Earlier today, the euro extended gains against the greenback, which resulted in a climb to two very important resistance levels. Will currency bulls be strong enough to break above them in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

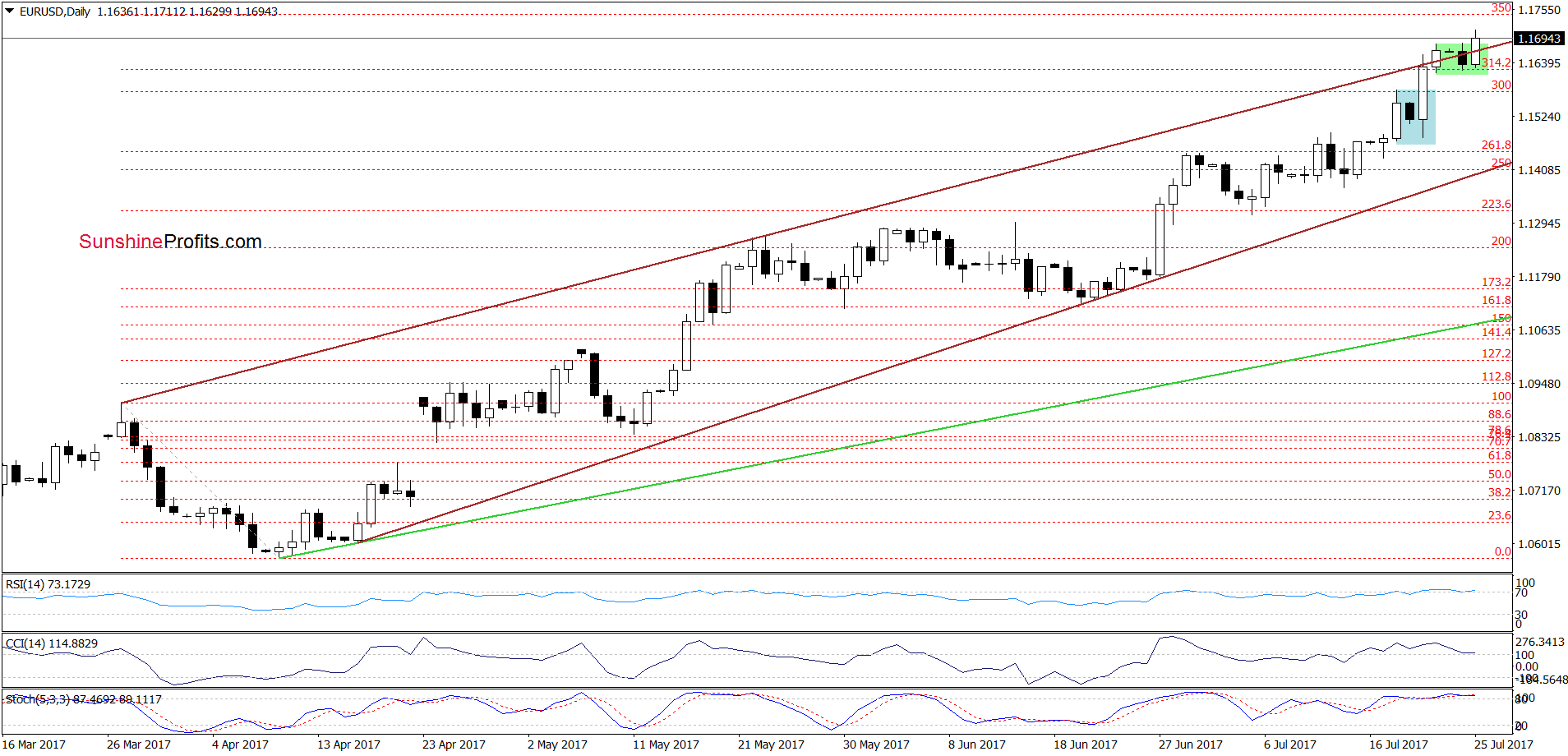

Earlier today, EUR/USD moved higher and broke above the upper border of the green consolidation (another breakout above the consolidation in a row). Thanks to this move the exchange rate invalidated the earlier breakdown under the upper border of the brown rising trend channel, which is a positive signal and suggests further improvement.

But will we see such price action? Let’s zoom out our picture and take a closer look at the medium-term chart.

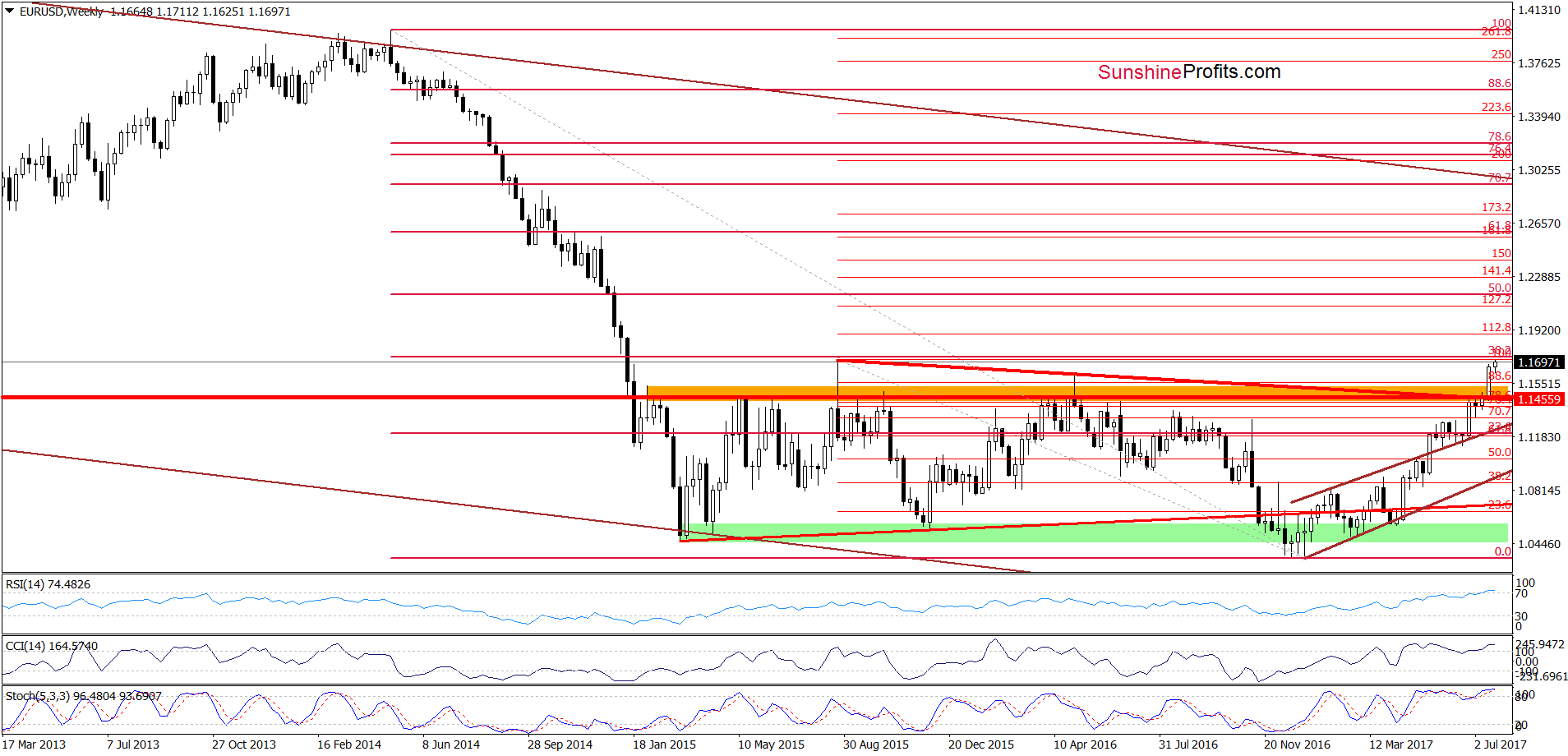

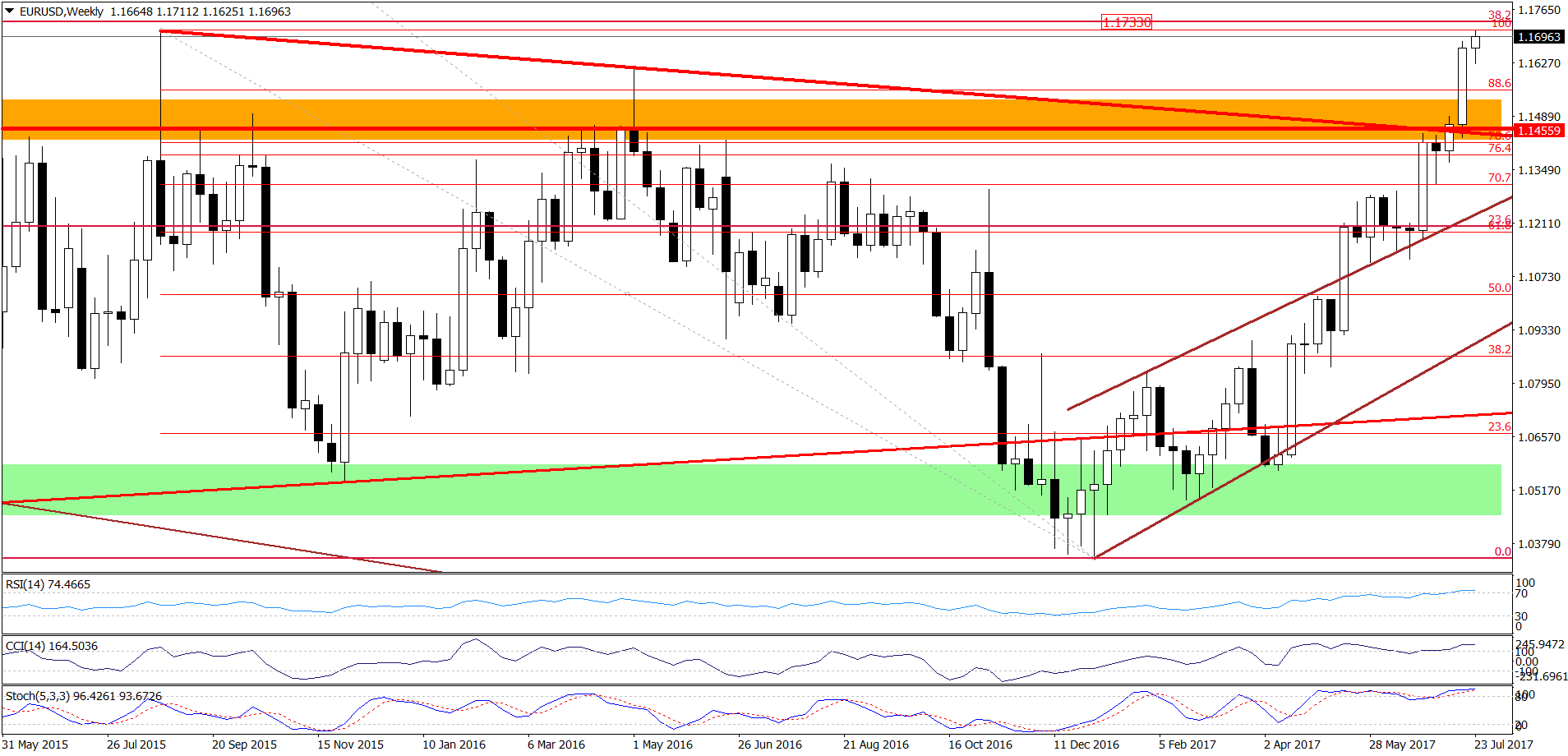

From this perspective, we see that EUR/USD approached not only the August 2015 high, but also the 38.2% Fibonacci based on the entire May 2014-January 2017 downward move. What does it mean for the exchange rate? Taking into account the importance (and potential strong) of these resistances and the current position of weekly and daily indicators, it seems that the area around 1.1713-1.1736 will stop currency bulls in the coming day(s). Therefore if we see any reliable bearish factors on the horizon, we’ll consider opening short positions.

Very short-term outlook: mixed

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

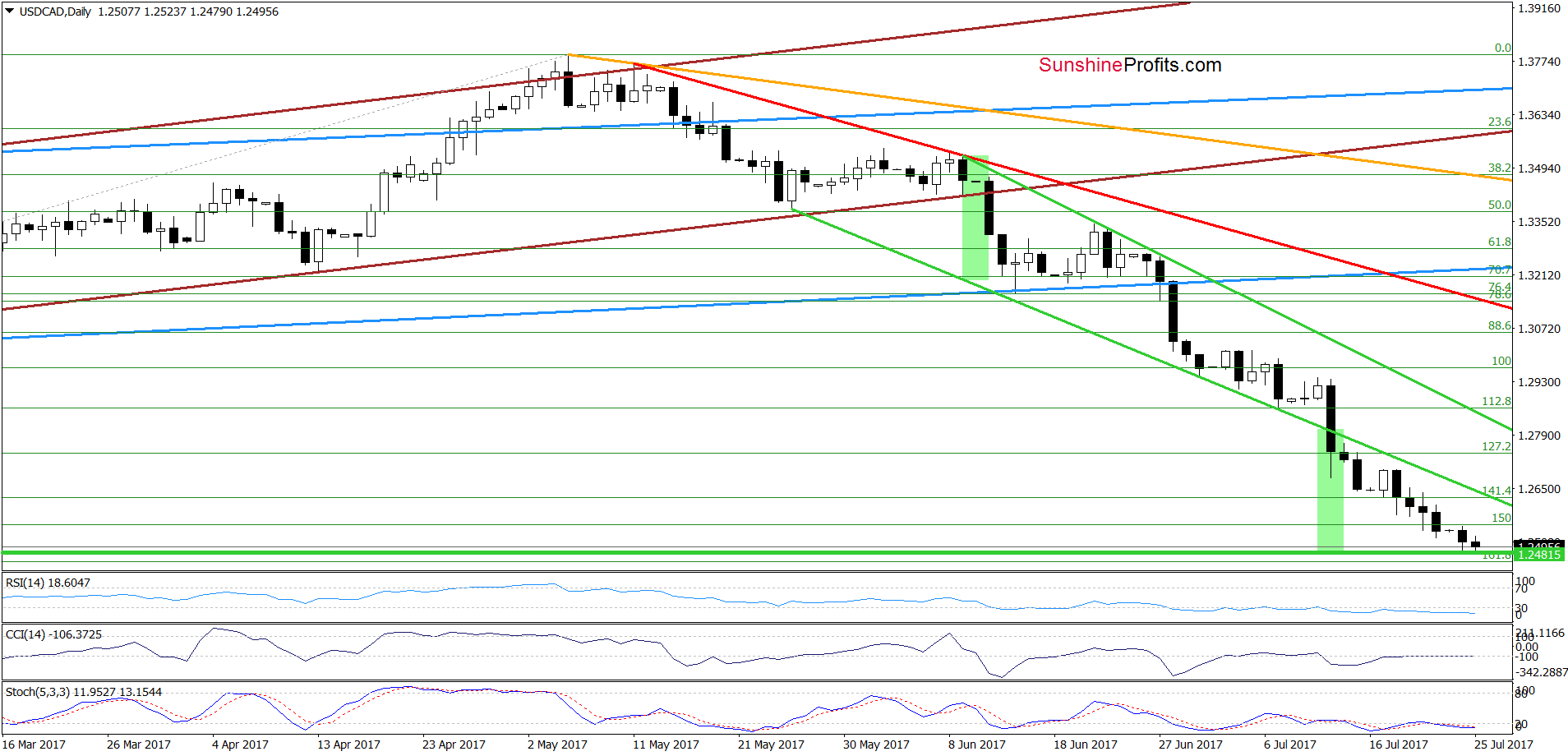

USD/CAD

In our Forex Trading Alert posted on July 13, we wrote the following:

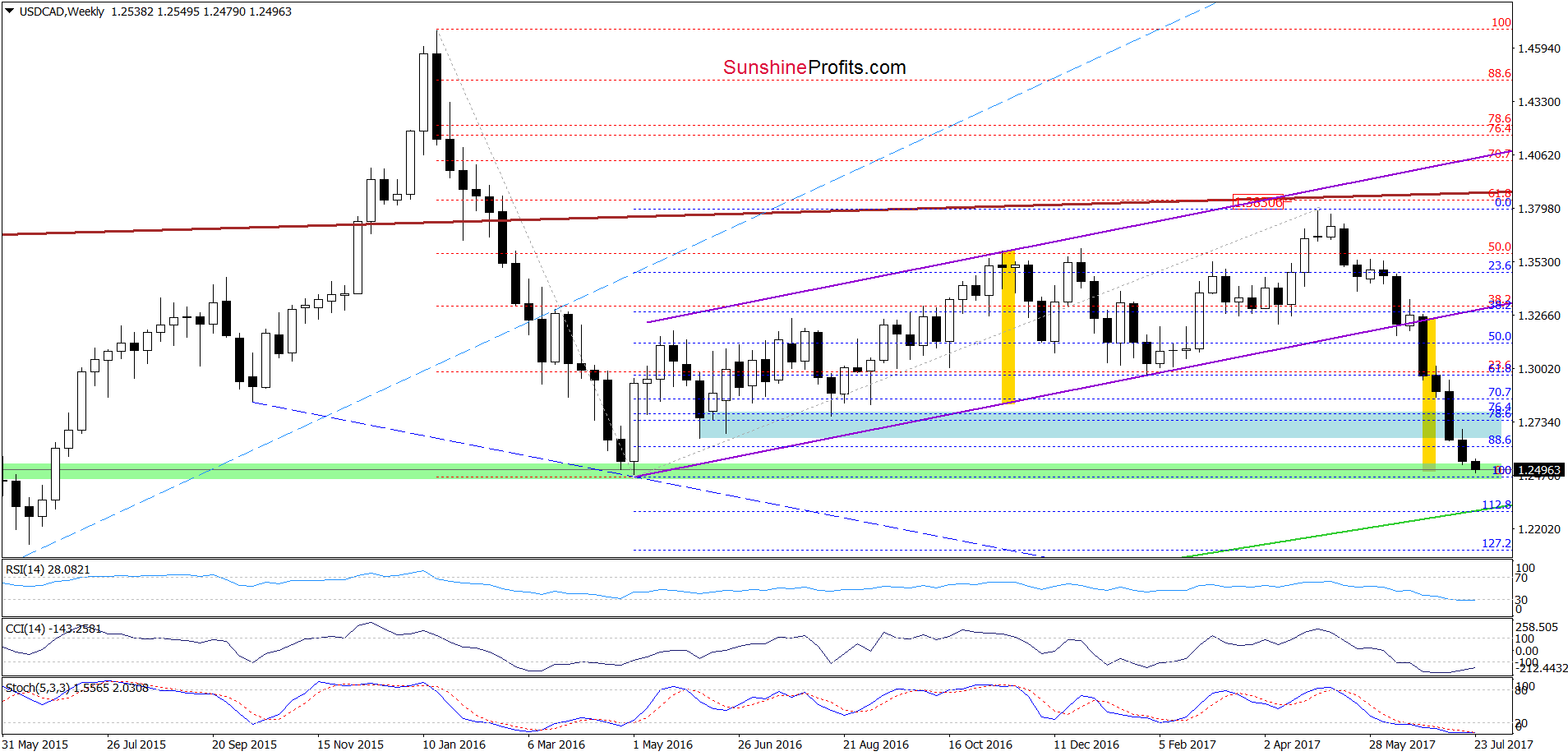

(…) What’s next? (…) taking into account the height of the trend channel (marked with yellow), we should (…) consider further deterioration and a drop to the green support zone (based on the late April and May 2016 lows) in the coming week(s) (in this area the size of the move will correspond to the height of the trend channel).

From today’s point of view, we see that the situation developed in line with the above scenario and currency bears pushed USD/CAD to our downside target. Additionally, in this area the size of decline corresponds to the height of the green declining wedge (seen on the daily chart), which suggests that the selling pressure may weaken and we could see a rebound from here in the very near future. This scenario is also reinforced by the current position of the daily and weekly indicators. Therefore if we see any reliable bullish factors on the horizon, we’ll consider opening long positions.

Very short-term outlook: mixed

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

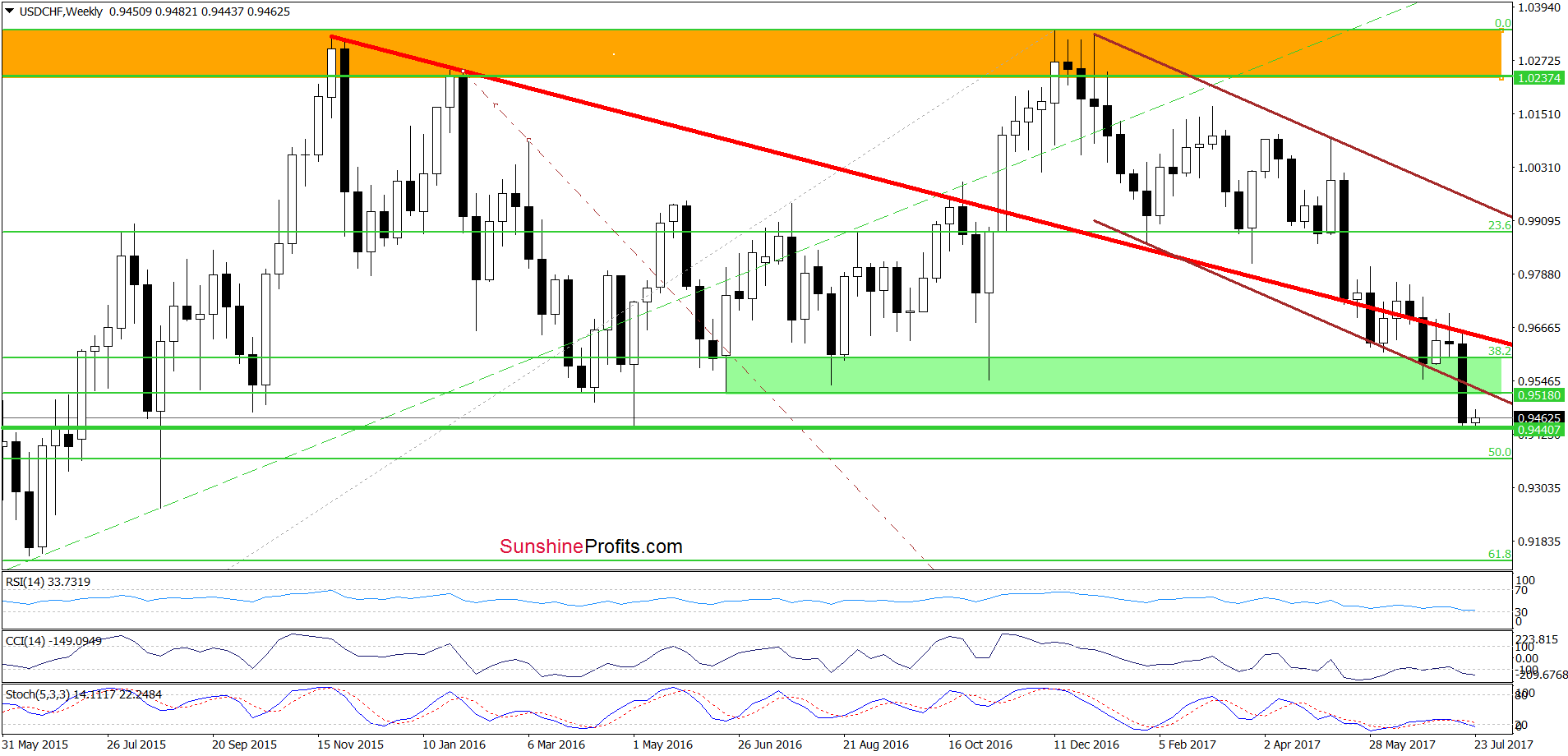

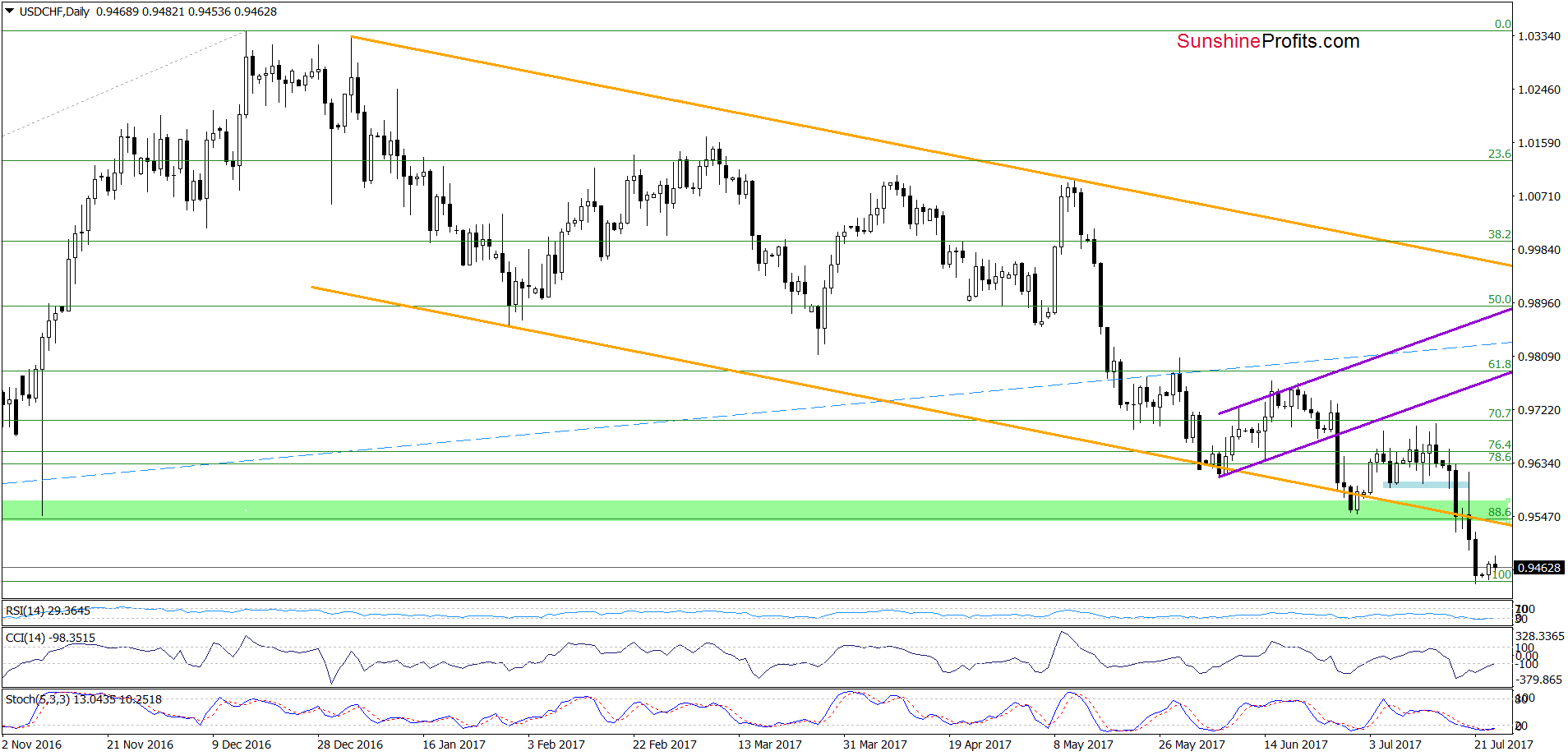

USD/CHF

Looking at the charts, we see that USD/CHF extended losses, broke below the lower border of the orange declining trend channel and the green support zone, which resulted in a decline to the long-term green horizontal line based on the May 2016 low. Will it manage to stop currency bears? It’s quite likely, but even if it doesn’t not far from current levels is also the 50% Fibonacci retracement based on the entire January 2015-ecember 2016 upward move, which seems to be stronger support at the moment. Therefore, if we see more bullish and reliable factors on the horizon, we’ll consider opening long positions. Until this time, waiting at the sidelines is justified from the risk/reward perspective.

As always, we will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts