Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral and no positions are currently justified from the risk/reward point of view.

The S&P 500 remains close to 4,000 – will the uptrend continue?

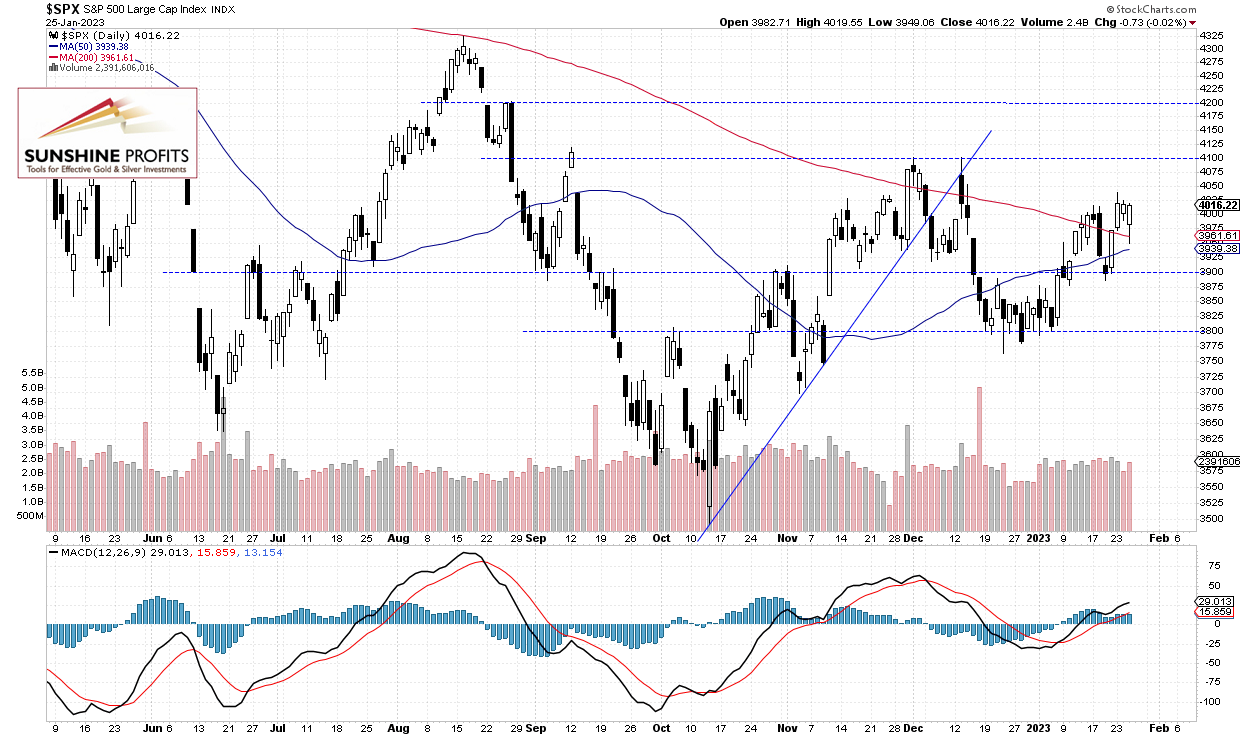

The broad stock market index lost 0.02% on Wednesday, after going down to the daily low just below the 3,950 level, as it extended a short-term consolidation along the 4,000. Recently the sentiment improved after economic data releases, weakening U.S. dollar, among other factors. The S&P 500 bounced from its last Thursday’s local low of 3,885.54. On Monday it went the highest since December 14, and the high was at 4,039.31.

Stocks are expected to open higher this morning following economic data releases, including higher-than-expected Advance GDP number. So the index may see an attempt at breaking above its three-day-long trading range and a consolidation along the 4,000 level. The S&P 500 continues to trade within a medium-term consolidation, as we can see on the daily chart:

Futures Contract at New Local High

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning it’s extending its short-term uptrend, as it is breaking slightly above the 4,050 level. The next resistance level is at 4,100.

Conclusion

The S&P 500 will likely open higher this morning and the market may see an attempt at breaking above the recent local highs following earnings, economic data releases. Today after the session’s close we will also have a quarterly report from INTC, among others.

Here’s the breakdown:

- The S&P 500 index extended its short-term consolidation and this morning it is expected to open higher.

- Investors will be waiting for earnings, economic data releases.

- In my opinion, the short-term outlook is neutral and no positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral and no positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care