Although the Australian dollar increased against its U.S. counterpart in the previous week, AUD/USD has spent recent days in the consolidation above the previously-broken resistance area. Will currency bulls be strong enough to push the pair higher in the following days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1510)

- GBP/USD: short (a stop-loss order at 1.3773; the next downside target at 1.3000)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: long (a stop-loss order at 0.7410; the initial upside target at 0.7725)

EUR/USD

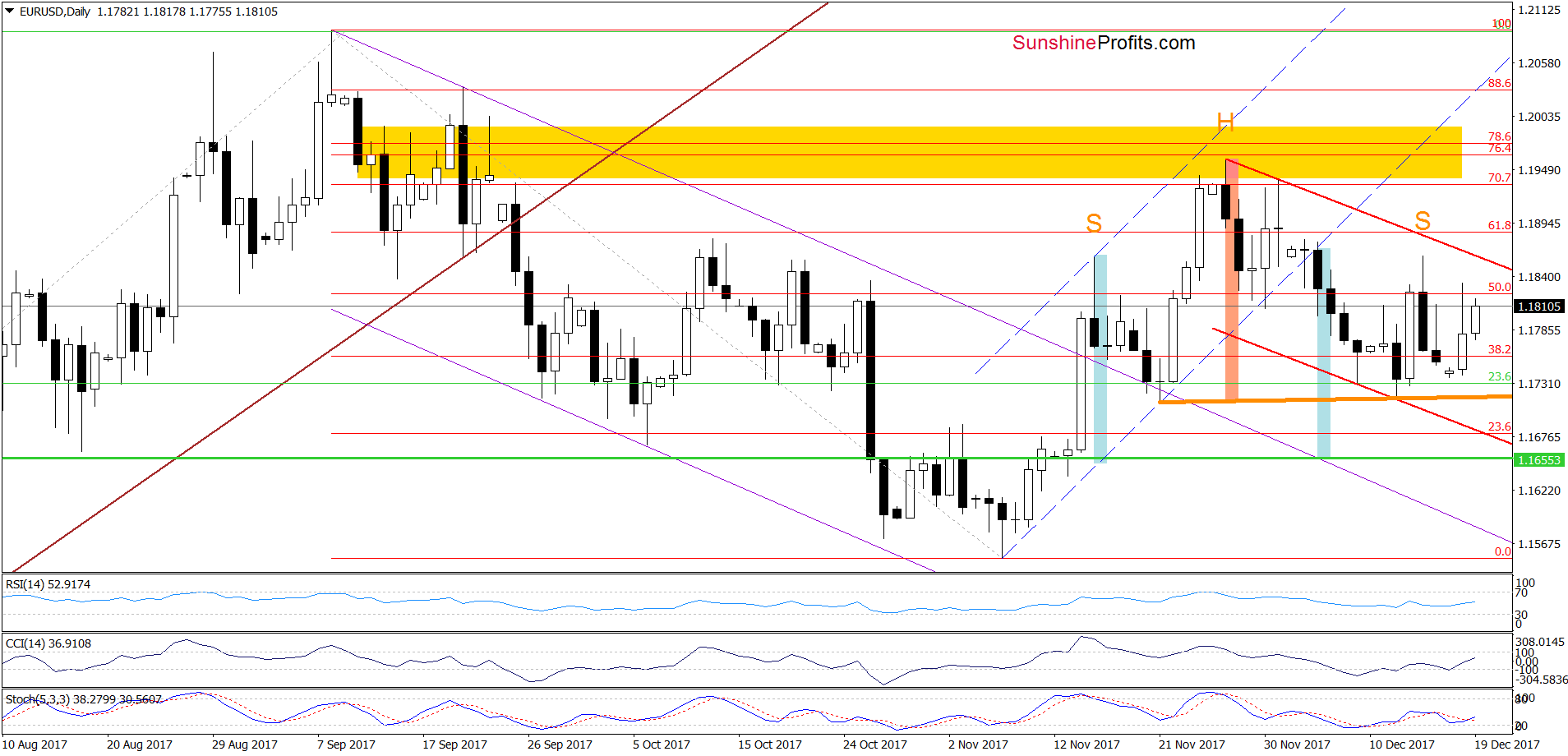

From today’s point of view, we see that although EUR/USD increased yesterday, currency bears push the pair lower and erased around 50% of earlier upswing. Earlier today, their opponents made another attempt to push the exchange rate higher, but at the moment of writing these words, the pair is still trading below Monday’s high.

This means that what we wrote yesterday remains up-to-date also today:

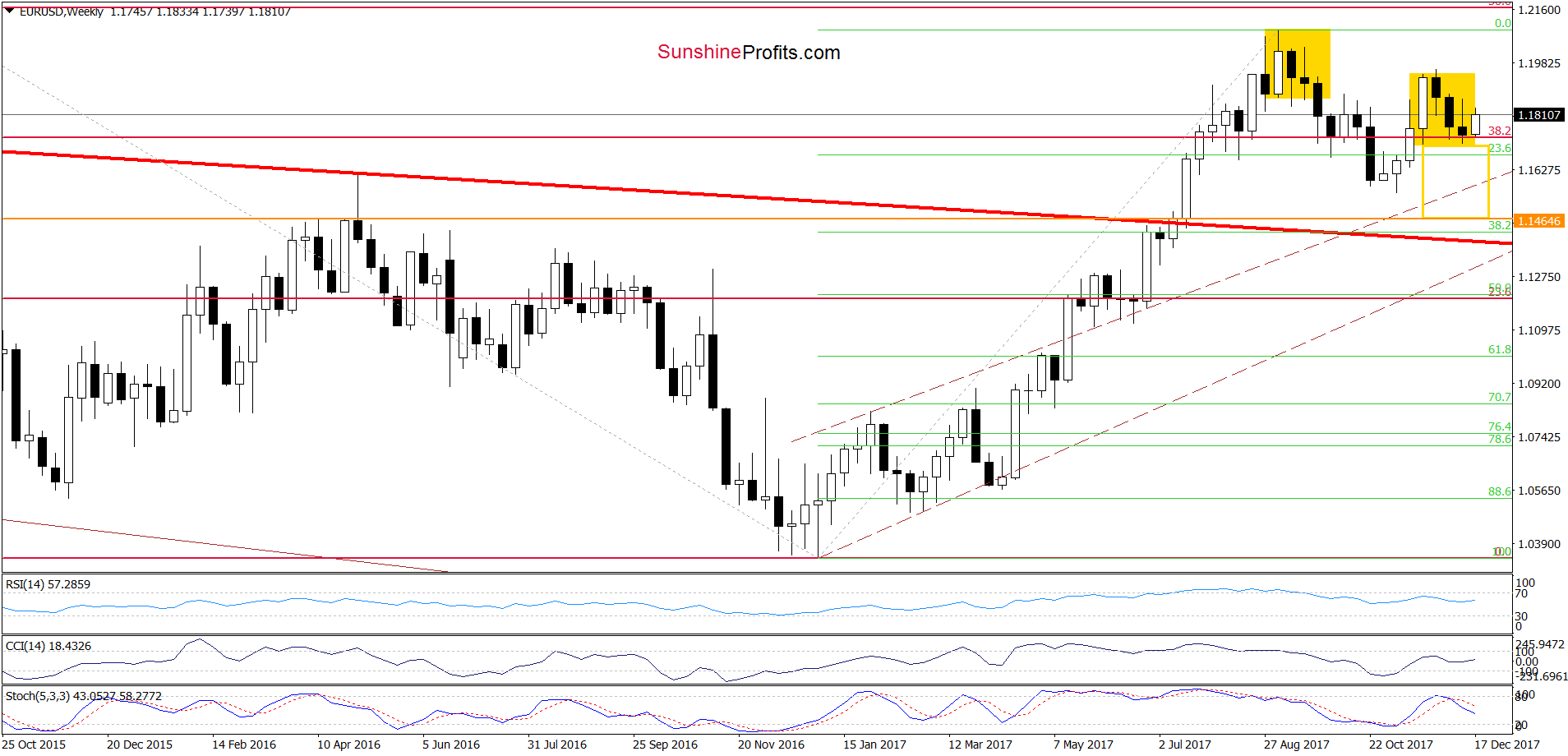

(…) at the weekly chart, we see that EUR/USD approached the lower border of the yellow consolidation in the previous week, which encouraged currency bulls to act. As a result, the exchange rate rebounded earlier today. Despite this increase, the pair remains not only in the above-mentioned yellow consolidation, but also inside the red declining trend channel.

Additionally, the sell signals generated by the medium-term indicators are still in cards, supporting currency bears. On top of that, the potential head and shoulders formation hasn’t been invalidated, which means that as long as there is no breakout above the upper border of the red declining trend channel and the last week high another move to the downside is very likely.

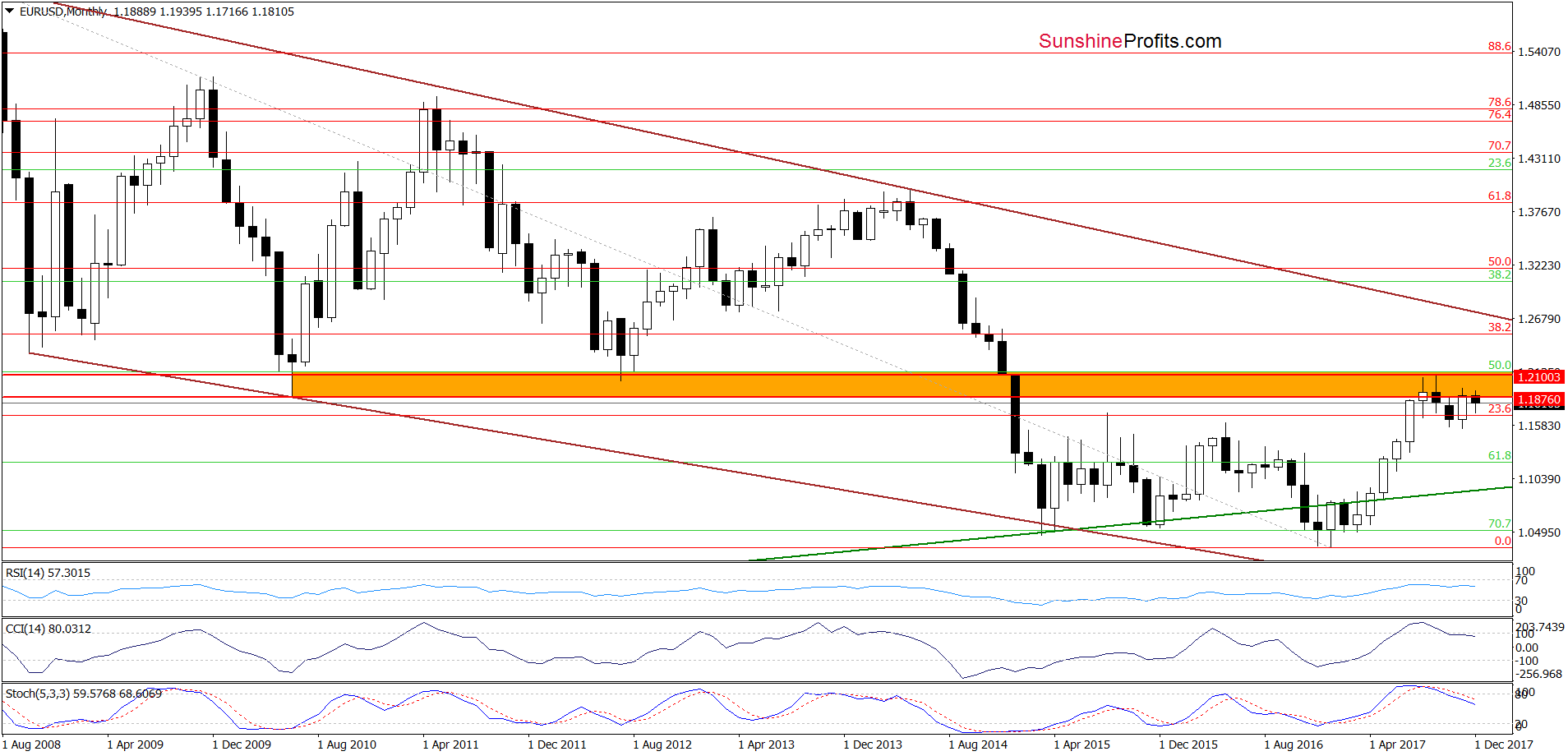

On top of that, the orange resistance zone marked on the monthly chart and the sell signals generated by the long-term indicators remain in cards, supporting currency bears and lower values of EUR/USD.

Trading position (short-term; our opinion): short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1510) continue to be justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

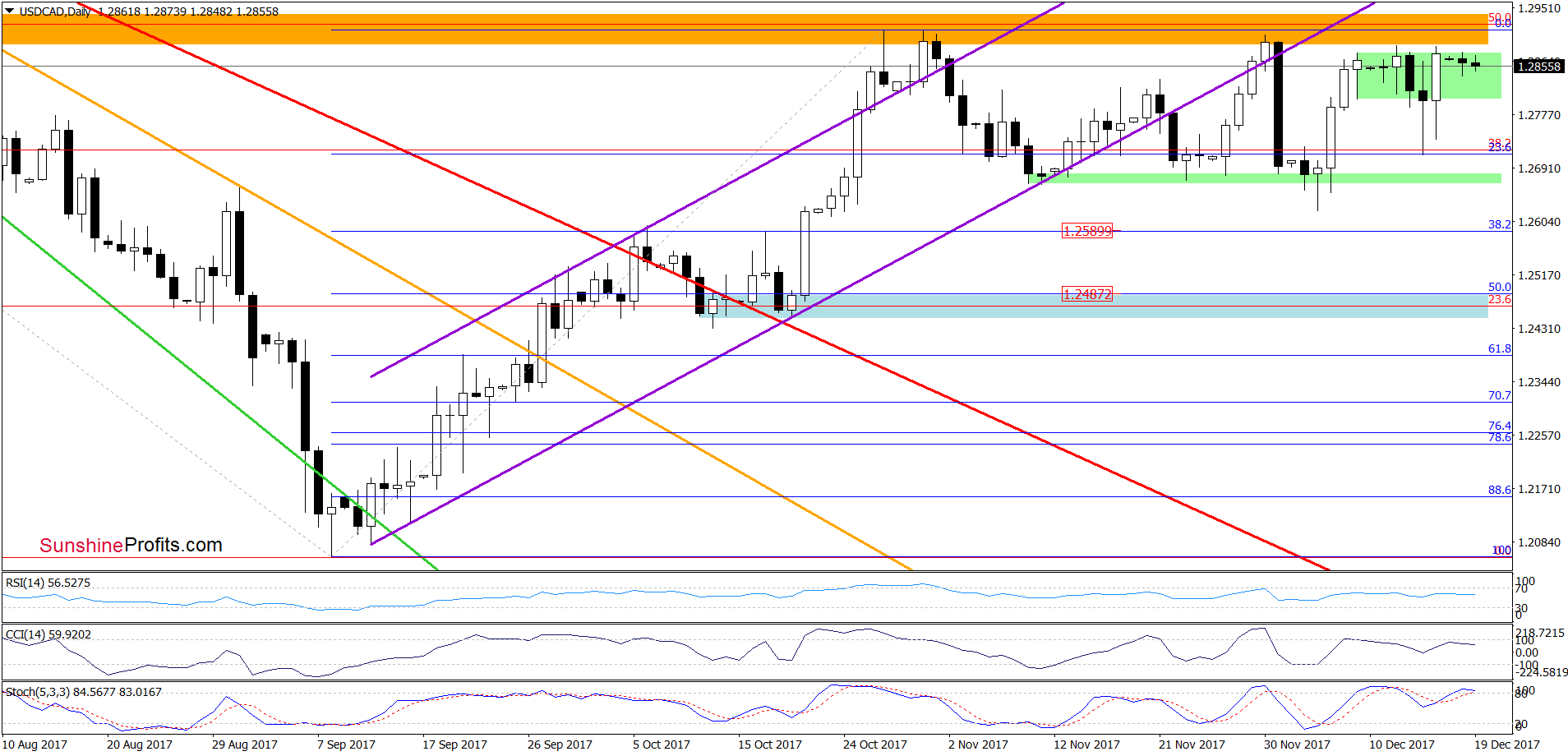

USD/CAD

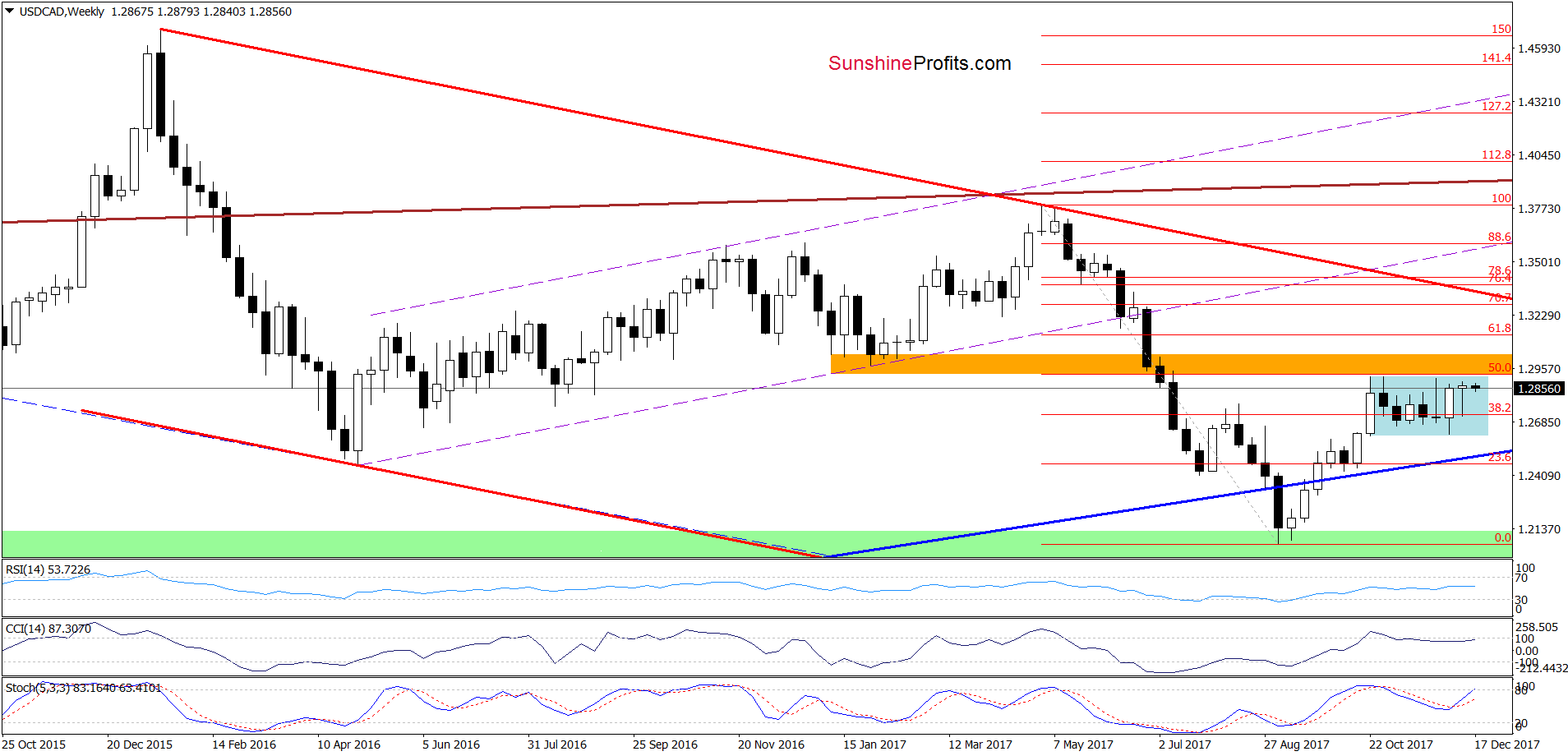

The situation in the medium term hasn’t changed much recently as USD/CAD continues its trading in a narrow rane slightly below the orange resistance zone and the 50% Fibonacci retracement.

Will the very short-term chart give us any clues about future moves? Let’s check.

On the very short-term chart, we see that although currency bears pushed the exchange rate under the lower border of the green consolidation, their opponents triggered a sharp rebound, which erased all earlier losses. This is a positive development, however, the current position of the daily indicators and the proximity to the resistance area (created by the previous peaks) suggest that the space for gains is limited and another reversal is just around the corner.

If we see a decline from current levels, we think that the pair will test the last week’s lows in the following days.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

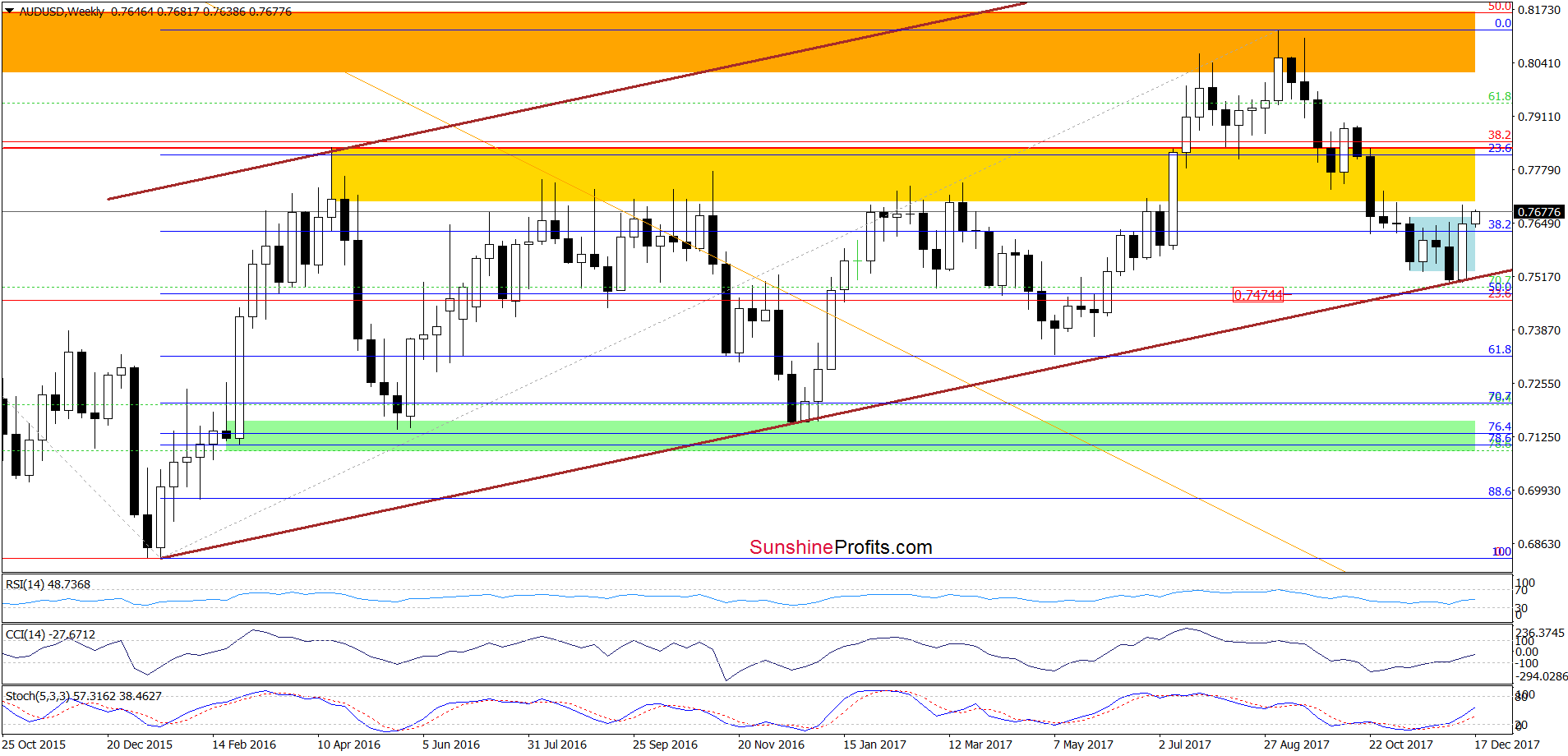

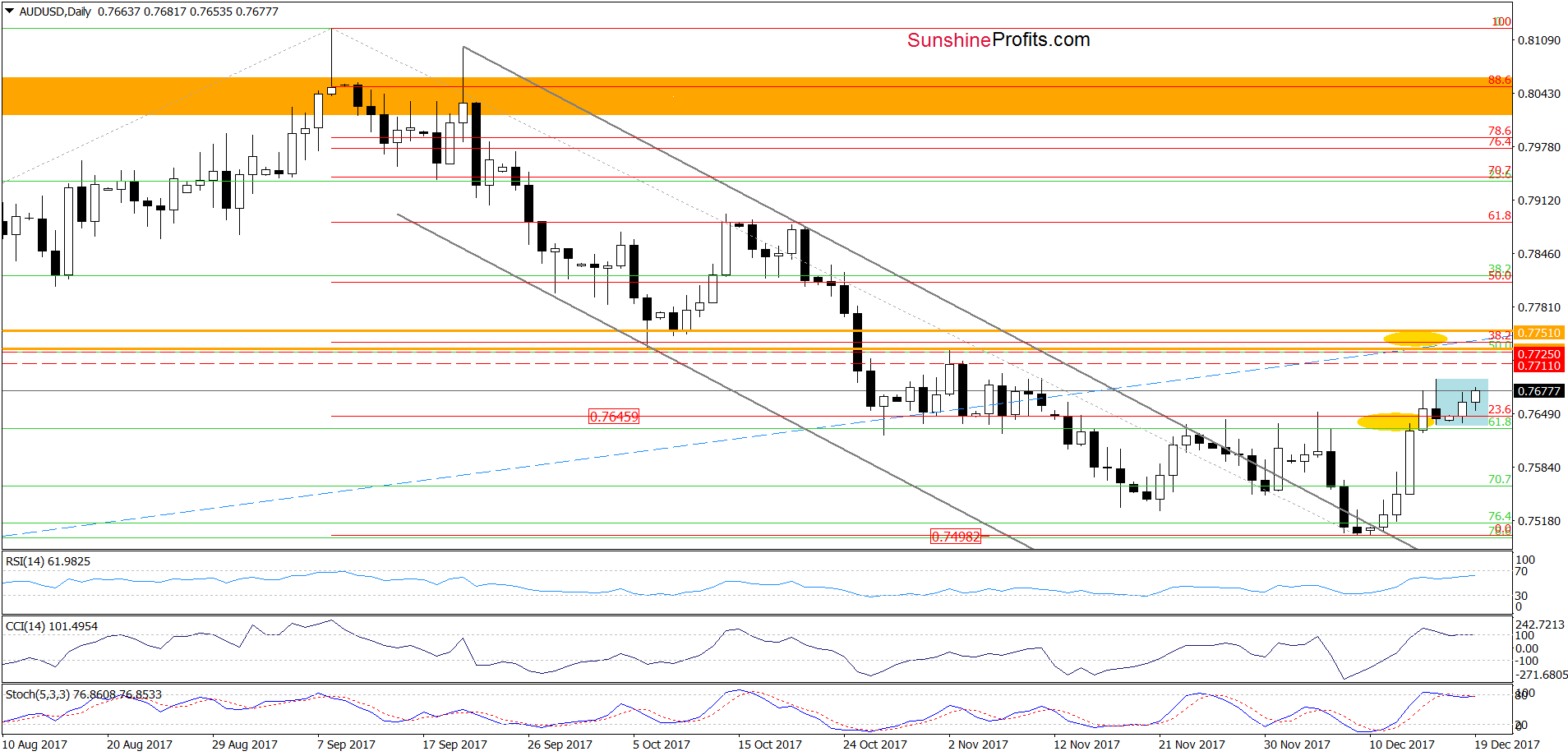

AUD/USD

Looking at the daily chart, we that the situation hasn’t changed much since Friday as AUD/USD is trading in the blue consolidation slightly above the previously-broken late-November and early-December highs. Although the exchange rate moved higher earlier today the current position of the daily indicators suggests that the space for gains may be limited.

Nevertheless, we believe that as long as there are no sell signals one more upswing is likely. If this is the case, and the exchange rate increases once again, we’ll see a test of the next upside target from our Wednesday alert in the coming week:

(…) we’ll likely see an increase even to around 0.7728-0.7751, where the orange horizontal resistance lines and the 38.2% Fibonacci retracement are.

Finishing today’s alert, please note that if we see such increase we’ll close our long positions and take profits off the table (as a reminder, we opened them on December 12 when AUD/USD was trading around 0.7550).

Trading position (short-term; our opinion): Profitable long positions (with the stop-loss order at 0.7410 and the upside target at 0.7725) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts