On Friday, the Labor Department showed that the U.S. economy added 211,000 jobs in the previous month, beating analysts’ forecasts and increasing expectations that the Fed will hike interest rates at its upcoming meeting. As a result the USD Index rebounded and climbed above 98. Earlier today, the index extended gains, which pushed the euro to the support area. Will it withstand the selling pressure in the coming days?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

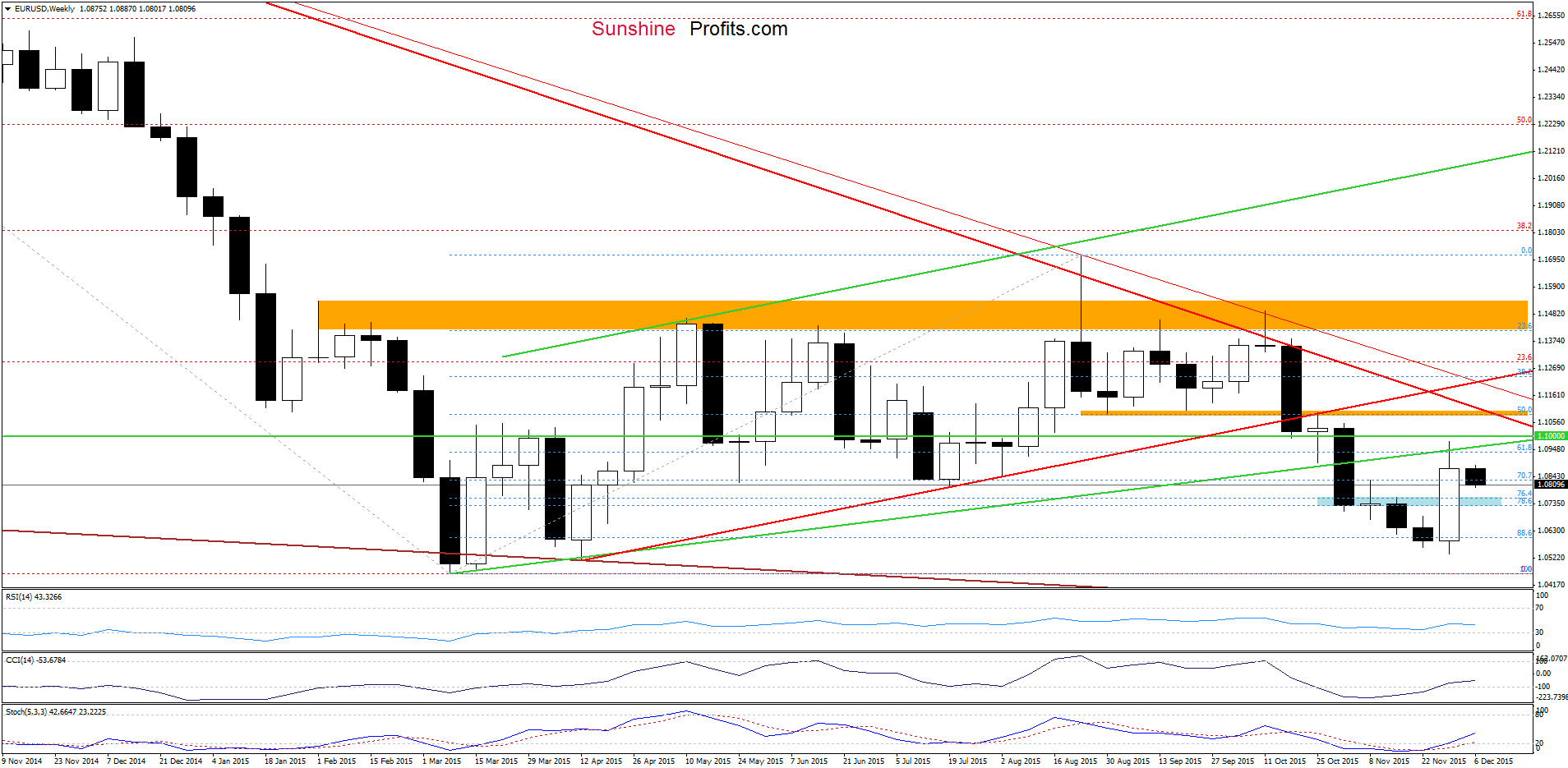

Looking at the weekly chart we see that EUR/USD invalidated earlier small breakout above the green resistance line, which suggests that we may see a test of the blue support zone in the coming days.

But will we see such price action? Let’s examine the daily chart and find out what can we infer from it.

Quoting our previous commentary:

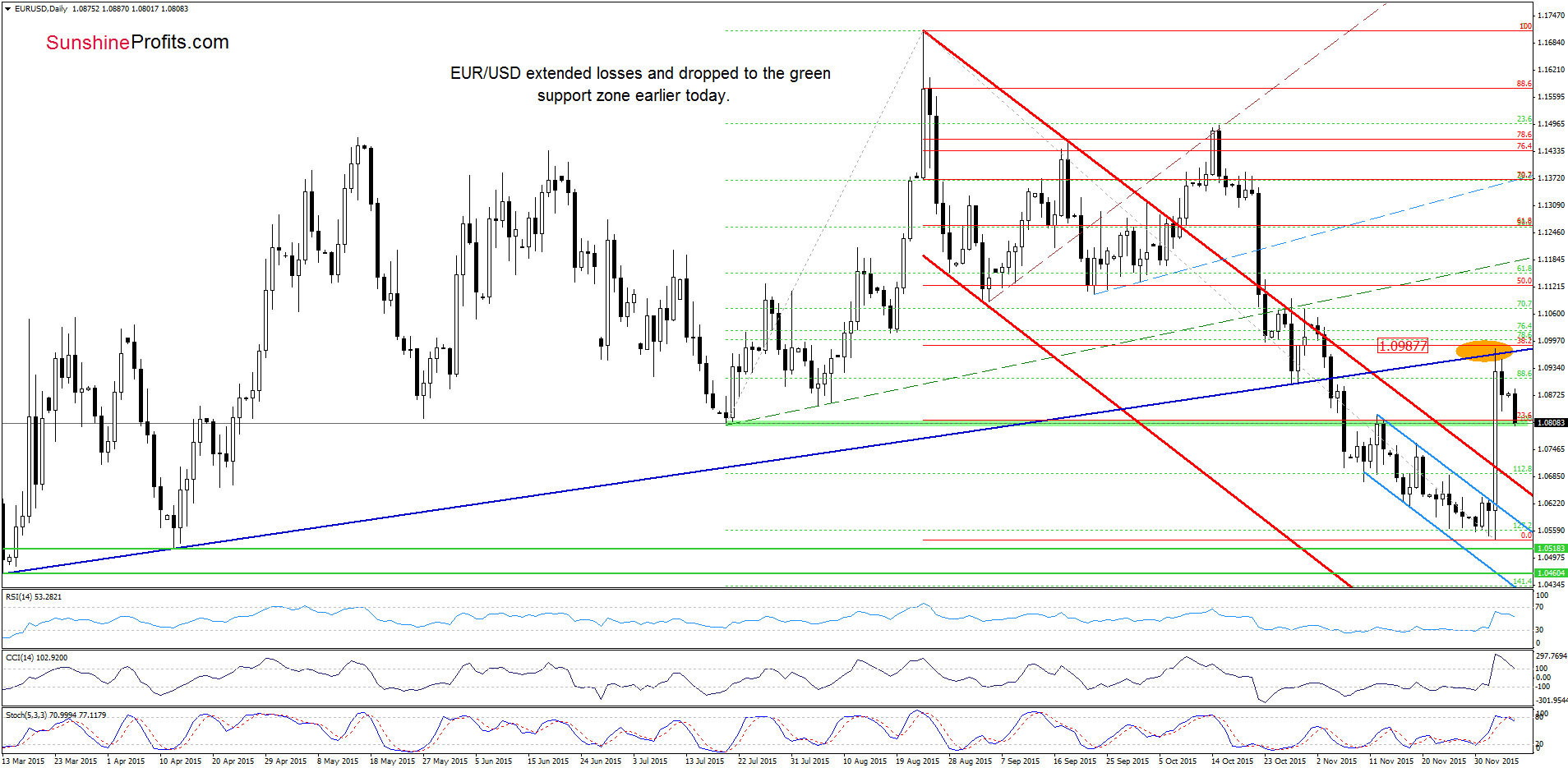

(…) the orange resistance area triggered a pullback, which suggests that the pair may extends losses and verified yesterday’s breakout above Jul low and the mid-Nov high in the coming day(s).

Looking at the above chart we see that the situation developed in line with the above scenario and EUR/USD declined to our initial downside target. If this area withstands the selling pressure, we’ll see a rebound to around 1.0865, where the 38.2% Fibonacci retracement (based on the recent decline) is.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

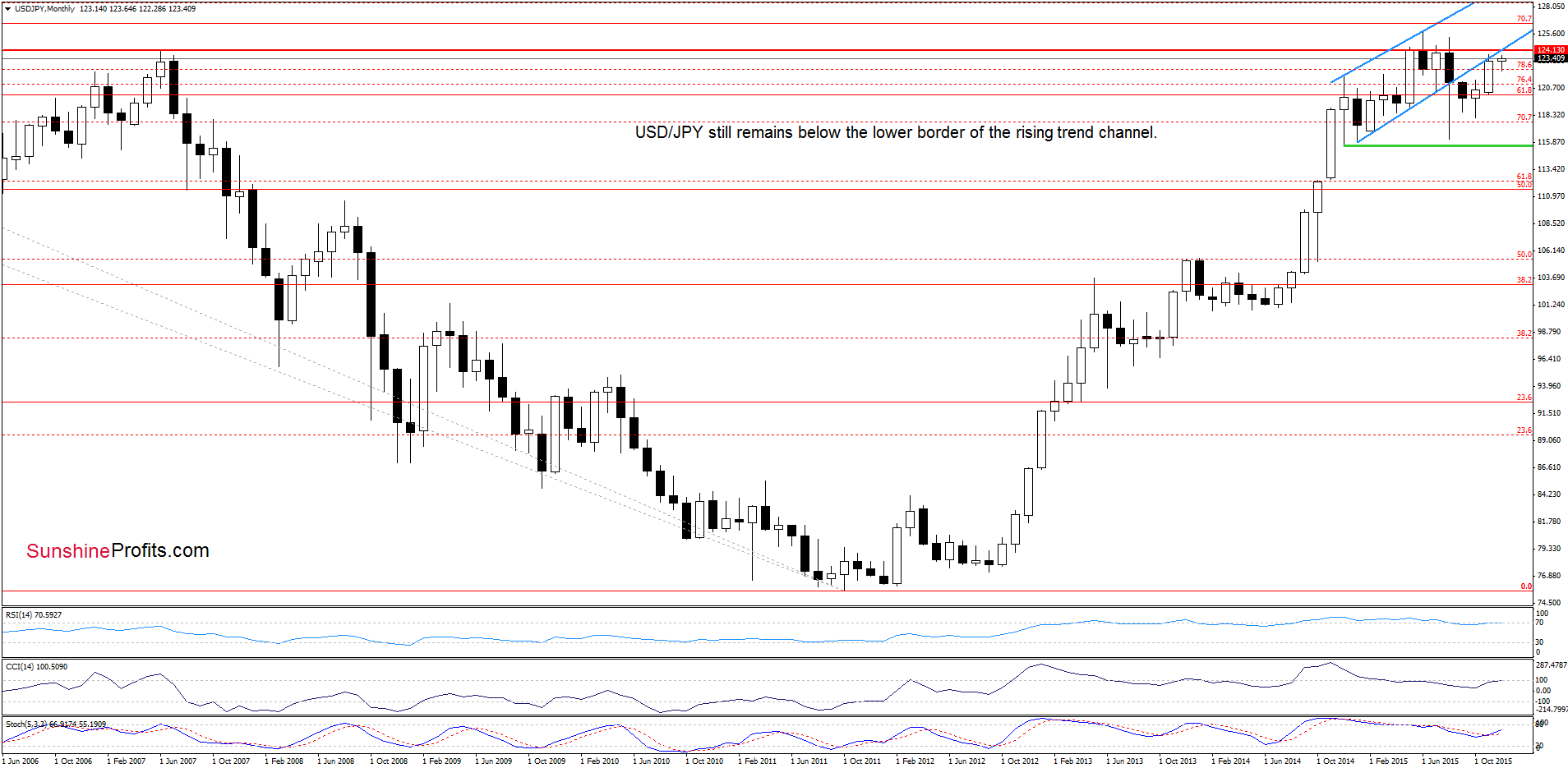

On the above chart, we see that USD/JPY is still trading under the lower border of the blue rising trend channel, which means that as long as there is no comeback above this key resistance line a sizable upward move is not likely to be seen.

Having said that, let’s examine the very short-term chart.

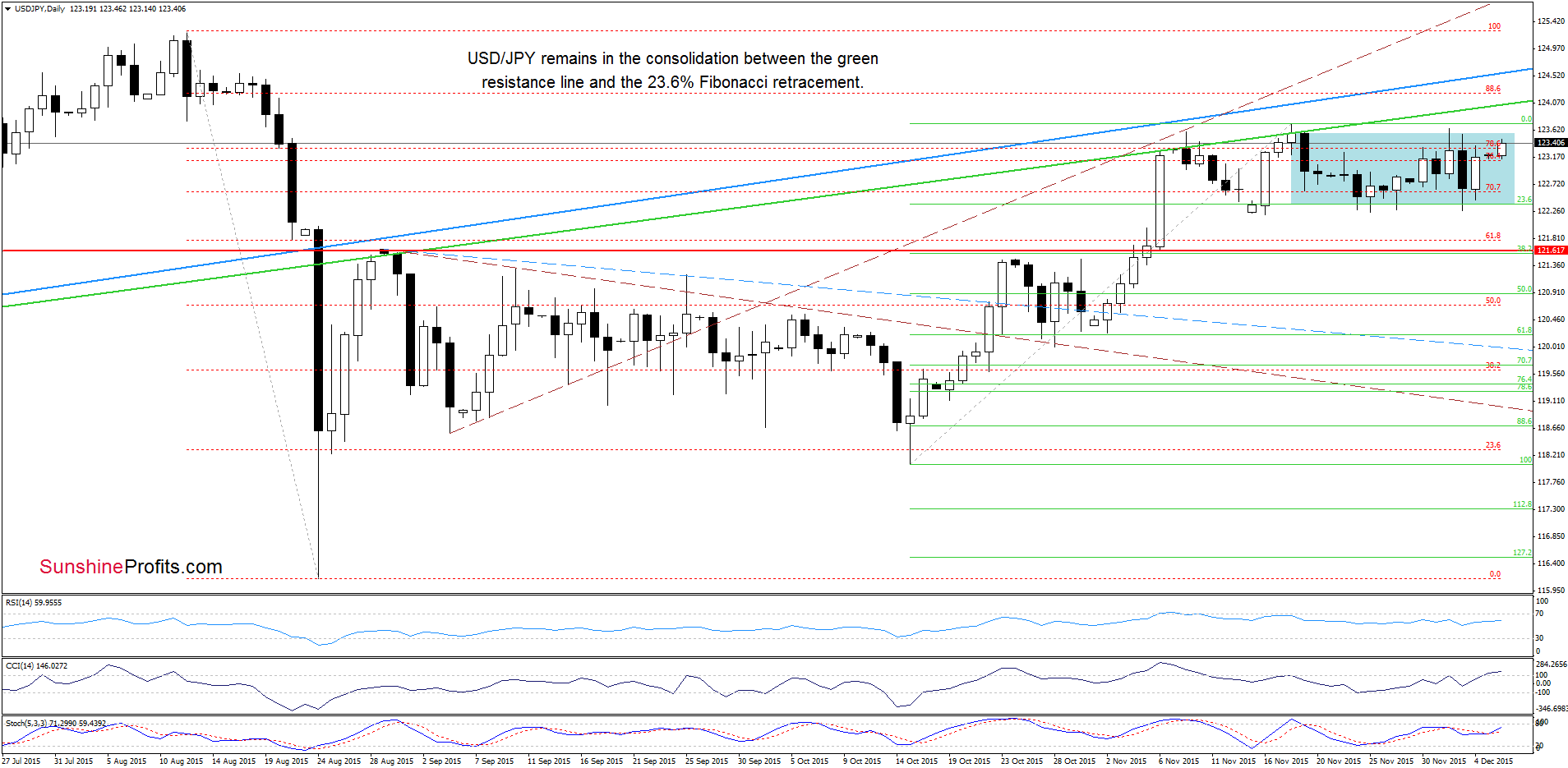

From this perspective we see the very short-term picture hasn’t changed much since our last commentary was posted as USD/JPY is consolidating between the mid-Nov high and the 23.6% Fibonacci retracement, which makes the situation a bit unclear. On Friday, the exchange rate declined and reached the lower border of the formation, which triggered a rebound. Earlier today, the pair extended gains, which approached USD/JPY to the last week’s high. Despite this improvement, we think that as long as there is no breakout above the green resistance line (or a breakdown under the Fibonacci retracement) another sizable move is not likely to be seen ant another downswing can’t be ruled out.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

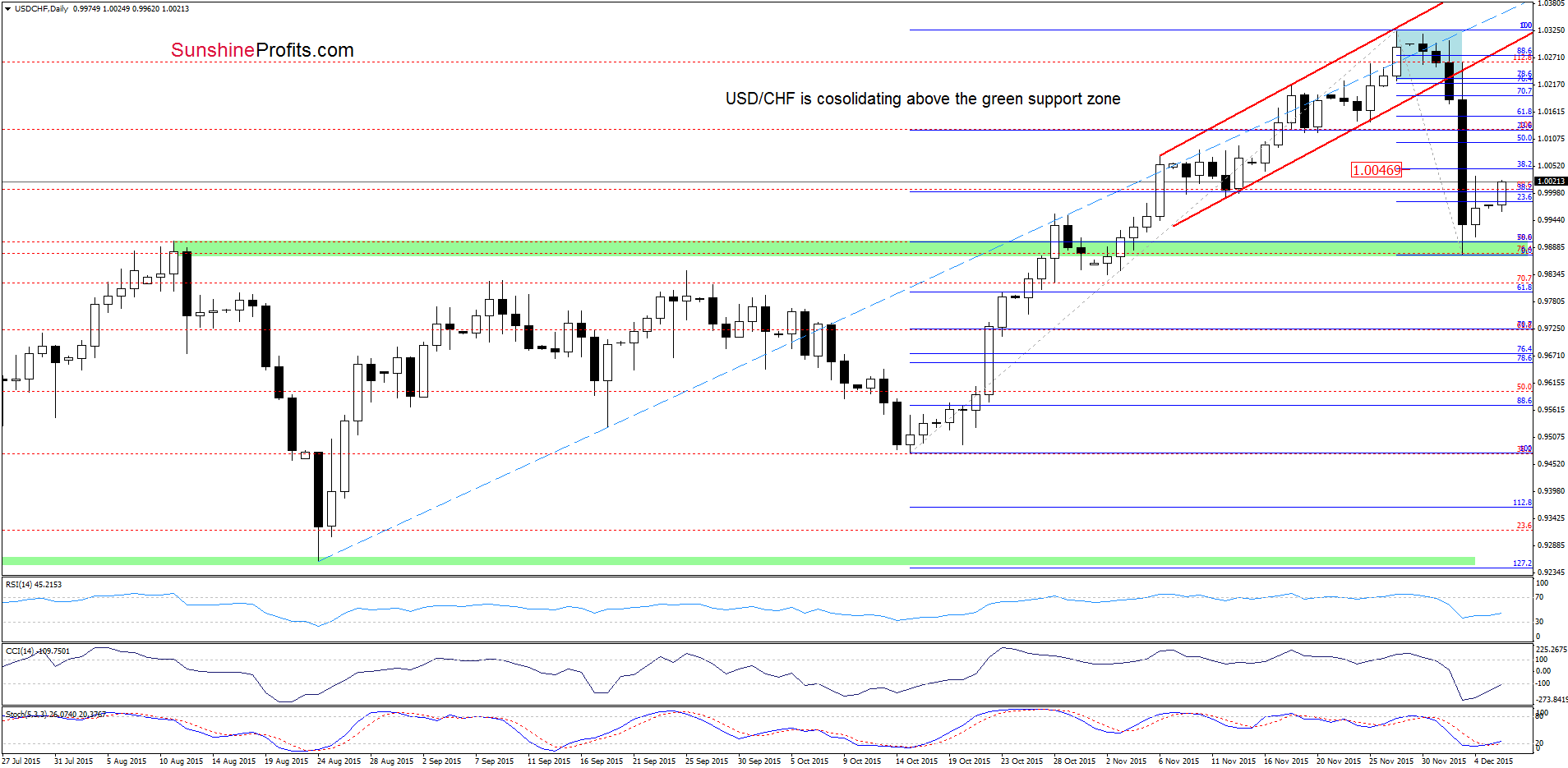

USD/CHF

The situation in the medium term hasn’t changed much as USD/CHD remains between the recent highs and the 23.6% Fibonacci retracement (based on the entire Jan-Dec upward move). Today, we’ll focus on the very short-term changes.

Looking at the daily chart, we see that although USD/CHF moved little lower earlier today, the pair reversed and approached the Friday’s high. This means that what we wrote in our last commentary on this currency pair is up-to-date also today:

(…) we may see an increase to around 1.0046, where the 38.2% Fibonacci retracement (based on the recent decline) is.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts