Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

S&P 500 went closer to 4,300 level again – will the uptrend resume?

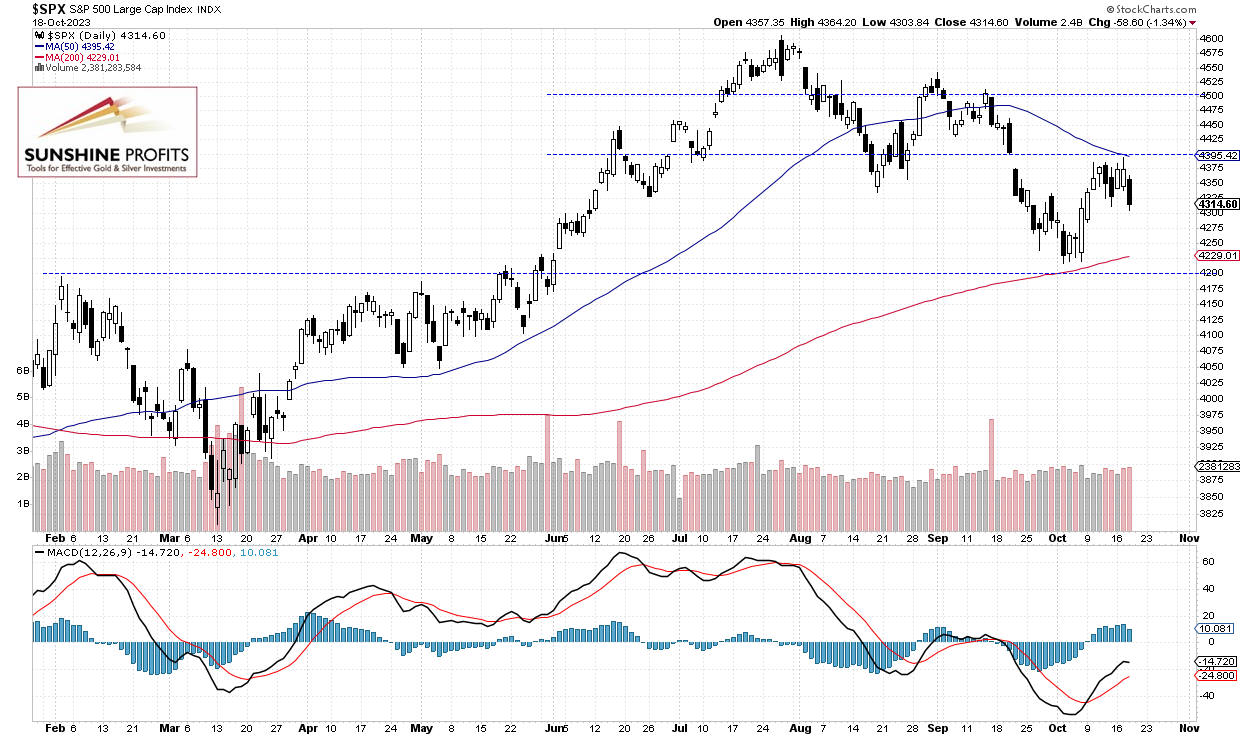

The S&P 500 index lost 1.34% on Wednesday as it retraced its Monday’s-Tuesday’s advances. The market bounced from 4,400 level again. Earlier in the week it was advancing despite geopolitical risks due to Israel-Hamas war, but yesterday it went closer to 4,300.

Recently stocks were rallying from their local lows along 4,220 level and on Tuesday the index traded as high as 4,394. There’s still a lot of uncertainty about monetary policy, economic growth and geopolitics.

Stocks will likely open 0.1% higher, so the S&P 500 may extend its consolidation above the 4,300 level. The broad stock market index continues to trade below the Sept. 21 daily gap down of 4,375.70-4,401.38 as we can see on the daily chart:

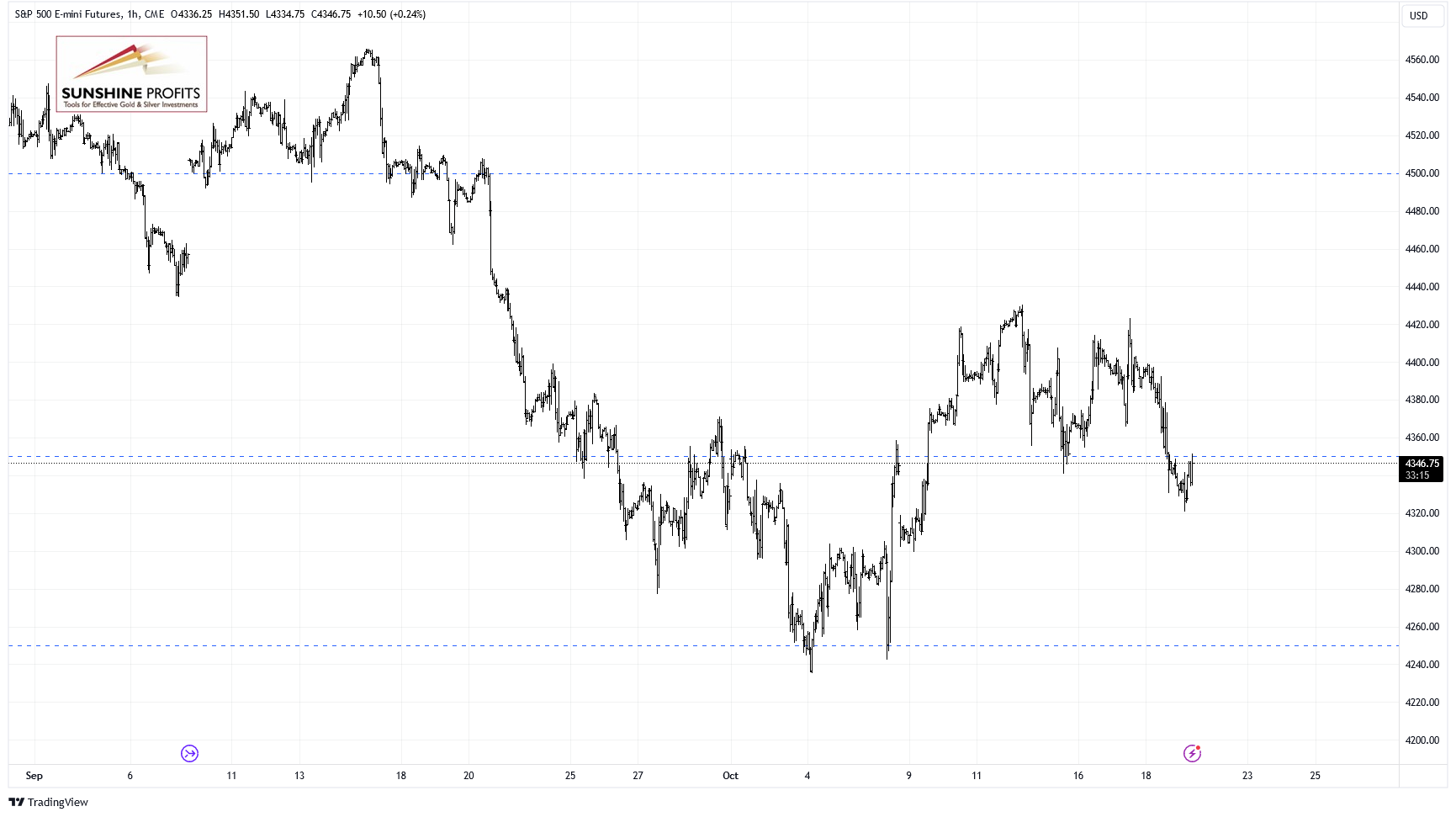

Futures Contract Trades Along 4,350

Let’s take a look at the hourly chart of the S&P 500 futures contract. Today it’s trading along the 4,350 level after bouncing from local low of around 4,320. The resistance level remains at 4,420-4,440 and the support level is now at 4,300, among others.

Conclusion

The S&P 500 will likely open virtually flat today and it may continue to fluctuate above the 4,300 level. It still looks like a relatively flat correction within an uptrend. The market will be waiting for more quarterly earnings announcements.

Here’s the breakdown:

- Stocks will likely extend their fluctuations following yesterday’s decline.

- The S&P 500 remains below its late September daily gap down; it is still acting as a resistance level.

- In my opinion, the short-term outlook is still bullish and long positions are still justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care