Since last Friday, GBP/USD wavers between small gains and losses around major short-term support area. Which side of the market has more arguments on its side?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

A week ago, we wrote the following:

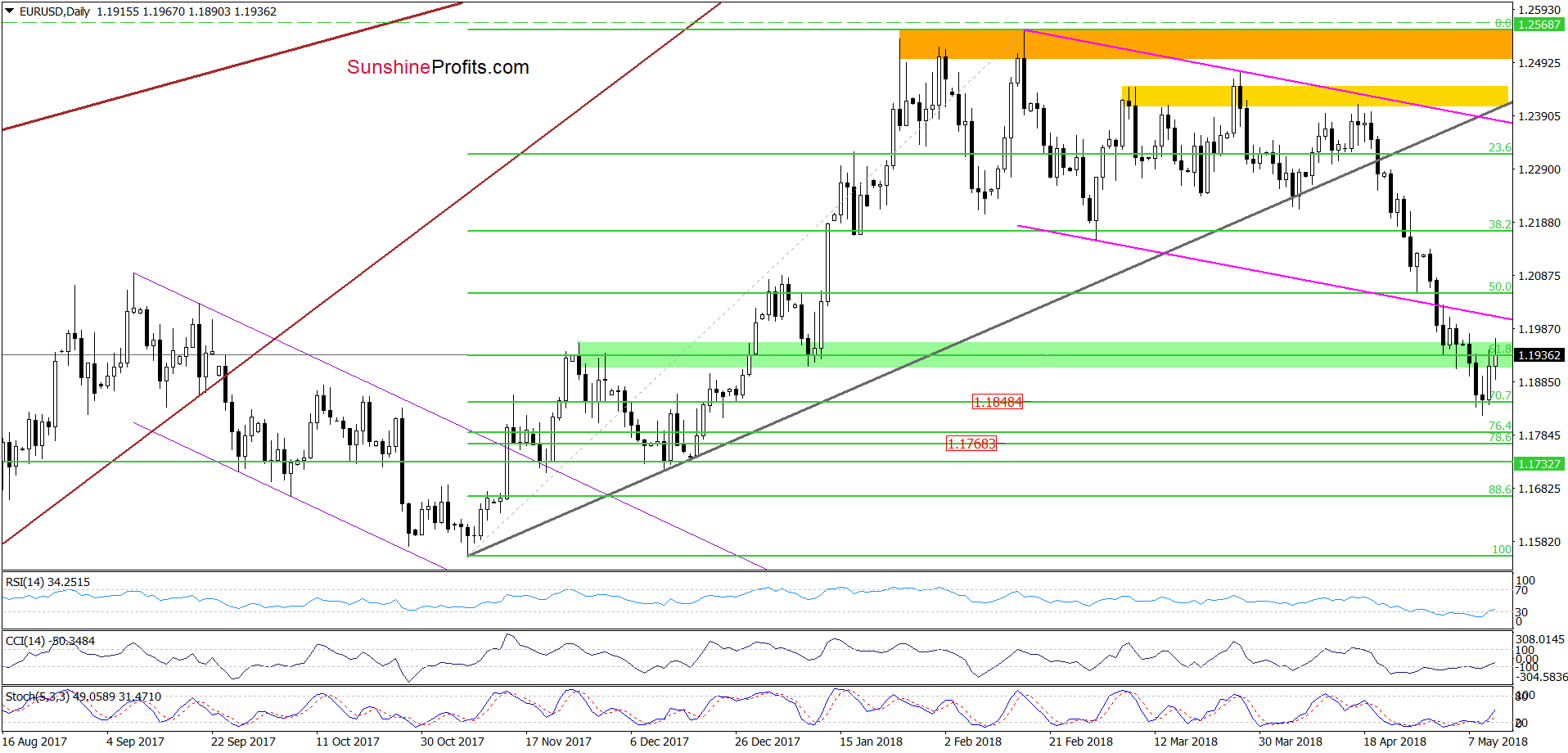

(…) although EUR/USD bounced off the January lows on Friday, the sellers came back to the market earlier today. This suggests a re-test of the recent low later in the day.

(…) If currency bears manage to close the day (todays or one of the following sessions) under this support, we could see a drop to around 1.1850 (the 70.7% Fibonacci retracement) or even to 1.1732-1.1770, where the next support area (created by the 78.6% Fibonacci retracement and mid-December lows) is.

From today’s point of view, we see that the situation developed in line with the above scenario and EUR/USD reached our next downside target - the 70.7% Fibonacci retracement. Although this support stopped currency bears and encouraged their opponents to act during yesterday’s session, the pair is still trading under the previously-broken lower border of the pink declining trend channel and the Monday’s high. This suggests that as long as there is no breakout above these resistances one more downswing can’t be ruled out. If this is the case, a re-test of the recent low should not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

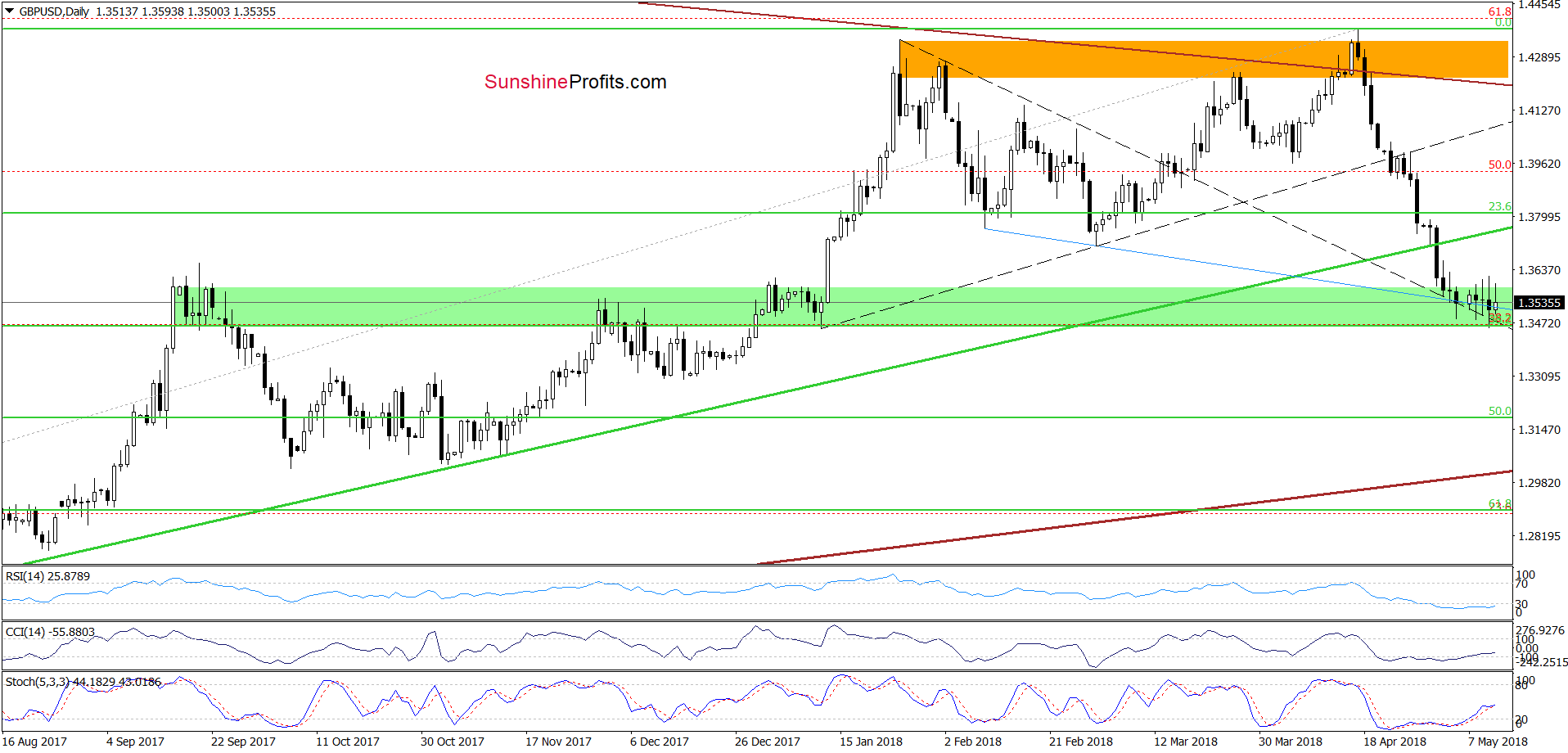

As you see on the daily chart, the overall situation in the very short term hasn’t changed much during this week as GBP/USD wavers between tiny gains and losses around the green support zone created by the September, December and early January highs.

Additionally, this area is also reinforced by the 38.2% Fibonacci retracement (based on the entire 2017-2018 upward move), the blue support line based on the previous lows and the upper line of the black triangle (marked with dashed lines) which together continue to keep declines in check.

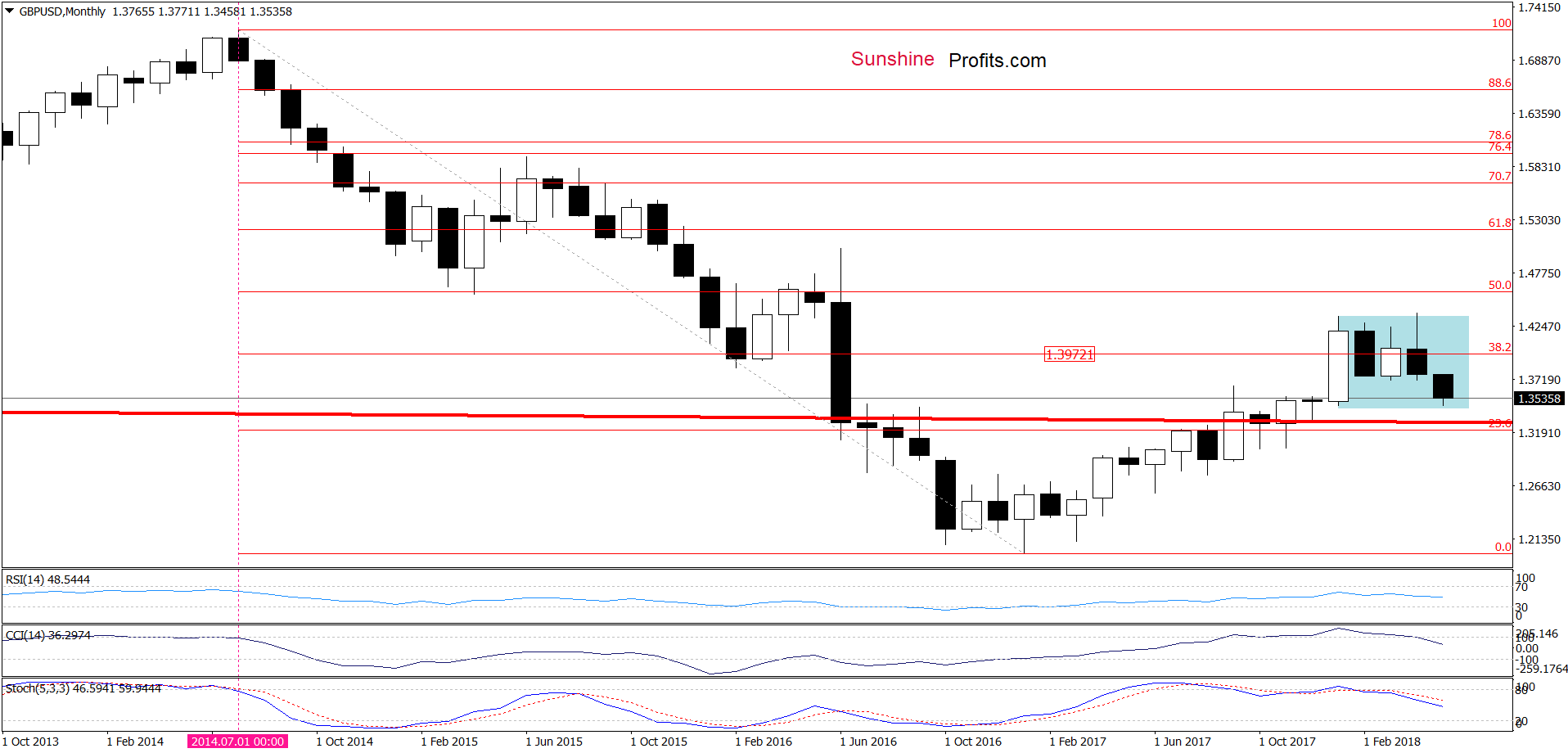

On top of that, when we take a closer look at the long-term chart below, we can notice that the pair is also trading in a consolidation (marked with blue), which increases the probability that we won’t see a bigger move to the downside as long as currency bears manage to break successfully under the lower border of the formation.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

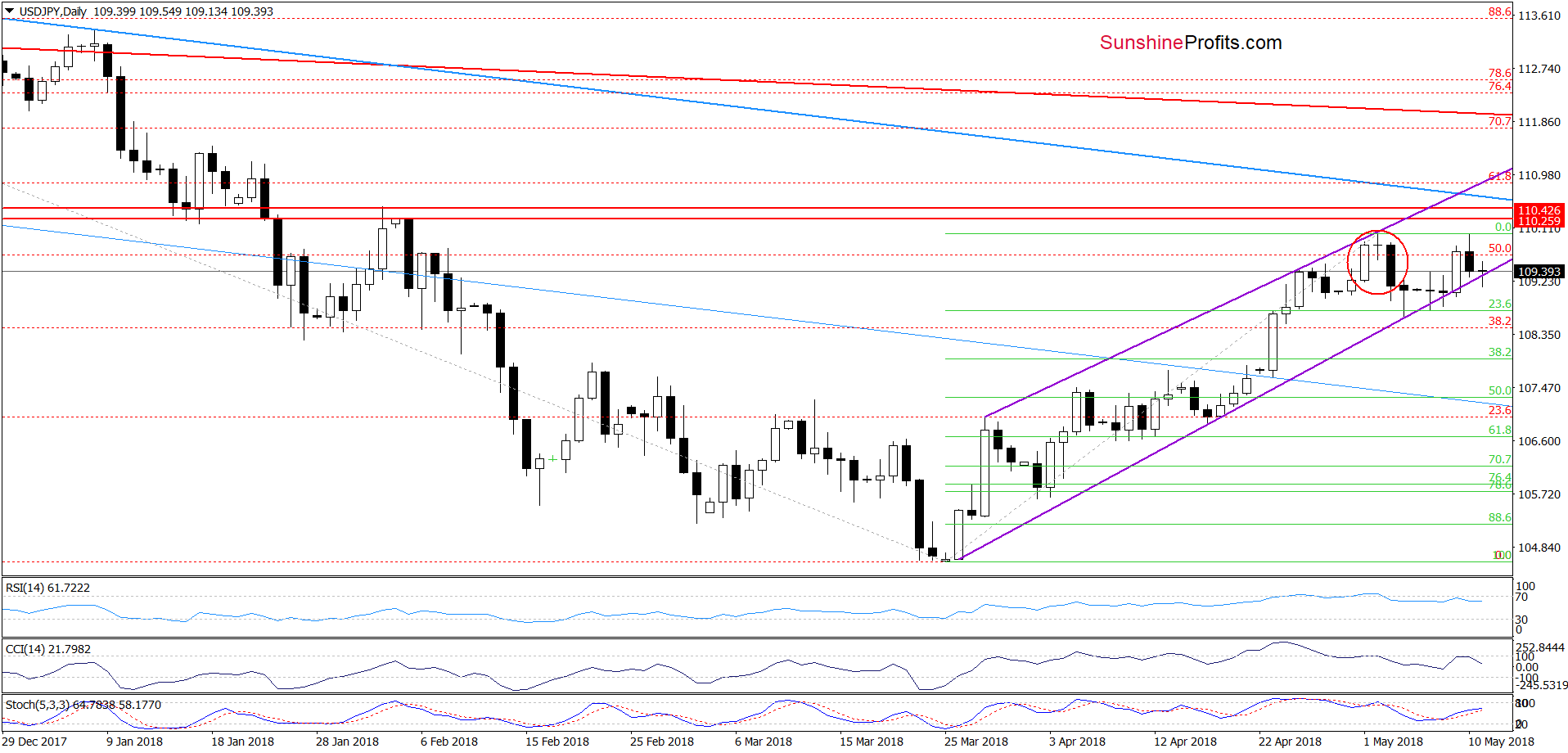

Looking at the above chart, we see that the 50% Fibonacci retracement encouraged currency bears to act during yesterday’s session once again.

Thanks to their attack, USD/JPY slipped under the lower border of the purple wedge for the fourth time, but we think that as long as there is no daily closure below this support a bigger decline is doubtful.

Nevertheless, current position of the daily indicators (the sell signals generated by the RSI and the CCI continue to support the sellers) increases the probability that currency bears will try to push the pair lower in the coming days. If we see breakdown under this support line, we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts