Volatile trading is calming down, revealing several opportunities. The euro has retraced its yesterday's downswing, the Japanese yen is strengthening - just as the Canadian dollar is. Swiss franc is another currency we're keeping a close eye on. But how does it translate into our trading plans?

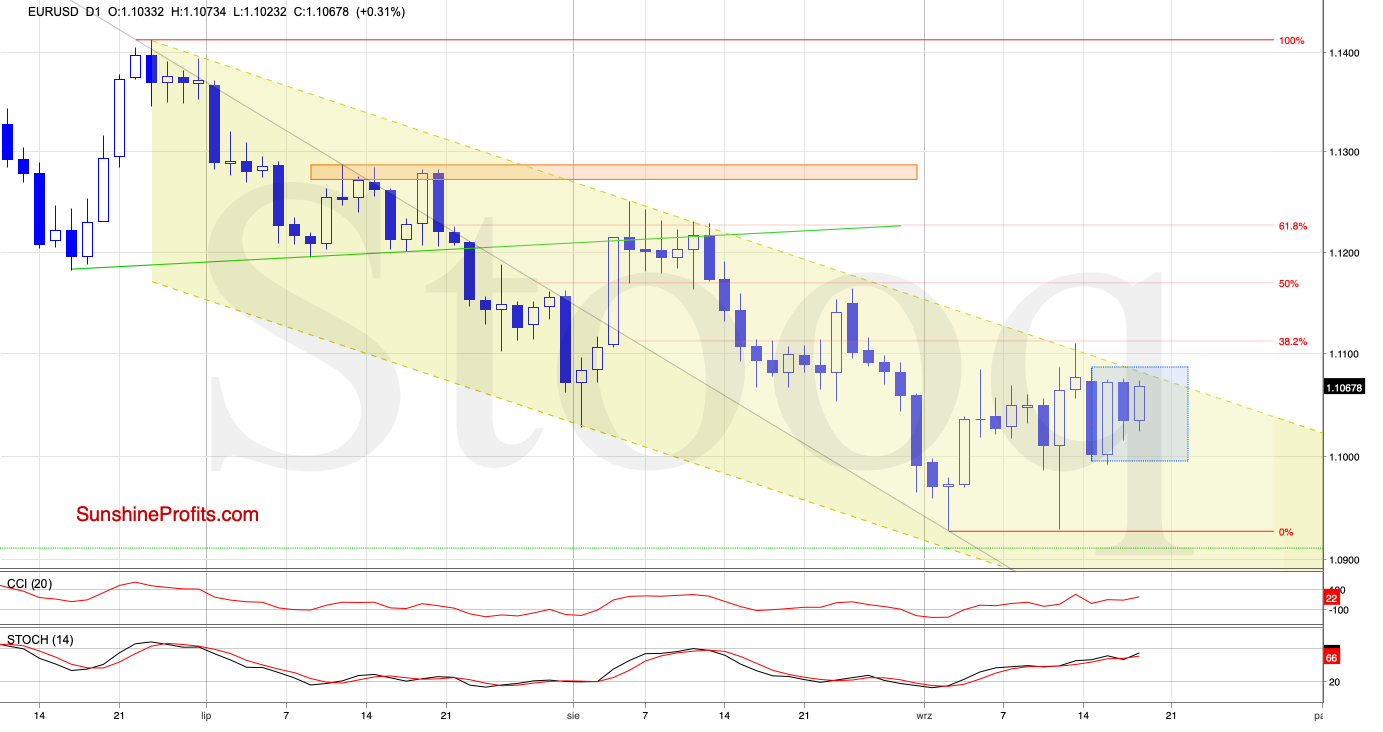

EUR/USD - Range-Bound for Now

The short term situation remains almost unchanged as EUR/USD is trading inside the blue slightly below the upper border of the yellow declining trend channel.

The buy signals remain on the cards, suggesting that we'll likely see a test of the upper border of the formation, or even of the recent high and the 38.2% Fibonacci retracement in the very near future.

Should the bulls show weakness in this area, we'll consider opening short positions.

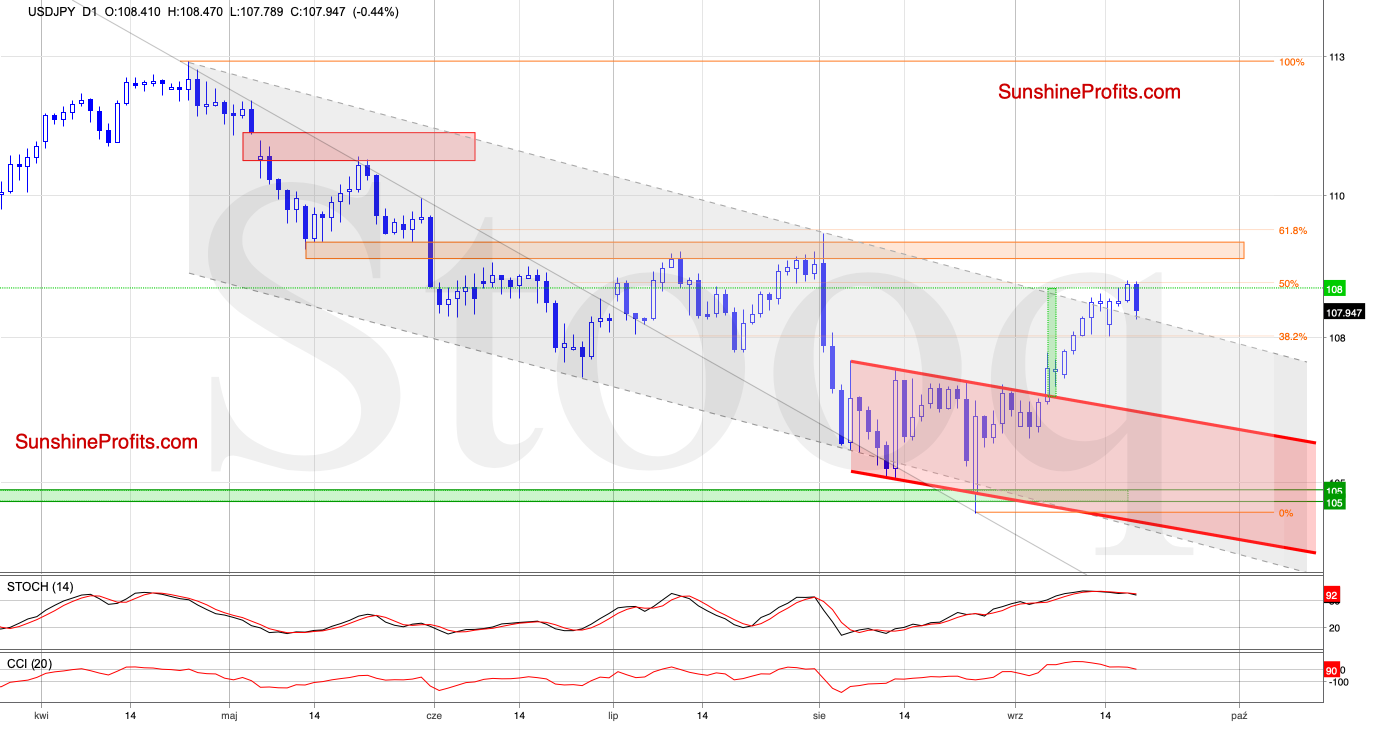

USD/JPY - About to Invalidate Its Breakout?

USD/JPY moved slightly above the 50% Fibonacci retracement during yesterday's session, but the bulls didn't manage to hold gained ground, and a pullback followed earlier today.

As a result, the pair invalidated yesterday's breakout. Coupled with the extended position of the daily indicators, it suggests that further deterioration is just around the corner. Nevertheless, a bigger downside move will be more likely and reliable only if the exchange rate closes today or one of the following sessions below the previously-broken upper border of the declining grey trend channel.

Should we see such a breakout invalidation, we'll consider opening short positions.

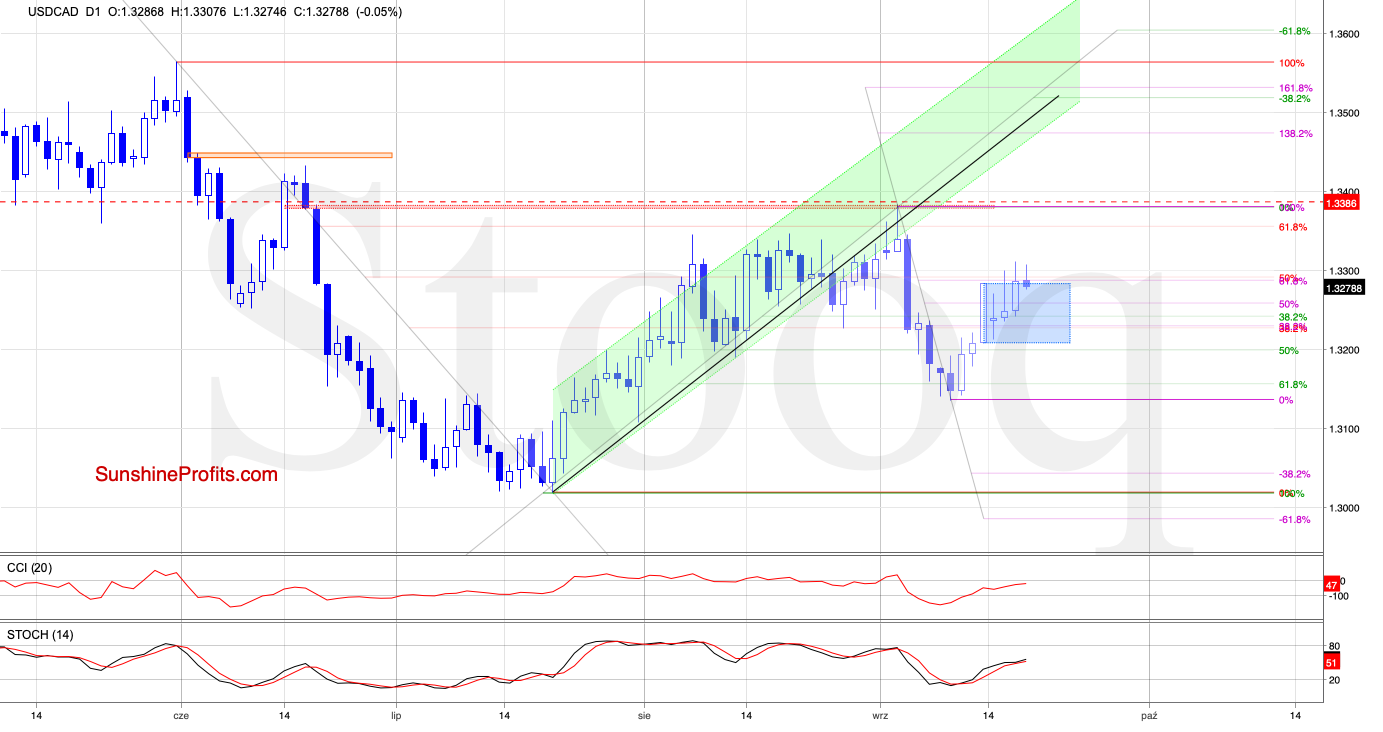

USD/CAD - Back into the Consolidation?

For the third time in a row, USD/CAD moved above the upper border of the blue consolidation and the 61.8 Fibonacci retracement based on the September decline. The buyers however didn't manage to go any higher, and a pullback followed earlier today.

This way, the pair invalidated its earlier breakouts, which increases the probability of further deterioration in the coming days. Nevertheless, a decline will be more likely and reliable only if USD/CAD closes today or one of the following sessions below the upper border of the consolidation.

Should we see such price action, we'll consider opening short positions.

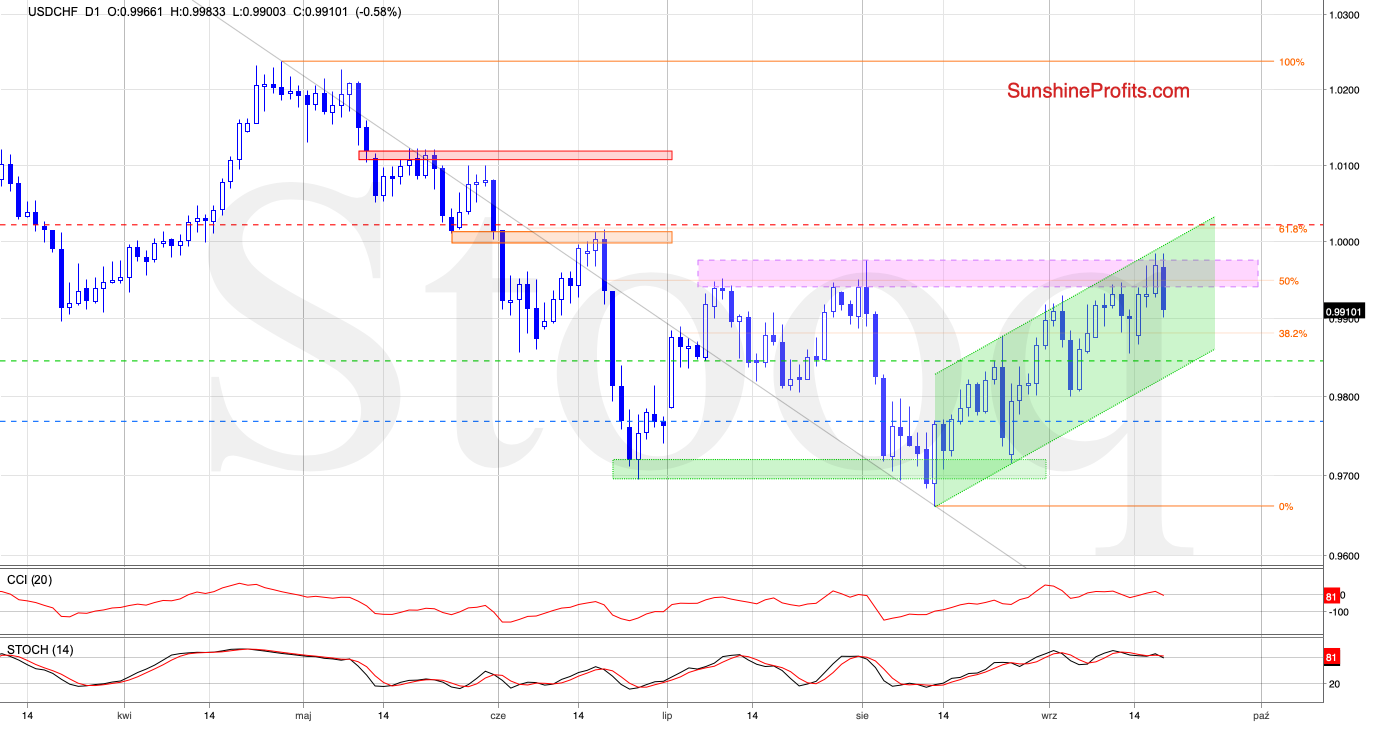

USD/CHF - Reversing Lower

Although USD/CHF extended gains in the previous days, the pink resistance zone and the proximity to the upper border of the green rising trend channel stopped the buyers.

The sellers took over, and the pair moved quite sharply lower earlier today. It suggests that further deterioration may still be ahead of us. If this is the case, we'll see at least a test of the lower border of the rising green trend channel in the following days.

Summing up the Alert, the euro keeps trading inside its recent consolidation, and the buy signals support a test of the formation's upper border, or even of the recent high and the 38.2% Fibonacci retracement. Should the buyers show weakness there, we'll consider opening short positions. USD/CHF has reversed at the pink resistance zone and the upper border of the rising green trend channel, and the short position remains justified. Should USD/JPY invalidate its breakout above the upper border of the declining grey trend channel, we'll consider opening short positions. Should USD/CAD close today or one of the following sessions below the upper border of its consolidation, we'll consider opening short positions. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Forex Trading Alerts to also benefit from the trading action we describe - the moment it happens. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. On top, you'll also get 7 days of instant email notifications the moment a new Signal is posted, bringing our Day Trading Signals at your fingertips. Sign up for the free newsletter today!

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care