US equity markets sold off a bit in Tuesday’s session ahead of today’s FOMC statement. What is your plan?

Major US equity indices traded lower ahead of the Fed meeting, and the debate over growth versus value stocks continues. Is there any magic language or policy stance that can come out of today’s Fed meeting to provide clarity in this market?

PPI data came out stronger than expected yesterday. This data adds more fuel to the inflationary theme, while Retail Sales were weak. The markets should have been lower from this data, and they were, albeit slightly.

As the anticipation builds to today’s FOMC statement at 2:00 PM ET today and the subsequent press conference at 2:30 PM ET, it seems like a good time to revisit a market that we are following - lumber.

If you have been following along and read the June 9th publication, you know that we are eyeballing the lumber markets for an ETF trade possibility. While the lumber market has been just insane to the upside in 2021, it has recently pulled back substantially. The question remains: are these higher lumber prices sustainable? If so, is there a way to participate via an ETF?

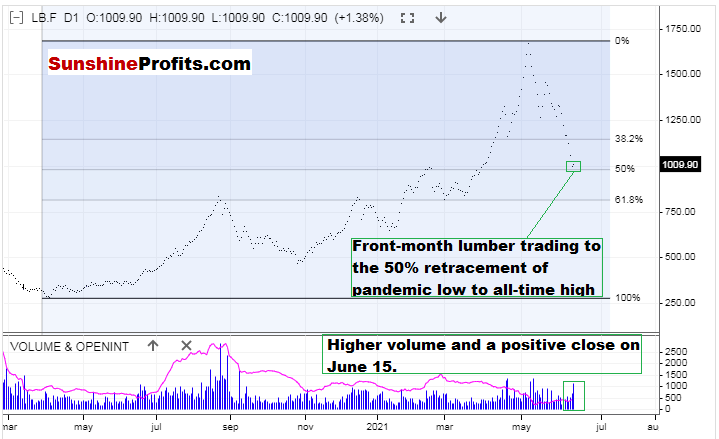

While this may seem like an obscure sector or at least an underappreciated one, let’s take a look at the front-month lumber futures to get caught up on the most recent price action.

Figure 1 - Random Length Lumber Futures Continuous Contract February 21, 2020 - June 15, 2021 Daily Source stooq.com

Front-month lumber futures made a pandemic low of 251.50 on April 1, 2020. Its recent and all-time high is 1733.30, which was put in on May 10, 2021. Taking a 50% retracement of this move, we have a value of 992.40. Yesterday’s low in front-month lumber futures was 943.70 and a close of 1009.90. Yesterday’s trading was also on higher than average volume. It is important to note that it traded below the psychologically important level of 1000, through the 50% Fibonacci retracement, and then reversed intraday and closed higher. This kind of price action really gets me going.

Let’s also illustrate this price action described above via weekly candlesticks:

Figure 2 - LBS1! Random Length Lumber Futures Continuous Contract September 2019 - June 2021 Weekly Candles Source tradingview.com

Isn’t that something? I wanted to illustrate this via the weekly candlesticks to add a little more clarity. The weekly candlestick that is being formed this week could be a sign of things to come. Now before we go any further:

I strongly suggest against trading in Lumber Futures. They can be illiquid, and experience many limit up and limit down days. You could be stuck in a losing position and not be able to get out. The only traders in Lumber futures should be hedgers that are in the wood business or deep pocket institutional traders that have real money to burn. Futures trading entails unlimited risk. I am sure that many fortunes have been made, and many more have been lost during this insane lumber market. Being on the wrong side of a futures market like Lumber can be brutal.

Lumber is a very thin contract and may only trade a few hundred contracts per day. But with such intriguing technicals, I want to circle back to an ETF that we covered in the June 9th publication: WOOD iShares Global Timber & Forestry ETF.

Figure 3 - iShares Global Timber & Forestry ETF (WOOD) Daily Candles November 10, 2020 - June 15, 2021. Source stockcharts.com

So, we see some interesting potential weekly candlestick formation in the Lumber futures and an interesting daily candle in WOOD. While the 2 instruments do not trade a perfect or near-perfect correlation, a correlation exists.

I like the idea of getting long the WOOD ETF based on the action in the Lumber futures markets.

While trying to catch a falling knife can be a precarious proposition, I view this as buying a pullback in a bull market. While we discussed certain levels in the June 9th publication, I would like to explore some different levels and a potential scaling/tranche entry strategy today.

And, while the price of gold certainly hasn’t caught an inflation bid (at least not yet), this could be a wooden opportunity. Maybe a wooden opportunity is the new golden opportunity.

To sum up the current viewpoint and opinion:

I have BUY opinions for:

- iShares Trust Russell 2000 ETF (IWM) for an index reconstitution trade. At this time, I would be looking to be long and then exiting upon the actual reconstituted index going into place on June 28, 2021. Buy the rumor, sell the fact type of trade. Buy Pullbacks. For equity-bearish folks, see the IWM/SPY spread idea in the May 27th publication. Always use a stop loss level that caters to your individual risk tolerance.

- Update: 06/16: The IWM shed 0.29% in Tuesday’s session to close at $230.36. It is still well above the $223.36 level when initiating coverage. Opinion: stay long. I think there is still time to get on board here, with the plan being to sell on June 28, 2021. See the May 27th publication.

- Defiance Quantum ETF (QTUM) between $44.00 - $49.50. Update 06/16: QTUM closed at $49.43 on Monday. In case you missed this one, I think there is still time to get on board and will raise the buy idea zone to $44.00 - $49.50. It looks like it wants to break out of its range soon, but could find some sellers at the psychologically important $50 level. Always use a stop loss level that caters to your individual risk tolerance.

- Amplify Transformational Data Sharing ETF (BLOK) between the 200-day moving average and $40.00 200-Day Moving Average is currently $39.49. BLOK has a history of high volatility, so proceed with caution. Always use a stop loss level that caters to your individual risk tolerance. Update 06/16: Patience still. I want to jump on board, but prefer to see how Bitcoin negotiates the $40,000 level. Wait for $40.00 to the 200-Day moving average. Monitoring.

- Invesco MSCI Sustainable Future ETF (ERTH) between $67.76 - $70.82. Always use a stop loss level that caters to your individual risk tolerance. Update 06/16: ERTH closed at $75.70 on Monday in sympathy with a weaker overall equity session ahead of the Fed. Hold longs. Chugging along. If you missed this one, let’s see if we can get a pullback to the 50-day moving average, which currently sits at $74.00. I am liking this one more and more for a long-term holding and will be willing to hold through short-term pullbacks at this time.

- Invesco Exchange-Traded Fund Trust - S&P SmallCap 600 Pure Value ETF (RZV) at the 50-day moving average. Patience and wait for the pullback. Always use a stop loss level that caters to your individual risk tolerance. Update 06/16: RZV 50-day MA is 92.50 as of the close Tuesday. Monitoring.

- iShares Global Timber & Forestry ETF (WOOD) Initial buy idea zone between $79.07 and the 200-day moving average ($79.72 as of 06/15 close). Update 06/16: Given the price action in the lumber futures described in today’s alert, consider an entry into ½ of a normal position size between $86.50 - $87.50. Should it pull back further, we can look to add another ½ position size.

- SPDR S&P 500 ETF (SPY) between $412.26 (61.8% Fibonacci retracement level) and the 50-day moving average ($416.58 as of the close on June 15th). Always use a stop loss level that caters to your individual risk tolerance.

- Invesco Solar ETF (TAN) between the 50-day moving average ($80.32 as of June 14th) and $81.50. Look for an intraday pullback for entry. Update 06/16: We wanted a pullback and we got a big one on Tuesday, with the range being $78.00 - $80.69. Ideally, this was taken advantage of on this pre-Fed meeting day. There could have been some “sell the news” price action with the SEIA report being released yesterday. Although we are below the 50-day MA, I like the previous consolidation and would look to be long at these levels. Always use a stop loss level that caters to your individual risk tolerance.

I have SELL opinions for:

NONE

I have a HOLD opinion for:

- First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID). GRID has traded through our idea range of between $86.91 and $88.17. Update 06/16: GRID closed at $92.06 yesterday, bucking the trend of the overall down day. That is excellent price action. Opinion: hold longs.

- Always use a stop loss level that caters to your individual risk tolerance.

Thank you for reading today’s Stock Trading Alerts. Your readership is valued and appreciated. Have a great day!

Thank you,

Rafael Zorabedian

Stock Trading Strategist