Monday's session discovered currency bulls’ weakness, which was mercilessly used by their opponents during yesterday's trading. Thanks to the sellers’ attack, EUR/USD hit a fresh 2018 low, but will we see further declines in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: small short positions (a stop-loss order at 1.2021; the next downside target at 1.1770)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

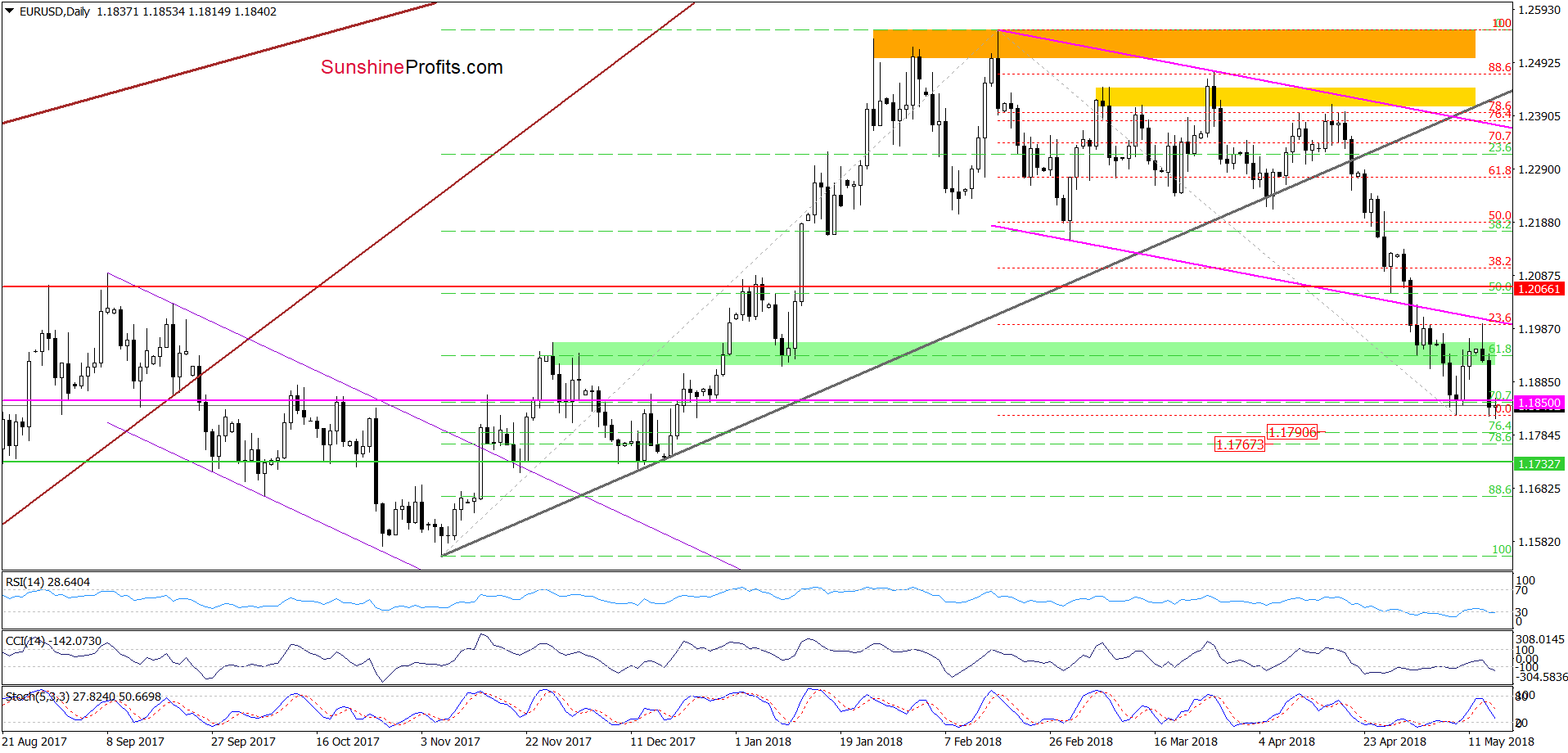

EUR/USD

Quoting our yesterday’s Forex Trading Alert:

(…) currency bulls confirmed their weakness (…), which resulted in a pullback and a comeback to the green zone. Additionally, earlier today, the Stochastic Oscillator generated a sell signal, which suggests that the worst may not be behind the buyers yet and another move to the downside is just around the corner.

If this is the case, and the exchange rate declines from current levels, we could see at least a test of the 70.7% Fibonacci retracement and the last week’s low.

From today’s point of view, we see that the situation developed in line with the above scenario and EUR/USD slipped to our first downside target yesterday, making our short positions profitable.

What’s next? Taking into account Tuesday’s sellers’ strength and the above-mentioned sell signal generated by the Stochastic Oscillator, we think that EUR/USD will extend losses and test our next downside target about which we wrote yesterday:

(…) Nevertheless, if this support area is broken, the next target for the sellers will be around 1.1767-1.1790, where the support area created by the 76.4% and 78.6% retracements is.

Finishing today’s alert, please note that we decided to move lower our stop-loss order to minimalize potential losses and at the same time lowered our next downside target to allow our profits to grow. We will keep you informed should anything change.

Trading position (short-term; our opinion): Small short positions (with a stop-loss order at 1. 2021 and the next downside target at 1.1770) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

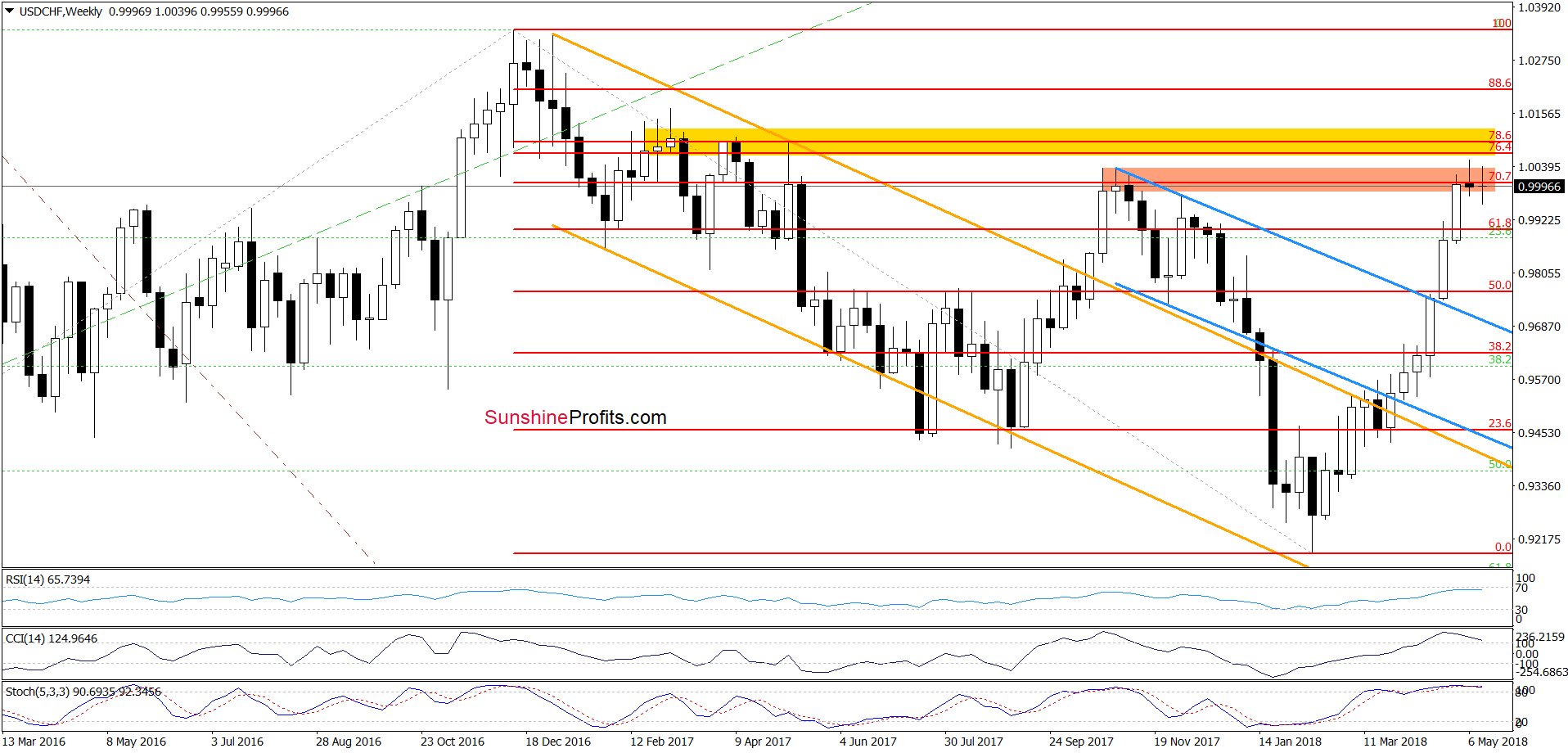

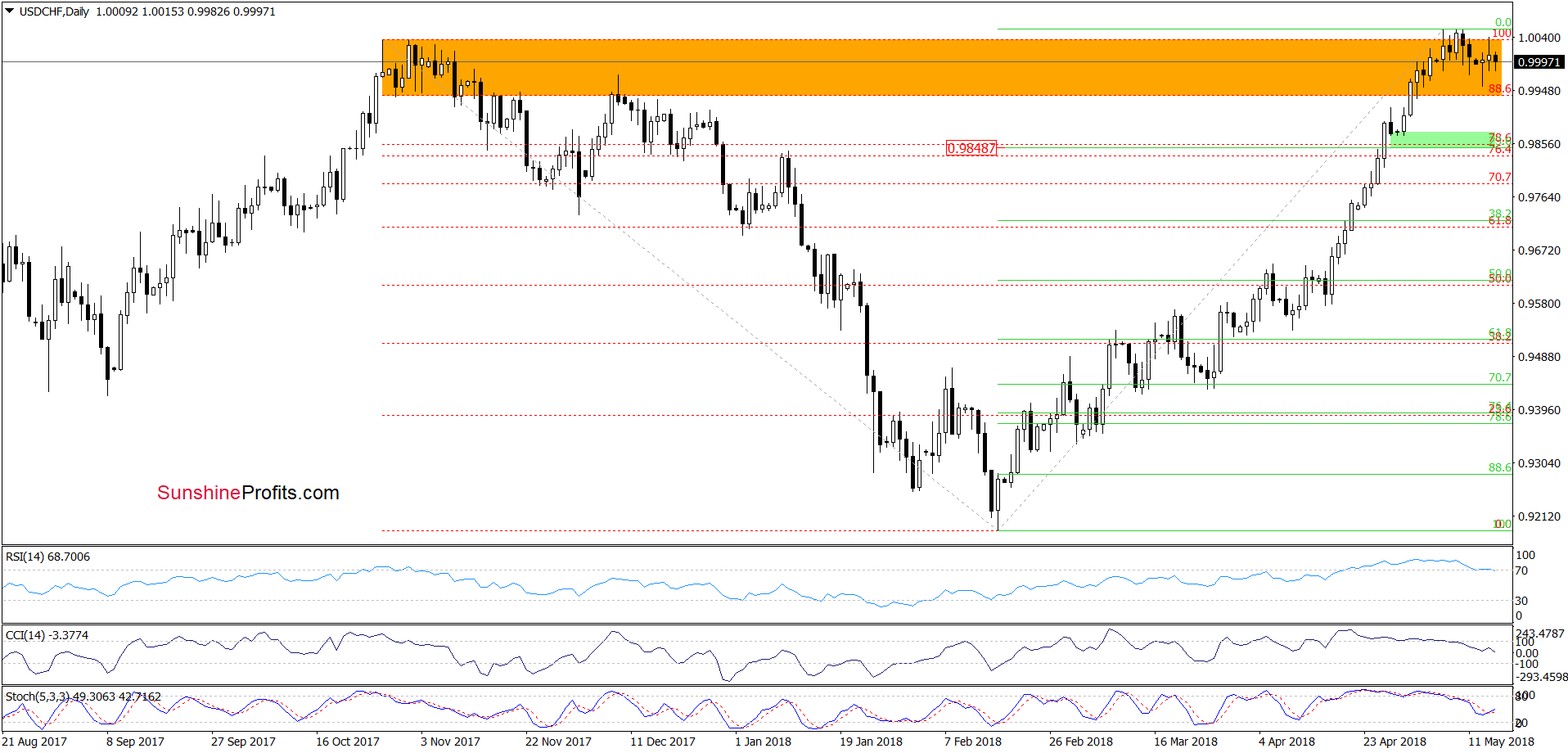

USD/CHF

Looking at the above charts, we see that the overall situation in the short term hasn’t changed much as USD/CHF is still trading inside the orange resistance zone. Therefore, we believe that as long as there is no breakut above this area or a breakdown under the previously-broken 88.6% Fibonacci retracement another bigger move is not likely to be seen.

Nevertheless, we should keeo in mind that even if the buyers push the pair higher (using the buy signal generated by the Stochastic Oscillator) the way to the north is blocked by the 70.7% Fibonacci retracement and the yellow resistance zone (seen on the weekly chart), which stopped the rally and triggered a pullback in the previous week.

And what could happen if USD/CHF drops under the orange zone? In our opinion, if the exchange rate slips under the lower border of this area, we could see a drop to around 0.9850-0.9875, where the green support zone (marked on the daily chart) is.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

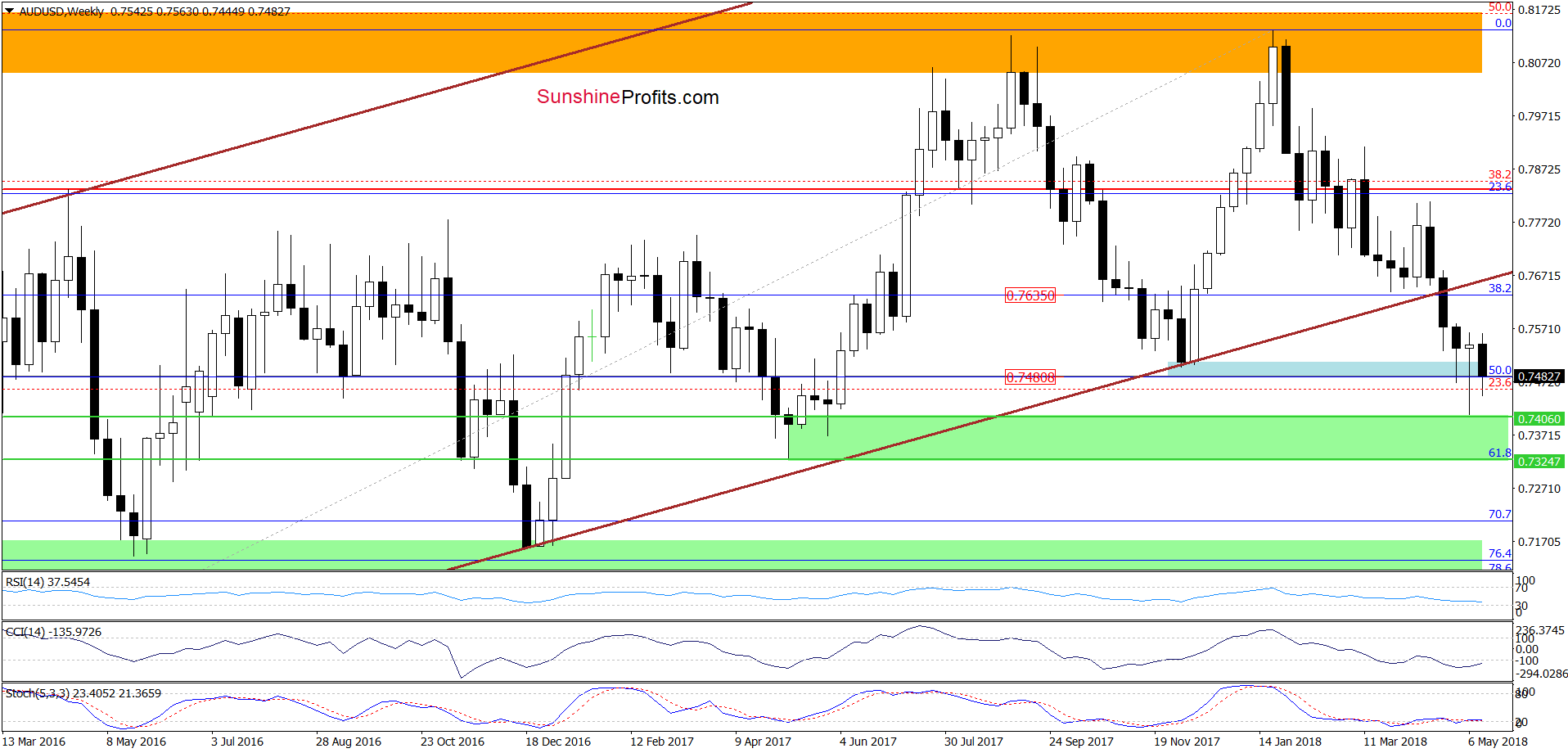

AUD/USD

On the daily chart, we see that although currency bulls managed to take AUD/USD above the previously-broken lower border of the blue declining trend channel at the end of the last week, this improvement was very temporary.

Why? Because their opponents showed strength and invalidated the earlier breakout yesterday, triggering a quite sharp decline. This is a bearish development, which in combination with the sell signal generated by the Stochastic Oscillator suggests that we could see a re-test of the May low and the green support zone in the coming day(s).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts