Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

Gold Price in October 2019

September 30, 2019, 8:12 AM

In the previous weeks we've been featuring multiple factors that are likely to usher in a sizable gold, silver and mining stocks' moves. Has the very recent downswing been the opening act? The USD Index closed flat on Friday, yet the metals declined across the board. The gold to silver ratio presents us with a highly interesting perspective to say the least. Can you say a meaningful clue of upcoming price action?

-

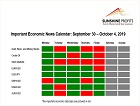

Important Economic News Calendar: September 30 - October 4, 2019

September 30, 2019, 6:10 AM

The U.S. Consumer Confidence number release caused a lot of confusion for the markets on Tuesday. And it was worth paying attention to our last week's News Calendar. This week, the new quarter begins, and we will have series of important economic data announcements. So let's take a look at these possible market-moving events.

-

Gold, Sliding Silver and Declining Interest Rates

September 27, 2019, 10:06 AM

As the Fed turned dovish this year, not only did the short-term interest rates move down - the long- and very-long-term ones also declined. Why would this be the case? After all, the long-term rates are set by market forces, not through Fed's direct decision... Did gold and silver act on that signal by declining this week? They're testing this month's lows and silver's outperformance indeed didn't last as the white metal is leading the way lower. It's already more than $2 below its September high and it begs the question whether the interest rate signal will continue playing out in the following months.

-

Will Gold Benefit from Trump Impeachment Proceedings?

September 26, 2019, 7:15 AM -

The World Fell into Debt Trap. Will Gold Help?

September 25, 2019, 8:58 AM

The global debt as a percentage of the GDP has increased from around 100 percent in 1950 to almost 200 percent in 2007 and to 225 percent in 2017. The world is more indebted than it was when the global financial crisis burst. Isn't this economic madness? We invite you to read our today's article about the debt trap and find out what it means for the gold market.

-

The Repo Liquidity Crunch Reveals Market Stress. Will Gold Shine?

September 24, 2019, 6:33 AM -

Did Gold and Silver Just Invalidate Their Short-Term Breakdown?

September 23, 2019, 7:20 AM

Friday's session brought us an informative sign for the precious metals. This development took place in the USD, as the world reserve currency initially declined only to reverse and close higher. Interestingly, the precious metals sector didn't react with a decline. Gold, silver and miners all closed higher, so this question naturally follows - what can we make of their upswing? Let's explore how the short- and long-term are affected exactly.

-

The Important Economic News Calendar: September 23 - September 27, 2019

September 23, 2019, 6:13 AM -

Gold among Negative-Yielding Bonds

September 20, 2019, 5:52 AM -

The Many Opportunities the Fed Day Has Dealt Us

September 19, 2019, 10:04 AM -

Fed Cuts and Gold Drops. Again

September 19, 2019, 6:59 AM -

Rising Miners, Gold and Countdown to the Fed

September 18, 2019, 6:44 AM

Both gold and silver moved higher yesterday but it were the miners that spiked. Looking at the last few sessions, have these moves changed anything? The FOMC releases its decision today, the markets are hesitating to move and it's nothing surprising. It is usually the case on Fed days (and around them) that we see increased intraday volatility that doesn't necessarily mean anything. Does it describe today's situation also?

-

Gold Spikes on the Saudi Oil Attacks: Can It Last?

September 17, 2019, 8:05 AM -

Will Draghi's Swan Song Revive the Eurozone? And Gold?

September 13, 2019, 7:52 AM -

Oil Reversed on Schedule. Then, Prices Just Collapsed

September 12, 2019, 9:54 AM

Yesterday's session gave us a resolute follow-up to Tuesday's reversal. Price sliding like there is no tomorrow, the bears keep pushing even lower today. Not a bit lower, but very much so lower. As black gold is trading at around $54.20 as we speak, is it time to look for the exit door in our promising open short position?

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts