also much weaker than in the two previous months (8.4 percent gain in June and 18.3 percent jump in May), when it seemed that the economy started to rebound.

Now, the weak July reading indicates that we have seen a false recovery. Or that it was brutally interrupted by the second wave of the coronavirus infections. Given that epidemic is still widespread (it seems that, as John Cochrane put it, "America has essentially given upon containing the corona virus, and will just let it spread while we await a vaccine"), the mediocre July data might be a sign of what is ahead.

In other words, August could be also not the best month for the U.S. economy, as the resurgence of the Covid-19 cases delayed the return of people to their jobs and the overall economy's return to normal. Importantly, the second wave coincided with the expiration of the $600 federal unemployment benefit, which also hit the real incomes of Americans and their spending power. All this is, of course, great news for the gold market.

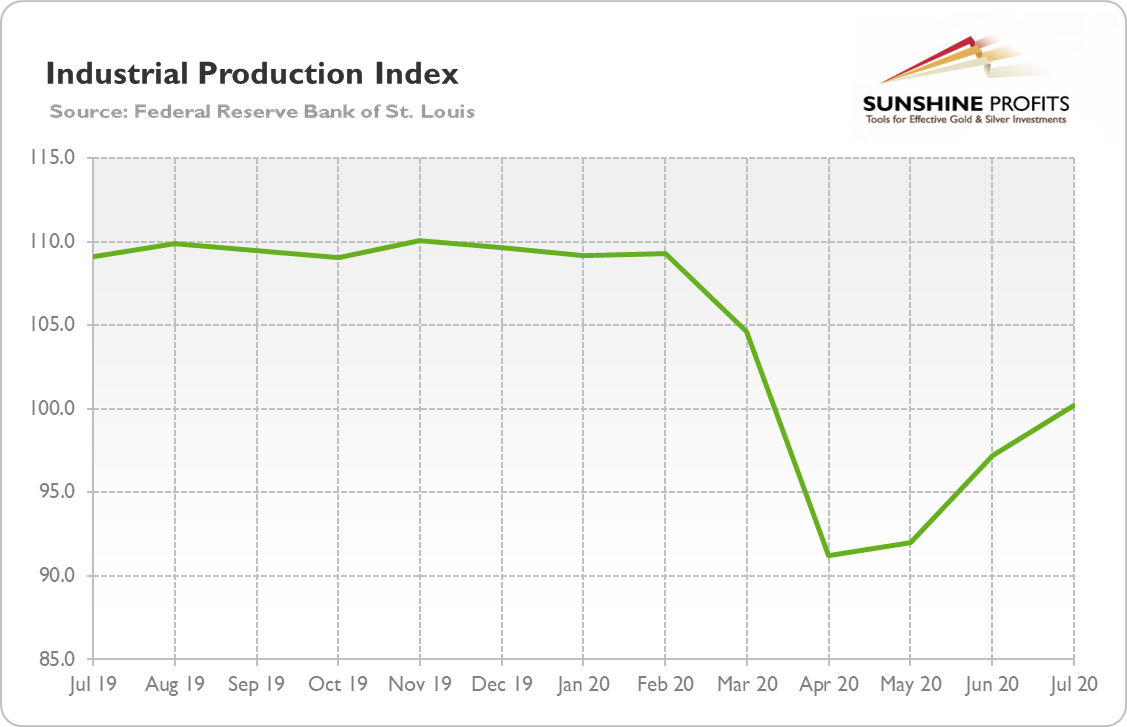

And what about other data? Industrial production rose 3 percent in July, more than forecasted. It was the third monthly gain in a row, which is a superb achievement in the current manic-depressive economy, but industrial production remains below the pre-crisis level, as the chart below shows.

Importantly, senior executives say that not all the jobs lost during the economic crisis are coming back soon. What a surprise! We warned since the very beginning that there will be no V-shaped recovery, especially in the labor market.

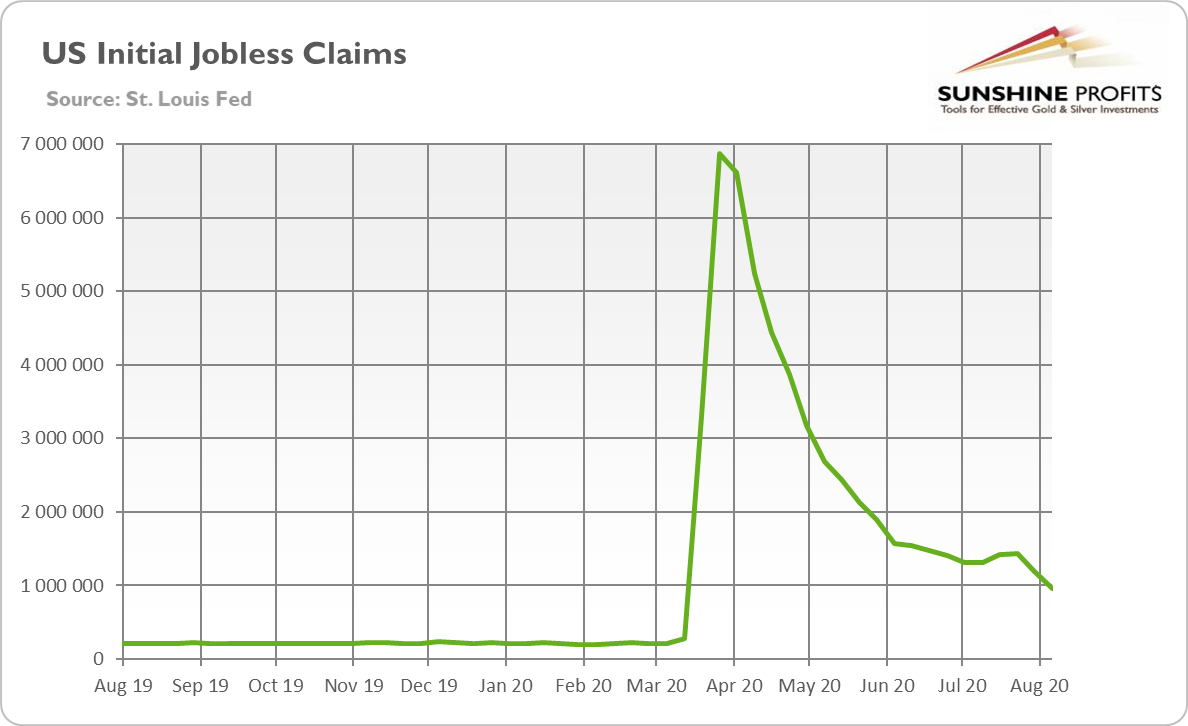

Oh, by the way, how is the labor market doing? Well, so-so. There are good signs, that's for sure. For example, last week, initial jobless claims fell below 1 million for the first time since the coronavirus crisis began, as the chart below shows. However, the drop reflects only partially economic reopening, as it also suggests the expiration of federal supplemental unemployment benefit last month.

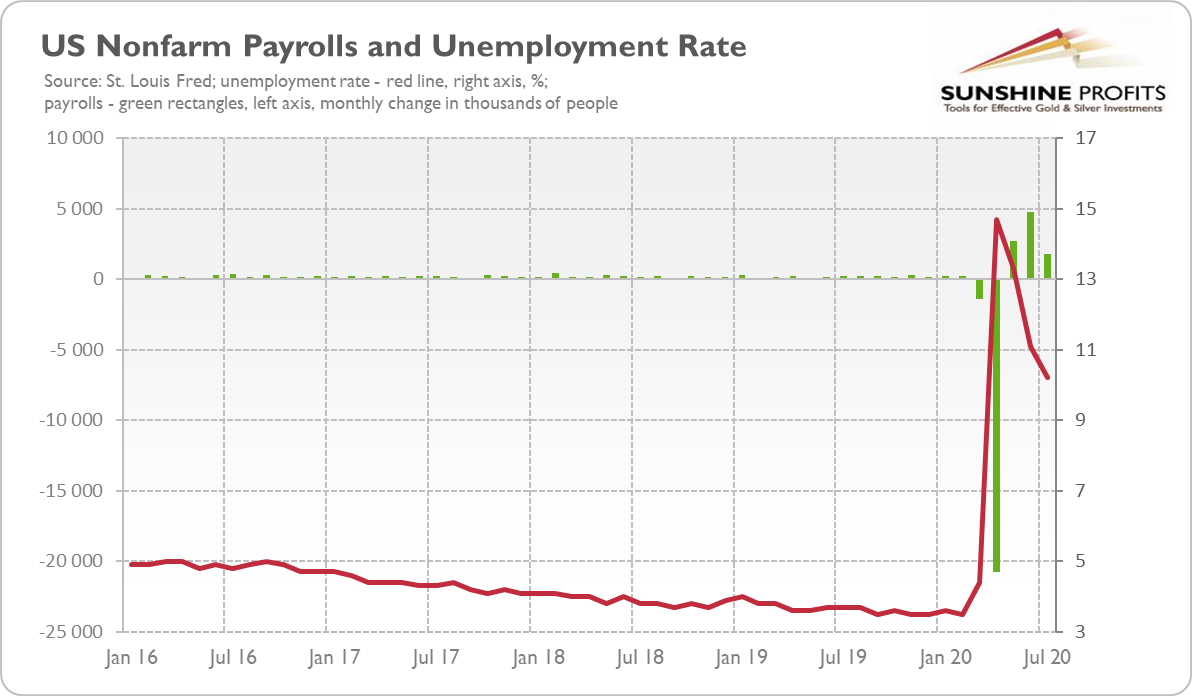

And although the unemployment rate declined in July to 10.2 percent, the pace of the U.S. employment growth has seriously slowed down as one can see in the chart below. The economy regained 1.76 million jobs, which is not so many compared with the revised 4.79 gain in June. And so far, the American economy restored less than half of the lost jobs during the pandemic.

As the health crisis goes on, many of the initially temporary job losses will become permanent, making it harder for the economy to recover. And making gold shine even brighter. What is important is that the U.S. labor market is weaker than the official data suggest, which was admitted by Cleveland Fed President Loretta Mester on Wednesday. She said that more than half of the companies in her district is laying off workers and cutting pay in response to the coronavirus crisis.

What does it all mean for the gold market? Well, it's true that July data is not as bad as it could be, given the resurgence of the Covid-19 cases. It seems that people, although still worried about their health, stopped to panic and instead they get used to the new epidemiological situation.

However, the recent data indicates that there will be a W-shaped rather than V-shaped recovery. Or that the economy will be in the "reopening" phase, rather than the "recovery" phase, as Loretta Mester put it. The labor market and industrial production are well below the pre-pandemic level. Retail sales managed to recover, but their growth has recently slowed down. It suggests that the recovery has been fragile and based to the large extent on the massive liquidity injections and stimulus packages. Now, without any fresh economic aid, we are observing the true condition of the U.S. economy. So, although the standoff among Democrats and Republicans over the size and scope of the next financial aid package could be the "unfortunate development" for the economy, as Chicago Fed President Charles Evans put it, it might be quite fortunate for the gold prices. However, it might be also the case that both the U.S. equities and gold need the next round of liquidity (and fear of inflation and sovereign debt crisis) to rally again.

All in all, there are multiple fundamental reasons due to which gold is likely to soar in the upcoming years, however, even the most profound bull markets can't move up in a straight line and some corrections will take place. After big rallies, we're likely to see big corrections, and one is long-overdue in case of the precious metals market.

Just as it was in March, it seems that the visible worsening in the economic situation might trigger a sell-off.

At this point we would like to quote what we wrote about the aspects of the virus scare and how the market reacts to them. In short, gold (and other markets) reacted when people started to strongly consider the economic implications and this topic was ubiquitous in the media.

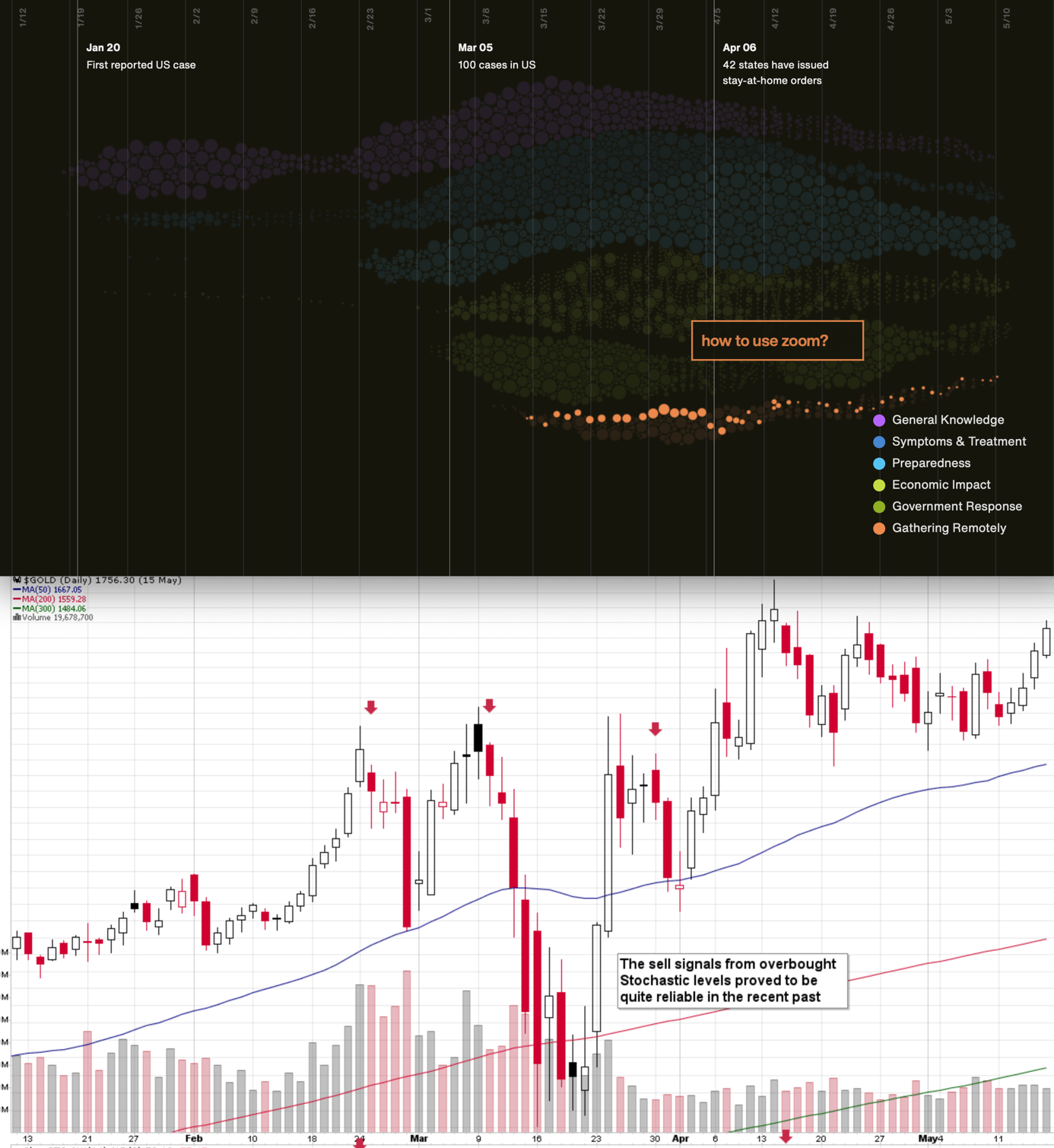

The particularly important factor for gold will likely be the economic implications of the second Covid-19 wave. How do we know that? Because we compared what people were searching for (online) with how gold prices shaped. There's a lot more data available on https://searchingcovid19.com/ but we'll focus on the chart that shows when people were getting interested in what aspects of the pandemic and we'll compare them to gold.

We aligned both charts with regard to time. The chart on the bottom is from Stockcharts.com and it features gold's continuous futures contract. The gold price (and the USD Index value) really started to move once people got particularly interested in the economic impact of the pandemic and in the government's response.

In the recent days (and weeks) the news is dominated by other issues. Once people start considering the economic implications of the second wave of this coronavirus, the prices would be likely to move.

The news coming from the Fed is positive for gold in the long run, but in the short term, they continue to indicate risk for the economy. This risk is likely to translate into lower stock values and initially gold is likely to slide given the above - just like it did in March.

All in all, gold is likely to rally far in the long run, but in the short run it's vulnerable to a sizable decline, when the economic implications of the pandemic's continuation become obvious to investors.

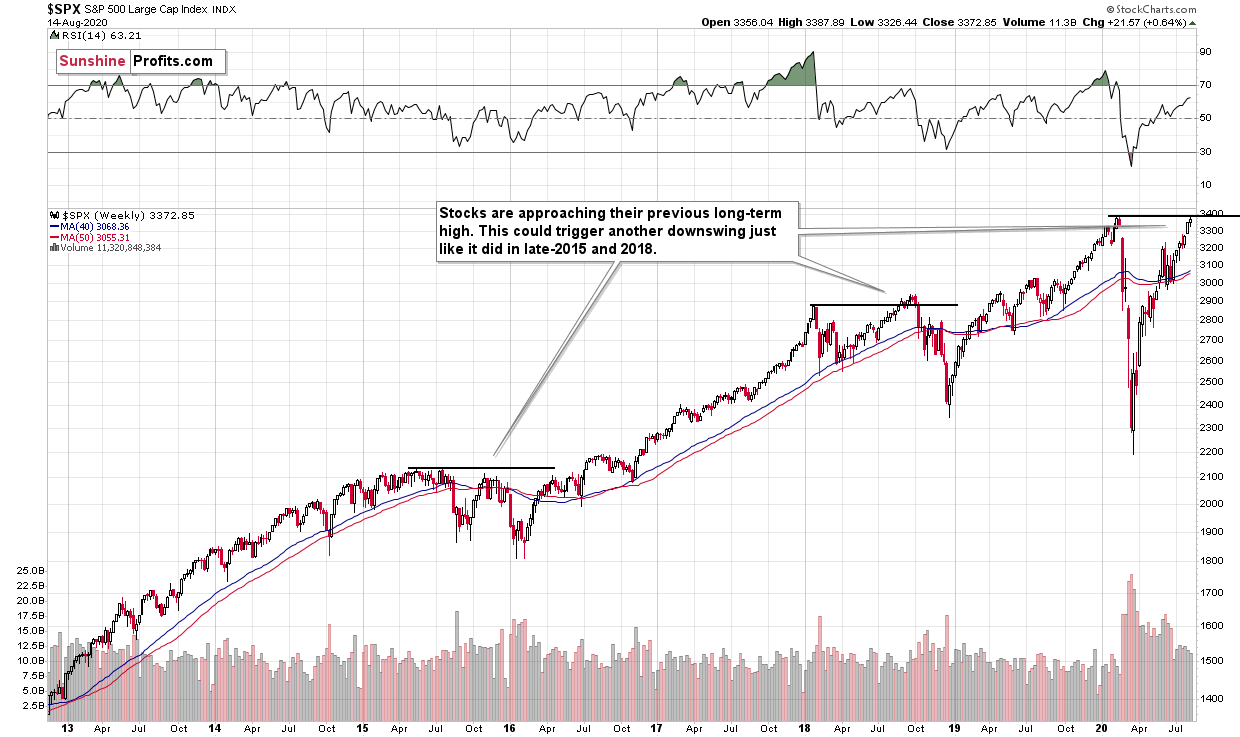

The S&P 500 is approaching its previous 2020 high. Given the economic background, I find this performance unfounded. But the markets can stick to a certain emotional trend for longer than many investors can remain logical, which would fit the above picture.

Back in 2015 stocks topped below their previous highs, and in 2018 they topped a bit above them, so the proximity to the previous is far from being a precise sell signal. It does indicate, that the stock market is likely vulnerable to sell signals coming from other markets and that this emotional rally could end sooner rather than later.

Do you remember what happened in February when the S&P 500 lost its upward momentum? They plunged, and that was when tops in mining stocks and silver formed. Gold made another attempt to move higher but ultimately declined profoundly in the following days.

Last week, the S&P 500 was just several index points below the previous highs. It seems quite possible that stocks will make another attempt to move higher this week and perhaps break to new highs. This means that if we see an invalidation of the breakout - and we would be very likely to see one based on the fundamental picture - we will get a massive sell signal from stocks. This could be the thing that triggers move in most markets, including the PMs.

It appears that on one hand, everything that could have gone well for gold on the fundamental front, has already gone well, and it already rallied, and on the other hand, we have many signals pointing to the situation being excessive. This means that as some of the bullish factors ease (perhaps temporarily) and investors get scared about economy's ability to really recover, gold is likely to correct significantly, before continuing its upward march.

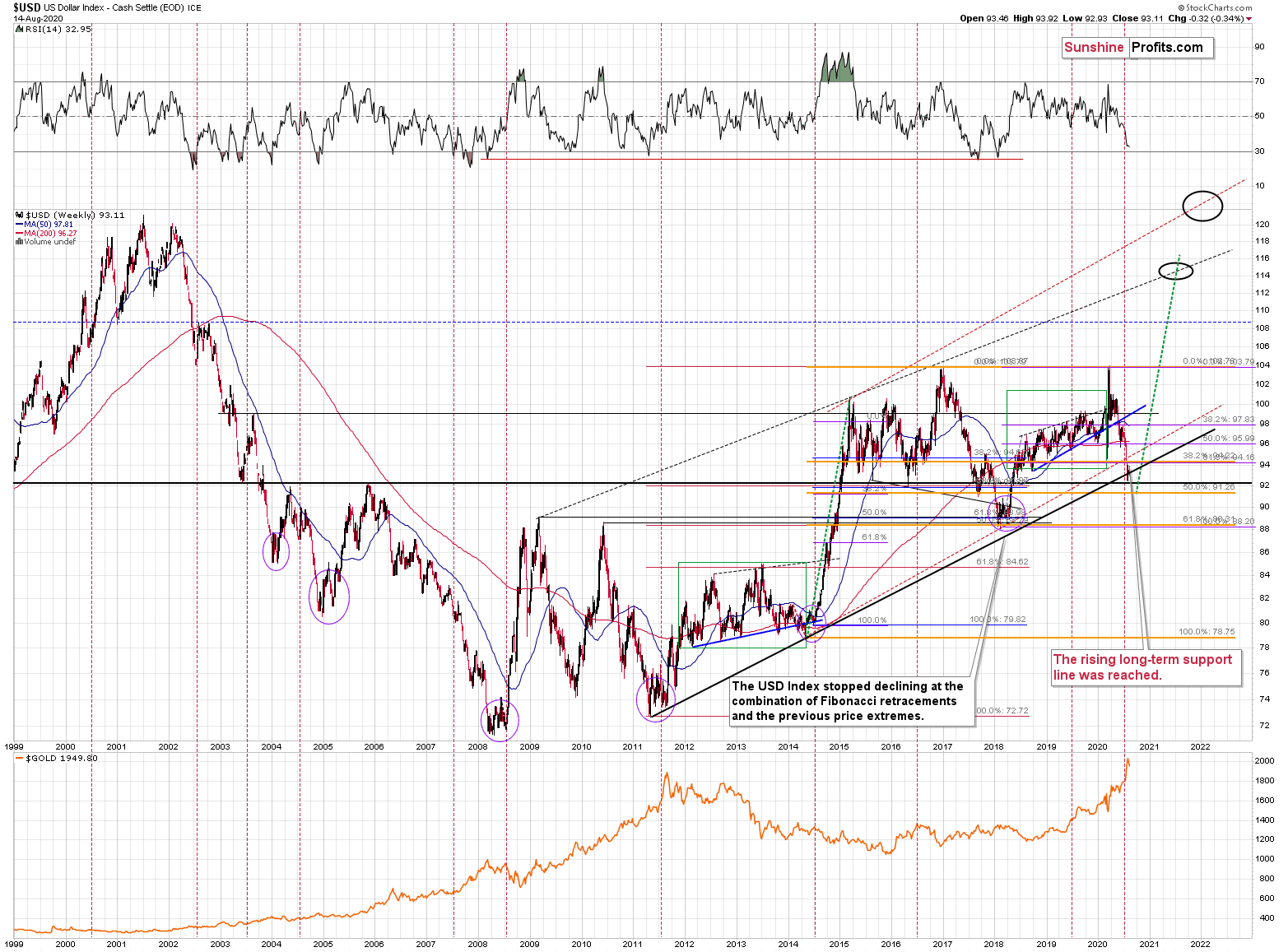

Speaking of indications pointing to the situation being excessive, let's take a look at the USD Index.

Remember when in early 2018 we wrote that the USD Index was bottoming due to a very powerful combination of support levels? Practically nobody wanted to read that as everyone "knew" that the USD Index is going to fall below 80. We were notified that people were hating on us in some blog comments for disclosing our opinion - that the USD Index was bottoming, and gold was topping. People were very unhappy with us writing that day after day, even though the USD Index refused to soar, and gold was not declining.

Well, it's the same right now.

The USD Index is at a powerful combination of support levels. One of them is the rising, long-term, black support line that's based on the 2011 and 2014 bottoms.

The other major, long-term factor is the proximity to the 92 level - that's when gold topped in 2004, 2005, and where it - approximately - bottomed in 2015, and 2016.

The USDX just moved to these profound support levels, and it's very oversold on a short-term basis. It all happened in the middle of the year, which is when the USDX formed major bottoms on many occasions. This makes a short-term rally here very likely.

While it might not be visible at the first sight (you can click on the chart to enlarge it), the USD Index moved briefly below the long-term, black support line and then it invalidated this breakdown before the end of the previous week. This is a very bullish indication for the next few weeks.

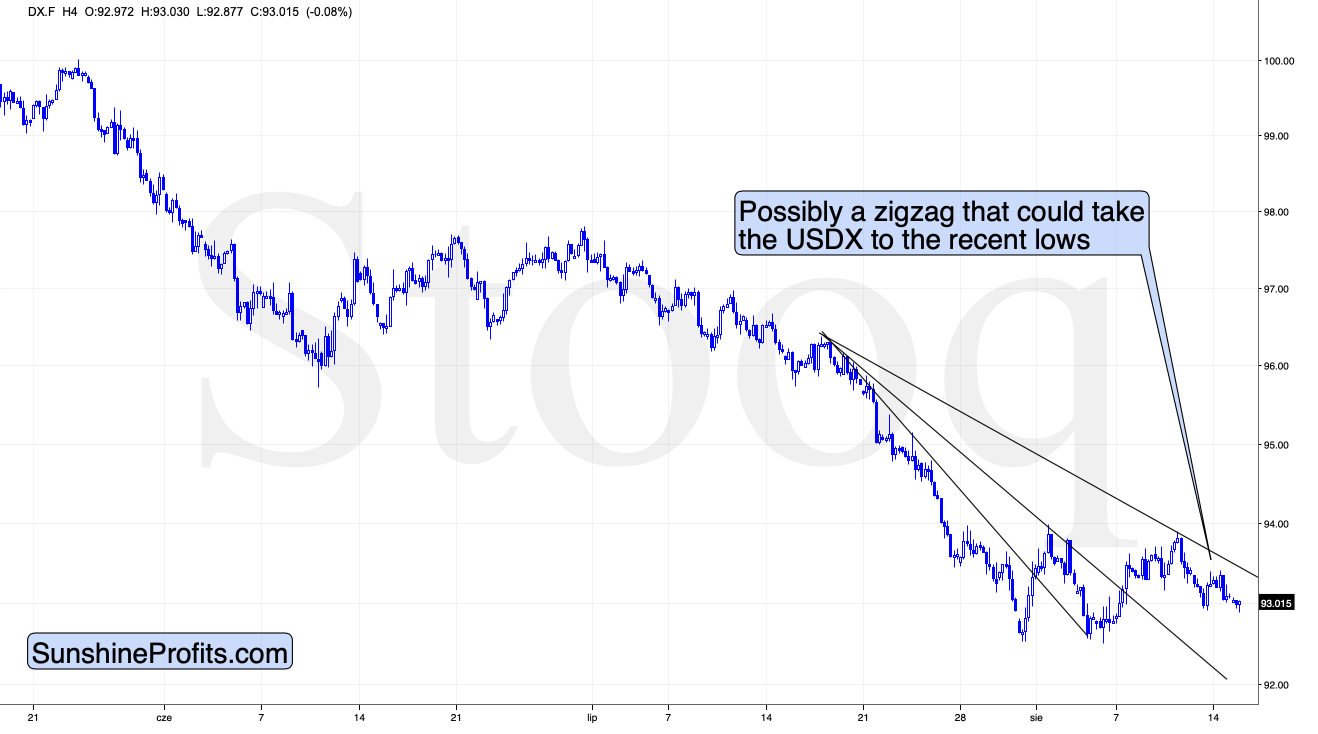

We even saw a confirmation from USD's short-term chart.

The U.S. currency is finally after a decisive short-term breakout. In fact, it's already after two short-term breakouts. Looking at the short-term picture only, the USD's sideways trading could be both: a triple-bottom pattern, or a flag consolidation pattern. The former would be bullish, and the latter would be bearish. Based on the previous long-term chart, the bullish interpretation is stronger.

Back in March, the short-term breakout in the USD Index was the thing that triggered the powerful rally in it, as well as a powerful plunge in the precious metals market. It's generally a good gold trading tip to monitor the USD Index's performance.

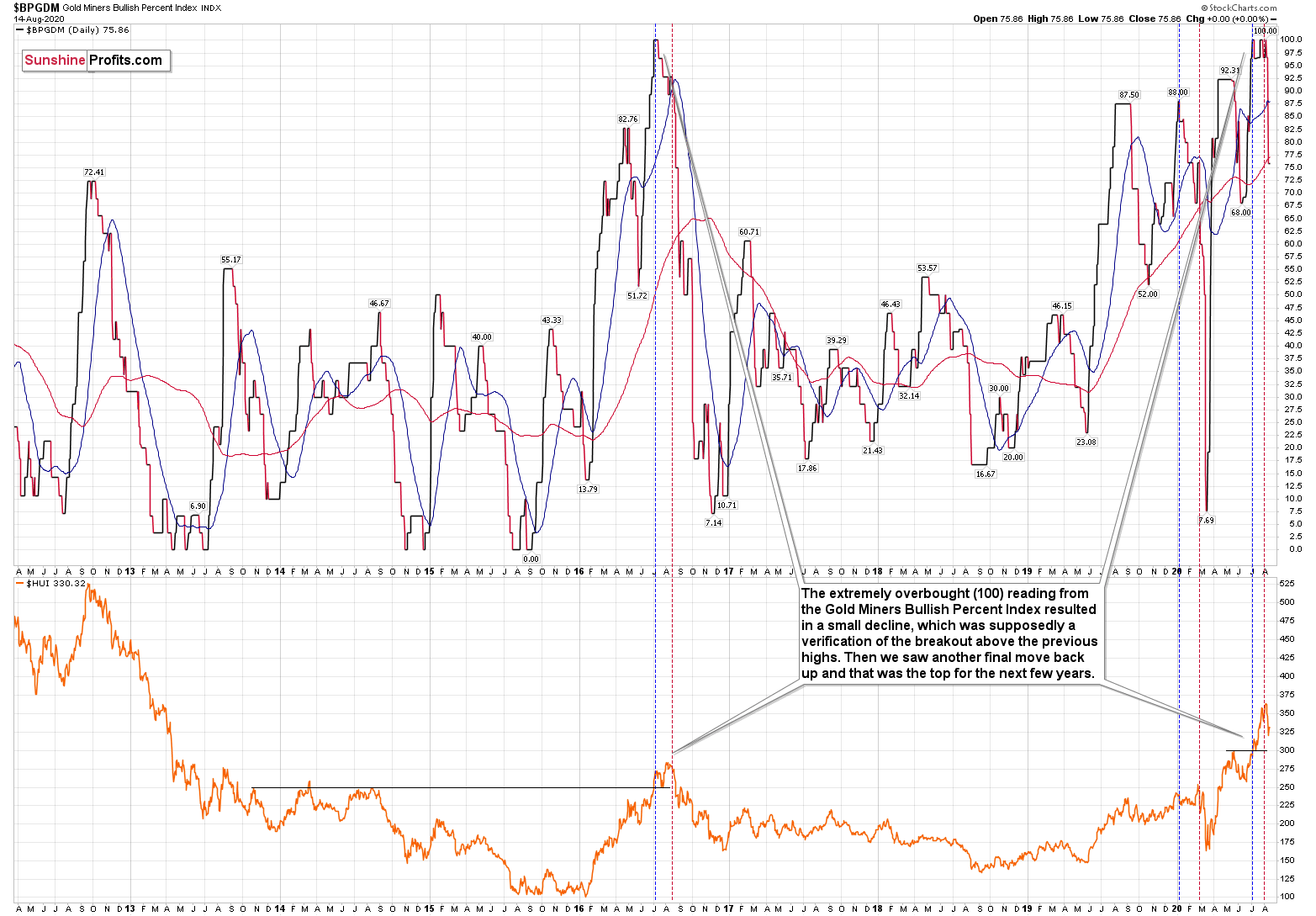

Consequently, based on this analogy, the implications for the near term are bearish for the PMs. Especially, when we consider the fact that Gold Miners Bullish Percent Index showed the highest possible overbought reading recently.

The excessive bullishness was present at the 2016 top as well and it didn't cause the situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-term outlook really is. Then, they correct. If the upswing was significant, the correction is also quite often significant.

Please note that back in 2016, there was an additional quick upswing before the slide and this additional upswing has caused the Gold Miners Bullish Percent Index to move up once again for a few days. It then declined once again. We saw something similar also this time. In this case, this move up took the index once again to the 100 level, while in 2016 this wasn't the case. But still, the similarity remains present.

Back in 2016, when we saw this phenomenon, it was already after the top, and right before the big decline. Given the situation in the USD Index, it seems that we're seeing the same thing also this time.

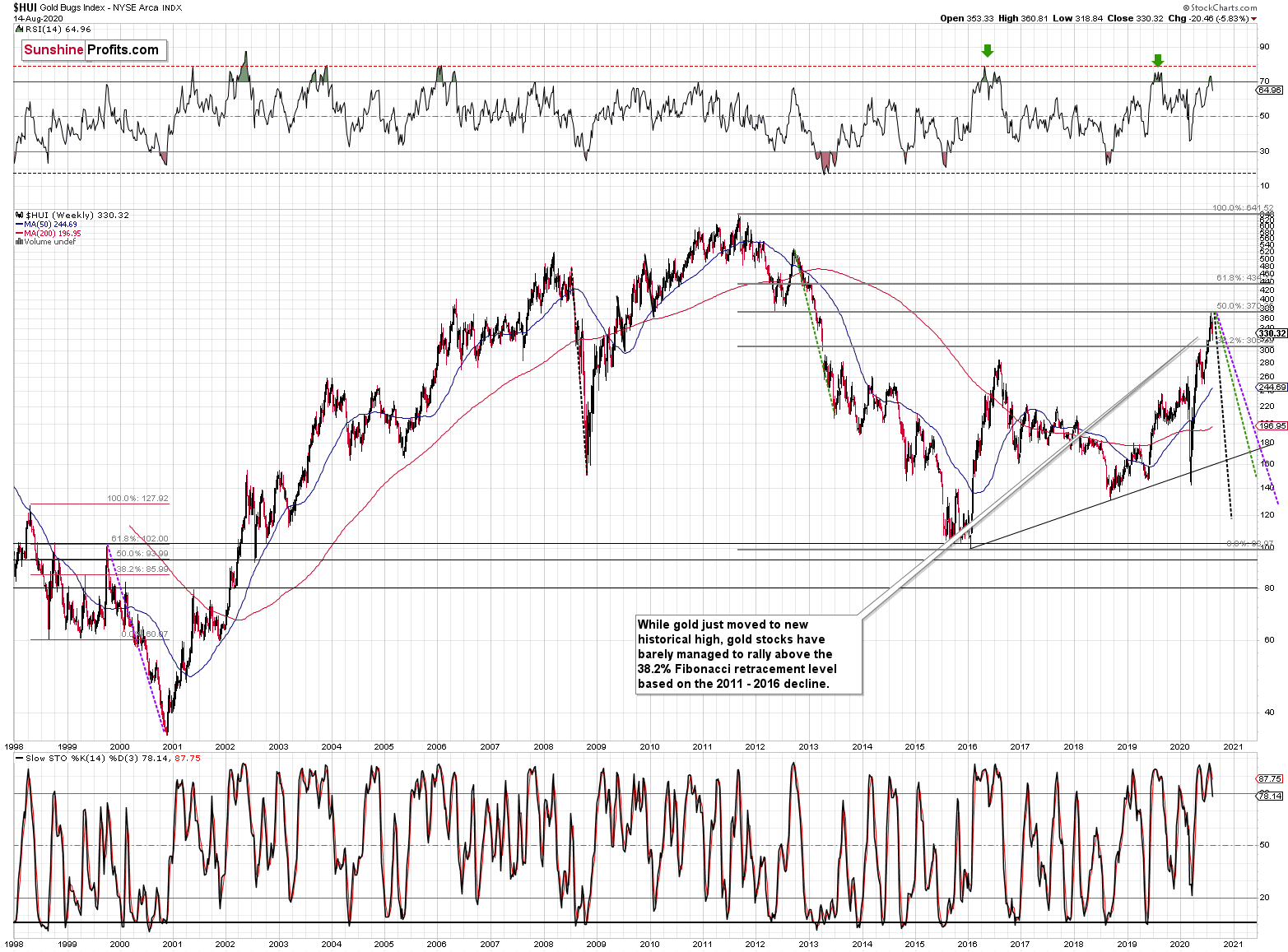

Please note that back in 2016, after the top, the buying opportunity didn't present itself until the Gold Miners Bullish Percent Index was below 10. It's currently above 70, so it seems that miners have a long way to go before they bottom.

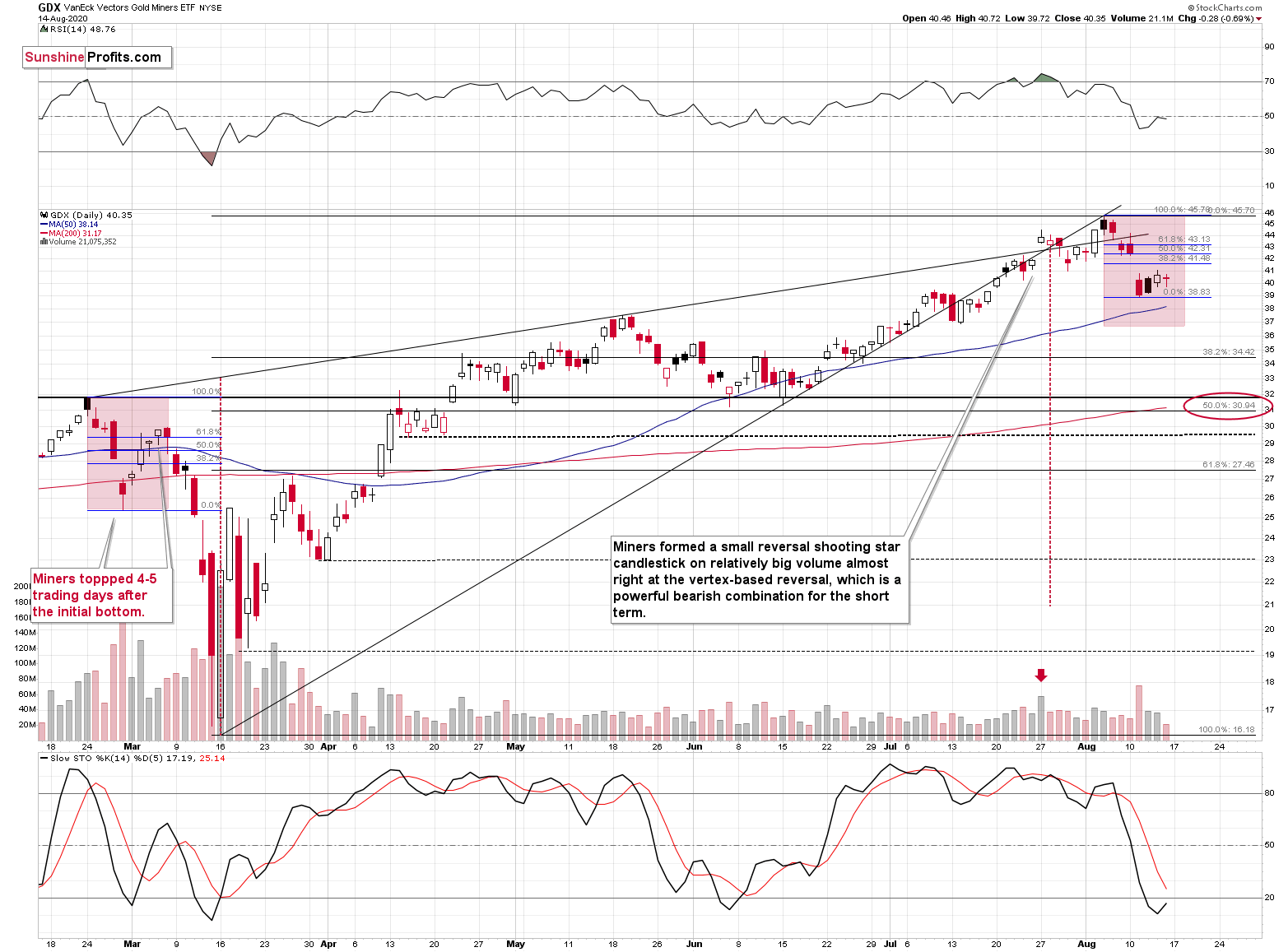

Gold stocks declined significantly last week, after which they paused. Their performance is weaker than it was in early March, but this can be explained by smaller size of gold's rebound.

Back in March, gold moved back to its previous highs (in fact it moved slightly above it) before topping and right now, it's consolidating lower. Still, we should keep in mind that there's also the possibility that gold won't repeat the March performance to the letter and history will rhyme instead.

Consequently, it might be more useful to monitor the market for signs of weakness and to pay extra attention to the time factor.

After all, time is more important than price; when the time is right, the price will reverse.

Back in February, it took 4 days after the top for the miners to form their initial bottom and we saw the same thing also this time.

Back then, it then took 4 (closing prices) or 5 (intraday extremes) trading days for the miners to top. Today will be the 4th trading day after the bottom, so if the history is to repeat itself with regard to time, miners might form the final top today or tomorrow. This would be in tune with where the general stock market is trading right now. It's so close to its previous high that it could easily break to new highs and then invalidate this breakout today or tomorrow.

If gold does indeed rally to the previous highs or even moves slightly above them, we don't expect miners to do the same thing. In fact, we think that they would be likely to top close to the 61.8% Fibonacci retracement level (at most) - at about $43.

The downside target for the mining stocks is very far from the current price. However, if the stock market declines significantly once again, miners can indeed fall far, even if gold declines by "only" a couple of hundreds of dollars.

We marked also an interim price target that's based on a few other techniques, with a red ellipse - at about $31 - $32. One of the techniques is the 50% Fibonacci retracement level based on the March - August rally, and the other two are the February high, and the May and June lows. That's also where - approximately - we have the 200-day moving average. The latter is not particularly strong in case of the GDX ETF, so we wouldn't say that it creates any significant support on its own, but it serves as a good confirmation of the other techniques.

Let's turn to metals themselves.

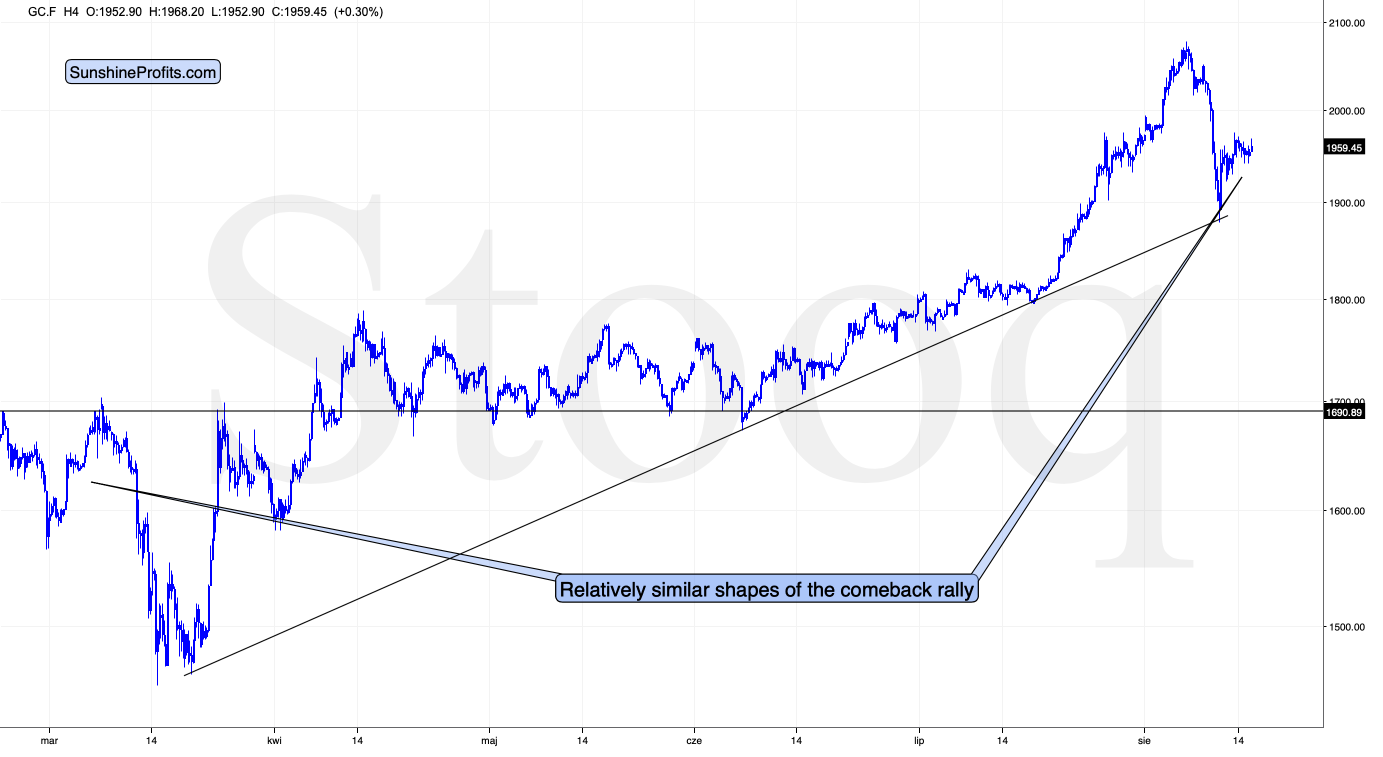

Gold's performance continues to be very similar to what happened in early March and the 4-hour candlestick chart shows the details.

Right after the bottom, we saw a sharp - and limited - rebound in both cases: in early March and right now. What happened next in March, was a small decline that was then followed by a sharp rally. We saw more or less the same thing this time, the difference being that now, the current immediate-term move is not huge. It could easily be the case that this move higher is not big yet, and the similarity-based rally unfolds later this week.

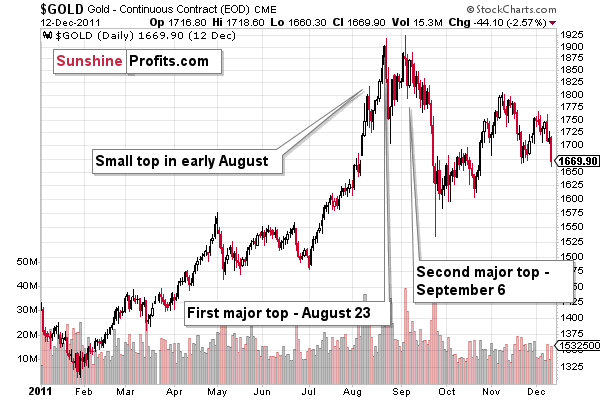

The continuation of the pattern would likely lead to a re-test of the previous highs (or at least to a move above $2,000), and perhaps a tiny move above them. Let's keep in mind that it's not only the similarity to the first quarter of this year suggests this kind of topping pattern, but also the analogy to how gold topped in 2011.

On the above chart you can also see that the pace at which gold corrected upward before the final (second) top, was slightly smaller than the pace at which gold declined from the first top. Consequently, seeing this kind of action right now is not a reason to be concerned. Even if gold moves slightly above the previous 2020 high this week, the short-term outlook would likely remain bearish.

The next support is at $1,700, which is where - approximately - gold topped and bottomed multiple times earlier this year.

The $1,700 level is additionally confirmed by the 61.8% Fibonacci retracement based on the entire 2015 - 2020 rally.

There's also possibility that gold would decline to the $1,500 - $1,600 area or so (50% Fibonacci retracement and the price level to which gold declined initially in 2011), but based on the size of the recent upswing, we no longer think that this scenario is the most likely one.

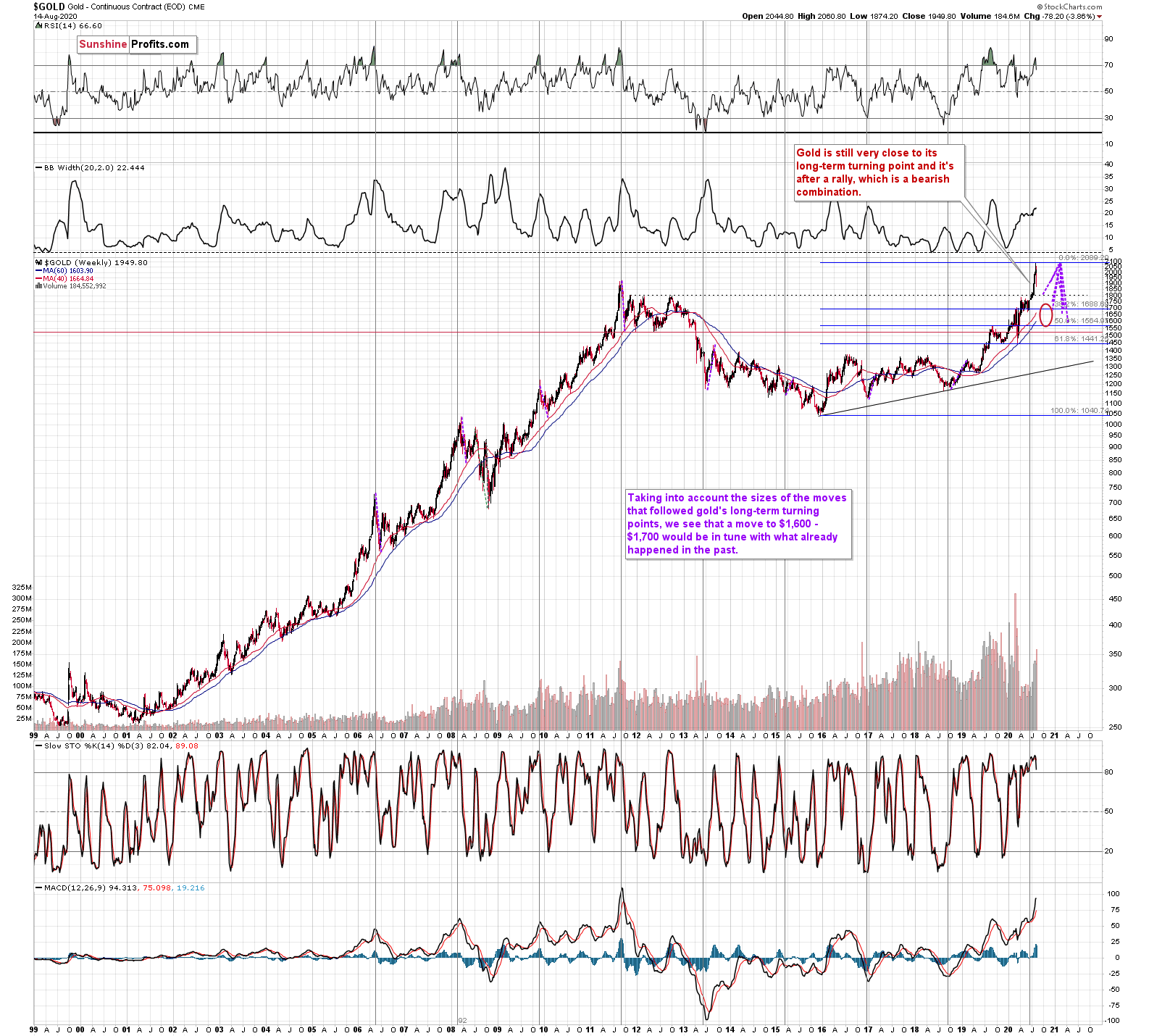

Gold's very long-term turning point is here and since the most recent move has definitely been to the upside, its implications are bearish.

We used the purple lines to mark the previous price moves that followed gold's long-term turning points, and we copied them to the current situation. We copied both the rallies and declines, which is why it seems that some moves would suggest that gold moves back in time - the point is to show how important the turning point is in general.

The big change here is that due to gold's big rally, we moved our downside target for it higher. Based on the information that we have available right now, it seems likely that gold will bottom close to the $1,700 level. That's very much in tune with how much gold moved after the previous long-term turning points.

Also, while we're discussing the long-term charts, please note the most important detail that you can see on the gold, silver, and mining stock charts, is hidden in plain sight. Please note how much silver and miners rallied.

The analogy to the price moves after the previous turning points didn't change, but since the starting point is much higher, the downside target is also higher.

Speaking of upside targets, two weeks ago, we wrote the following:

Based on gold's Fibonacci extensions and the previous major highs and lows (the 2018 high and late-2019 low along with the 2020 low), we get a nearby upside target of $2085. At the moment of writing these words, gold is trading at $2044. Given this week's volatility, it could even be a matter of hours before gold reaches the above-mentioned target and reverses. Taking closing prices into account, gold is up by $35, so if it reverses significantly, we would be likely to see a powerful weekly reversal candlestick and one that causes gold to decline in the following weeks.

That's more or less what happened. Gold topped at $2,089.20. It then declined quite visibly and closed last week at about $1,950.

And what about silver?

While gold moved to new highs, silver - despite its powerful short-term upswing - didn't manage to correct more than half of its 2011 - 2020 decline.

We see something similar in the HUI Index. The latter corrected half of its 2011 - 2016 decline and nothing more, while gold moved well above its 2011 high.

All in all, it's mostly gold that is making the major gains - not the entire precious metals sector.

Moving back to silver's forecast, it's good to note that the time the current rally is taking, is still very similar to the time that the final part of the 2016 run-up took. The current move is bigger, but in terms of time, they are still very alike. This adds to the bearish implications of the situation in the USD Index and gold miners' extremely overbought condition that we saw recently.

Overview of the Upcoming Decline

As far as the current overview of the upcoming decline is concerned, I think that after bottoming temporarily at about $1,900, gold, silver and miners will bounce back at least above $2,000 and perhaps even to or slightly above the previous highs. Then we will probably see another - bigger - move lower. The latter would likely be triggered by a visible upswing in the USD Index and / or the invalidation of the breakout in the U.S. general stock market.

During this final part of the slide, we would expect silver to decline more than miners. That would be in tune with how the markets initially reacted to the Covid-19 threat.

The impact of all the new rounds of money printing in the U.S. and Europe on the precious metals prices is very positive in the long run, but it doesn't make the short-term decline unlikely. In the very near term, markets can and do get ahead of themselves and then need to decline - sometimes very profoundly - before continuing their upward march.

We previously wrote that gold might (it was not likely, but we were mentioning this as one of the possibilities) even end its decline at about $1,900, but this is now quite unlikely. The reason is that gold already declined to this level, even though the USD Index's rally didn't really start just yet. So, when the USDX does indeed soar, gold would be likely to decline more.

Summary

Summing up, it seems that after reversing $4 above our upside target, gold has finally topped. The opposite appears likely in store for the USD Index from the medium-term point of view, however, it seems that the short-term (triple)bottom is still being formed. While I can't rule out a situation in which the PMs and miners move higher one final time before plunging (in fact, it's likely in my view), it seems that regardless of this move, the outlook for the next few weeks for the mining stocks is very bearish.

Naturally, everyone's trading is their responsibility, but in our opinion, if there ever was a time to either enter a short position in the miners or to increase its size if it wasn't already sizable, it's now. We made money on the March decline and on the March rebound, and it seems that another massive slide is about to start. When everyone is on one side of the boat, it's a good idea to be on the other side, and the Gold Miners Bullish Percent Index literally indicates that this is the case with mining stocks.

After the sell-off (that takes gold to about $1,700 or lower), we expect the precious metals to rally significantly. The final decline might take as little as 1-6 weeks, so it's important to stay alert to any changes.

Most importantly - stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can't promise that it will be the case each week.

Please note that this service does not include daily or intraday follow-ups. If you'd like to receive them, we encourage you to subscribe to our Gold & Silver Trading Alerts today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager