In the previous week, the Australian dollar moved sharply higher against its U.S. counterpart, which resulted in a breakout above the upper line of the declining trend channel. Will we see a test of September peaks in the coming days?

- EUR/USD: long (a stop-loss order at 1.1260 the initial upside target at 1.1544)

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 111.11; the exit upside target at 113.40)

- USD/CAD: none

- USD/CHF:short (a stop loss order at 1.0128; the initial downside target at 0.9881)

- AUD/USD: none

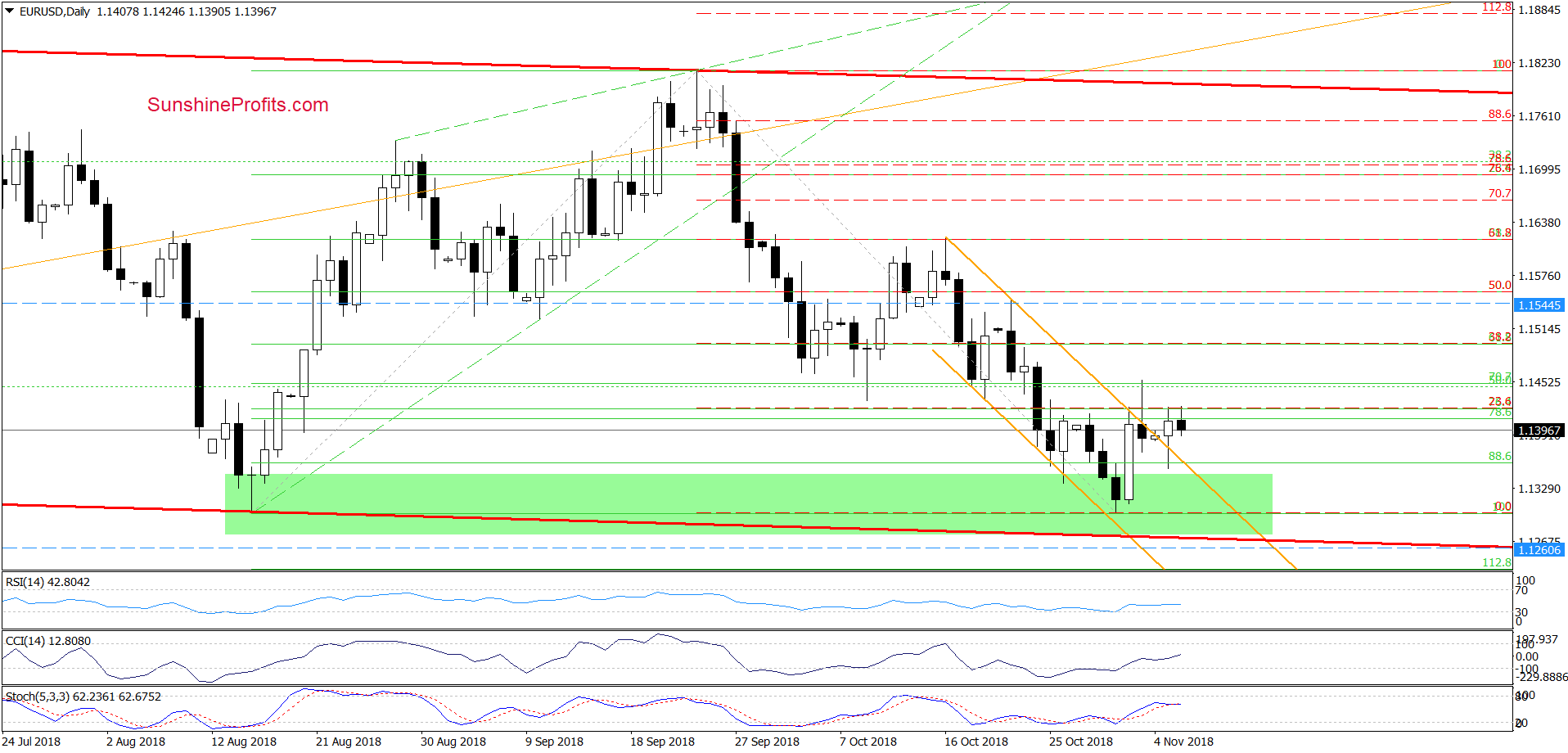

EUR/USD

The first thing that catches the eye on the daily chart is an invalidation of the earlier breakdown under the upper line of the orange declining trend channel. Taking this positive development into account and combining it with the lack of the sell signals, we think that further improvement is still ahead of us.

If this is the case and the pair moves higher from current levels, we’ll see at least a test of the 38.2% Fibonacci retracement (around 1.5000). If it is broken, the way to our initial upside target, the October 22 peak and the next retracement will be open.

Trading position (short-term; our opinion): Long positions with the stop-loss order at 1.1260 and the initial upside target at 1.1544 are justified from the risk/reward perspective.

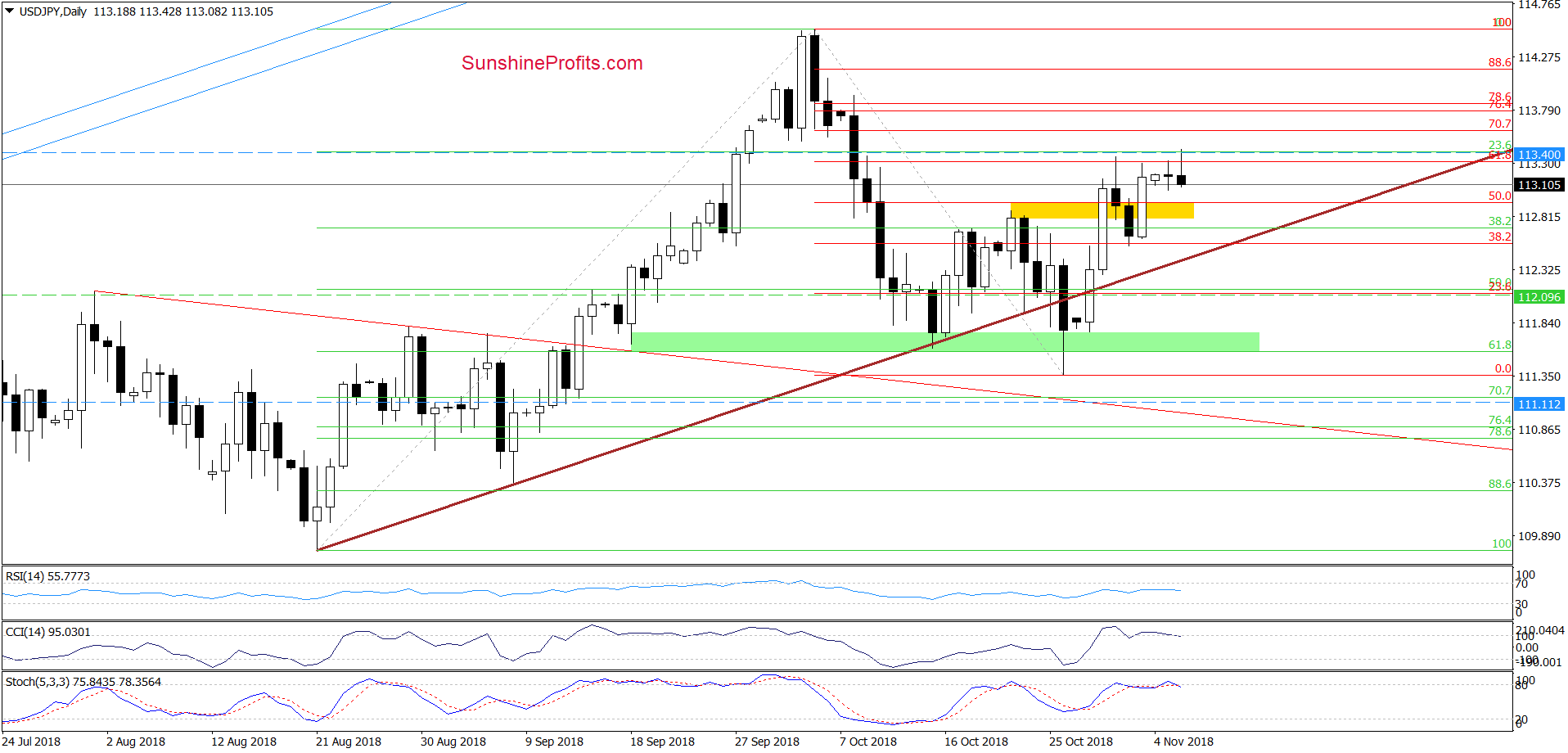

USD/JPY

Quoting our Friday’s alert:

(…) currency bulls pushed the exchange rate higher earlier today invalidating the earlier breakdown under the yellow support zone.

Taking this fact into account, we think that (at least) one more upswing is just around the corner. If this is the case and the pair extends gains from here, we’ll see an increase to (at least) our initial upside target at 113.40 in the coming week.

On the daily char, we see that USD/JPY climbed to our upside target, but then reversed and pulled back, invalidating the earlier tiny breakout above the 61.8% Fibonacci retracement. Such price action together with the current position of the indicators suggests that another move to the downside from here is likely.

Therefore, if the exchange rate increases to 113.40 once again, we’ll close our long positions and take profits off the table (as a reminder, we opened them when the pair was trading at around 112.096).

Trading position (short-term; our opinion): long positions with a stop-loss order at 111.11 and the exit target at 113.40 are justified from the risk/reward perspective.

AUD/USD

In our alert posted on October 30, we wrote the following:

(…) the currency pair returned above the pink triangle, which suggests that further increases may be just around the corner. If this is the case and AUD/USD extends gains from here, we’ll likely see a test of the mid-October highs or even the upper border of the red declining trend channel in the following days.

Looking at the daily chart, we see that the situation developed in tune with the above assumptions and the exchange rate moved sharply higher in the previous week. As a result, the pair not only tested, but also broke above the upper line of the red declining trend channel, which suggests that we’ll likely see a climb to the next upside target.

At this point, it is worth noting that the mid-October peaks are reinforced by the 23.6% Fibonacci retracement based on the entire 2018 downward move, which increases the probability of reversal in the coming days – especially when we factor in the current position of the daily indicators (the CCI and the Stochastic Oscillator are overbought and very close to generating the sell signals).

If we see currency bulls’ weakness in the above-mentioned area and the sell signals, we’ll consider opening short positions later this week.

Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts