Trading position (short-term; our opinion): long position (100% position size) with stop-loss at 2570 and the initial upside target at 3220.

Just as I called for, there wasn't much S&P 500 downside left, and I am hugely profitable on the upside reversal from near yesterday's premarket lows. That's quite a turn in momentum, isn't it? So, is the correction in the last throws?

I would certainly say so in terms of prices, though it might take a little longer in terms of time. If I look though at the enthusiastic reaction to the Fed announcing late yesterday its purchases of individual corporate bonds on the secondary market, I doubt that the correction has much shelf life left.

S&P 500 in the Short-Run

Let's start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

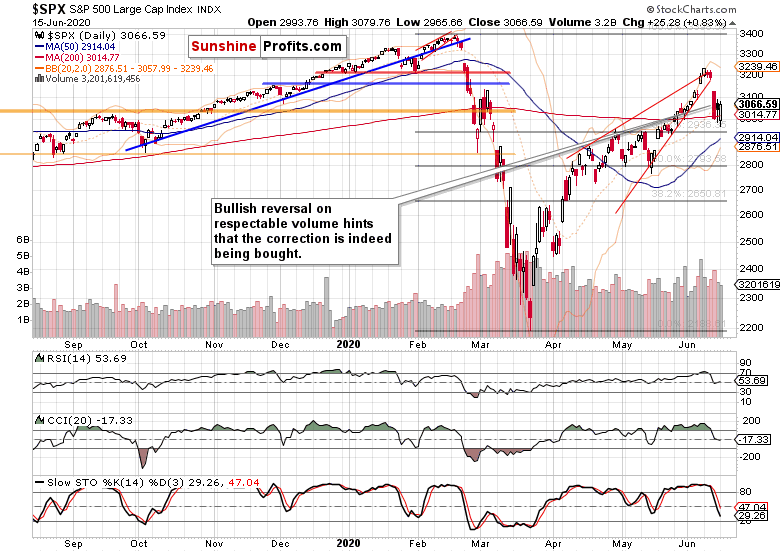

The 200-day moving average was briefly broken in yesterday's premarket trading, and the bears probed the 61.8% Fibonacci retracement too. The bulls stepped in well before the U.S. market open, and prices have moved relentlessly higher since. Not only did I grab the almost 50-point profit off the open short position earlier yesterday, but the simultaneously entered long position at 2965 is in an 175-point open profit in less than 36 hours!

Reflecting upon the rebound's veracity, the still bearishly looking daily indicators are likely to turn much more positive for the bulls quite soon. Yesterday's volume also gives no reason to doubt the reversal, showing that buy-the-dip mentality won the day.

Should this paradigm hold, then the price consequences of the bearish wedge breakout invalidation and of the island top reversal, would be over pretty soon. I wouldn't be too afraid of stocks approaching the lower border of Thursday's bearish gap, or even of prices moving back near the declining support line connecting the March and May lows.

I consider these technical features as short- to medium-term challenges to the stock bull market, that the bulls would overcome. In other words, I treat the bull market as intact, and merely undergoing a healthy correction that wouldn't result in much technical damage.

These were my yesterday's thoughts about the unfolding correction:

(...) given the technical and fundamental circumstances, I don't expect the correction to reach farther, let alone as low the 50% Fibonacci retracement at around 2790. In terms of the price decline, we might very well be more than halfway through already - that's the scenario I consider most likely.

Would the credit markets agree?

The Credit Markets' Point of View

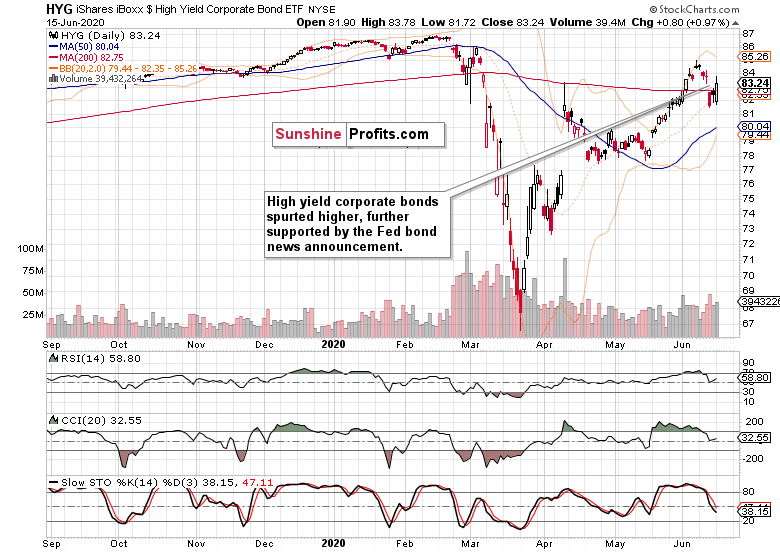

High yield corporate bonds (HYG ETF) acted constructively since the market open, and the cherry on the bullish cake came when the Fed made public its decision to start buying individual corporate bonds.

The daily upswing picked up steam, but retreated since its highs to a degree. Is that a problem for the S&P 500 move higher?

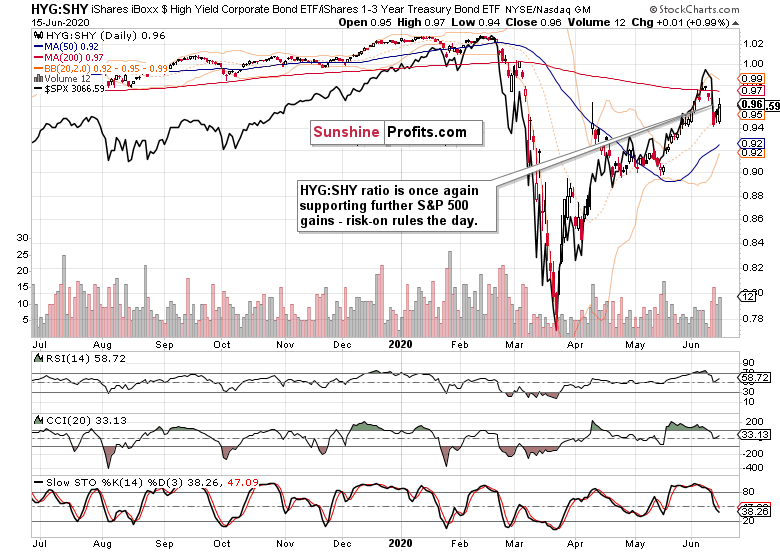

It doesn't seem so really, as the closing prices of the credit market ratio and the stock index are matching each other's dynamics. Not only has the HYG ETF spurted higher, but short-term Treasuries (SHY ETF) reversed lower yesterday, with both factors driving the HYG:SHY ratio up.

Actually, the longer-dated Treasuries turned down yesterday too - both the IEI ETF and TLT ETF - as the market interpreted the Fed's move as yet another risk-on nudge. Understandably, the USD Index took it on the chin likewise.

Has the Fed again tamed the financial markets?

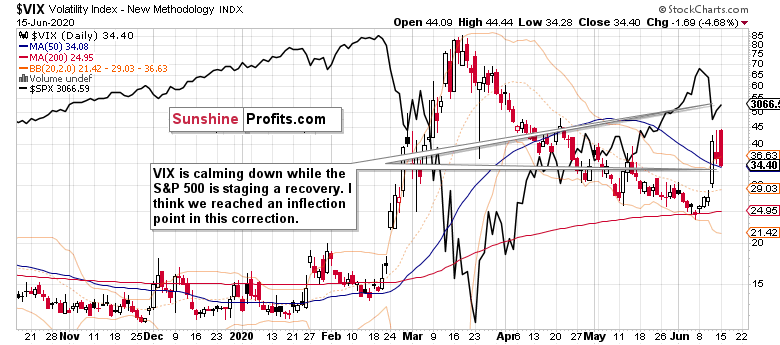

The decreasing volatility says so, and I think that we've reached a turning point in this correction upon which volatility will start once again moving generally lower.

Clearly, the Fed has made its point of bringing in liquidity and support clear - and stocks obliged by going sharply higher on that announcement. The markets don't really look ready to start questioning the Fed.

Key S&P 500 Sectors in Focus

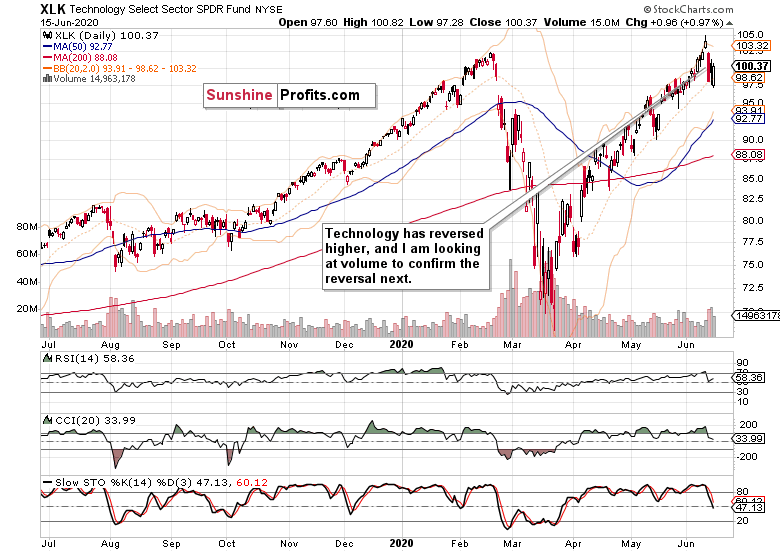

Technology (XLK ETF) reversed higher, and just like the stock index, it also overcame its Friday's closing values. The sector has retraced a similar portion of Thursday's slump as the S&P 500 did, which just goes to show that the stock advance is broad-based.

Semiconductors (XSD ETF) certainly show the degree of risk-on revival. It's a good omen for the bulls that they're this prominent in the upswing. Semiconductors lead technology, and where technology goes, the S&P 500 follows.

Healthcare (XLV ETF) also reversed higher, but not as profoundly as technology, and actually it's been the financials (XLF ETF) that are the rebound's star heavyweight performer, having already beaten their Thursday's opening prices.

The stealth bull market trio of energy (XLE ETF), materials (XLB ETF) and industrials (XLI ETF) have all advanced, working to repair the technical damage sustained. Despite the steep Thursday downswing, these sectors appear far from having topped, which bodes well for the stock bull market.

It's still young, and many profitable trades await!

Summary

Summing up, Monday indeed brought us new lows in the correction, and also a powerful upside reversal at the same time. Not merely fueled by the Fed's decision to start buying individual corporate bonds, the high yield corporate bond ETF has been confirming the unfolding upswing throughout the session. Falling dollar and rising Treasury yields also contributed to the risk-on sentiment. Encouragingly, smallcaps (IWM ETF) are leading the S&P 500 higher, which bodes as well for the 500-strong index advance as market breadth or semiconductor's leadership does. Accounting for the above, I think that this correction is more over than not, with the S&P 500 just about ready for another run higher.

Trading position (short-term; our opinion): long position (100% position size) with stop-loss at 2570 and the initial upside target at 3220.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.