The trade wars have escalated again. Should investors worry about them? Or should they focus on the Fed’s hawkish policy? Let’s find out what is a greater threat (or opportunity) for the gold market.

Trade Wars Are Closer…

Last week, President Trump slapped new steep tariffs on Chinese goods. He imposed 25% tariffs on almost $50 billion worth of goods (for most of them, tariffs will start on July 6). China quickly responded to such a move, announcing its own tariffs on $35 billion worth of U.S. goods. Chinese officials said in a statement:

The United States has initiated a trade war and violated market regulations, and is harming the interests of not just the people of China and the US, but of the world.

But that’s not end. On Monday, Trump has threatened China with new 10% tariffs on a whopping $200 billion worth of goods:

These tariffs will go into effect if China refuses to change its practices, and also if it insists on going forward with the new tariffs that it has recently announced.

Moreover, the EU also retaliated. The union imposed 25% tariffs on a range of $3.2 billion worth of American products, such as Bourbon whiskey, orange juice, motorcycles or jeans, starting on Friday. The EU officials said in a statement:

We did not want to be in this position. However, the unilateral and unjustified decision of the U.S. to impose steel and aluminum tariffs on the EU means that we are left with no other choice.

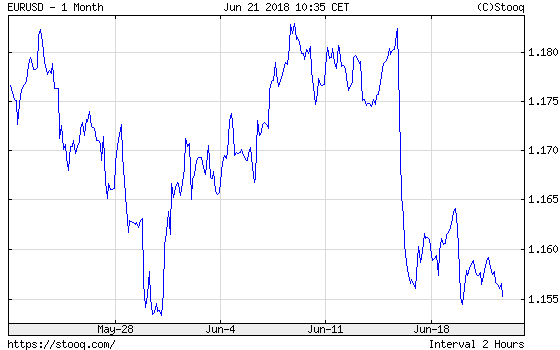

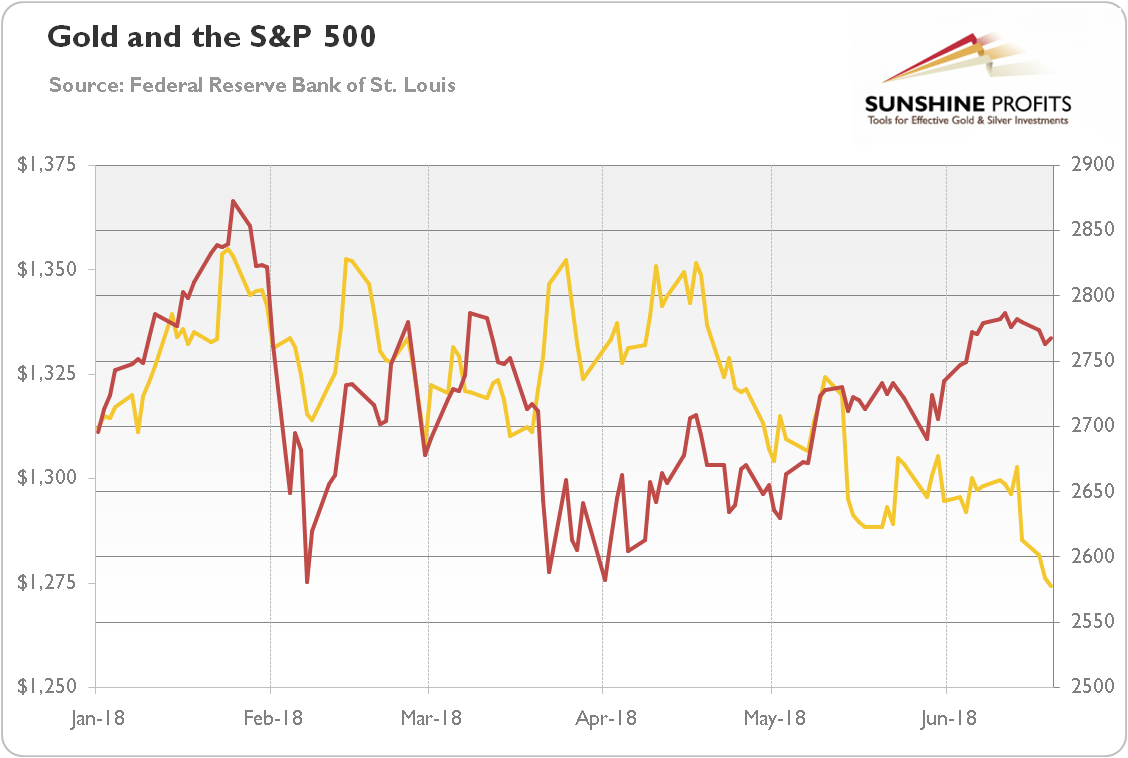

Trump’s tariffs triggered fresh worries about full-blown trade wars. The markets rattled. The commodities and Treasury yields fell. The greenback rose against the euro, while the U.S. stock market dropped, as one can see in the charts below.

Chart 1: EUR/USD exchange rate over the last month.

Chart 2: Price of gold (yellow line, left axis, London P.M. Fix, in $) and S&P 500 (red line, right axis) in 2018.

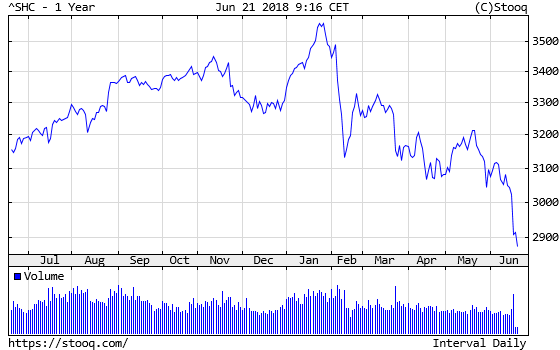

However, it was China’s economy that was hurt the most. The yuan depreciated, while the Shanghai stock market plunged to its lowest numbers in two years, as the next chart shows.

Chart 3: Shanghai Composite Index over the last year.

Gold’s reaction is quite puzzling. There was a flight to safety, as the U.S. dollar rose (and Treasury yields declined), but – as the Chart 2 shows – the price of the yellow metal dropped below $1,280. Gold’s weakness in the face of global turmoil and investors’ worries is rather bearish and it could not be fully justified by the greenback’s strength.

It seems that the sell-off in gold was caused by the widespread liquidation across the commodities. You see, the Chinese tariffs are imposed mainly on commodities and it’s possible that traders adopted a “sell first, ask questions later” approach to the news, selling everything related to commodities, even precious metals. It could imply that the recent weakness in gold would be temporary, as investors should calm down after a while. However, there is one problem: the Fed.

…While the Fed Is Increasingly Hawkish

The trade disputes between China and the U.S. are in the headlines again. However, we consider them a big bluff, or a show to please the voters. Surely, some companies or even sectors will be significantly hit, but the overall impact on the global economy should be minor.

The Fed’s increasingly hawkish stance could be much more problematic, especially that the investors seem to underestimate the gravity of the recent developments in central banking. We mean here that the FOMC members see four, not three, hikes in 2018 overall. And the Fed also removed the assurance that “the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run”. Moreover, just one day later, the ECB also adopted a more hawkish stance, announcing the end of quantitative easing in December. It looks like coordinated action with aim to end the era of ultra low interest rates and normalize monetary policy.

Implications for Gold

Trade wars should be theoretically positive for the gold prices. However, they supported the greenback, which put downward pressure on the yellow metal. Additionally, the sell-off in commodities hit precious metals. Moreover, the recent hawkish ECB and Fed’s decisions to normalize their monetary policies reduce the attractiveness of gold as an inflation hedge which protects investors against the monetary madness of central banks. It implies that, in the medium term, gold investors should worry more about the Fed.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview