It looks like the calm in the currencies is drawing to a close and volatility is about to pick up. So far, so good. We're at a crossroads these days: after a recent string of declines, the USD appears to be catching a bid. This is not without repercussions and a move either way will be profoundly felt across the markets. But which way that move will be? Read on to find out - and also get positioned accordingly.

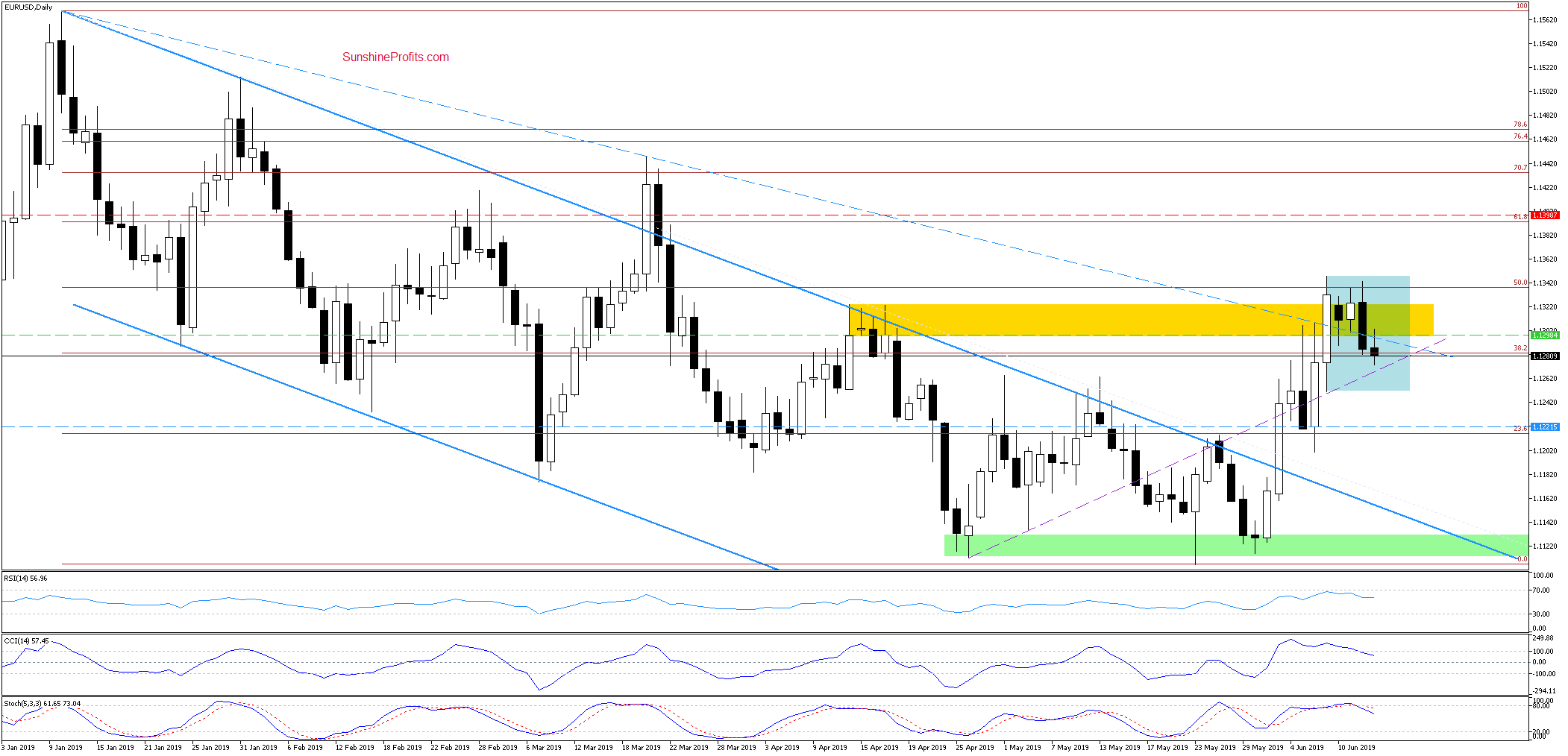

EUR/USD - The Bearish Momentum Is Picking Steam

While EUR/USD attempted to move higher yesterday, the proximity to the upper border of the blue consolidation encouraged the sellers to act. The pair has been unable to overcome last week's highs and sharply reversed lower.

Earlier today, the bulls tried to recoup some of yesterday's losses, but have failed again. Coupled with the sell signals of all daily indicators, the probability of a larger upcoming move to the downside remains high and the profitable short position is therefore justified.

The first objective for the bears will be the lower border of the blue consolidation. German CPI data failed to help the bulls meaningfully and the bearish momentum looks about to accelerate in the coming days.

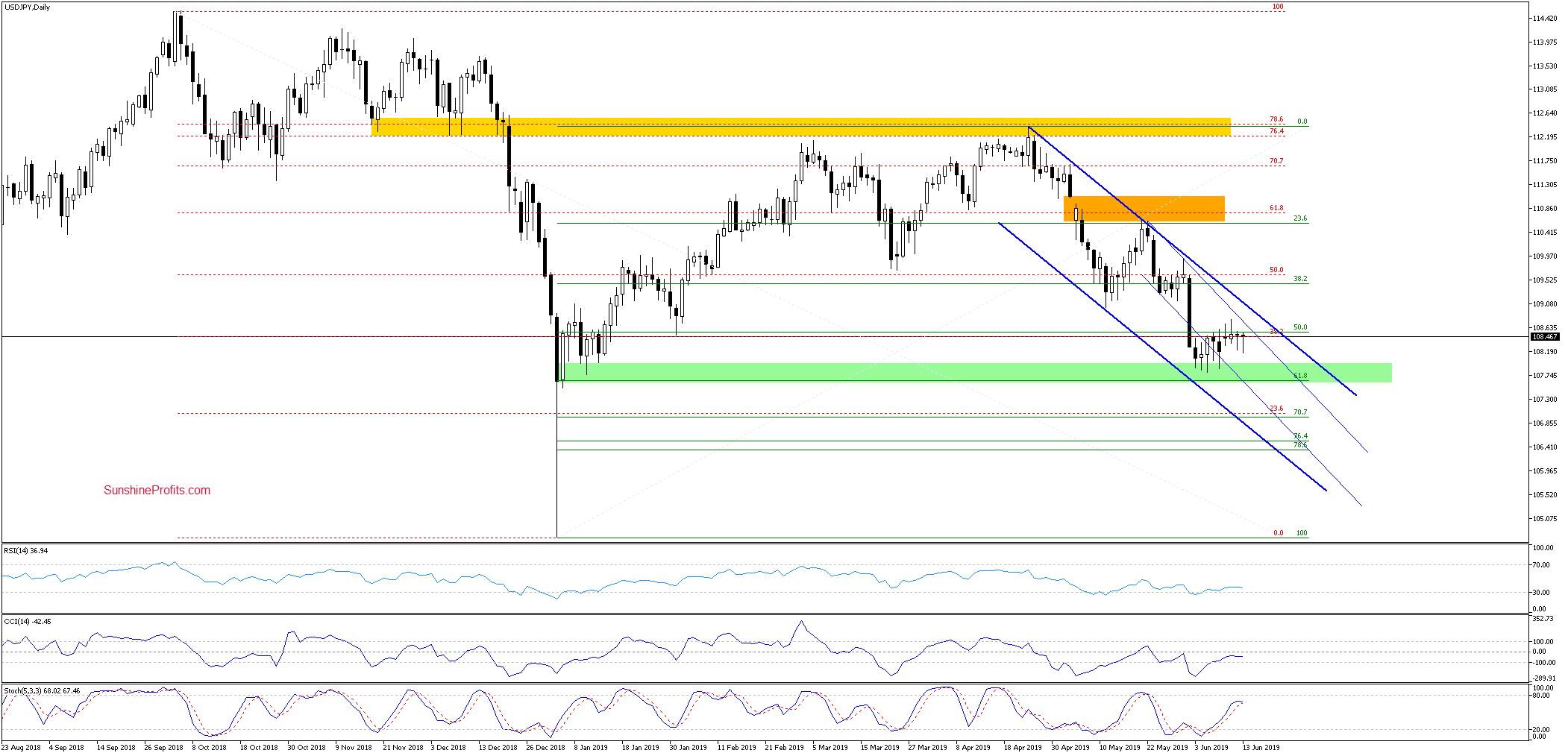

USD/JPY - More of the Same

USD/JPY situation hasn't changed much in recent days. The pair is still trading in a narrow range inside the thin declining blue trend channel. The rebound from the green support zone remains on.

While the Stochastic Oscillator has moved higher, it hadn't issued any sell signals yet. One more move to the upside and a test of the upper border of the declining thin blue trend channel, or even a climb to the upper border of the thick declining blue trend channel can't be ruled out in the coming days.

Then, the Stochastics would be in a more extended position. Compared with its positioning right now, its upcoming sell signal would be more reliable by itself. For now, it doesn't indicate any change of our positions in this pair.

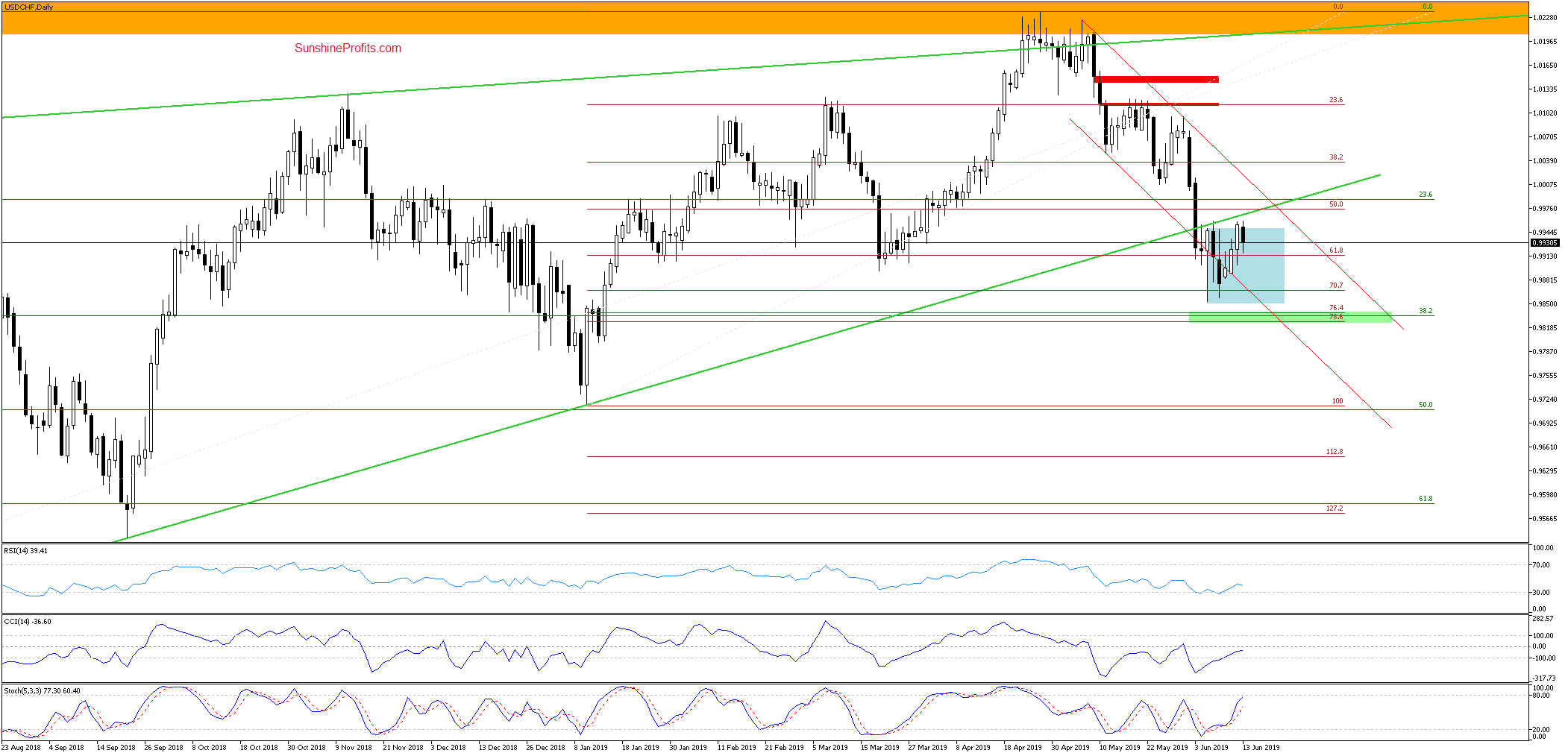

USD/CHF - the Upswing May Not Be Over Yet

USD/CHF has dropped below the lower border of the rising green wedge in the previous week, however the 70.7% Fibonacci retracement triggered a rebound. This means invalidation of the earlier breakdown below the lower border of the declining red trend channel.

The pair went on to test the upper border of the blue consolidation and approached the previously-broken lower border of the green wedge yesterday. Its vicinity triggered a pullback earlier today.

Daily indicators haven't though issued any sell signals yet. This hints at one more upswing being likely.

Summing up the Alert, EUR/USD looks to be about picking steam on its journey south. Neither the GBP/USD bulls have made much progress. AUD/USD keeps experiencing lower and lower values. The bearish momentum in these three pairs keeps reasserting itself after the bulls demonstrated the difficulty in overcoming nearest resistances. It bodes well for seeing lower values ahead - in each of the above pairs. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Forex Trading Alerts to also benefit from the trading action we describe. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up for the free newsletter today!

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care