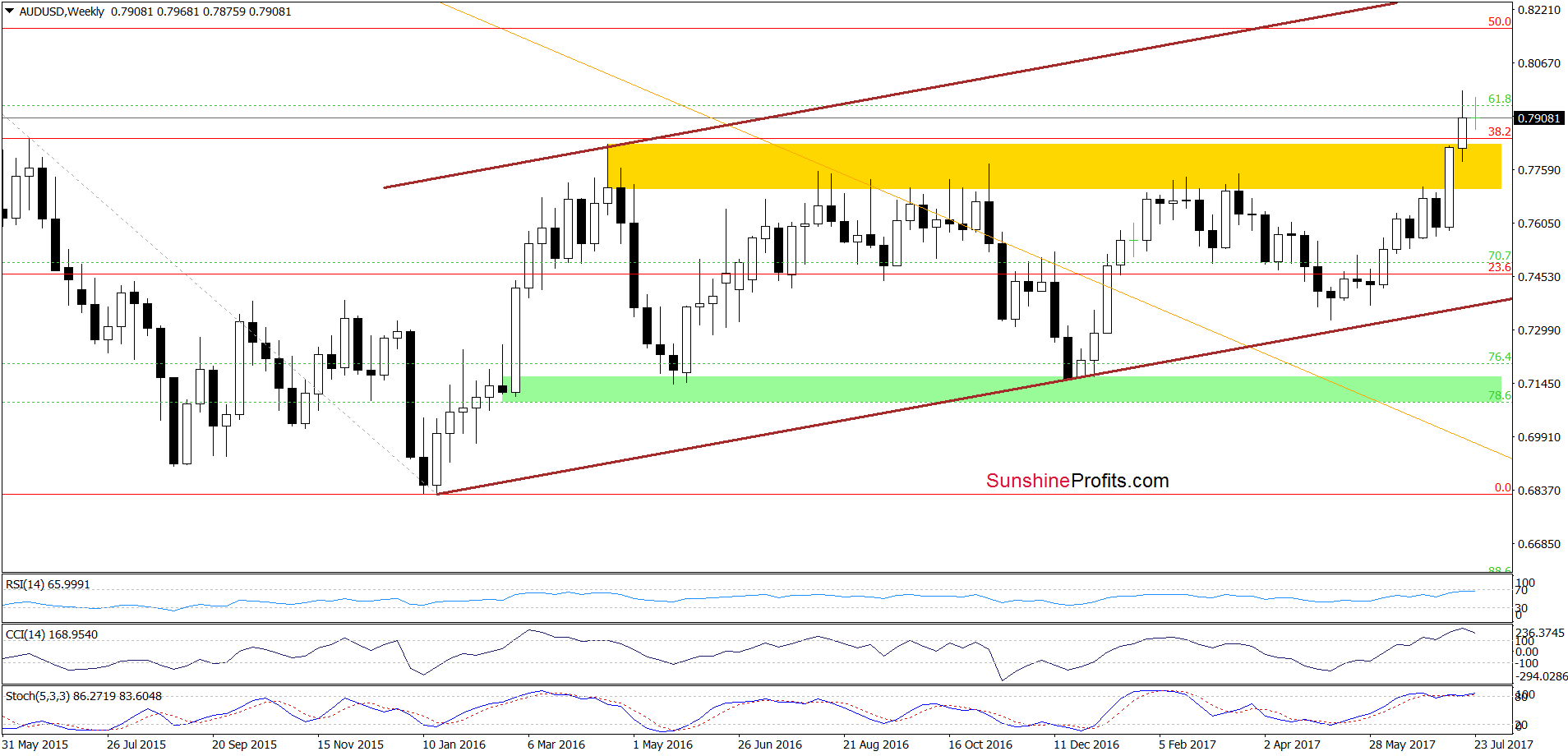

Earlier today, the Australian dollar declined against its U.S. counterpart, but the combination of two supports triggered a rebound. But is it enough to push AUD/USD to fresh highs?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1803; the initial downside target at 1.1408)

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

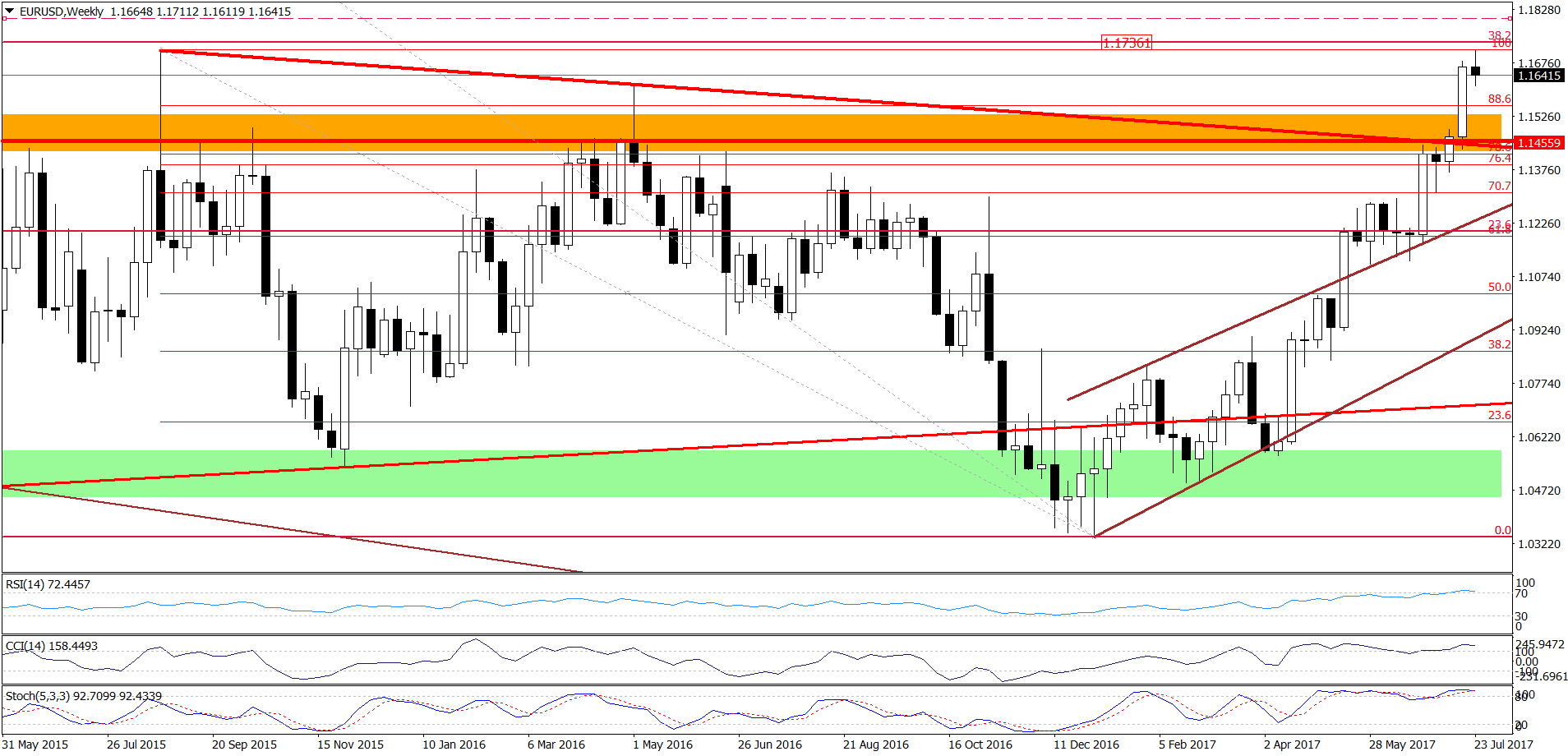

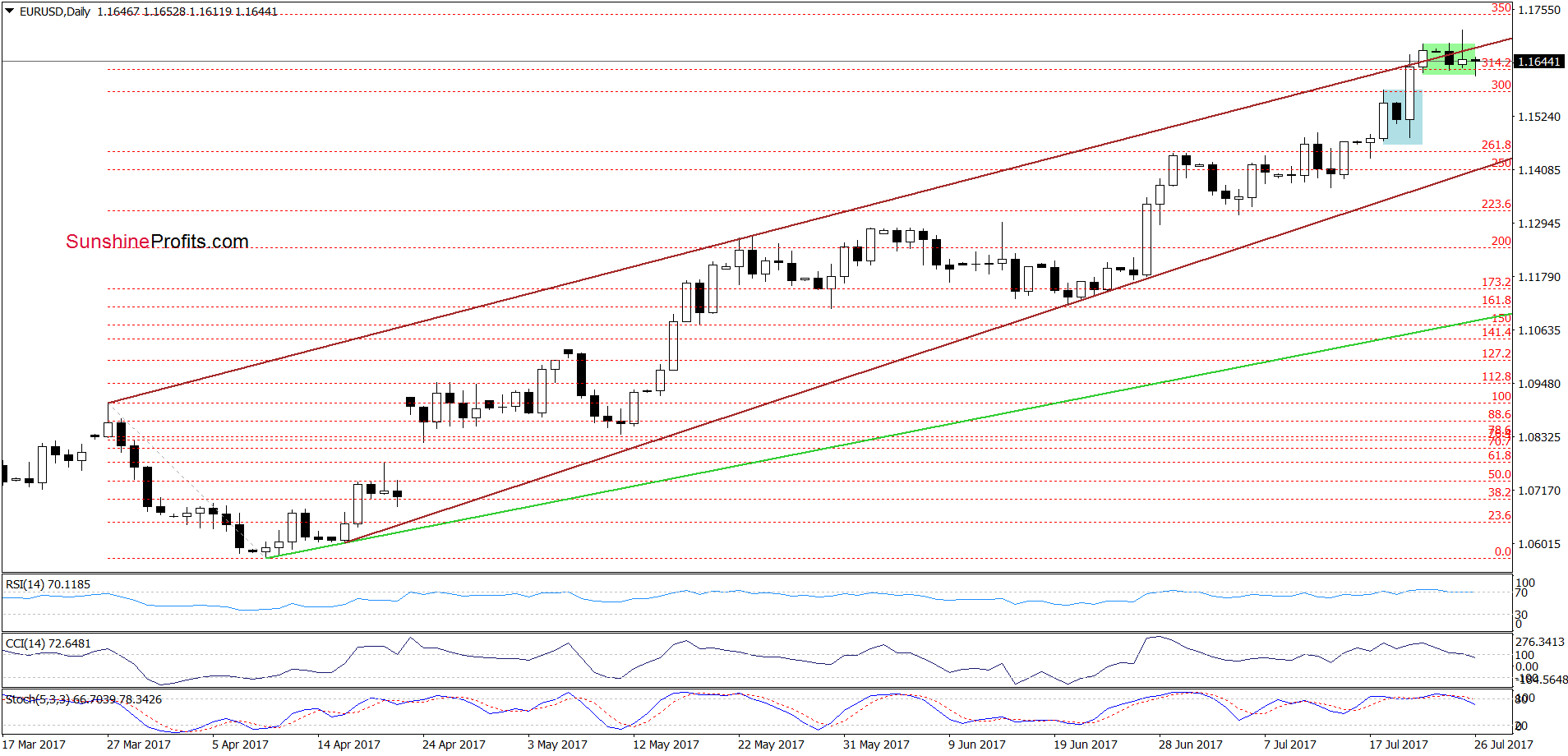

EUR/USD

Yesterday, we wrote the following:

(…) EUR/USD approached not only the August 2015 high, but also the 38.2% Fibonacci based on the entire May 2014-January 2017 downward move. What does it mean for the exchange rate? Taking into account the importance (and potential strong) of these resistances and the current position of weekly and daily indicators, it seems that the area around 1.1713-1.1736 will stop currency bulls in the coming day(s). Therefore if we see any reliable bearish factors on the horizon, we’ll consider opening short positions.

Looking at the daily chart, we see that although EUR/USD broke above the upper border of the green consolidation and the upper border of the brown rising trend channel, the combination of the above-mentioned medium-term resistances encouraged currency bears to act. As a result, the pair pulled back and invalidated yesterday’s breakout. Taking this fact into account and combining it with the sell signals generated by the daily indicators and the medium-term picture, we think that opening short positions is justified from the risk/reward perspective.

How low could the exchange rate go in the coming days? In our opinion, the first downside target for currency bears will we around 1.1408, where the lower border of the brown rising trend channel currently is. If this support is broken, the way to lower levels will be open.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1803 and the initial downside target at 1.1408) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

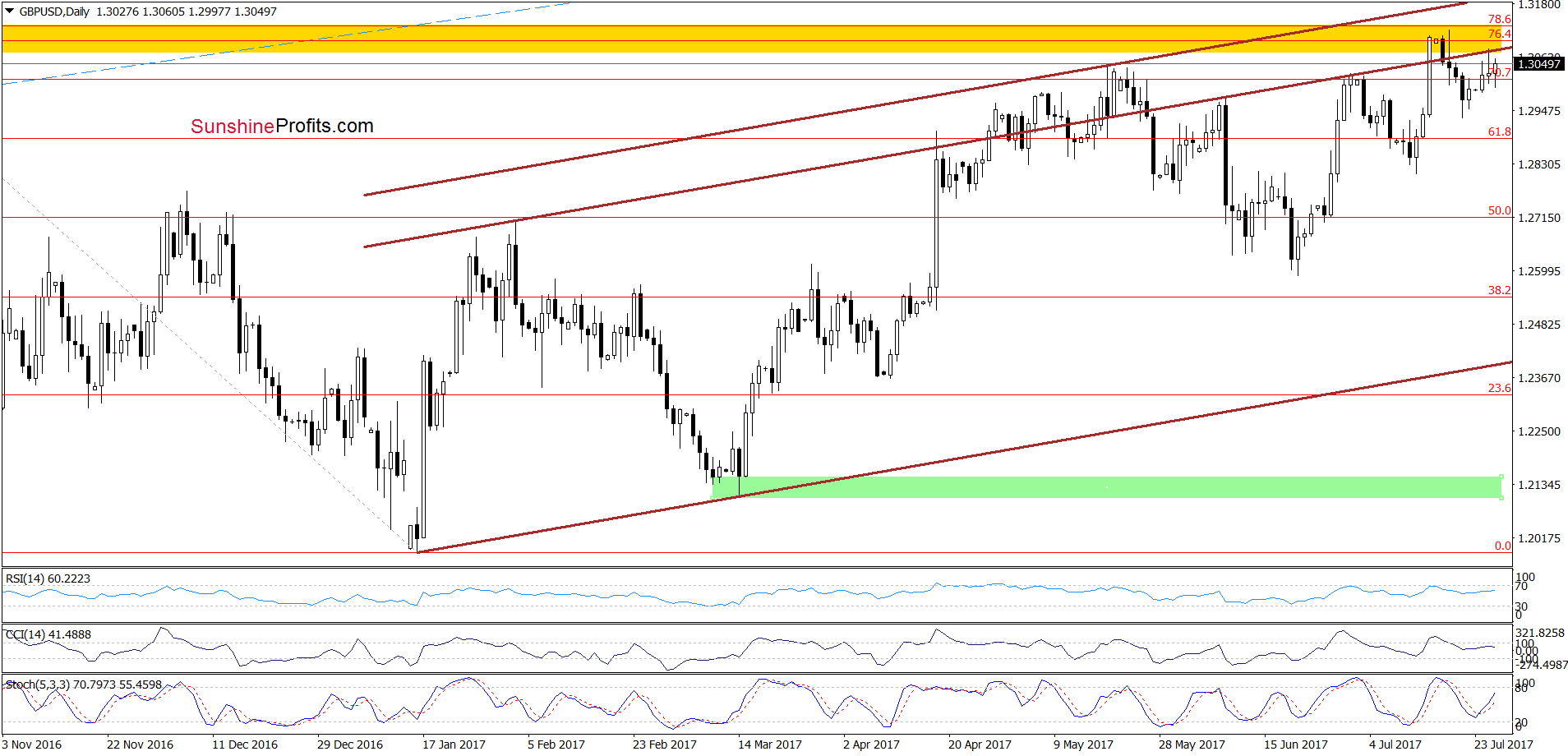

GBP/USD

Looking at the daily chart, we see that although GBP/USD rebounded slightly in recent days, the exchange rate is still trading below the upper border of the brown rising trend channel and the yellow resistance zone (created by the 76.4% and 78.6% Fibonacci retracements and the last week high). Therefore, in our opinion, as long as there is no breakout above this major resistance area another attempt to move lower is very likely. If this is the case and we’ll see a decline from current levels, the next downside target for currency bears will be the mid-July or even late June low.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.3232 and the initial downside target at 1.2375) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

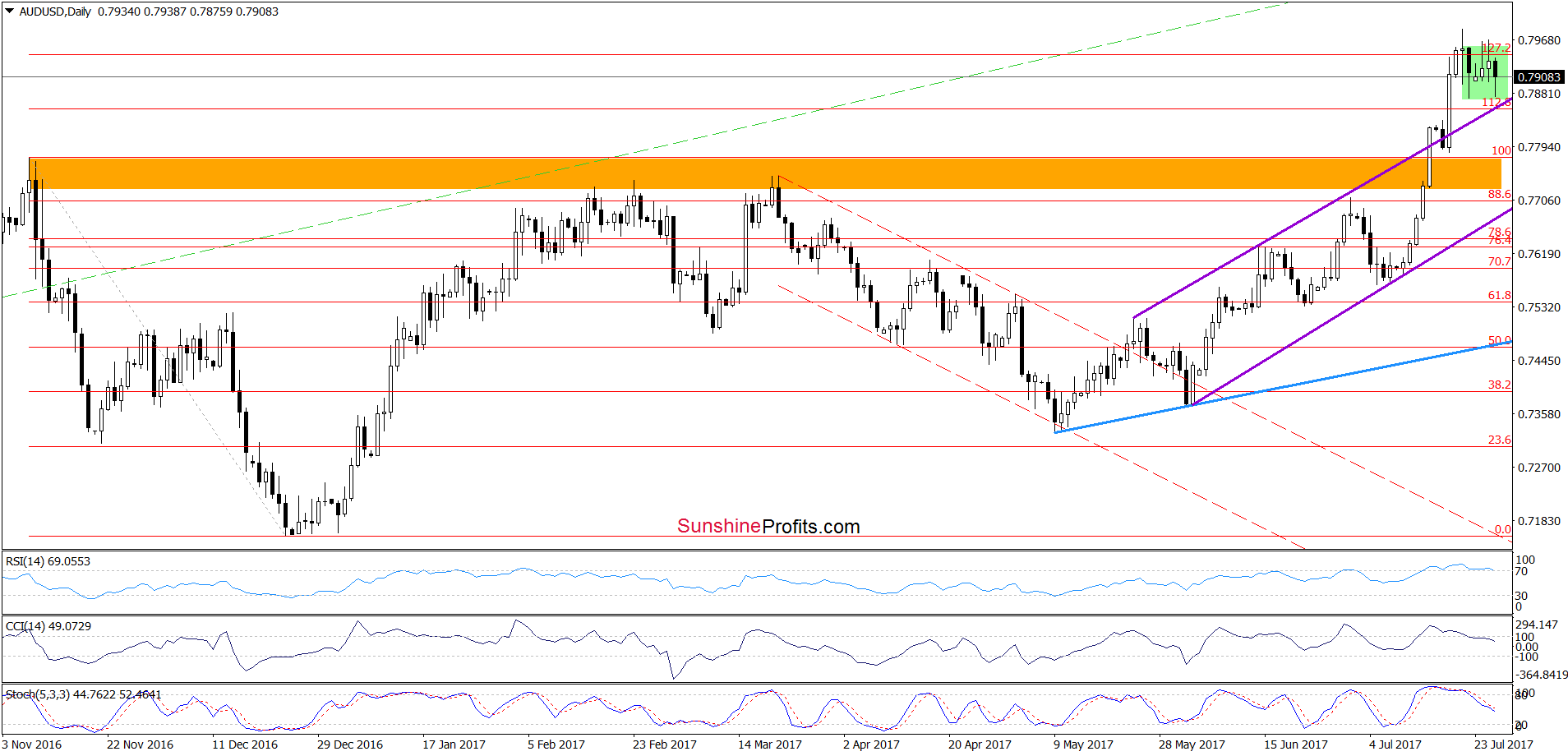

From today’s point of view, we see that the situation in the very short term hasn’t changed much as AUD/USD remains in the green consolidation between the 127.2% Fibonacci extension and the previously-broken upper border of the purple rising trend channel. What’s next? The sell signals generated by the daily indicators suggest another attempt to move lower. Nevertheless, in our opinion, as long as there is no invalidation of the breakout above the upper line of the trend channel and the breakdown below the lower border of the green consolidation, bigger decline is not likely to be seen. However, if currency bears push the pair under these supports, we’ll consider opening short positions.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts