Trading position (short-term; our opinion): no positions are justified from the risk-reward perspective.

When it comes to closing prices, stocks entered the month of June on a strong note, but the daily volume wasn't exactly convincing. While many signs though continue to be arrayed behind the slow grind higher, first swallows of short-term non-confirmation are appearing. Which way will they resolve? And what's the upside potential of the stock rally in short run anyway?

S&P 500 in the Short-Run

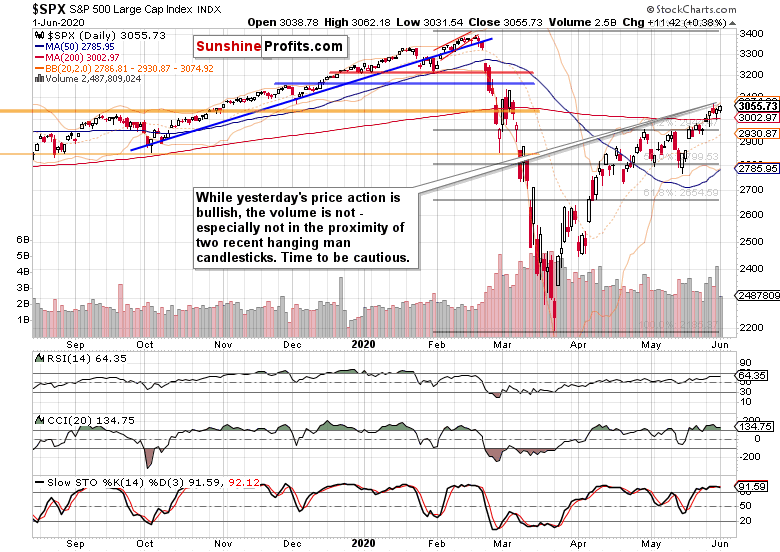

Let's start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

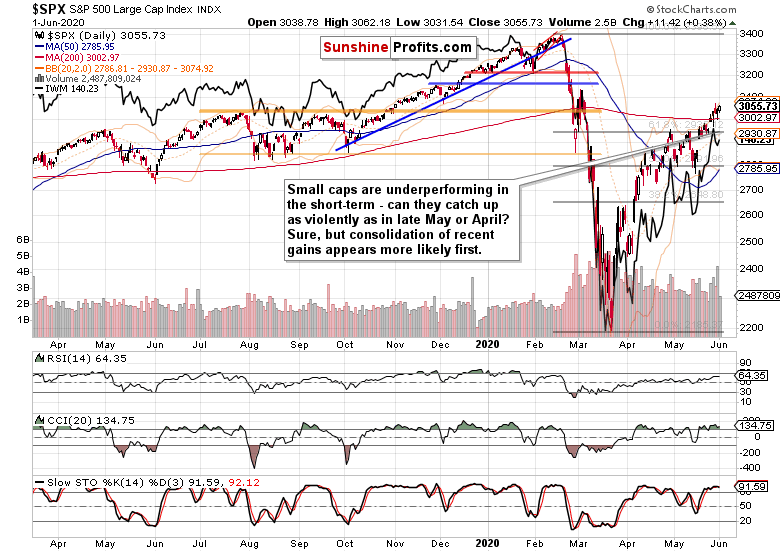

Prices are grinding slowly higher without too much of a downside, but on the second lowest volume in last two months. As a minimum, that calls for caution - regardless of the fact that lower daily volume on similarly lazy days during bull market runs is no reason for concern, but this one is suspiciously low. This means that the market is pausing, and looking for short-term direction.

Should it break higher from here, and leave the further detailed non-confirmations unresolved, that would be concerning for the short-term prospects of the bull market. With the early March highs at 3137, the upside potential isn't huge - it's roughly the same as any temporary drop below 3000. That's not what I would call either a high-odds setup to reach those highs, or a favorable risk-reward ratio.

Yes, the monthly price action is bullish, and the weekly one is probing a key resistance (the yesterday-discussed lower border of the rising medium-term channel on the weekly chart), but I think it's a matter of relatively short time when the sellers test the buyers' resolve here.

After a plunge that gains momentum and doesn't fizzle out within a few hours or less, we would be presented with another opportune setup. Of course, other conditions would have to met simultaneously to tip the odds in our favor some more.

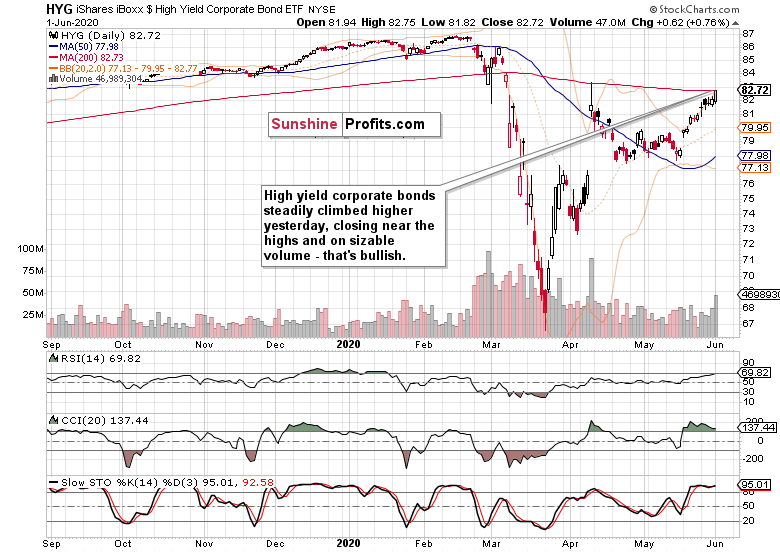

How did the credit markets support yesterday's stock upswing exactly?

The Credit Markets' Point of View

Despite struggling in the roughly first third of the session, high yield corporate bonds (HYG ETF) made a staircase climb higher, closing sharply up. As the move happened on high volume, it has bullish implications for this key ETF. The cause for concern however, was that stocks lagged relatively during the day, as can be seen in the following chart.

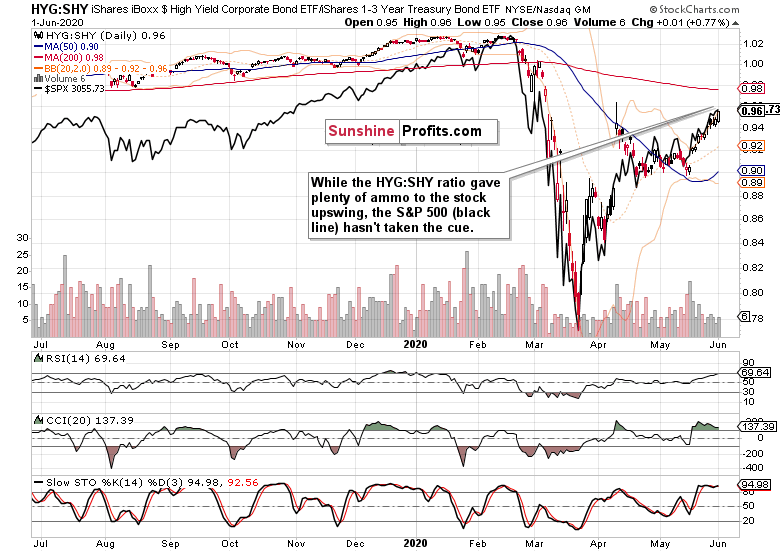

Since the early April $2.3T bombshell was digested, stocks have been leading higher. This is what the high yield corporate bonds to short-term Treasuries ratio (HYG:SHY) with the overlaid S&P 500 prices (black line) shows.

Thanks to the spurt higher in the HYG ETF, that might be resolved with a premarket stock upswing that the S&P 500 keeps intact till the closing bell, or stocks might start to lag in the short-term. Of course, this dynamic might take more than a few sessions to kick in, but given the ratio's extended indicator readings, it's a very valid scenario.

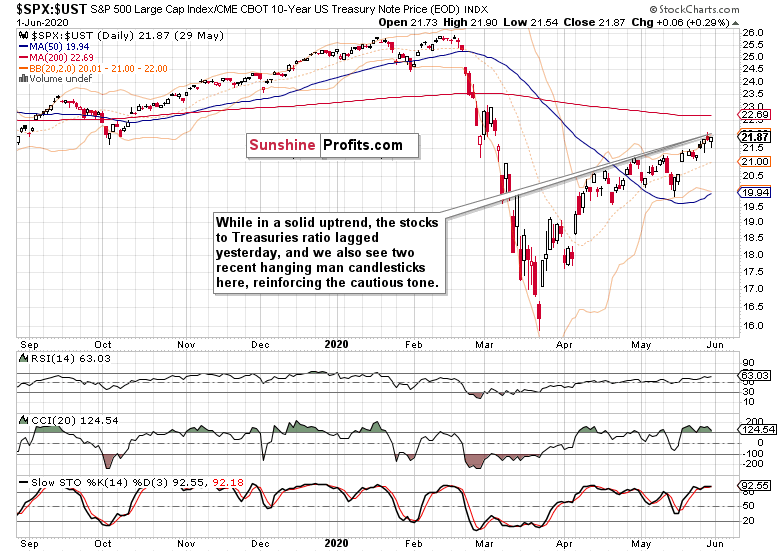

While both the index itself, and the S&P 500 to Treasuries ratio have overcome their April highs, the short-term swallow of stock underperformance is clear. Despite stocks moving higher, their ratio to Treasuries hasn't made a new high. That's a short-term sign for caution, and of clouds on the horizons that the bond market sees.

At the same time though, the stock bull run remains intact regardless of whatever short-term hiccups it's going to run into over the coming days and weeks. That's the essence of my call for a not-so-smooth sailing over the summer months.

Key S&P 500 Sectors in Focus

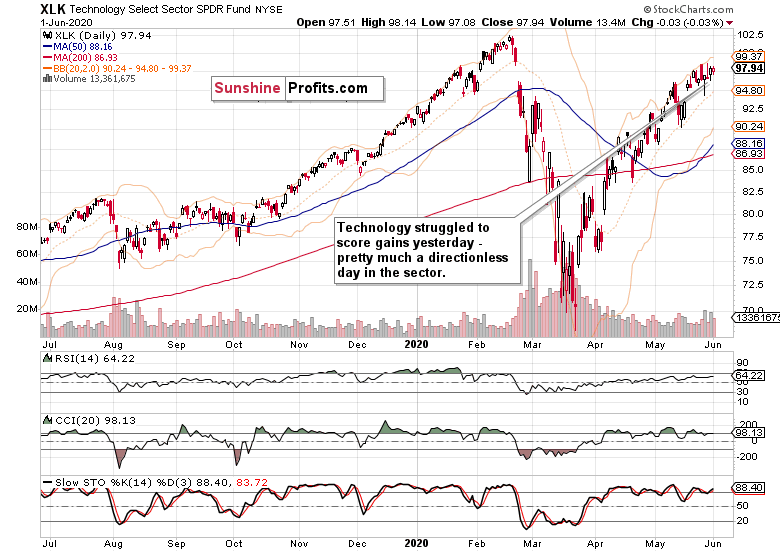

As said in yesterday's intraday Stock Trading Alert, technology (XLK ETF) hasn't been exactly leading higher on the day. Apart from a sideways consolidation, yesterday didn't bring anything new to the table.

Healthcare (XLV ETF) performed more constructively, but the buyers had to defend the daily lows several times. The sector closed around the mid-point of its daily range, which is quite positive for the buyers. Such price action appears to be a consolidation of recent gains, and it's encouraging that it didn't happen on higher volume.

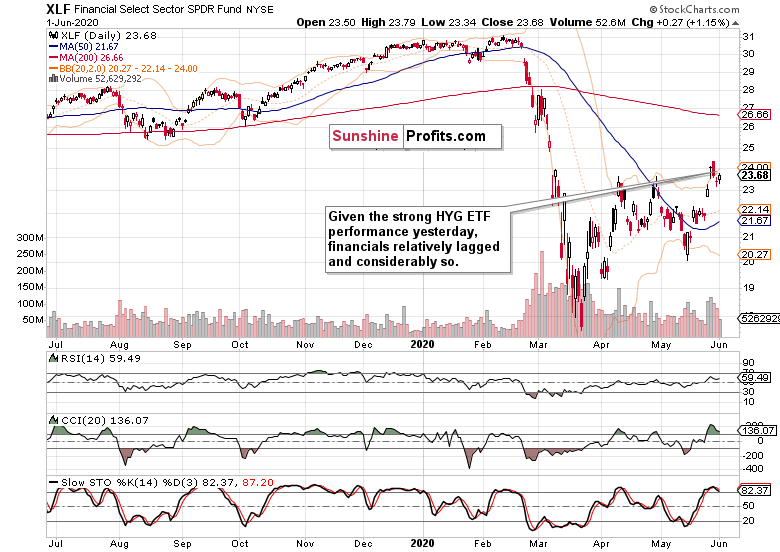

The price action in financials (XLF ETF) wasn't as bullish yesterday. As they are not too close to their recent highs, the lower volume has neutral-to-bearish implications for the sector in the short run. That's true despite my call for the sector to muddle through with a bullish bias in the medium-term.

Another short-term watchout are the leading ratios, as they haven't yet recovered from last week's setback. Both financials to utilities (XLF:XLU) and consumer discretionaries to staples (XLY:XLP) are pointing in the short-term direction of the amber light.

Out of the stealth bull market trio, materials (XLB ETF) performed best. Energy (XLE ETF) outperformed industrials (XLI ETF), and the overall impression of these three sectors is one of a slow grind higher in the weeks to come.

So, what other argument can be made in favor of short-term caution?

After the late-May steep rise in small caps, the Russell 2000 (IWM ETF) is taking a breather now. And earlier in April and May, that has resulted in a sharper temporary downswing than what we've seen so far.

That's why I think it's reasonable to let the non-confirmations work themselves out these days. There will always be opportunities in the markets, long or short, and it's key to be picky and act on only the strongest setups.

One more piece to the puzzle. On a short-term note from the currency markets, the USD Index appears oversold and ready for a bounce any day now. Tomorrow's ADP Non-Farm Payrolls could provide catalyst for this reversal of fortunes. And we know what kind of a stock move a risk-off environment brings...

Such were my parting pre-summary thoughts yesterday:

(...) after the March deflationary episode, the market is sensing inflation on the way... Remember, bonds peak first, then stocks, and finally commodities. And we haven't seen the peak in bonds yet, let alone in stocks.

From the Readers' Mailbag

Q: At what point does reality set in for this rally? Is it the start of a new bull market or a bull trend in a bear market?

A: I'm of the opinion that we're in a bull market. After all, the post-WWII stock bear market was the only instance when the S&P 500 made new lows after beating the 61.8% Fibonacci retracement. Given the extraordinary monetary and fiscal stimulus, it's highly unlikely to the point of unimaginable that we would make new lows, let alone retest the existing ones.

I think that this fast and sharp bear market is history, and after a sideways-to-down trading range over much of summer, this fact will become increasingly apparent both for the investment public and professionals. Look at the retail participation - it's still relatively slim, though money is increasingly coming out of the bond funds. Similarly to the run from the March 2009 lows, it has (generously speaking) taken the public till 2012 to come out of the bunker in droves and increase their stock allocation. There are few professionals that call for taking on the February highs before the year's end, and I think we have a pretty good chance to actually overcome them still this year. But we'll see and I'll keep you updated as we go.

Summary

Summing up, while yesterday's upswing ticks many a stock bull's boxes, it doesn't do the trick for several key ones. On one hand, the performance of the high yield corporate bonds is the strongest bullish factor, while the relatively limited upside potential, low daily volume coupled with extended daily indicators, and underperformance of the stocks to Treasuries ratio are the key short-term watchouts. So is the Russell 2000 lagging over the last few sessions, or the lagging leading indicators (financials to utilities, and consumer discretionaries to staples). As we're in a bull market, the balance of risks in the medium-term remains skewed to the upside, but I'm striking a bit cautious tone for the very short-term.

Trading position (short-term; our opinion): no positions are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.