For almost a week we have been witnessing jostling between currency bulls and bears in the narrow price area. To make matters worse, the whole "action" takes place inside the declining trend channel, which additionally raises doubts about the direction of the next USD/CAD bigger move. However, we found some tips that can tell us where will the exchange rate likely go at the beginning of this month and we would like to share them with you in today's alert. We invite you to read.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2806; the initial downside target at 1.2186)

- GBP/USD: short (a stop-loss order at 1.4548; the initial downside target at 1.3820)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.8222; the initial downside target at 0.7730)

EUR/USD

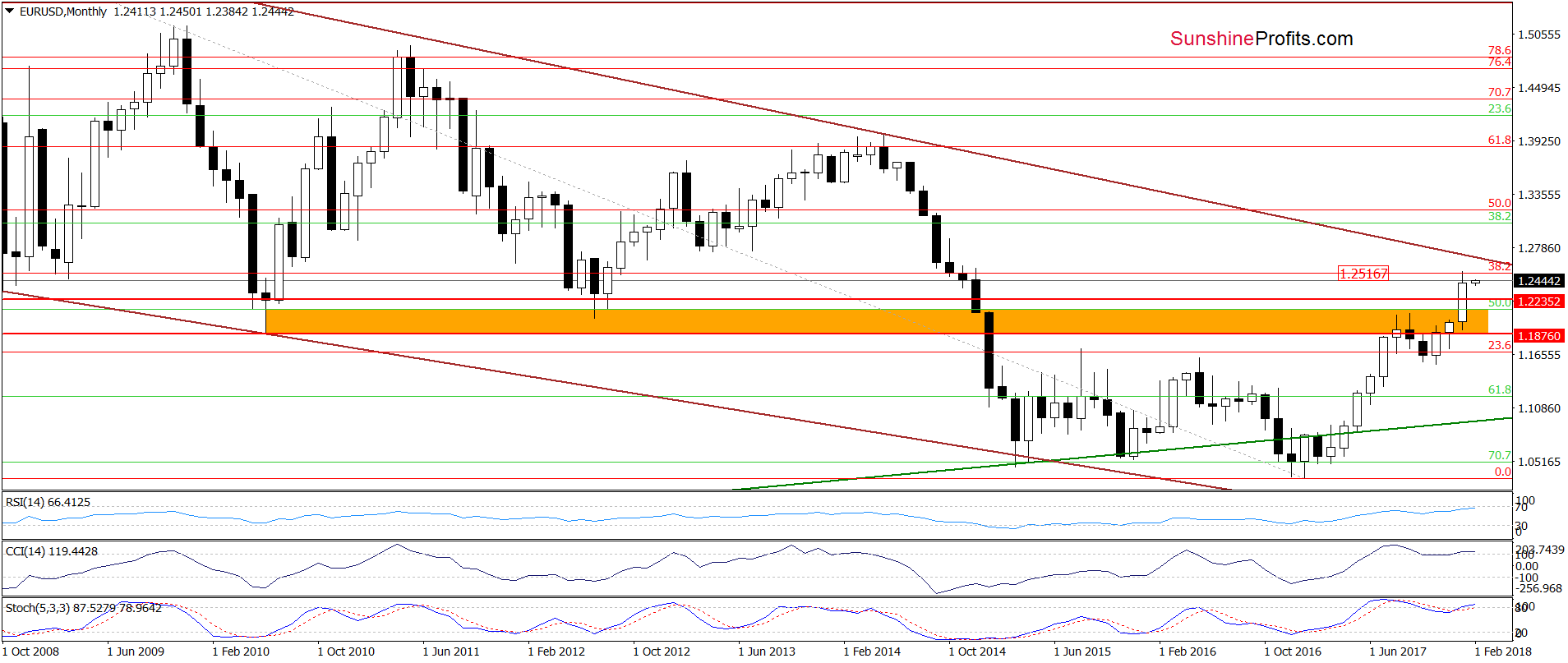

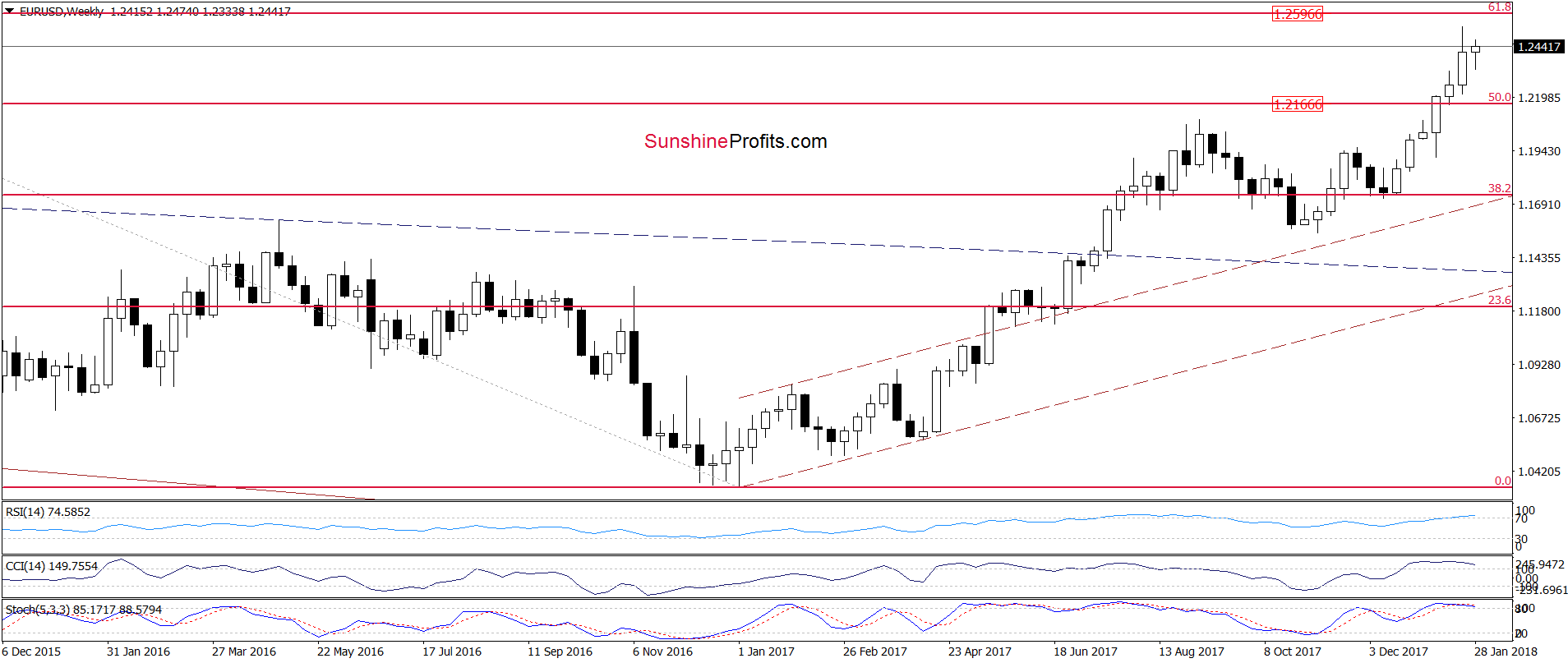

The monthly chart shows that EUR/USD officially closed the first month of 2018 under the 38.2% Fibonacci retracement based on the entire 2008-2017 downward move. In this way, the exchange rate invalidated the earlier tiny breakout, which suggests further deterioration in the coming month.

What impact did this fact have on today’s session so far?

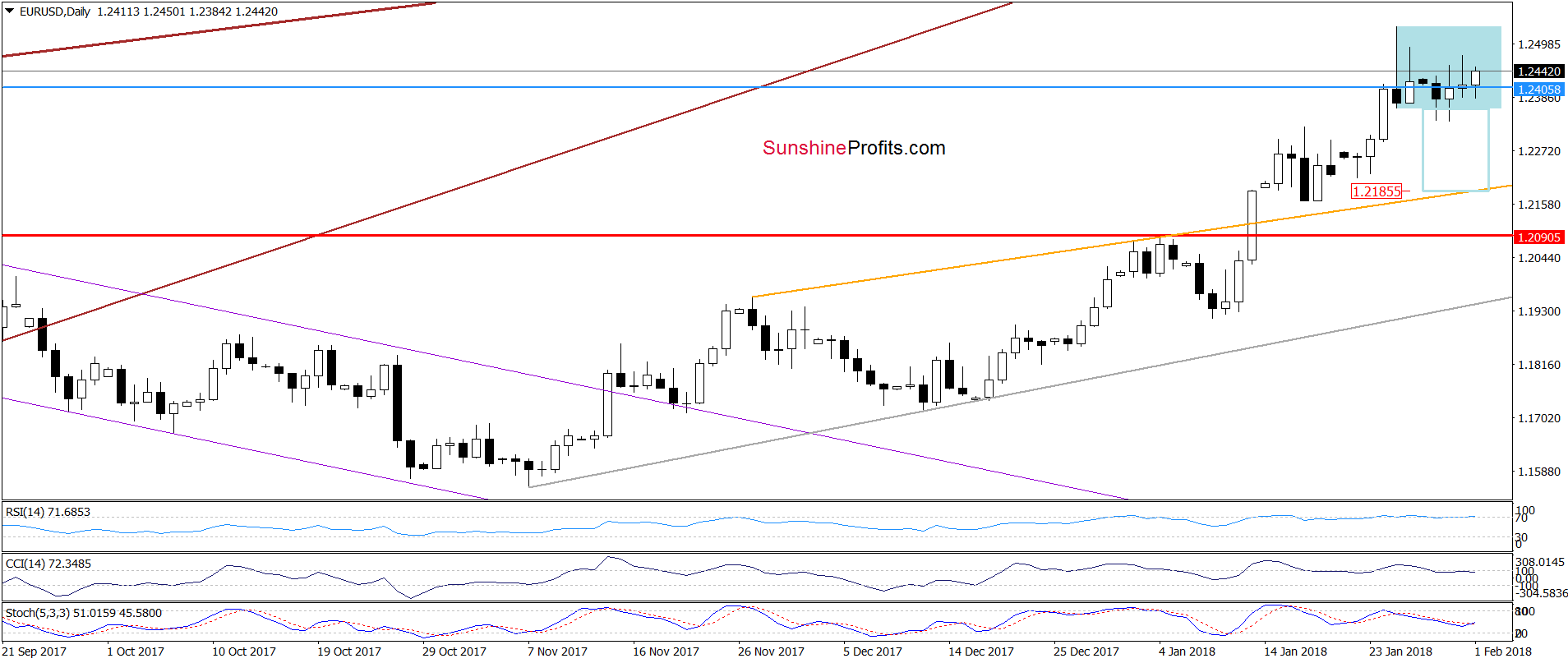

Not big, because EUR/USD is still trading in the blue consolidation under the above-mentioned retracement. Therefore, we believe that our last commentary remains up-to date also today:

(…) the 38.2% Fibonacci retracement based on the entire 2008-2017 downward move together with the pro-bearish candlestick formation (the shooting star) continue to block the way to higher levels.

Nevertheless, (…) we think that it would be wise to consider the worst possible scenario for currency bears. So, what could happen if EUR/USD extends increases (…)?

In our opinion, even if we see such price action, the space for gains seems limited as the 61.8% Fibonacci retracement marked on the weekly chart above is quite close from current levels.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.2806 and the initial downside target at 1.2186) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

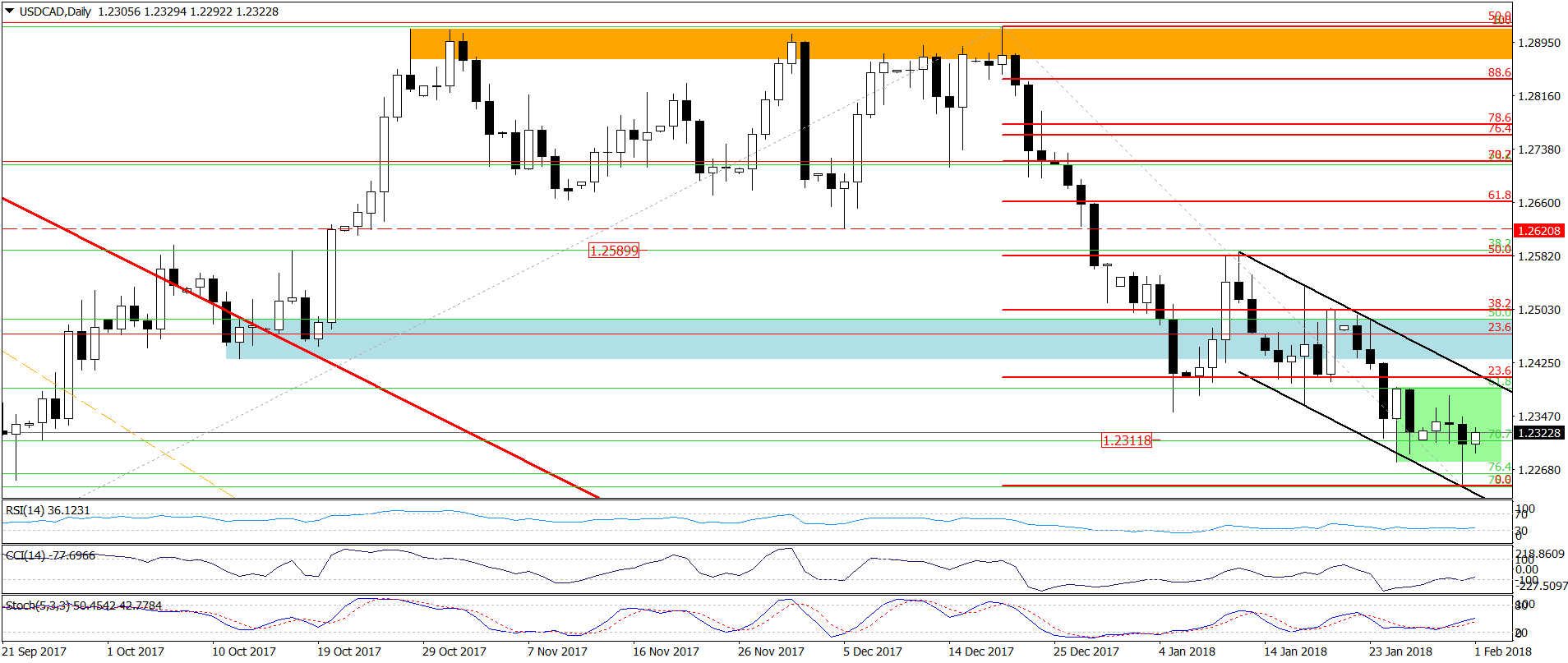

USD/CAD

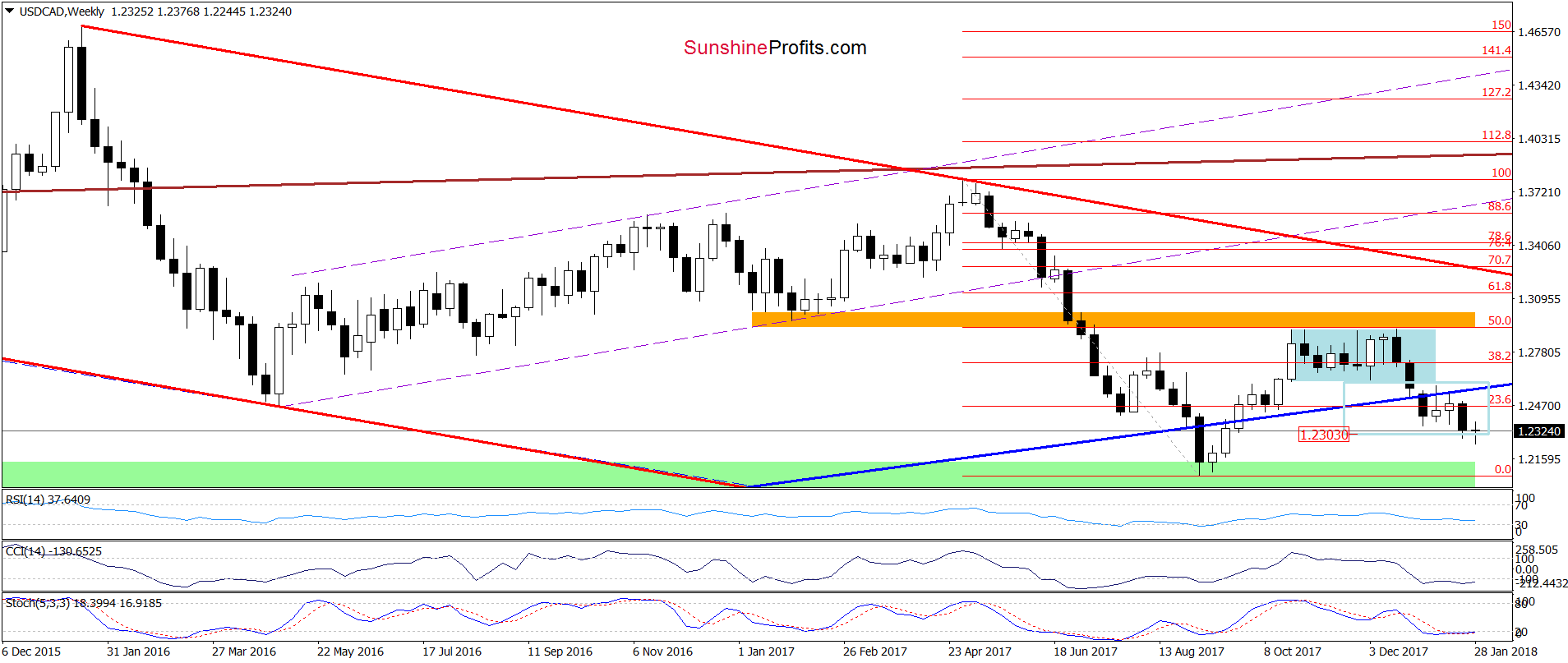

From today’s point of view, we see that although USD/CAD slipped under the lower border of the green consolidation yesterday, the lower line of the black declining trend channel stopped currency bears.

As a result, the exchange rate rebounded and came back into consolidation, invalidating the earlier breakdown, which means that our last commentary on this currency pair is still valid:

(…) USD/CAD is trading in a narrow range (the green consolidation) inside the black declining trend channel.

What does it mean to us? That as long as there is no breakout above the upper line of the channel or a breakdown under the lower line opening any positions is not justified from the risk/reward perspective.

However, there are some technical details, which suggest that the next bigger move should be to the upside. Why? Firstly, currency bears reached their downside target (USD/CAD dropped to the area, where the size of the downward move corresponded to the height of blue consolidation marked on the weekly chart), which could reduce the selling pressure. Secondly, the consolidation itself suggests that that the forces of the buyers and the sellers are beginning to balance, which may translate into a change in the recent direction (in other words, a trend reversal). Thirdly, the current position of the weekly and daily indicators almost screams: it's time to move up!

Connecting the dots, we will continue to monitor the market in the coming days and if we see any reliable signs justifying the opening long positions, we will send you a message.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

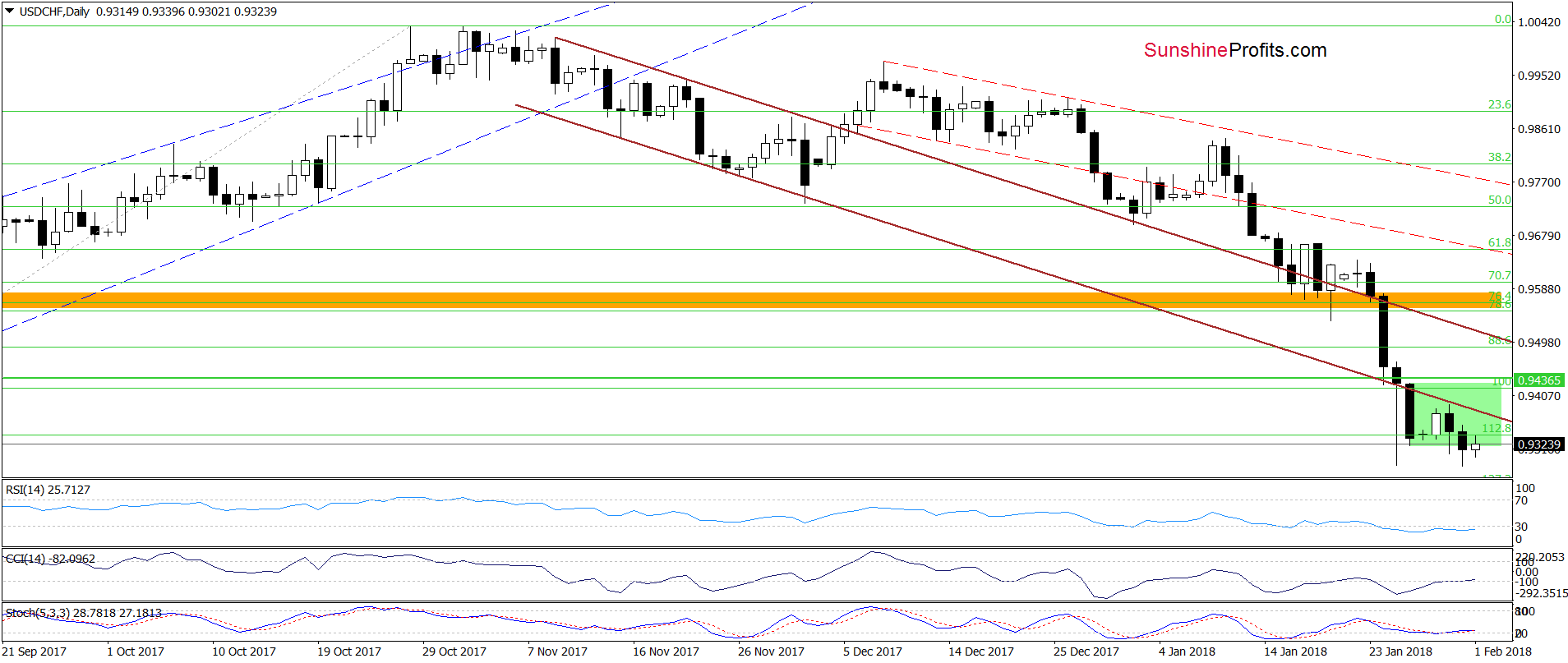

USD/CHF

Looking at the daily chart, we see that USD/CHF closed yesterday’s session below the lower border of the green consolidation, which doesn’t bode well for currency bulls. Earlier today, they tried to push the pair higher, but we think that as long as there is no invalidation of the breakdown under the lower brown line all upswing will be nothing more than another verification of the breakdown.

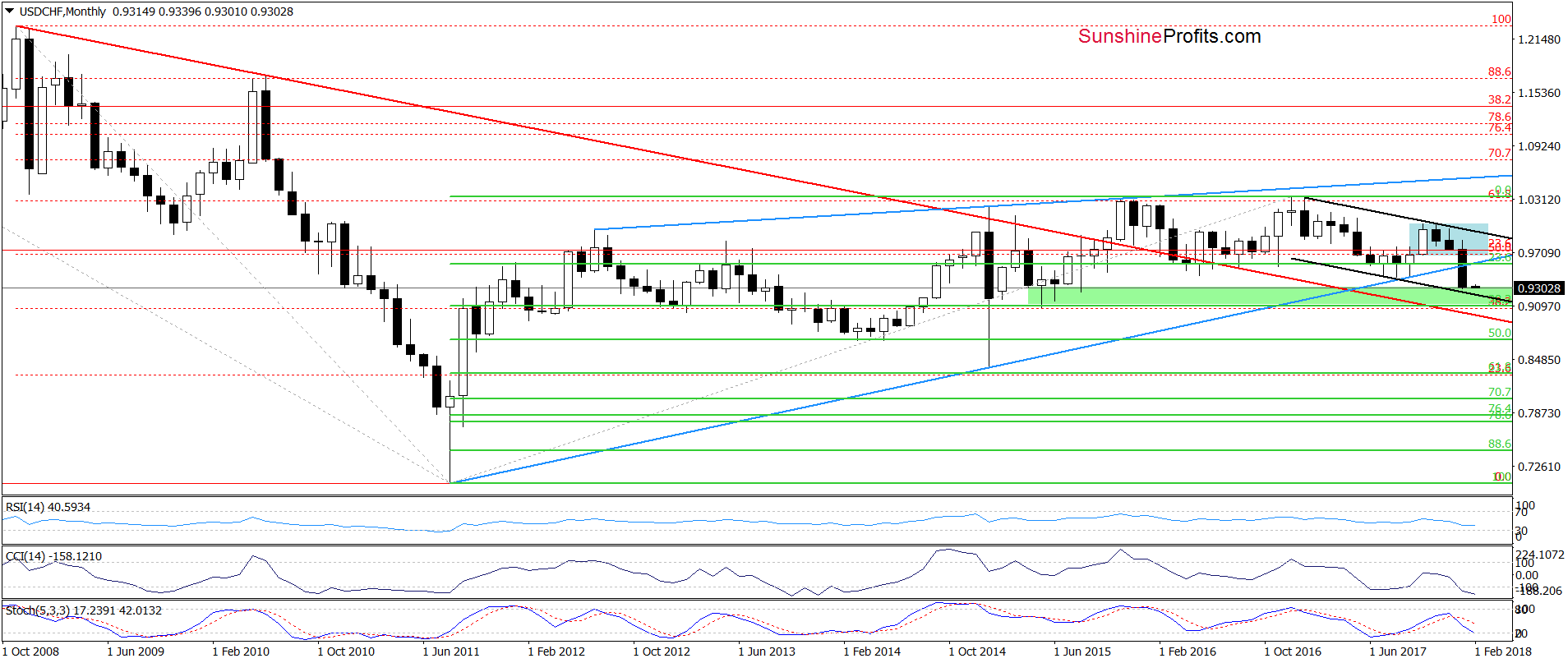

Therefore, in our opinion, one more downswing can’t be ruled out – especially when we factor in the fact that USD/CHF is still trading under the long-term blue line marked on the monthly chart below.

How low could the pair go if the situation develops in line with our assumptions? In our opinion, the first downside target will be the 127.2% Fibonacci extension around 0.9252. If this support is broken, currency bears will likely test the lower border of the black declining trend channel seen on the above chart.

Nevertheless, we should keep in mind that USD/CHF slipped to the green support zone created by the April-August lows and the 38.2% Fibonacci retracement (based on the entire 2011-2016 upward move), which suggests that the space for declines may be limited and reversal is just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts