Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

The Many Aligning Signals in Gold

October 14, 2019, 9:51 AM -

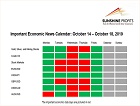

Important Economic News Calendar: October 14 - October 18, 2019

October 14, 2019, 7:40 AM

The markets basically ignored the Fed talk last week, as U.S. - China trade war developments stole investors' attention away from the scheduled news releases. But it was worth paying attention to our last week's News Calendar that highlighted U.K.'s economic data preceding end of week GBP rally. This week, we will have some potentially moving news releases too. So let's take a look at those events.

-

The USD Index: Having Reached Important Supports, It's Primed for Upswing Now

October 11, 2019, 7:42 AM -

The Fed Grows Concerned - Should Gold Investors Do the Same?

October 10, 2019, 8:23 AM -

The Allure of Upswings in Miners and Silver

October 9, 2019, 7:49 AM

The entire precious metals sector rallied yesterday, but the upswing was particularly visible in case of silver and (especially) mining stocks. Both: silver, and miners moved to new October highs. Silver's breakout was tiny, but miners rallied relatively significantly and that's the part of the current long trade that's particularly profitable. Of course, these profits are near to nothing compared to what's likely ahead in case of the big short trade that we plan to profit on in the following months, but they add their part to the overall results. Please note that a small long position here also means staying temporarily out of the short position, which brings the likelihood of re-entering them at higher prices.

-

Employment Data, Rate Cut Speculations and Gold

October 8, 2019, 7:24 AM -

Gold in the Negative Real Interest Rates Environment

October 7, 2019, 7:35 AM

Many believe that negative interest rates will never arrive to the United States. This can't possibly happen here. The discussions of their theoretical benefits almost remind you of the not-in-my-backyard mentality. But this is not true - they are already present in America. Hard to believe it? Hiding in plain sight, let's take it a step further and look at gold in the negative real interest rates environment.

-

Important Economic News Calendar: October 7 - October 11, 2019

October 7, 2019, 6:52 AM -

Oil Deals Us an Instantly Profitable Rebound

October 4, 2019, 6:34 AM -

The True Causes Behind the Yield Curve Inversion and Gold

October 3, 2019, 11:57 PM

By now, everyone and their brother has heard about the yield curve inversion. How come it has inverted and how much should we read into it? Is it really such a reliable indicator of an upcoming recession? Let's dig into the true causes behind the inversion and find out what its meaning for the gold market.

-

Stumbling Manufacturing and Rising Gold - Now or Later?

October 3, 2019, 7:27 AM -

When Will the Turnaround in Gold Likely Come? Implications for Silver?

October 2, 2019, 7:53 AM

In yesterday's analysis, we emphasized that even though a big decline in gold is already underway, it's likely that it won't be a straight move down and there will be periodic corrections. Moreover, we provided price targets from which the bounce could start. Based on the circumstances, it might even be a tradable move. In today's analysis, we're going to show you that there are signals suggesting that the turnaround might start relatively soon - during this month.

-

Silver’s Q4 Seasonal Outlook

October 1, 2019, 10:37 AM -

Can the Oil Bulls Succeed in Their Comeback Attempt After Yesterday's Slide?

October 1, 2019, 9:15 AM -

Is Reserve Bank of Australia a New Friend of Gold?

October 1, 2019, 7:56 AM

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts