Although currency bulls pushed USD/CHF to a fresh 2018 peak on Wednesday, this improvement wasn’t as stable as one would expect. Are the pro-growth currency bulls’ plans already buried? What can we expect in the coming week?

- EUR/USD: long (a stop-loss order at 1.1260 the initial upside target at 1.1544)

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 111.11; the initial upside target at 113.40)

- USD/CAD: none

- USD/CHF: short (a stop loss order at 1.0128; the initial downside target at 0.9881)

- AUD/USD: none

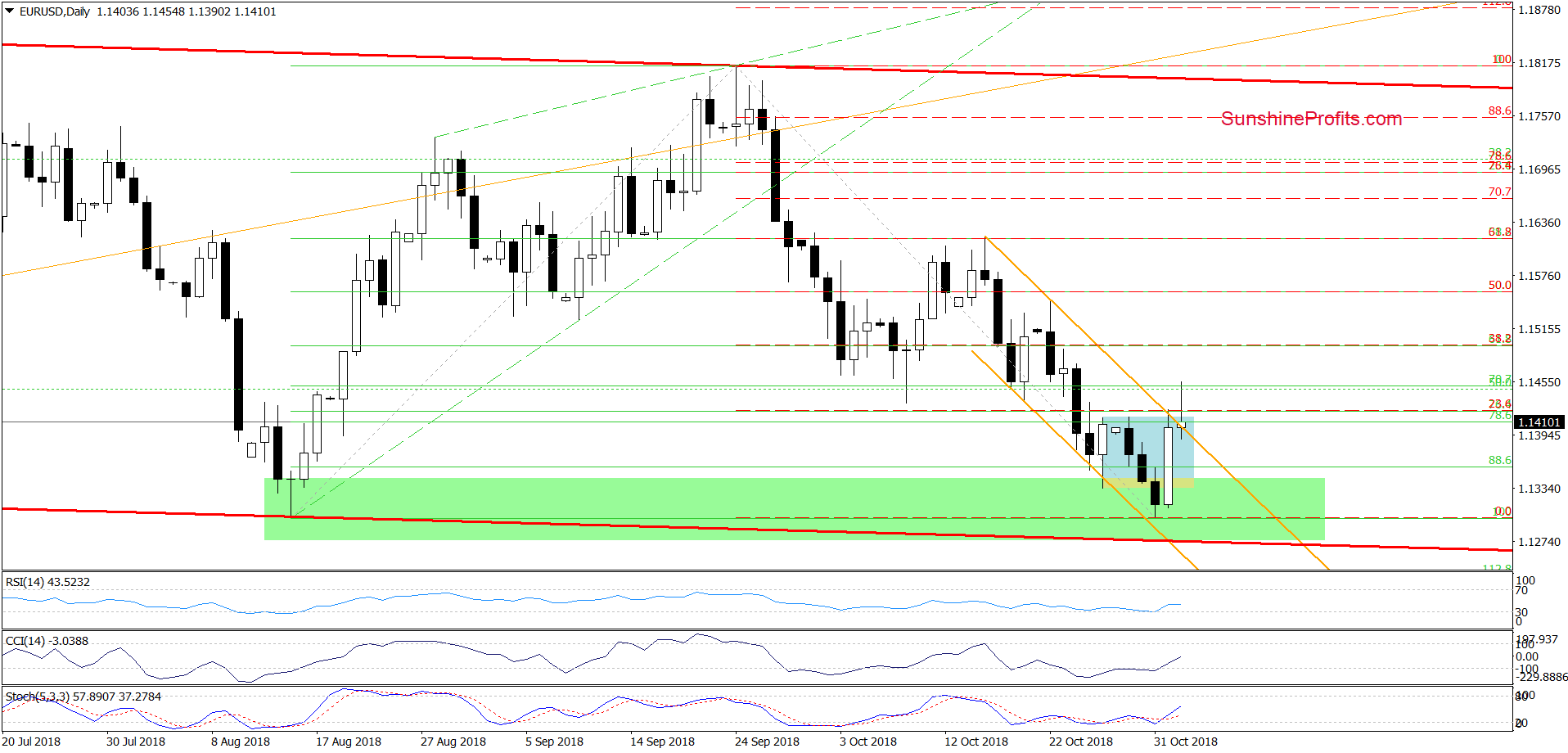

EUR/USD

Yesterday, we wrote the following:

(…) the exchange rate approached three important supports: the lower line of the orange declining trend channel, the lower border of the red declining trend and the mid-August low.

(…) the combination of these supports encouraged currency bulls to act, which translated into rebound that took the pair back to the interior of the blue consolidation. In this way, the buyers invalidated yesterday’s breakdown, but the pronunciation of today's move will be more positive if EUR/USD closes today's session above the lower line of the formation.

If we see such price action, currency bulls will likely try to test the upper line of the orange declining trend channel in the following days. If they manage to break above this resistance line, we’ll consider opening log positions.

The first thing that caches the eye on the daily chart is a breakout above the upper line of the orange declining trend channel. Additionally, all daily indicators generated buy signals, suggesting further improvement in the coming days.

If this is the case and EUR/USD closes today’s session above the channel, we’ll likely see an increase to around 1.1544, were the size of the upward move will correspond to the height of the channel. In this area is also the October 22 peak and the 50% Fibonacci retracement, which together can act attractive for currency bulls.

Taking all the above into account, we think that opening long positions is justified from the risk/reward perspective. All needed details you will find below.

Trading position (short-term; our opinion): Long positions with the stop-loss order at 1.1260 and the initial upside target at 1.1544 are justified from the risk/reward perspective.

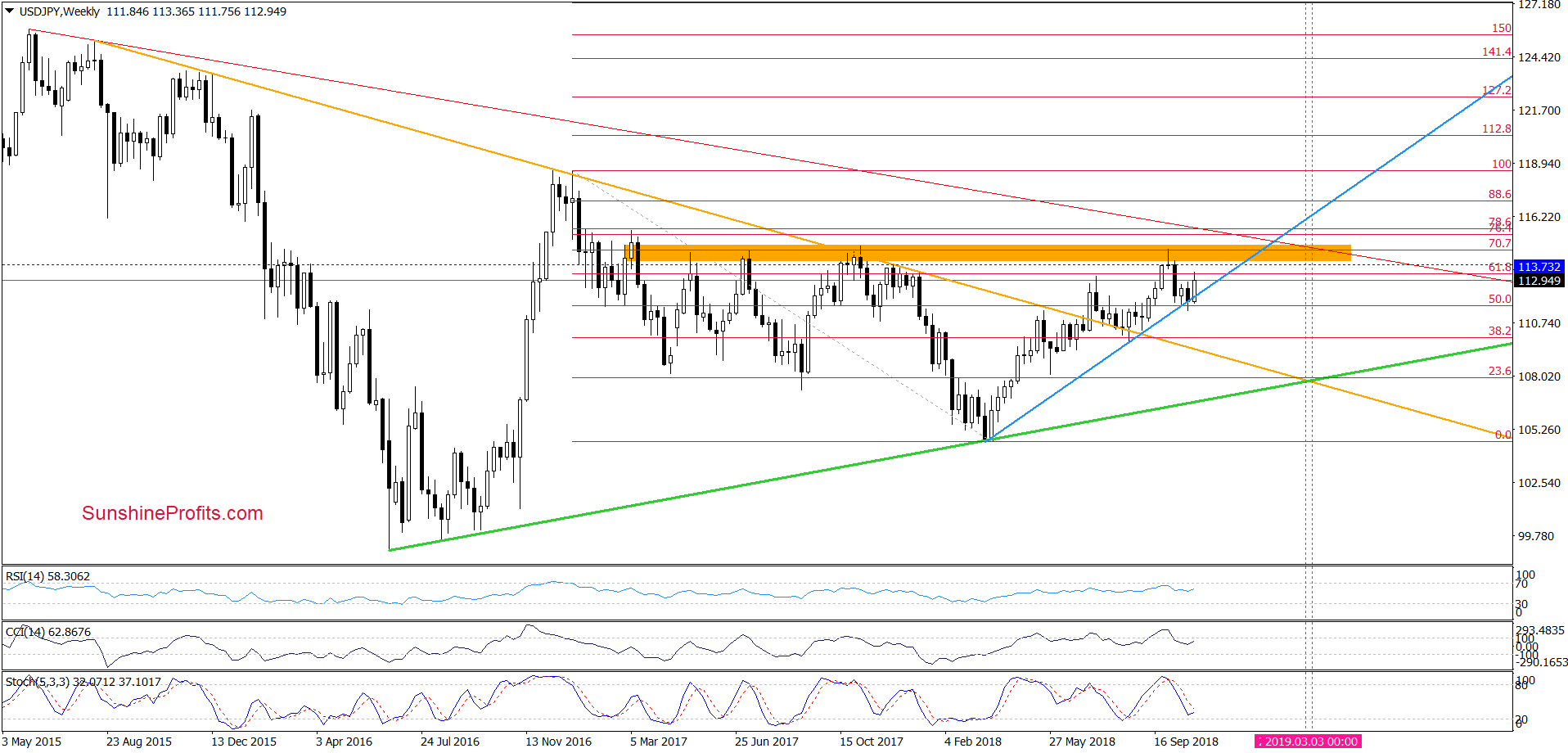

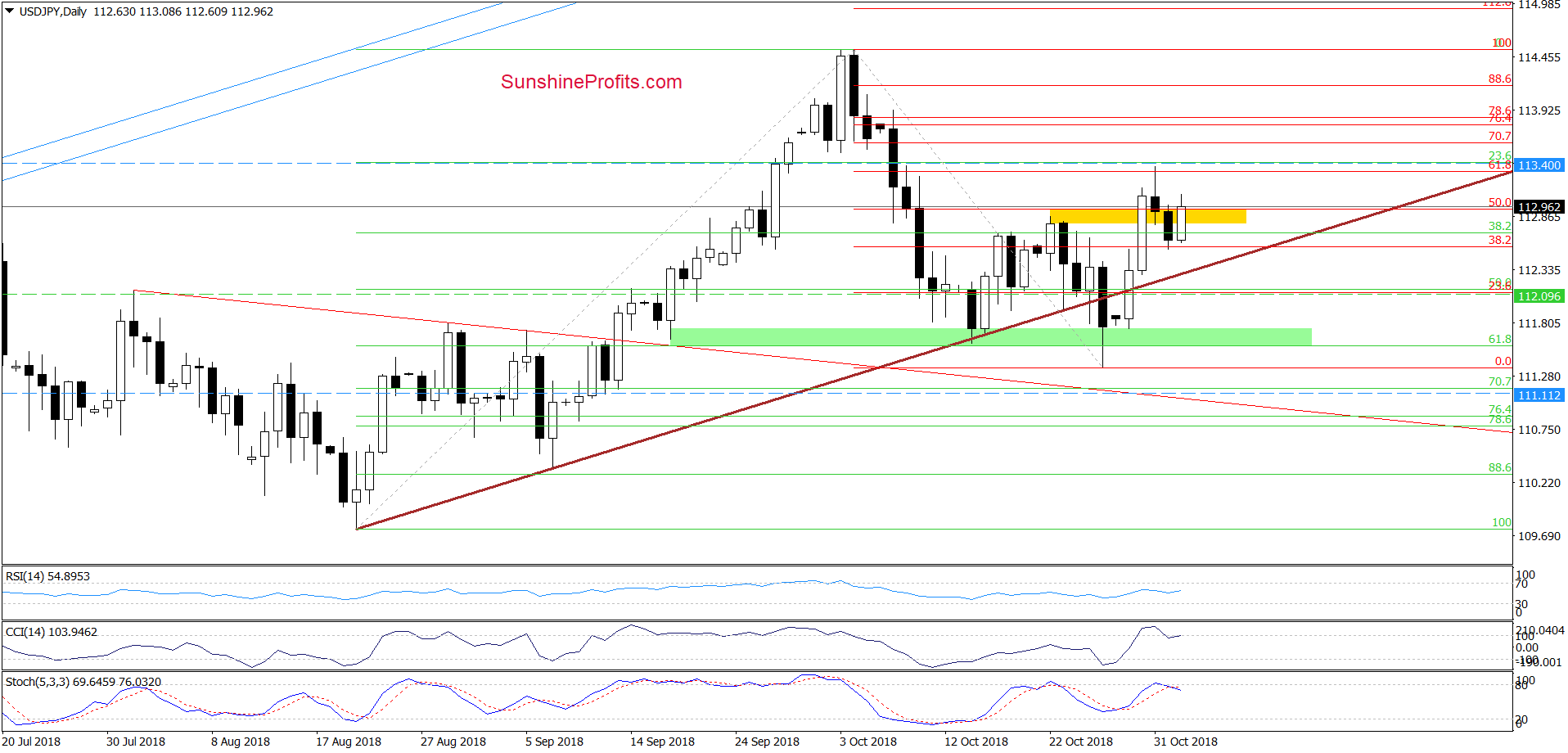

USD/JPY

From today’s point of view, we see that although USD/JPY pulled back a bit in recent days, currency bulls pushed the exchange rate higher earlier today invalidating the earlier breakdown under the yellow support zone.

Taking this fact into account, we think that (at least) one more upswing is just around the corner. If this is the case and the pair extends gains from here, we’ll see an increase to (at least) our initial upside target at 113.40 in the coming week.

Trading position (short-term; our opinion): long positions with a stop-loss order at 111.11 and the initial upside target at 113.40 are justified from the risk/reward perspective.

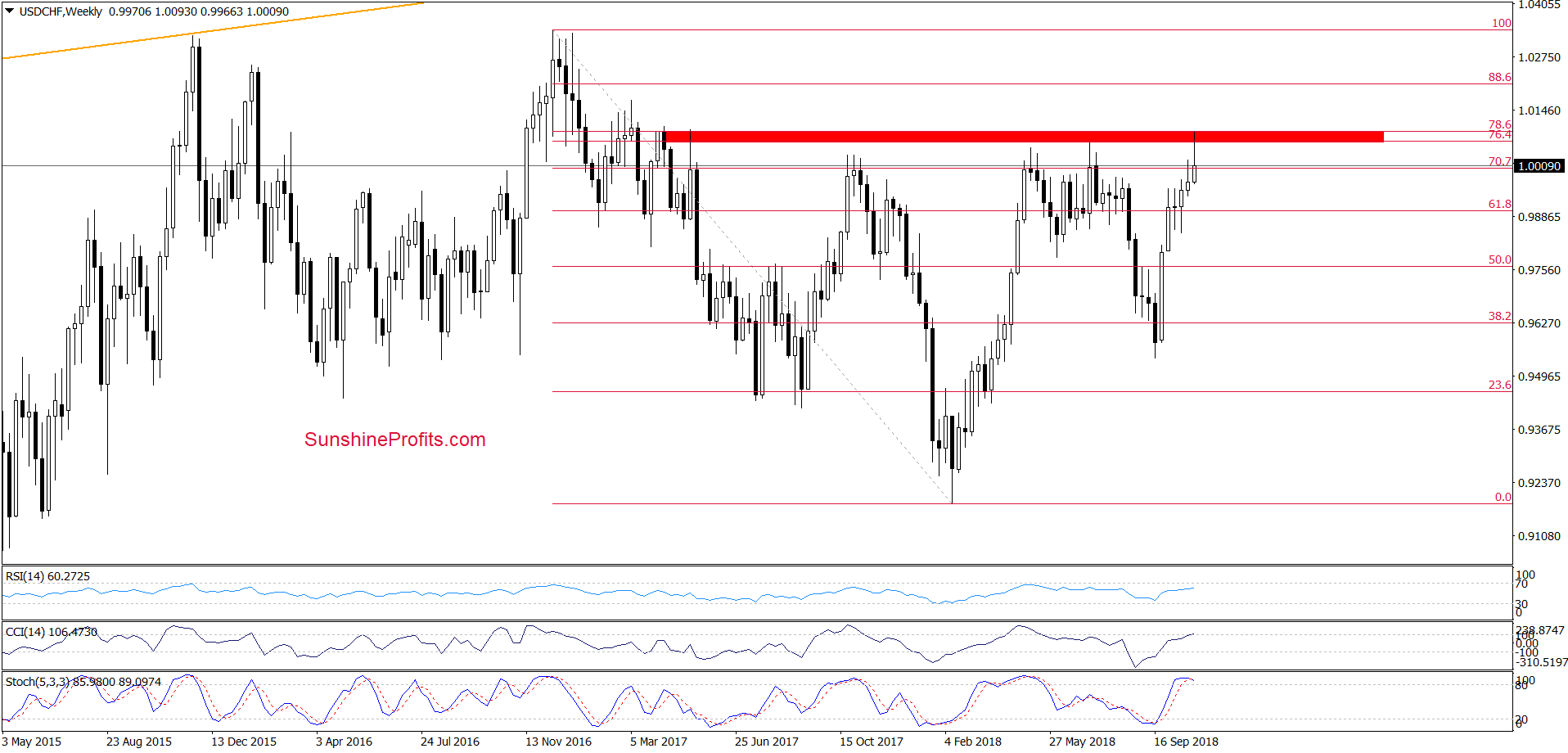

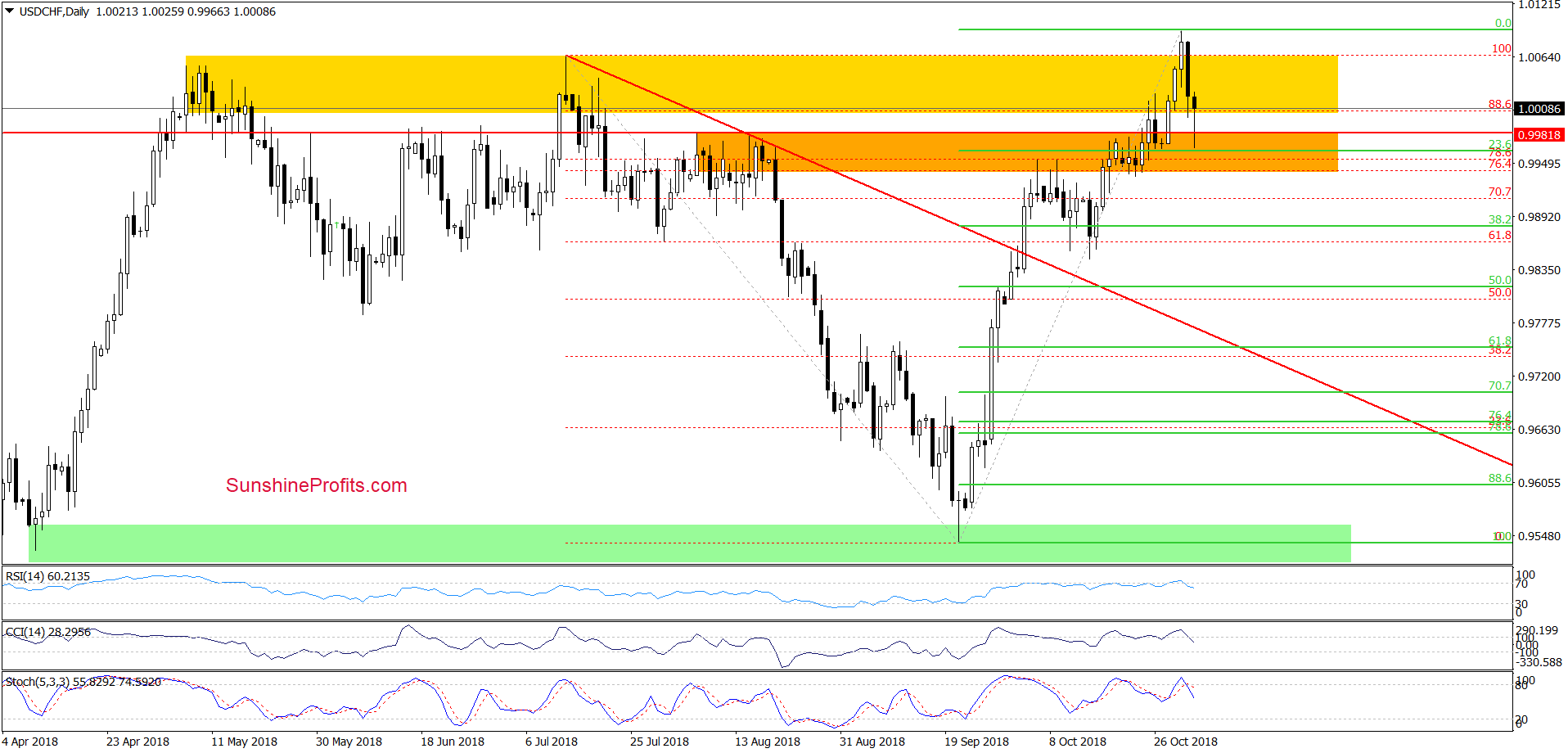

USD/CHF

Quoting our last commentary on this currency pair:

(…) USD/CHF also approached the red resistance zone created by the 76.4% and the 78.6% Fibonacci retracements, which was strong enough to trigger a reversal in May and July.

Therefore, in our opinion, further rally and a test of December 2016 peak will be more likely and reliable only if we see a successful breakout above the above-mentioned red zone. Until this time, one more reversal should not surprise us.

As you see on the weekly chart, the situation developed in line with our assumptions and USD/CHF declined in recent days.

How did this decline affect the very short-term picture of USD/CHF?

From this perspective, we see that although the pair moved a bit higher after our alert was posted, the above-mentioned red resistance zone triggered a move to the downside, which invalidated the earlier tiny breakout above the upper line of the yellow consolidation.

Additionally, the bearish divergences between the RSI and the CCI translated into sell signals (the Stochastic Oscillator also generated a negative signal), which suggests that further deterioration is may be just around the corner.

If this is the case and the pair extends losses from current levels, we’ll see at least a drop to around 0.9881, where the 38.2% Fibonacci retracement is.

Connecting the dots, we think that opening short positions is justified from the risk/reward perspective.

Trading position (short-term; our opinion): Short positions with a stop loss order at 1.0128 and the initial downside target at 0.9881 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts