There is a saying in the trading world to the effect that one never get poorer by cashing in profits. It’s certainly true and knowing when to ring the cashier’s bell (so as not to leave profits on the table) is even better. Capital protection and growth is key to long-term success. Come and see what kind of action is most sensible right now.

- EUR/USD: short (a stop-loss order at 1.1416; the initial downside target at 1.1305. In other words, we decided to move to the stop-loss order down and effectively lock in gains)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: half of short positions (with a stop-loss order at our entry level at 0.7228 and the next downside target at 0.7041). In other words, we decided to close half of our profitable short positions and take profits off the table.

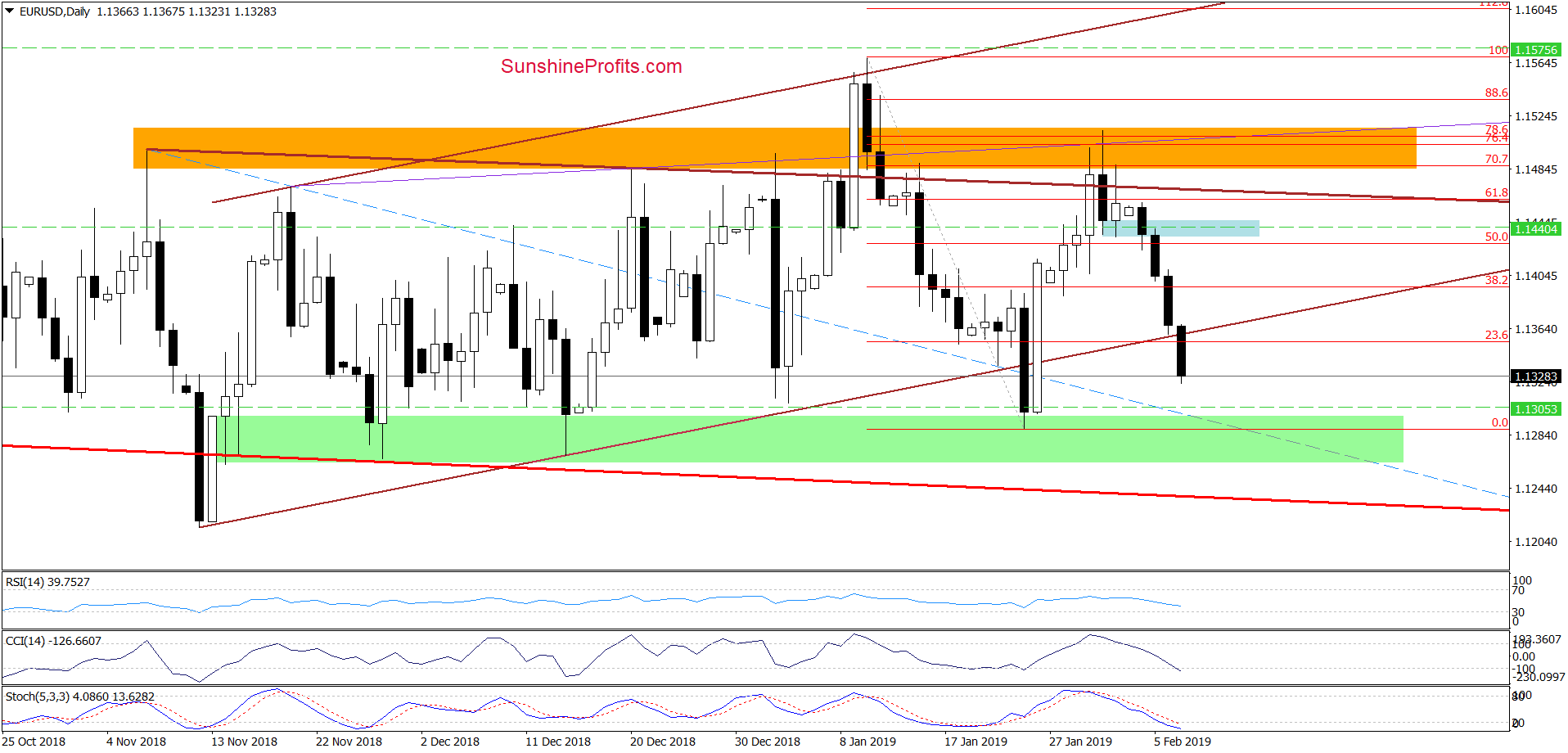

EUR/USD

We’ll take a look at the daily chart. The first thing that catches the eye, is today’s breakdown below the lower border of the brown rising trend channel. This is a negative development for the bulls and suggests further deterioration in the very near future. The indicators are still positioned in a supportive way for such an outcome.

Taking the above into account, we continue to believe that we’ll see a realization our pro-bearish scenario from our Friday’s alert:

(…) EUR/USD will likely turn south and re-test the lower border of the brown triangle or even the green support area, which stopped the sellers several times in recent weeks.

Finishing today’s commentary on this currency pair, we would like to add that we decided to move our stop-loss order below the entry price to protect some of our profits. Additionally, if the exchange rate drops to our initial downside target, we’ll close half of the current position and take profits off the table. The other half will stay in play with the lowered stop-loss order.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 1.1416 and the initial downside target at 1.1305 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

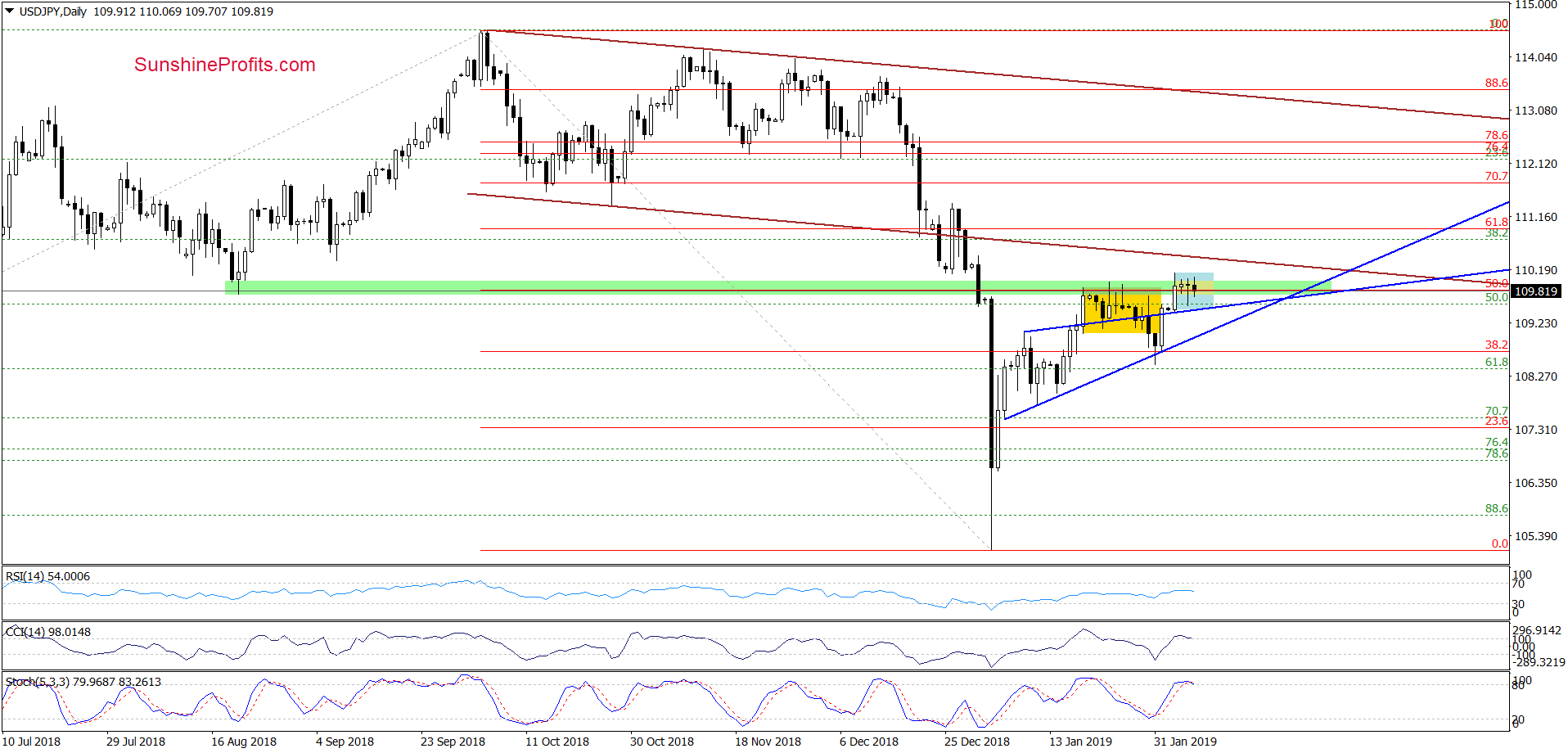

USD/JPY

One consolidation ends and another one starts. From today’s point of view, we see that although USD/JPY broke above the January highs, currency bulls failed to take the exchange rate higher. Instead of continuing with the upward move, the pair got stuck in the blue consolidation, pointing to the buyers’ weakness.

Additionally, the CCI and the Stochastic Oscillator moved to their overbought areas, suggesting that their flashing respective sell signals is a question of a short time only. If this is indeed the case, and the bulls do not manage to take USD/JPY higher (to at least the previously-broken lower border of the brown declining trend channel), we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. As always, we will keep you – our subscribers – informed should anything change, or should we see a confirmation/invalidation of the above.

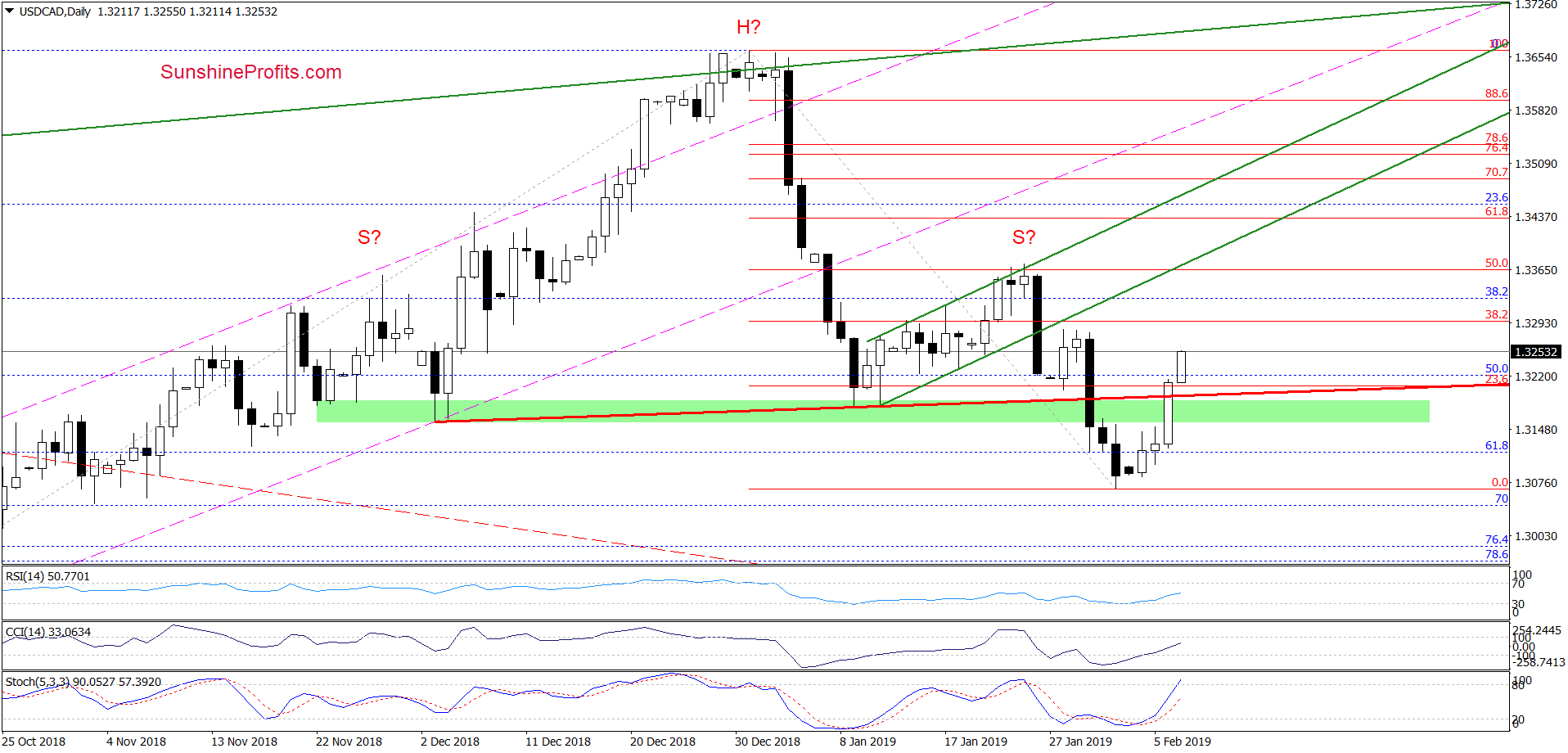

USD/CAD

Quoting our last commentary on this currency pair:

(…) USD/CAD has been spending recent days in the yellow consolidation area, which could be just a pause before further deterioration. Nevertheless, as the daily indicators currently generated multiple buy signals, we think that we’ll likely see breakdown verification first before the price commits to the next move down.

If this is the case, the exchange rate will likely break above the upper border of the yellow consolidation and test the strength of the red resistance line.

Our expectations proved to be correct. Looking at the daily chart, we see that the buyers not only tested, but also managed to break above the red resistance line. In this way, USD/CAD invalidated the earlier breakdown below both the red resistance line and the green support zone, which is a bullish development.

Taking this into account and combining it with the buy signals generated by the indicators, we think that further improvement is just around the corner. The pair will likely extend gains from current levels and test the 38.2% Fibonacci retracement based on the entire recent downward move in the very near future. If this resistance is broken, we’ll likely see a move to the January peaks and the 50% Fibonacci retracement level in the following days. Depending on the time it takes, it could happen at the proximity to another resistance level - the lower border of the previously broken rising green trend channel.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

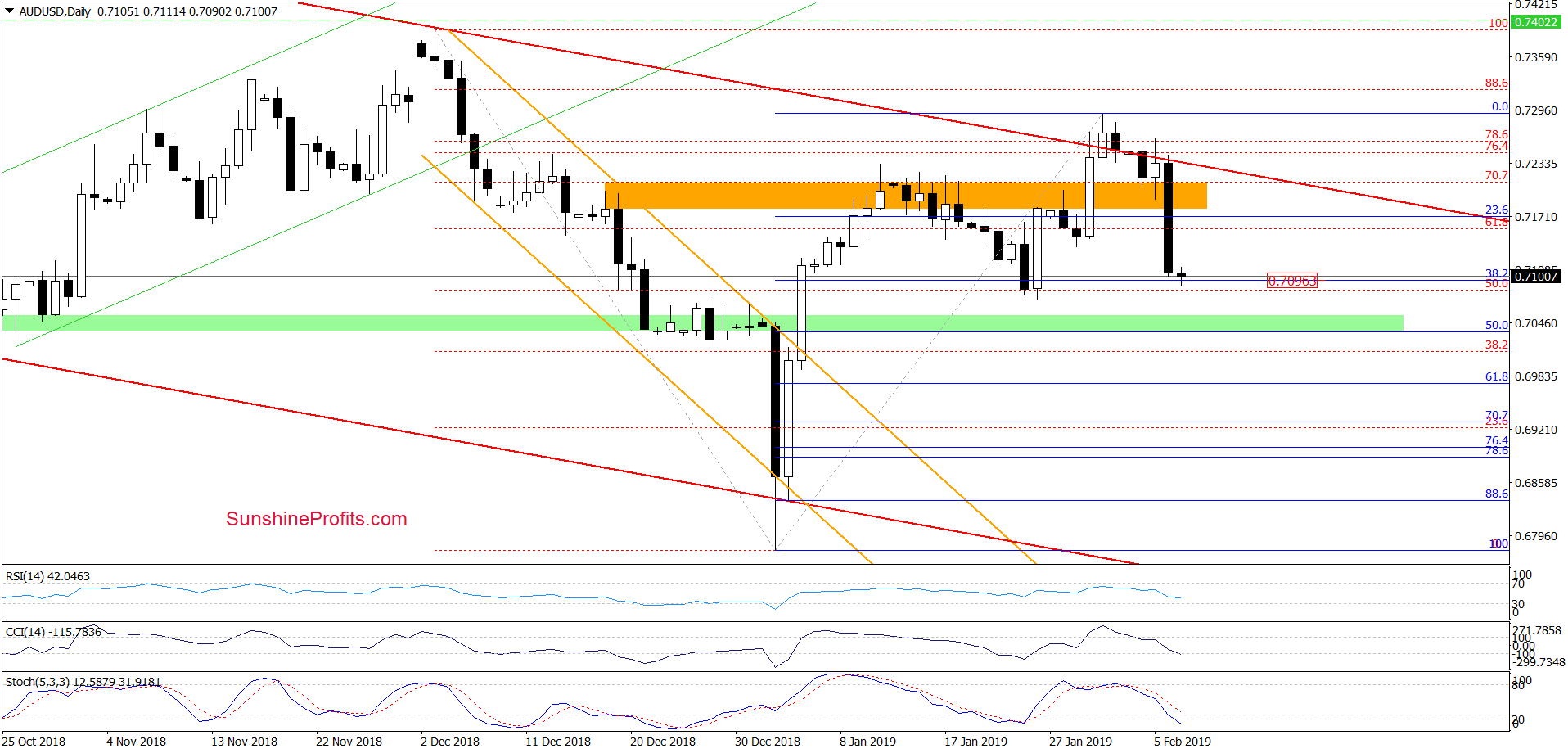

AUD/USD

Yesterday, we wrote the following:

(…) Thanks to today’s downswing, the pair not only verified the earlier breakdown below the upper border of the declining red trend channel, but also cut through the orange zone like a hot knife through butter. The orange zone used to be a resistance and with the breakout last week, it looked like it would become a support now. However, the support didn’t hold and thus the zone has back again turned into a resistance. This is what invalidation of a breakout looks like – a strongly bearish sign on its own.

On top of that, the sell signals generated by the daily indicators remain on the cards. They suggest further deterioration and a realization of our Monday’s scenario in the very near future, namely that we’d likely see a test of the recent lows.

From today’s point of view, we see that the situation developed in tune with our assumptions and AUD/USD slipped to our initial downside target earlier today. Taking this fact into account, we decided to close half of our short positions and take profits off the table. The other half of the current positions remains in the cards, but we decided to lower our stop-loss order (similarly to what we one in the case of EUR/USD) to protect our capital. All needed details below.

Trading position (short-term; our opinion): Half of profitable short positions (with a stop-loss order at our entry level at 0.7228 and the next downside target at 0.7041) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist