Earlier today, EUR/USD broke above the upper line of the trend channel, but can we trust this move?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1510)

- GBP/USD: short (a stop-loss order at 1.3773; the next downside target at 1.3000)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: long (a stop-loss order at 0.7410; the initial upside target at 0.7725)

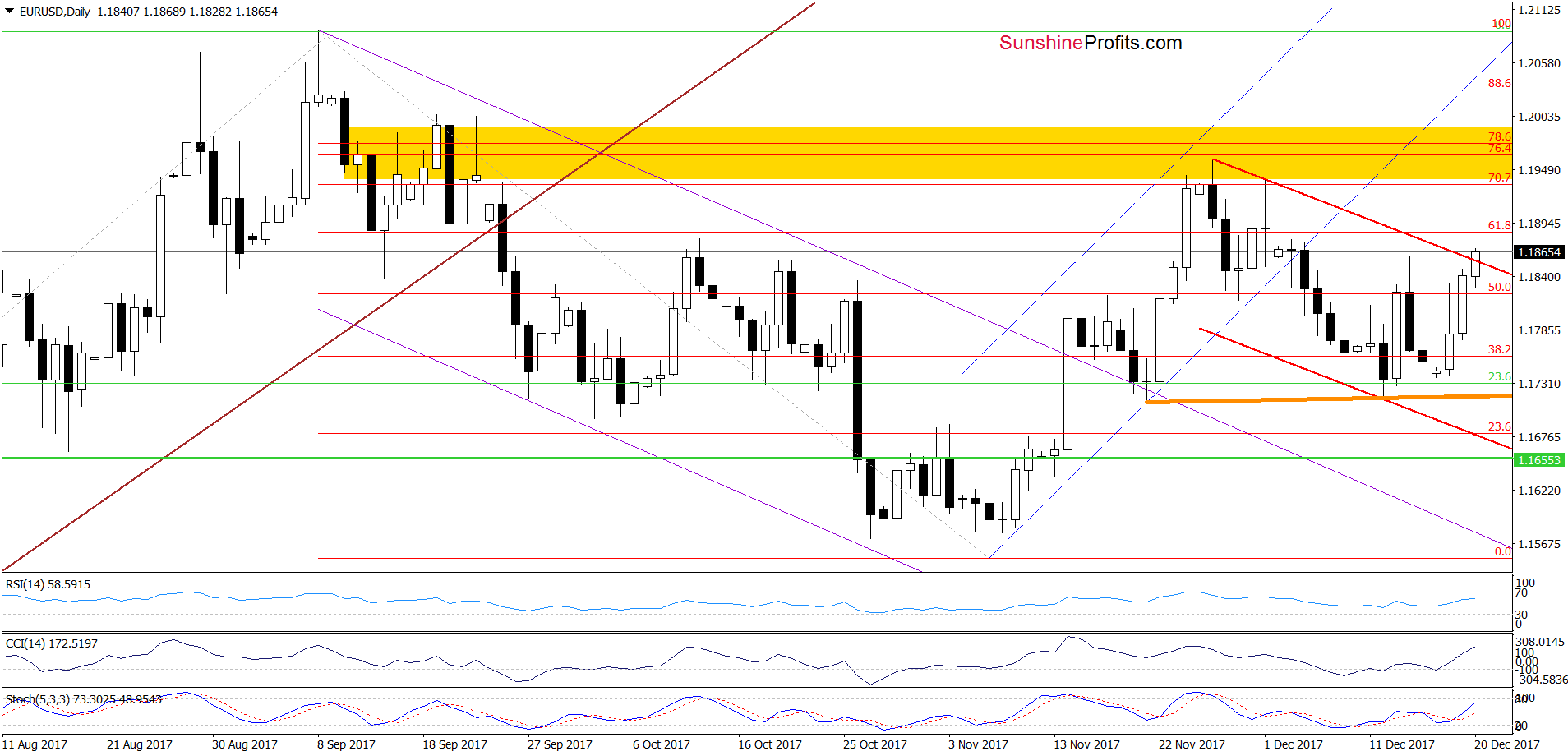

EUR/USD

Looking at the daily chart, we see that EUR/USD broke above the upper border of the red declining trend channel, which is a positive sign. Nevertheless, it will be more reliable if we see a daily closure above this resistance line. At this point it is also worth noting that even if the exchange rate moves higher from current levels, the space for increases seems limited as the yellow resistance zone is quite close.

Trading position (short-term; our opinion): short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1510) continue to be justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

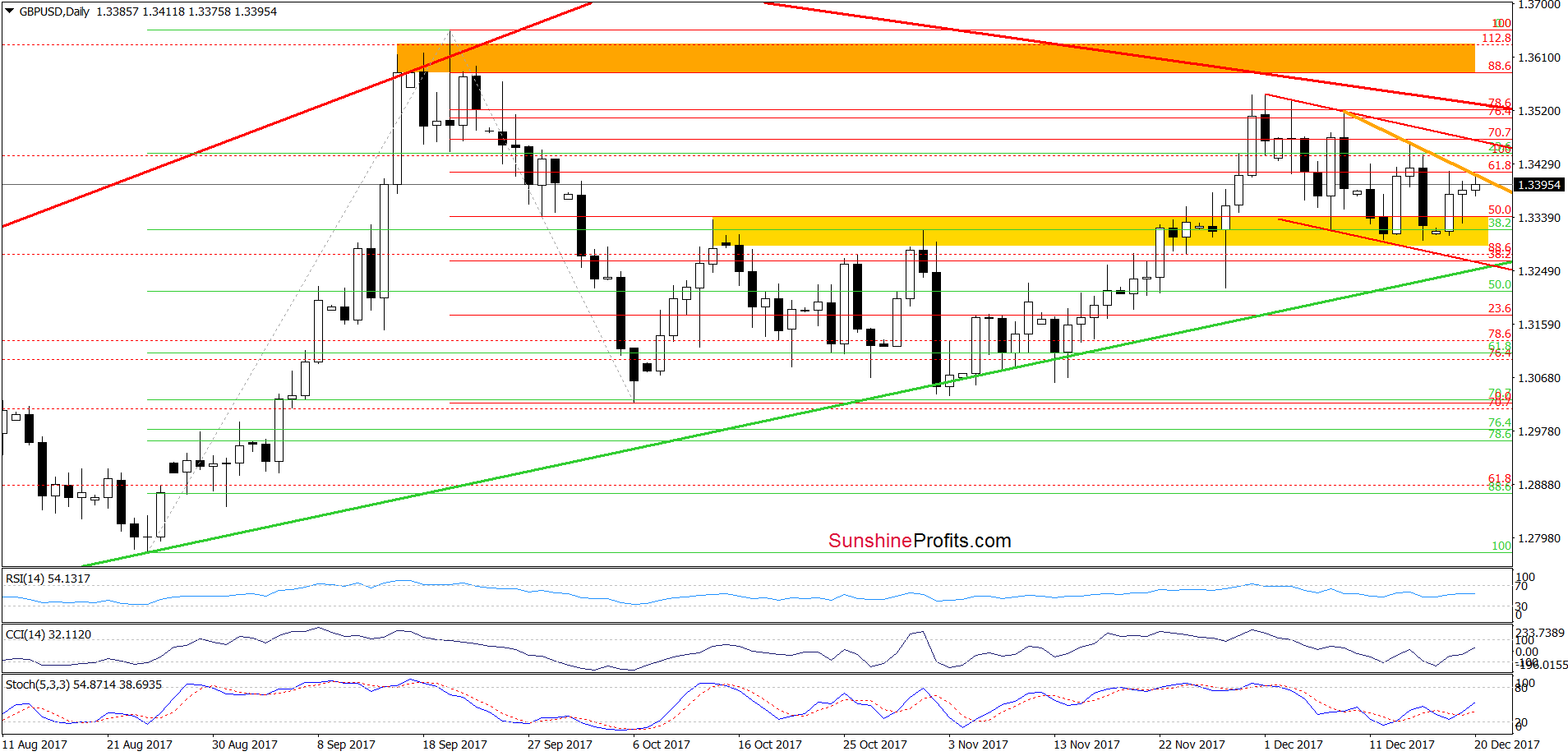

GBP/USD

From today’s point of view, we see that the overall situation in the short term hasn’t changed much as GBP/USD is still trading in a narrow rane between the yellow zone, which serves as the nearest support ad the orange declining resistance line based on the previous highs. Taking the above into account, we believe that our last commentary on this currency apir remains up-to-date also today:

(…) GBP/USD bounced off the yellow support zone once again (…). We saw similar price action two times in December, but none of them brought any improvement in the short-term (not to mention the medium-term perspective). When we take a closer look at the above chart, we notice that the last week’s increase was smaller than the previous one, which translated into another decline. Therefore, in our opinion, as long as there is no breakout above the upper border of the red declining trend channel lower values of GBPUSD are very likely and short positions continue to be justified from the risk/reward perspective.

Trading position (short-term; our opinion): short positions (with a stop-loss order at 1.3773 and the next downside target at 1.3000) continue to be justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

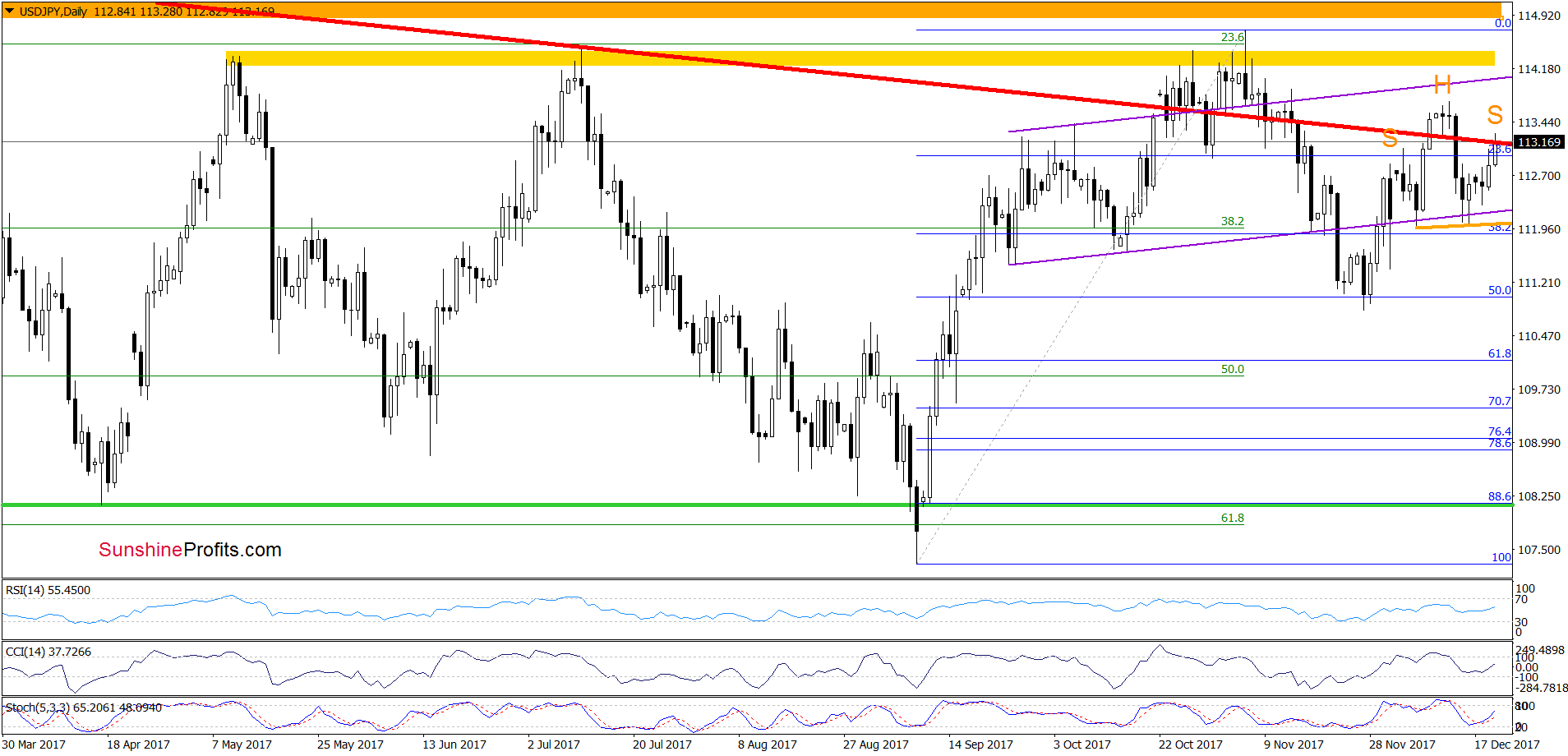

USD/JPY

On the daily chart, we see that although USD/JPY increased in recent days, the exchange rate remains under the long-term red declining resistance line. Earlier today, we saw a tiny breakout above this line, but currency bears pushed the pair lower quickly, which suggests that another move to the downside may be just around the corner.

If this is the case, we could see a pro bearish scenario from our Monday alert:

(…) currency bears came back (…), triggering another pullback. (…) if they manage to push the pair under the orange support line based on the recent lows, we can see a decline to the 50% Fibonacci retracement and the November lows.

Why? As you see on the daily chart, we marked a potential head and shoulders formation, which will turn into a strong bearish signal if USD/JPY declines under the orange line (the neck line of he formation). Therefore, waiting at the sidelines for a confirmation/invalidation of the above is justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts