The U.S. dollar moved higher against the British pound after reports that Ukrainian troops were moving in to the rebel held city of Donetsk, which weighed on market sentiment and fueled concerns over an escalation in the region. As a result GBP/USD declined to the lower border of the consolidation. Is it the last stop before further deterioration?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order: 1.3670)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

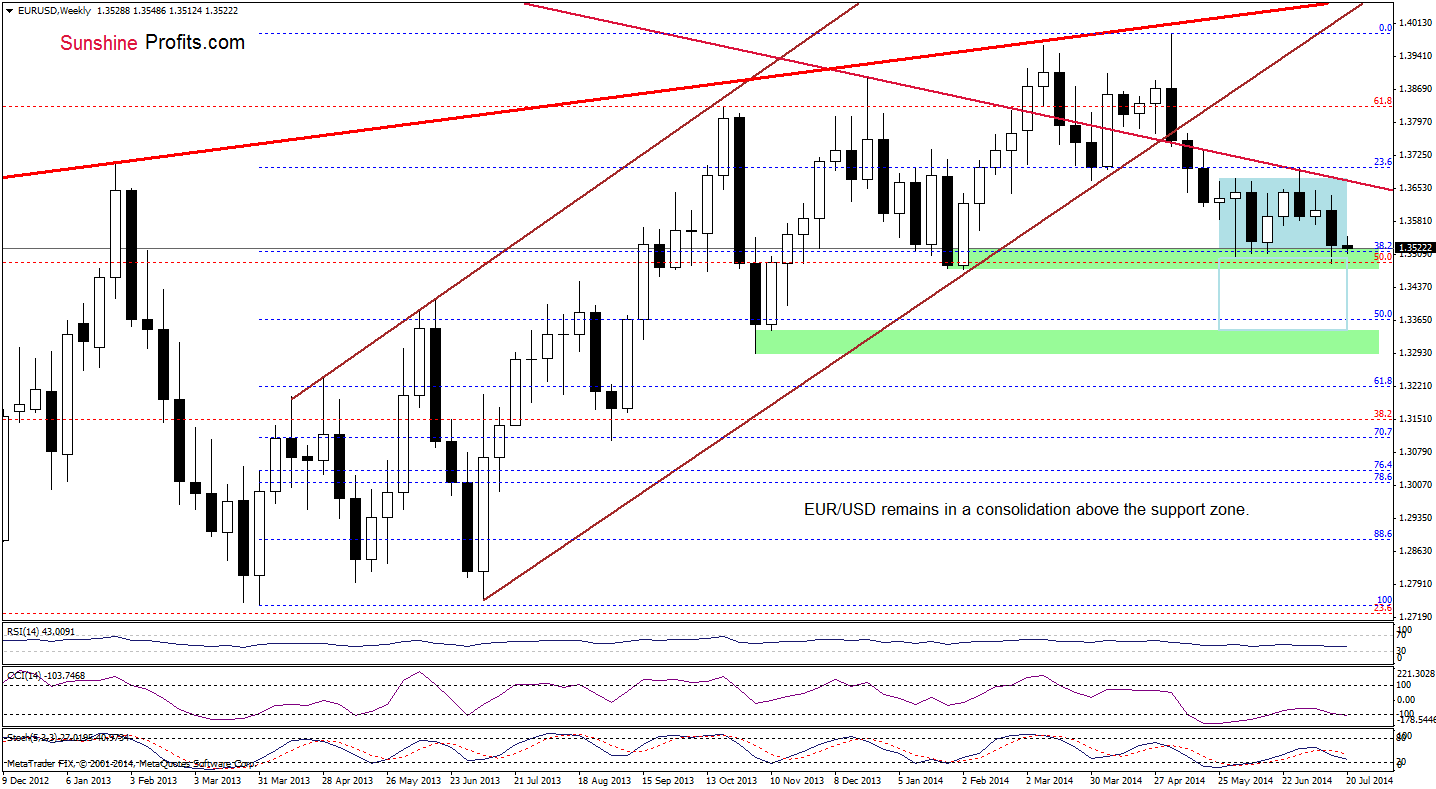

EUR/USD

The overall situation in the medium-term hasn’t changed much as EUR/USD still remains slightly above the lower border of the consolidation. Therefore, what we wrote on Friday is up-to-date:

(…) this area is reinforced by the 38.2% Fibonacci retracement and the June and February lows. If this strong support zone withstand the selling pressure, we’ll see another attempt to break above the upper border of the consolidation and the long-term resistance line (similarly to what we saw at the beginning and also in mid-June). However, if currency bulls fail and the pair moves lower, we may see a drop even to around 1.3320, where the size of the downswing will correspond to the height of the consolidation.

Having discussed the medium-term outlook, let’s check the daily chart.

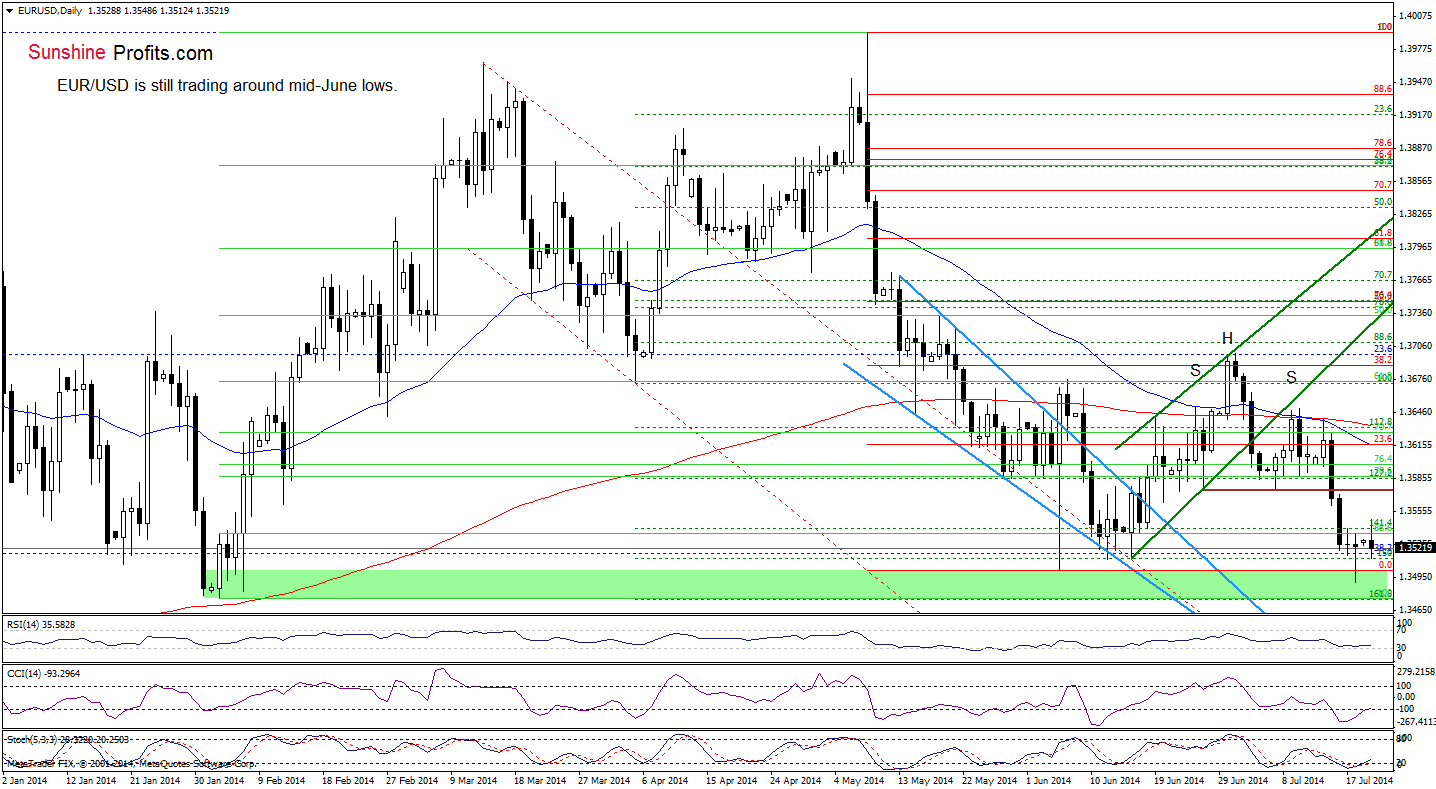

Looking at the above chart, we see that the situation in the very short-term also hasn’t changed much. Although the exchange rate rebounded slightly after Friday’s drop, EUR/USD is still trading in a narrow range, slightly above the June lows. That’s why we are convinced that our last commentary is still valid:

(…) If this area holds, we may see a corrective upswing to the previously-broken neck line of the bearish head and shoulders reversal formation. However, if it is broken, the next target for currency bears will be around 1.3476, where the February low is.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): Small short positions (using half of the capital that one would normally use). Stop-loss order: 1.3670. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

The medium-term outlook didn’t changed since our last Forex Trading Alert was posted and remains mixed as GBP/USD is trading in the consolidation range above the key support line created by the 2009 high.

Will the daily chart give us clues where the pair head next?

Unfortunately not. Why? As you see on the above chart, the pair is still trading in the consolidation (marked with blue), therefore, we are convinced that as long as there is no breakout/breakdown we won’t see another bigger move. So, where the pair head next? We believe that the best answer to this question will be a quote from our last Forex Trading Alert:

(…) In our opinion, based on the visible negative divergences between GBP/USD and all indicators, the next move will be to the downside. As you see on the above chart, if the pair breaks below the lower border of the consolidation, the nearest downside target will be the 2009 high, and the next - the medium-term orange line. Please note that only if the pair breaks below these lines, we’ll see a correction to around June 18 low, where the size of a pullback will correspond to the height of the formation.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: bearish

LT outlook: mixed

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

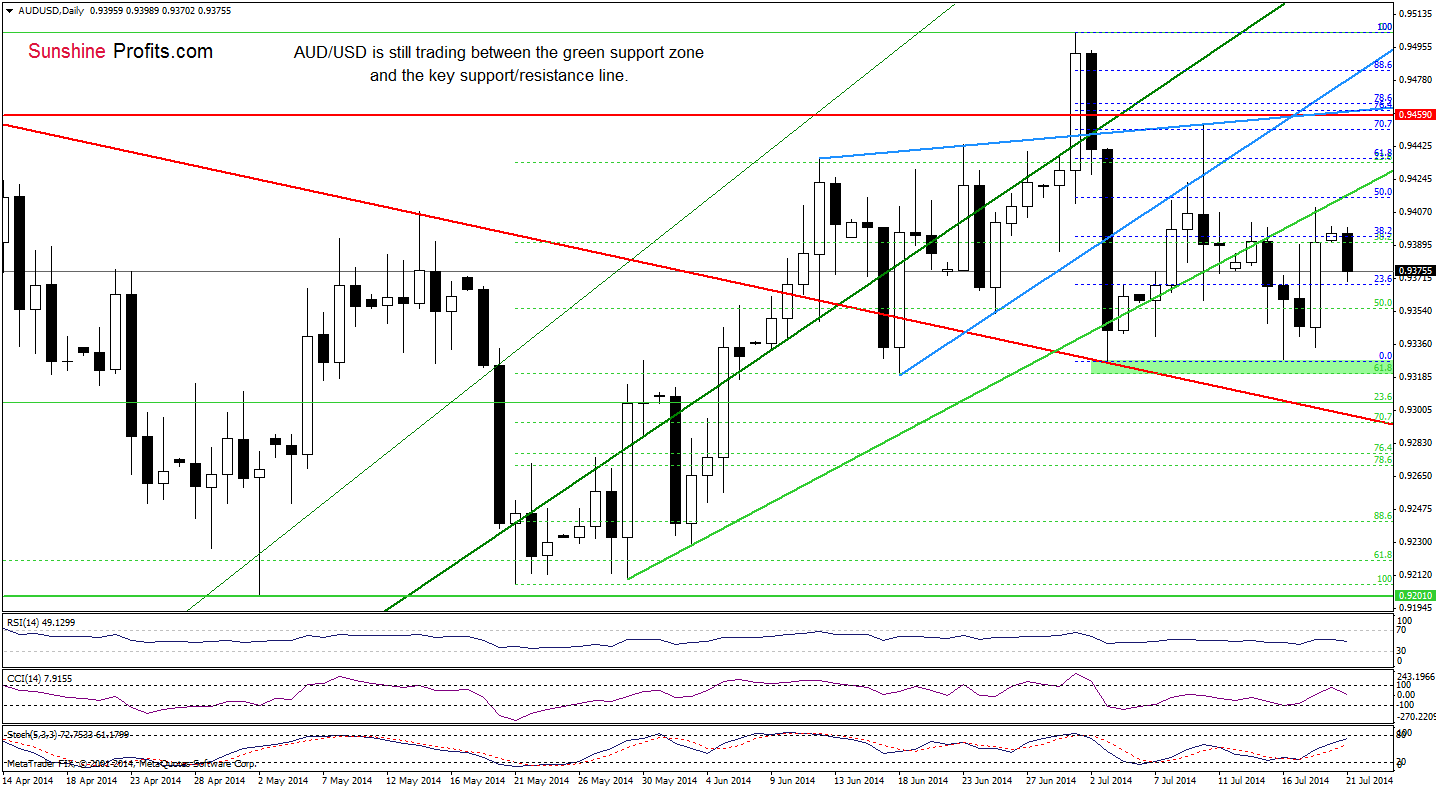

AUD/USD

The medium-term outlook remains mixed as AUD/USD is still trading in a consolidation slightly below the 2014 high. Will the very short-term picture give us more learly clues where the pair head next? Let’s check.

From this perspective, we can summarize the previous week in one simple sentence: although a lot happened, nothing really has changed. As you see on the daily chart, AUD/USD has been trading between the green support zone and the support/resistance line recently. Although both, the bulls and the bears, have tried to push the exchange rate above/below these key levels, none of them managed to hold gained levels and the pair has fluctuated in a quite narrow range. So, what’s next? Here's what we think: when in doubt, stay out. Similarly to what we wrote in the case of GBP/USD, as long as there is no breakout above the major resistance (or breakdown under the key support), another sizable move is not likely to be seen.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts