A week ago, currency bulls allowed their opponents to take control on the trading floor, but they didn’t expect how much this decision would cost them in the next days. If you want to know what caused the bear's attack, what are its consequences and what we can expect during the upcoming sessions, we invite you to read today's alert.

- EUR/USD: short (a stop-loss order at 1.1807; the initial downside target at 1.1343)

- GBP/USD: short (a stop-loss order at 1.3220; the initial downside target at 1.2848)

- USD/JPY: long (a stop-loss order at 110.80; the initial upside target at 112.88)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

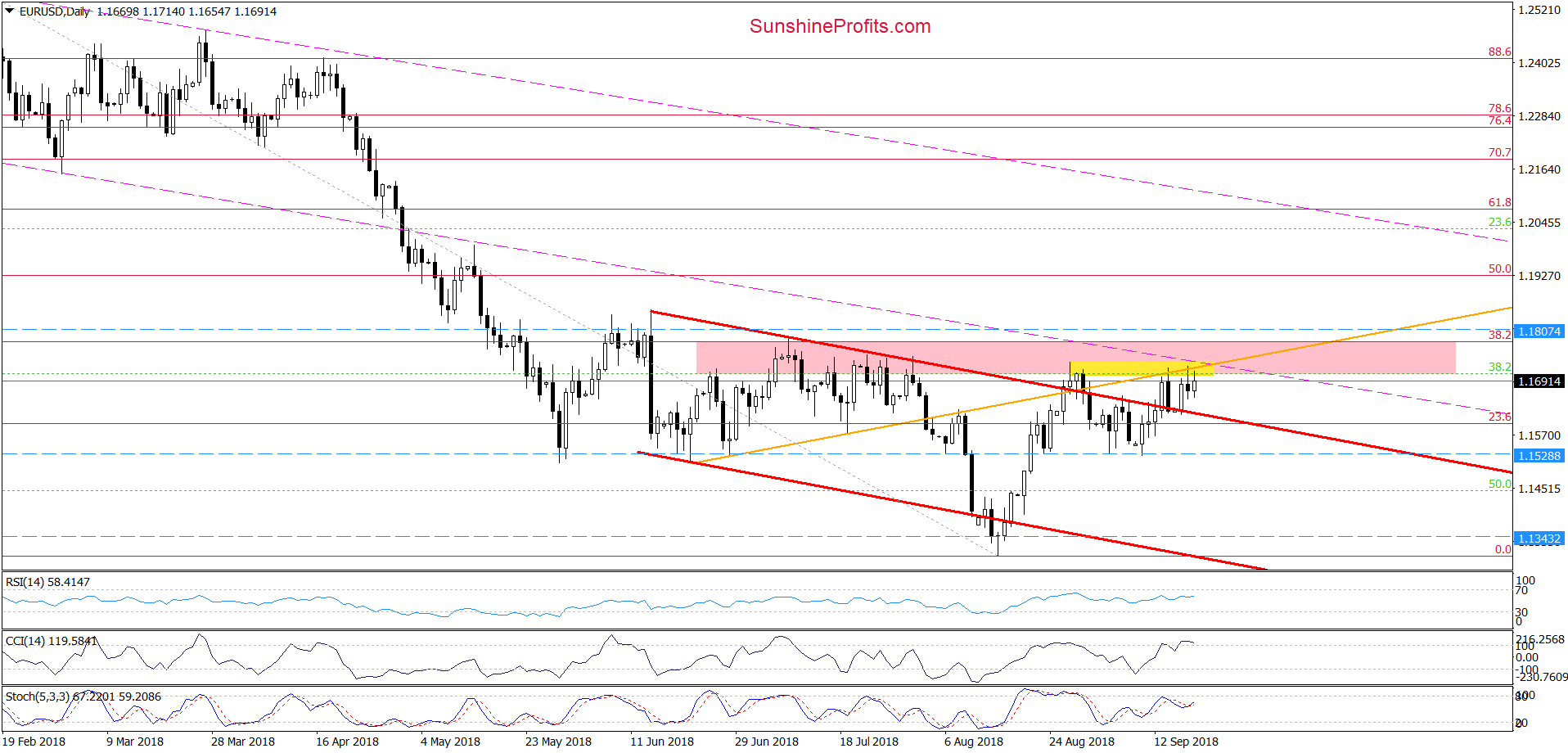

EUR/USD

On Tuesday, currency bulls disappointed as the previously-broken orange resistance line and the yellow resistance zone based on the recent peaks stopped them once again, triggering a pullback.

Earlier today, we saw another upswing, but despite this move, EUR/USD is still trading under the major resistances, which means that our Friday’s comments on this currency pair is up-to-date also today:

(…) the pink resistance zone (…) was strong enough to stop the buyers several times in July and also at the and of August, which means that as long as there is no breakout above it higher values of EUR/USD are questionable, and another reversal is very likely.

(…) currency bulls approached (…) the late-August high, but there was no breakout above it. Instead, the pair pulled back, which shows that their opponent are active in this area and they will fight to stop further improvement.

(…) today’s upswing took the pair to the previously-broken orange resistance line, which looks like another verification of the early-August breakdown. (…) similar price action at the beginning of he previous month preceded a bigger move to the downside, which increases the probability that the history will repeat itself once again in the very near future.

In our opinion, the pro-bearish scenario will be even more likely and reliable if EUR/USD invalidates (…) breakout above the upper line of the red trend channel. If we see such price action, we’ll consider increasing short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1807 and the initial downside target at 1.1343 are justified from the risk/reward perspective.

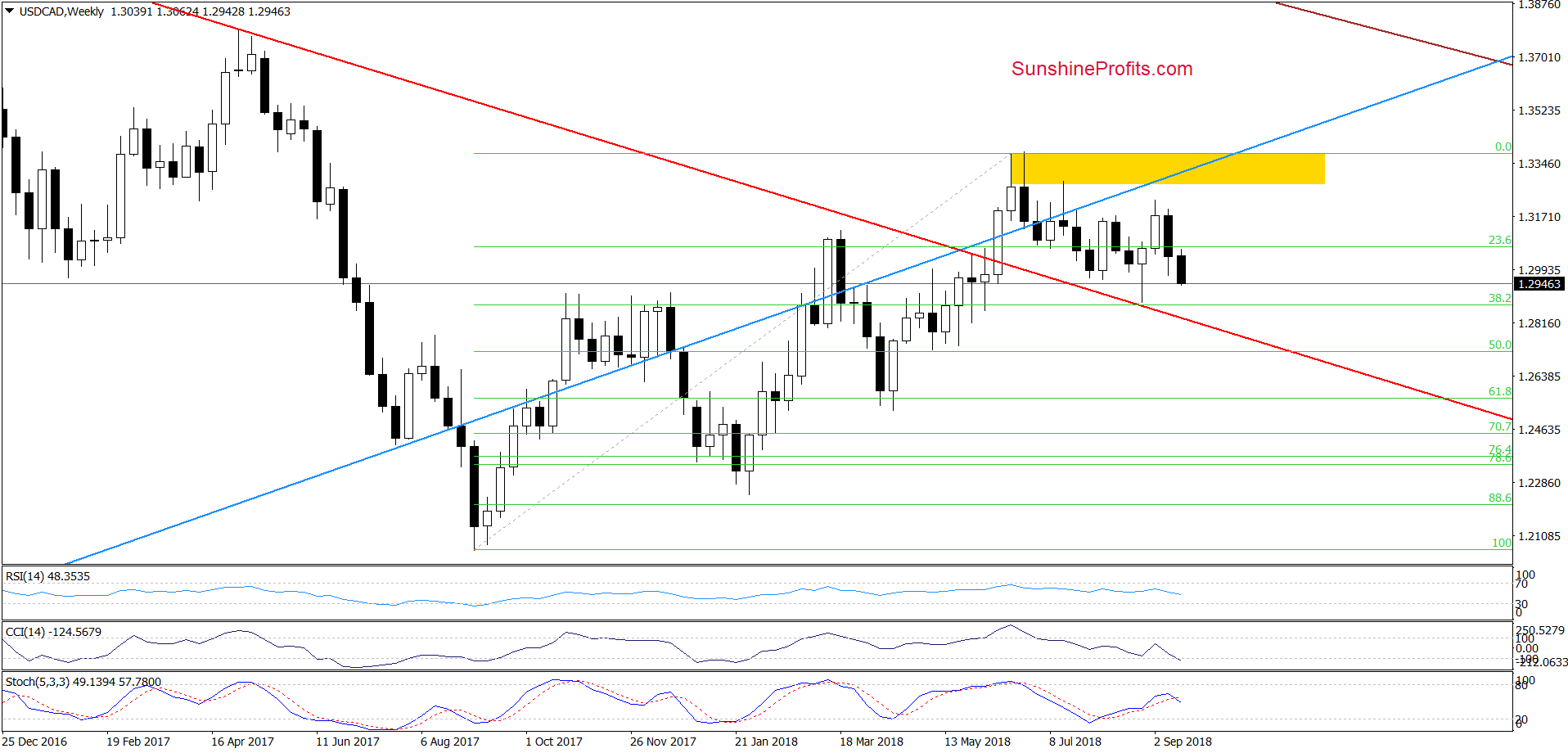

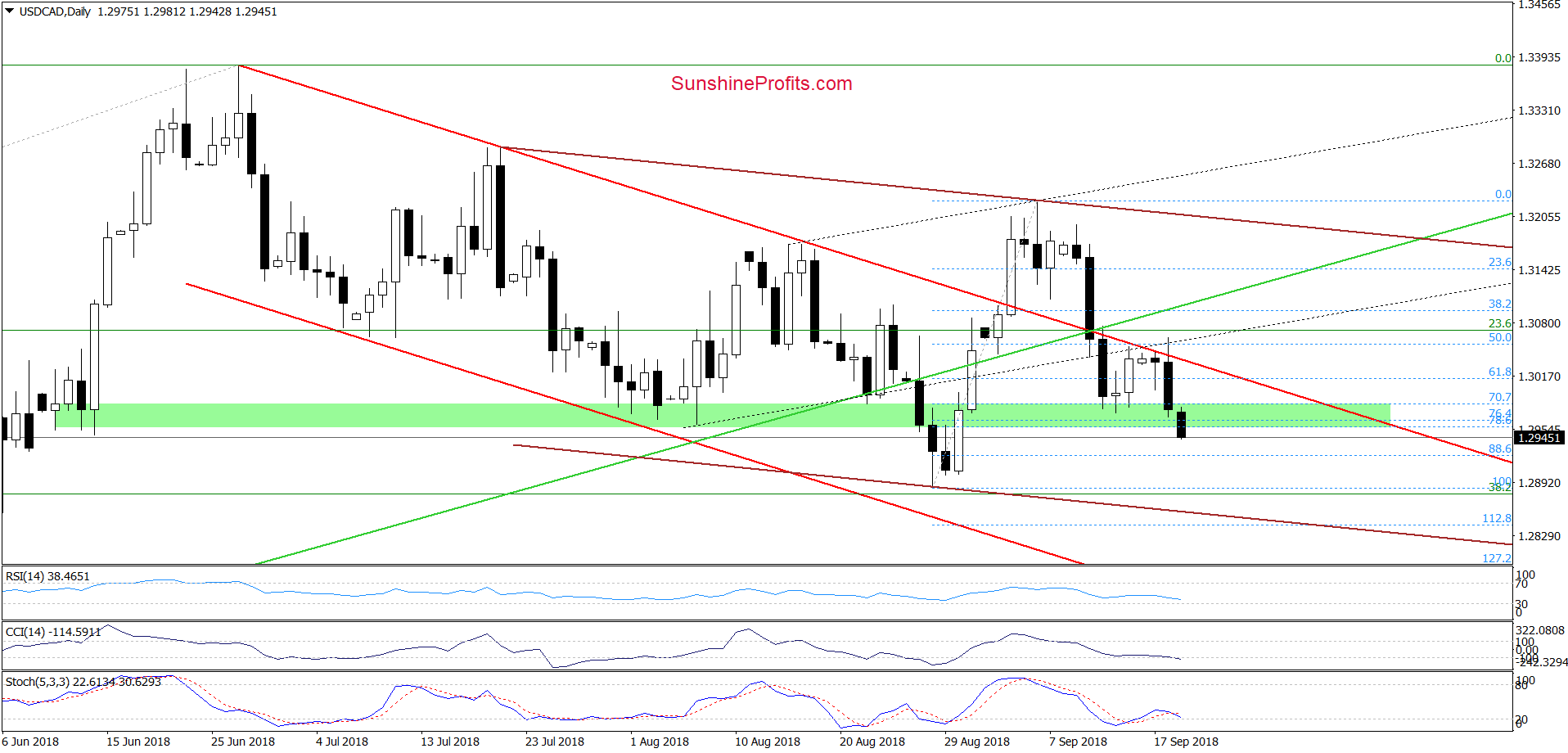

USD/CAD

From today’s point of view, we see that last Tuesday’s drop (which took USD/CAD not only below the previously-broken upper border of the red declining trend channel, but also under the medium-term green support line) gave currency bears a green light to fight for lower levels.

Although USD/CAD bounced off the green support zone in the previous week, the upper border of the red declining trend channel was strong enough to stop further improvement and trigger another move to the downside earlier this week.

Thanks to this price action, currency bears took the exchange rate under the above-mentioned support zone, which suggests that we’ll see a test of the late-August lows in the very near future. At this point, it is worth noting that slightly below these levels is also the brown support line (parallel to the resistance line based on July and September lows), which could give currency bulls an additional reason to act.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

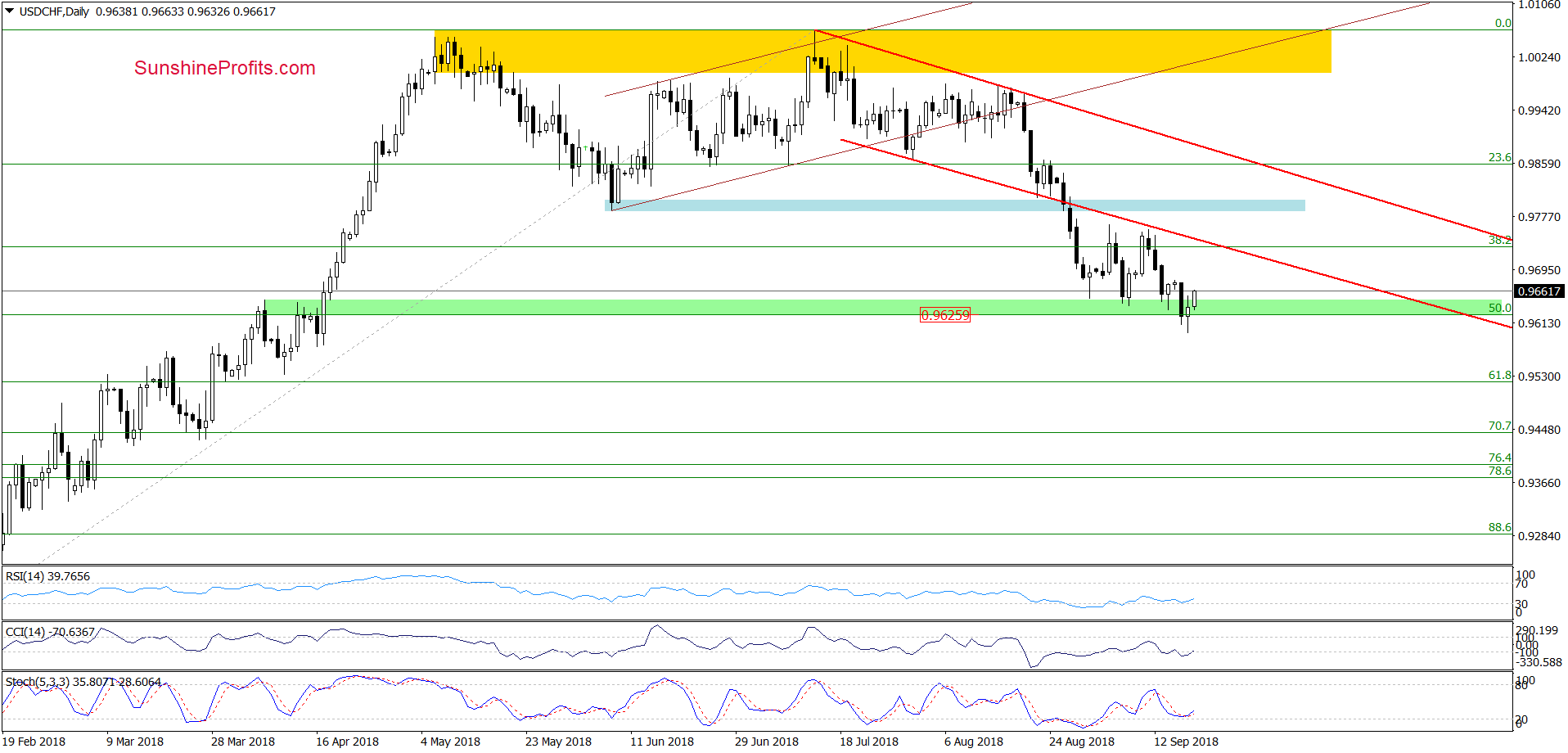

USD/CHF

In our last commentary on this currency pair, we wrote the following:

(…) although currency bulls tried to push the exchange rate higher yesterday, they failed not far from the opening price. This show of weakness triggered a decline, which erased almost entire Monday’s upswing.

Earlier today, currency bears extended losses, which together with the sell signal generated by the Stochastic Oscillator suggests that we’ll see a re-test of the green support zone in the very near future.

Looking at the daily chart, we see that currency bears not only took the exchange rate to the above-mentioned downside target, but also managed to push USD/CHF below the green support zone.

Despite this deterioration, the buyers kept cool, which resulted in yesterday’s upswing that invalidated the earlier breakdown under the 50% Fibonacci retracement. This positive development triggered further improvement during today’s session, which in combination with the buy signals generated by the daily indicators increases the probability that we’ll see another test of the previously-broken lower border of the red declining trend channel in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts